- Home

- »

- Plastics, Polymers & Resins

- »

-

Calendered Polyvinyl Chloride Flexible Films Market Size Report, 2030GVR Report cover

![Calendered Polyvinyl Chloride Flexible Films Market Size, Share & Trends Report]()

Calendered Polyvinyl Chloride Flexible Films Market Size, Share & Trends Analysis Report By End-use (Pharmaceutical, Medical, Automotive, Building & Construction, Consumer Goods, And Industrial), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-948-7

- Number of Report Pages: 88

- Format: PDF, Horizon Databook

- Historical Range: 2019 - 2020

- Forecast Period: 2022 - 2030

- Industry: Bulk Chemicals

Report Overview

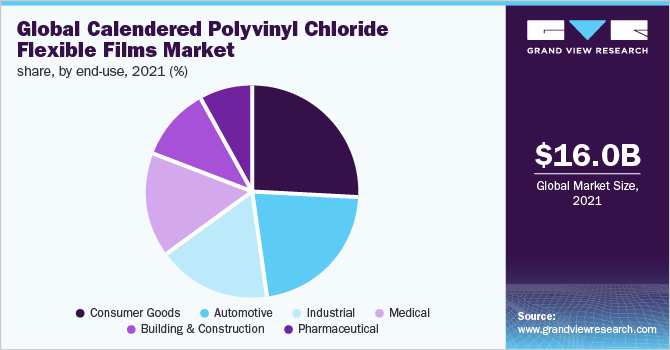

The global calendered polyvinyl chloride flexible films market size was valued at USD 16.0 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 5.3% from 2022 to 2030. Factors, such as increasing global demand from the building & construction industry and the surging demand for calendered polyvinyl chloride (PVC) flexible films in food and beverage packaging applications are anticipated to fuel the growth of this market across the globe.

Calendered polyvinyl chloride flexible films are used across various end-use industries owing to their lightweight, sturdiness, and abrasion resistance. Moreover, they are resistant to all inorganic chemicals and can withstand extreme climatic conditions, and are corrosion-free. According to a report published by the New Plastics Economy Global Commitment, approximately 60% of the signatory group (players committed in the aforementioned program), including packaging product manufacturers, and retailers that employ single-use cutlery, Polystyrene (PS), polyvinyl chloride, or carbon black, have planned to remove these plastic packaging materials from their portfolios as there is a significant global shift toward using reusable/recyclable packaging materials from conventional packaging materials.

The U.S. calendered polyvinyl chloride flexible films market is expected to witness slow growth as there is limited cross-border trade between the countries on account of the COVID-19 pandemic. The market is primarily driven by the rising demand for calendered PVC flexible films in medical applications for manufacturing capsules, tablets, drainage bags, and other medical equipment. The demand for plastics in various applications, including packaging, construction, electrical & electronics, automotive, agriculture, and consumer goods, is expected to grow after the current pandemic ends.

The demand for calendered polyvinyl chloride flexible films in packaging is expected to shift toward food packaging applications owing to the increasing demand for takeaways and the shutdown of restaurants and foodservice outlets amid the pandemic. The stockpile and panic purchases of food, groceries and other homecare necessities are further expected to accentuate the aforementioned trend in the U.S. Furthermore, the demand for calendered polyvinyl chloride flexible films in premium goods and non-food packaging is expected to rise significantly as supermarkets and convenience stores have started operations at full capacities.

End-use Insights

The consumer goods segment dominated the market and accounted for the largest revenue share of 25.5% in 2021. Calendered Polyvinyl Chloride (PVC) flexible film is a transparent, low-cost material with high thermoforming, physical, and chemical resistance; low permeability to oils, fats, and aromatic substances, and low permeability index to air humidity. It is the most common material used in blister packaging in the pharmaceutical industry.

In medical applications, calendered polyvinyl chloride flexible film is used for packaging medicines and drugs and storing medicines owing to their highly effective chemical resistance properties. In addition, they are also used in the production of fluid bags, transdermal patches, wound-care products, and disposable surgical gowns.

The use of calendered polyvinyl chloride flexible film in the automotive sector is in underbody coatings, sealants, floor modules, and wire harnesses (cable insulation and grommets). Calendered PVC flexible films are used mainly on the exterior of the car, particularly in areas where the paint on the vehicle body is exposed to wear and impact from dirt and gravel from the road. Their main function is to ensure that the paint coating of a component is not damaged throughout its lifetime and to preserve its appearance over time. They usually have a form of thin transparent sheet covered with an adhesive material on one side.

Building and construction is one of the prominent applications of calendered polyvinyl chloride (PVC) flexible films. Calendered PVC flexible films are effective in protecting the environment, in terms of low greenhouse gas emissions and conservation of resources and energy due to their strong resistance to moisture and abrasion. It is also ideal for cladding, windows, roofing, fencing, decking, wallcoverings, and flooring.

Regional Insights

Asia Pacific dominated the market and accounted for a revenue share of more than 28.0% in 2021. The market across the region is expected to witness substantial growth on account of increasing applications of calendered PVC flexible films in dialyzing, IV & pharmacology, and urine bags, among others. Further, the demand for high-quality medical devices and components from hospitals in major economies such as China, India, and Japan is increasing on account of rising expenditure on the healthcare industry. In addition, improving service and safety standards in hospitals is expected to drive the market over the forecast period.

The presence of major economies with high healthcare costs and increasing expenditure of various governments on public and private health systems are expected to positively impact the market growth. Increasing private participation in the healthcare industry to improve healthcare services and infrastructure and offer high-quality treatment in countries like China, Japan, India, Singapore, and Australia is expected to boost the market growth.

Key Companies & Market Share Insights

Manufacturers of polyvinyl chloride (PVC) used for calendered flexible films aim to strengthen their market position by expanding their customer base. Caprihans India Limited, ACG, and Mississippi Polymers Inc. are producers of economical and lightweight polyvinyl chloride (PVC) resins with good resistance to inorganic chemicals that are used for calendered polyvinyl chloride flexible films. Some of the prominent players in the calendered polyvinyl chloride flexible films market include:

-

Mississippi Polymers, Inc.

-

Teknor Apex Company, Inc.

-

Canadian Speciality Vinyls

-

South Asia Plastics Group

-

ACG

-

Caprihans India Limited

-

Mondorevive S.p.a.

-

ALFATHERM SpA

-

HEXIS S.A.S.

-

ZHONGSHAN LIN-YANG PLASTIC CO.LTD.

-

RENOLIT SE

Calendered Polyvinyl Chloride Flexible Films Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 16.5 billion

Revenue forecast in 2030

USD 25.2 billion

Growth Rate

CAGR of 5.3% from 2022 to 2030

Base year for estimation

2021

Historical data

2019 - 2020

Forecast period

2022 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2022 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End-use, region

Region scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; India; Japan; Taiwan; South Korea; Brazil; GCC Countries

Key companies profiled

Mississippi Polymers Inc.; Teknor Apex Company, Inc.; Canadian Speciality Vinyls; South Asia Plastic Group; ACG; Caprihans India Limited; Mondorevive S.p.a.; ALFATHERM SpA; ZHONGSHAN LIN-YANG PLASTIC CO.LTD.; RENOLIT SE; HEXIS S.A.S.; ZHONGSHAN LIN-YANG PLASTIC CO.LTD.; RENOLIT SE

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2030. For this study, Grand View Research has segmented the global calendered polyvinyl chloride flexible films market report based on end-use and region:

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

Pharmaceutical

-

Medical

-

Automotive

-

Building & Construction

-

Consumer Goods

-

Industrial

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Taiwan

-

South Korea

-

ASEAN

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

GCC Countries

-

-

Frequently Asked Questions About This Report

b. The global calendered polyvinyl chloride flexible films market size was estimated at USD 16.0 billion in 2021 and is expected to reach USD 16.5 billion in 2022.

b. The global calendered polyvinyl chloride flexible films market is expected to grow at a compound annual growth rate of 5.3% from 2022 to 2030 to reach USD 25.2 billion by 2030.

b. Asia Pacific dominated the reclaimed rubber market with a share of 28.72% in 2021. This is in line with the increasing applications of calendered polyvinyl chloride flexible films in dialyzing, IV & pharmacology, and urine bags, among others.

b. Some key players operating in the calendered polyvinyl chloride flexible films market include Mississippi Polymers, Inc., Teknor Apex Company, Inc., Canadian Speciality Vinyls, South Asia Plastics Group, ACG, Caprihans India Limited, Mondorevive S.p.a., ALFATHERM SpA, HEXIS S.A.S., ZHONGSHAN LIN-YANG PLASTIC CO.LTD., and RENOLIT SE.

b. Key factors that are driving the calendered polyvinyl chloride flexible films market growth include the rising demand for calendered polyvinyl chloride flexible films in food & beverage packaging applications and growing utilization of calendered polyvinyl chloride flexible films in global building & construction industry.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."