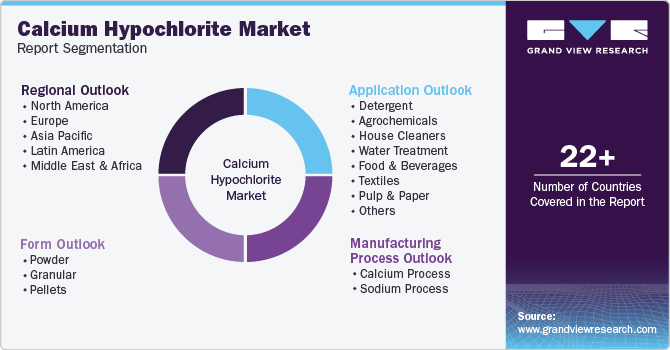

Calcium Hypochlorite Market Size, Share & Trends Analysis Report By Manufacturing Process (Calcium Process, Sodium Process), By Form (Powder), By Application (Water Treatment), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-652-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

Calcium Hypochlorite Market Size & Trends

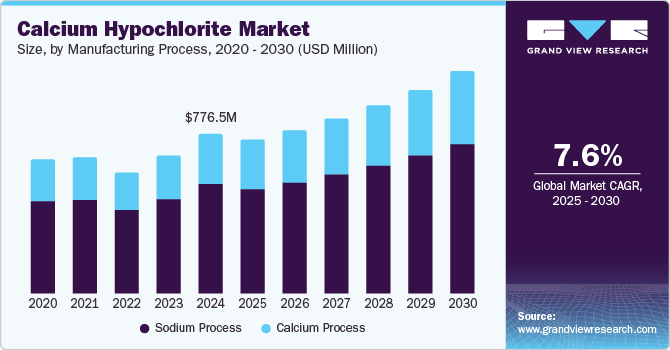

The global calcium hypochlorite market size was valued at USD 776.5 million in 2024 and is expected to grow at a CAGR of 7.6% from 2025 to 2030. This growth is attributed to the Increasing demand for safe drinking water and effective sanitation, particularly in developing countries, which significantly boosts its use in water treatment applications. In addition, rising health awareness and stringent regulatory requirements for water quality further propel market expansion. Furthermore, the compound's versatility in household cleaning products and industrial applications and its growing focus on hygiene and disinfection in various sectors contribute to its sustained global demand.

Calcium hypochlorite is an inorganic compound and is widely recognized for its role in chlorine and bleaching powders. It decomposes slowly in humid air, releasing a strong chlorine scent, and can irritate the skin when overused. This compound is extensively employed for disinfecting swimming pools, purifying drinking water, and bleaching textiles and paper. Due to its reactive nature, it must be stored away from organic materials to prevent potential fire hazards or explosions.

A significant driver of calcium hypochlorite's demand is the rising incidence of waterborne illnesses, particularly in densely populated urban areas where sanitation may be lacking. The increasing global population exacerbates this issue, leading to heightened awareness regarding the need for clean water. Moreover, the compound's application in water treatment is expanding as concerns about freshwater contamination grow. Calcium hypochlorite is crucial in the pre-treatment and post-treatment stages of water purification. It effectively sanitizes wastewater treatment facilities and public swimming pools, ensuring safe recreational environments. Furthermore, it is a powerful disinfectant for various household products and surfaces, including kitchen utensils and equipment.

The versatility of calcium hypochlorite extends beyond water treatment; it is also utilized as an oxidizer for decontaminating hazardous substances and as a pesticide against pests such as caterpillars. Its role in maintaining hygiene across multiple sectors underscores its importance in contemporary sanitation practices, making it vital in combating health risks associated with contaminated water and unsanitary conditions.

Manufacturing Process Insights

The sodium process dominated the market and accounted for the largest revenue share of 68.3% in 2024 attributed to its superior properties, particularly its high chlorine content and enhanced thermal stability. In addition, this process produces calcium hypochlorite that is less prone to moisture absorption, making it ideal for applications requiring stringent water quality standards, such as in swimming pools and drinking water disinfection. Furthermore, the sodium process yields a product with better whiteness and lower precipitation, which appeals to industries focused on environmental applications and sanitation, thereby increasing its market share.

The calcium process is expected to grow at a CAGR of 7.9% over the forecast period, owing to its extensive use in bleaching applications across various industries, including textiles and paper. This method produces calcium hypochlorite that effectively disinfects water and promotes hygiene in agricultural practices. In addition, the rising awareness of waterborne diseases has spurred demand for this process, particularly in developing regions where access to clean water is critical. Furthermore, the calcium process supports epidemic prevention efforts and is increasingly utilized in municipal water treatment facilities, contributing to its growth in the market.

Form Insights

The powder form held the dominant position in the calcium hypochlorite industry and accounted for the largest revenue share of 52.8% in 2024 attributed to its rapid dissolution properties, making it highly effective for various applications, particularly in water treatment. In addition, powdered calcium hypochlorite is preferred by end-users because it offers better stability during storage and is less prone to caking compared to granules. Furthermore, its quick solubility allows for immediate use in disinfection processes, enhancing its appeal in settings that require prompt action against pathogens, such as swimming pools and municipal water systems.

The granular form is expected to grow at a CAGR of 7.7% over the forecast period, owing to its effectiveness as a powerful disinfectant that can be easily handled and stored. Granular calcium hypochlorite is particularly favored for water treatment applications due to its controlled release of chlorine, which ensures prolonged disinfection. Furthermore, this form is also commonly used in larger-scale applications, including wastewater treatment plants and agricultural practices. Moreover, the convenience of measuring and dosing granular products makes them suitable for various industrial cleaning tasks, thereby supporting their growth in the market as industries seek efficient and reliable sanitation solutions.

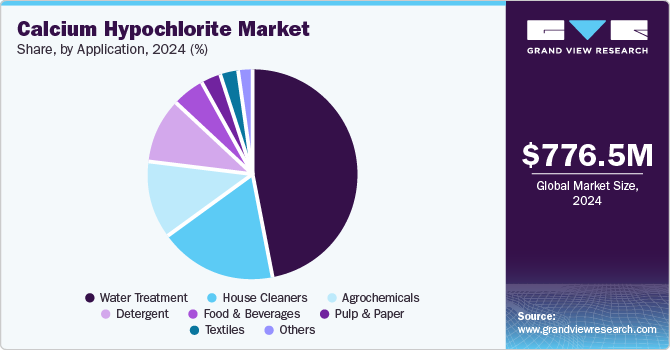

Application Insights

The water treatment application segment led the market and accounted for the largest revenue share of 46.8% in 2024, driven by the increasing need for safe and clean drinking water. With rising urban populations and industrial activities leading to water contamination, there is a heightened demand for effective disinfection solutions. In addition, calcium hypochlorite is favored for its powerful oxidizing properties, making it essential for municipal water treatment facilities and swimming pools. Furthermore, stringent regulations regarding water quality and public health concerns further propel its use in ensuring safe water supply across various regions.

House Cleaners application is expected to grow at a CAGR of 8.4% from 2025 to 2030, owing to the growing consumer awareness of hygiene and sanitation. As households increasingly prioritize cleanliness, products containing calcium hypochlorite are sought after for their effective disinfecting capabilities. In addition, this compound is commonly found in various household cleaning agents, including bathroom cleaners and laundry detergents, due to its ability to eliminate bacteria and odors. Furthermore, the ongoing trend toward maintaining a hygienic living environment, especially in light of recent global health crises, continues to drive the growth of this segment in the market.

Regional Insights

North America calcium hypochlorite market is expected to grow at a CAGR of 7.6% over the forecast period, owing to the increasing number of households with swimming pools, which drives demand for effective pool maintenance products. In addition, the region's established infrastructure for water treatment also supports the rising usage of calcium hypochlorite in municipal facilities for disinfecting drinking water. Furthermore, heightened awareness of hygiene and sanitation standards among consumers has led to increased adoption of calcium hypochlorite in household cleaning products, further contributing to market growth.

U.S. Calcium Hypochlorite Market Trends

The calcium hypochlorite in the U.S. dominated the North American market and accounted for the largest revenue share in 2024 attributed to its application in municipal water treatment plants and swimming pool maintenance. In addition, the growing focus on public health initiatives and stringent regulations regarding water quality drive the need for reliable disinfection methods. Furthermore, the rising prevalence of waterborne diseases has heightened consumer awareness about hygiene practices, increasing calcium hypochlorite utilization in residential and commercial cleaning applications.

Asia Pacific Calcium Hypochlorite Market Trends

The Asia Pacific calcium hypochlorite market dominated the global market and accounted for the largest revenue share of 43.8% in 2024 attributed to rapid industrialization and urbanization, particularly in countries such as China and India. In addition, the increasing population and rising awareness of waterborne diseases have intensified the demand for effective water treatment solutions. Furthermore, stringent regulatory measures regarding water quality further propel this growth as governments invest in infrastructure to ensure safe drinking water. Moreover, expanding agriculture, municipal water treatment, and swimming pool applications contribute significantly to this region's expansion.

The calcium hypochlorite market in Japan dominated the Asia Pacific market and accounted for the largest revenue share in 2024, driven by a strong emphasis on public health and safety standards. In addition, the country’s advanced water treatment infrastructure necessitates high-quality disinfection solutions to maintain water purity. Furthermore, Japan's proactive approach to environmental sustainability drives the adoption of calcium hypochlorite in various sectors, including agriculture and food processing. Moreover, the increasing focus on hygiene, especially following health crises, has increased demand for effective disinfectants, further boosting the market.

Europe Calcium Hypochlorite Market Trends

Europe calcium hypochlorite market is expected to be driven by stringent environmental regulations to improve water quality across member states. The growing emphasis on sustainable practices encourages industries to adopt effective disinfection solutions such as calcium hypochlorite. Furthermore, rising consumer awareness regarding hygiene standards in public spaces and households contributes to increased demand for this compound in cleaning products and sanitation applications. Moreover, the region's robust infrastructure for wastewater management also supports the ongoing use of calcium hypochlorite in various industrial processes.

The growth of the calcium hypochlorite market in the UK is driven by increasing investments in water treatment facilities and public health initiatives focused on combating waterborne illnesses. Furthermore, the government’s commitment to maintaining high drinking water quality standards drives demand for effective disinfectants such as calcium hypochlorite. Moreover, the rising popularity of home cleaning products that utilize this compound enhances its market presence as consumers prioritize hygiene in their daily lives following recent health crises.

Key Calcium Hypochlorite Company Insights

Some of the key companies in the calcium hypochlorite industry include Olin Corporation, Aditya Birla Chemicals, RXChemicals, and others. These companies adopt various strategies to enhance their competitive edge. These include investing in research and development to innovate and improve product formulations that cater to evolving customer needs. In addition, strategic partnerships and collaborations with other firms and organizations are also common, enabling companies to expand their market reach and leverage shared resources. Furthermore, companies focus on enhancing their distribution networks to ensure efficient product delivery while emphasizing sustainability practices to align with environmental regulations and consumer preferences.

-

RXChemicals manufactures and supplies calcium hypochlorite granules, which are widely recognized for their efficacy in disinfection and sanitation applications. The company operates primarily in the water treatment segment, providing solutions for swimming pools, spas, and municipal water supplies. The company produces high-quality calcium hypochlorite that effectively eliminates harmful microorganisms, making it a vital component in maintaining water hygiene and safety across various industries.

-

Hawkins Chemical, Inc. produces and distributes calcium hypochlorite, primarily for water treatment facilities and industrial applications. The company also operates within the chemical manufacturing segment, offering a range of disinfectants and sanitizers. The company emphasizes the versatility of calcium hypochlorite in applications such as wastewater treatment, agriculture, and household cleaning, ensuring that customers can access effective solutions for maintaining hygiene and safety in diverse environments.

Key Calcium Hypochlorite Companies:

The following are the leading companies in the calcium hypochlorite market. These companies collectively hold the largest market share and dictate industry trends.

- Tianjin Kaifeng Chemical Co., Ltd.

- Olin Corporation

- Aditya Birla Chemicals

- RXChemicals

- Hawkins Chemical, Inc.

- Sigura

- Sinopec

- Nikunj Chemicals

- American Elements

- Westlake Chemical Corporation

- Tosoh Corporation

- Tianjin Ruifuxin Chemical Co., Ltd.

- Vizag Chemicals

- Kakadiya Chemicals

- Sage Oil LLC

Recent Developments

-

In August 2024, Olin Corporation announced lifting its system-wide force majeure on chlor-alkali products, which had been declared on July 10 due to disruptions caused by Hurricane Beryl at its Freeport, Texas facility. With production restored, Olin is set to resume manufacturing calcium hypochlorite and other chlor-alkali derivatives. This resumption is crucial for ensuring a stable supply of calcium hypochlorite, widely used in water treatment and sanitation applications, thereby supporting public health initiatives.

Calcium Hypochlorite Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 746.0 million |

|

Revenue forecast in 2030 |

USD 1.07 billion |

|

Growth rate |

CAGR of 7.6% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Volume in kilotons, revenue in USD million, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Manufacturing process, form, application, region |

|

Regional scope |

North America; Asia Pacific; Europe; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; China; India; Japan; Germany; UK; France; Italy; Brazil; Argentina; South Africa; Saudi Arabia |

|

Key companies profiled |

Tianjin Kaifeng Chemical Co., Ltd.; Olin Corporation; Aditya Birla Chemicals; RXChemicals; Hawkins Chemical, Inc.; Sigura; Sinopec; Nikunj Chemicals; American Elements; Westlake Chemical Corporation; Tosoh Corporation; Tianjin Ruifuxin Chemical Co., Ltd.; Vizag Chemicals; Kakadiya Chemicals; Sage Oil LLC. |

|

Customization scope |

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Calcium Hypochlorite Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global calcium hypochlorite market report based on manufacturing process, form, application, and region:

-

Manufacturing Process Outlook (Volume Kilotons; Revenue, USD Million, 2018 - 2030)

-

Calcium Process

-

Sodium Process

-

-

Form Outlook (Volume Kilotons; Revenue, USD Million, 2018 - 2030)

-

Powder

-

Granular

-

Pellets

-

-

Application Outlook (Volume kilotons; Revenue, USD Million, 2018 - 2030)

-

Detergent

-

Agrochemicals

-

House Cleaners

-

Water Treatment

-

Food & Beverages

-

Textiles

-

Pulp & Paper

-

Others

-

-

Regional Outlook (Volume Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."