- Home

- »

- Consumer F&B

- »

-

Calcium-fortified Food Market Size & Share Report, 2030GVR Report cover

![Calcium-fortified Food Market Size, Share & Trends Report]()

Calcium-fortified Food Market Size, Share & Trends Analysis Report By Nature (Organic, Conventional), By Distribution Channel (Specialty Store, Online), By Product, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-372-3

- Number of Report Pages: 102

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Calcium-fortified Food Market Size & Trends

The global calcium-fortified food market size was estimated at USD 3.10 billion in 2023 and is expected to grow at a CAGR of 6.8% from 2024 to 2030. Increasing health awareness is a significant factor driving the demand for calcium-fortified foods. The global population is aging, with a significant increase in the number of elderly individuals. Aging is associated with a higher risk of osteoporosis and other bone-density-related issues. As bones lose density and strength with age, the demand for calcium-enriched products rises. Elderly individuals and their caregivers are increasingly seeking out foods fortified with calcium to help mitigate the risks associated with aging bones. This demographic shift is a substantial driver of the market, as manufacturers cater to the nutritional needs of an older population.

Consumers are more informed about the importance of adequate calcium intake for maintaining bone health and preventing conditions like osteoporosis. According to the International Osteoporosis Foundation (IOF), an estimated 200 million people worldwide suffer from osteoporosis, a condition that leads to weakened bones and an increased risk of fractures. According to the American Medical Association (AMA), in May 2024, approximately 10 million people had osteoporosis, and another 44 million had low bone density in the U.S.

Modern dietary habits have shifted significantly, with a notable trend towards plant-based and dairy-free diets. While these diets offer various health benefits, they can also lead to a lower intake of calcium if not properly managed. Vegetarians, vegans, and individuals with lactose intolerance often seek out calcium-fortified foods to ensure they meet their daily nutritional requirements. This dietary shift has prompted food manufacturers to innovate and expand their product lines to include calcium-fortified options that appeal to these consumer segments. For instance, according to a 2022 report by the Plant Based Foods Association, the plant-based food market grew by 27% in the previous year, indicating a shift in consumer preferences. However, these dietary patterns can lead to lower calcium intake if not carefully managed.

The growing interest in sports and fitness is another factor contributing to the increased demand for calcium-fortified foods. Athletes and fitness enthusiasts are particularly conscious of their nutritional needs, including calcium, which is crucial for muscle function and bone strength. Calcium-fortified products are often marketed to these consumers as part of a balanced diet that supports physical activity and performance. The association between calcium intake and optimal health outcomes for active individuals has led to the incorporation of calcium fortification in various sports nutrition products.

The food and beverage industry is continually evolving, with innovation playing a key role in meeting consumer demands. Manufacturers are developing new and exciting products that cater to the growing interest in functional foods—those that provide health benefits beyond basic nutrition. Calcium-fortified foods fall into this category, and the market has seen the introduction of innovative products such as fortified juices, plant-based milks, cereals, and even snacks. These innovations make it easier for consumers to incorporate calcium into their daily diets in convenient and enjoyable ways.

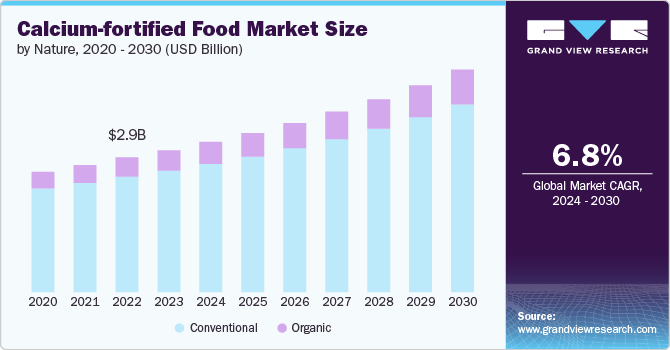

Nature Insights

Conventional calcium-fortified food accounted for a revenue share of around 85.67% in the year 2023, owing to growing health awareness and the increasing prevalence of calcium deficiencies. In addition, the rising trend of veganism and lactose intolerance has spurred the demand for fortified plant-based alternatives. With calcium being crucial for bone health, manufacturers are increasingly adding it to a variety of products, including juices, cereals, and snacks, to cater to the health-conscious consumer base.

Organic calcium-fortified food is projected to grow at a CAGR of 8.2% over the forecast period of 2024-2030. The rising consumer preference for natural and health-focused products is propelling market growth. As awareness of the health benefits of organic foods grows, more people are seeking calcium-fortified options to prevent deficiencies and support bone health. The rise of chronic diseases related to poor dietary habits has led individuals to proactively seek fortified foods to improve their overall health and well-being. These factors collectively contribute to the increasing demand for organic calcium-fortified foods.

Product Insights

The dairy & dairy alternatives accounted for a revenue share of around 38.46% in the year 2023. Health and ethical considerations drive the growing trend towards plant-based diets and lactose-free options. Brands like Almond Breeze and Silk offer calcium-fortified almond and soymilk alternatives to cater to this demand. Secondly, rising awareness of bone health and calcium's role in preventing osteoporosis has led consumers to seek out fortified dairy products and alternatives

The baby food & infant formula is projected to grow at a CAGR of 7.8% over the forecast period of 2024-2030. Parents are becoming more health-conscious and aware of the importance of adequate calcium intake for their children's growth and bone development. This awareness is driving them to seek out fortified options. The rise in dual-income households has also led to a greater reliance on convenient and nutritionally complete baby foods and formulas. In addition, advancements in food science have enabled manufacturers to create products with improved taste, texture, and nutritional profiles, making them more appealing to both parents and infants.

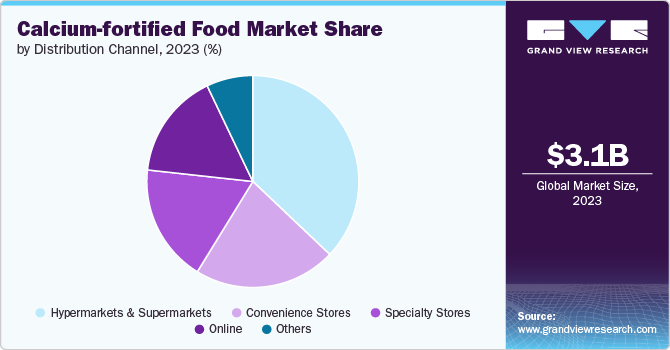

Distribution Channel Insights

The hypermarkets & supermarkets channel accounted for a revenue share of around 37.08% in 2023. The extensive product variety available in these large retail formats allows consumers to easily find and choose from a wide range of calcium-fortified options, from dairy products to cereals and beverages. Moreover, the convenience and one-stop-shopping experience that hypermarkets and supermarkets provide attract busy consumers who prefer to buy all their groceries in one place is expected to drive the market growth.

The online channel is estimated is projected to grow at a CAGR of 8.3% over the forecast period of 2024 to 2030. Online platforms provide a wide selection of products from various brands, allowing shoppers to compare options and find specialized fortified foods easily. The ability to shop anytime and anywhere appeals to busy individuals seeking convenient solutions for their nutritional needs. Moreover, online retailers often offer competitive pricing, discounts, and promotions that attract cost-conscious consumers.

Regional Insights

The calcium-fortified food market in North America held 35.85% of the global revenue in 2023. There is a growing awareness of bone health and the importance of calcium in preventing osteoporosis among the aging population. Governments and health organizations play a crucial role in promoting the consumption of calcium-fortified foods. The U.S. has implemented policies to encourage fortifying staple foods with essential nutrients, including calcium. For instance, the U.S. Food and Drug Administration (FDA) sets guidelines for fortifying foods to address nutrient deficiencies in the population.

U.S. Calcium-fortified Food Market Trends

The calcium-fortified food market in the U.S. is expected to grow at the highest CAGR from 2024 to 2030. The popularity of plant-based diets and dairy alternatives has surged, with products like fortified almond milk and soy-based snacks gaining traction. Busy lifestyles also contribute, with fortified convenience foods meeting the demand for easy-to-access nutritional options. These trends, coupled with robust marketing and regulatory support, are driving the expansion of the U.S. market.

Europe Calcium-fortified Food Market Trends

The calcium-fortified food market in Europe is projected to grow at a CAGR of 5.8% from 2024 to 2030. The rising concerns over bone health and osteoporosis prevention, affecting a substantial portion of the population. Furthermore, the shift towards healthier diets and fortified food options, including dairy alternatives and fortified cereals, is gaining momentum. Regulatory support and consumer awareness campaigns promoting the benefits of calcium-fortified foods also play pivotal roles in driving market growth across Europe. These factors collectively contribute to the increasing adoption of calcium-fortified foods in the region.

Asia Pacific Calcium-fortified Food Market Trends

The calcium-fortified food market in Asia Pacific accounted for a revenue share of around 24.54% in the year 2023. Rising incidences of osteoporosis and calcium deficiency are major concerns, particularly among aging populations in countries like Japan, South Korea, and China. The adoption of Western dietary trends and lifestyles, including fortified dairy products and breakfast cereals, is also contributing to market growth. Moreover, the expanding middle-class population and rising disposable incomes are fueling demand for functional and fortified foods.

Key Calcium-fortified Food Company Insights

The market features both established global firms and emerging players. Key industry leaders prioritize product innovation, differentiation, and distinctive designs in line with evolving consumer preferences. Leveraging extensive global distribution networks, these major players effectively reach diverse customer bases and tap into emerging markets.

Key Calcium-fortified Food Companies:

The following are the leading companies in the calcium-fortified food market. These companies collectively hold the largest market share and dictate industry trends.

- Danone

- General Mills Inc.

- Arla Foods amba

- Nestlé S.A.

- Lucerne Foods

- Kellogg’s

- Clif Bar & Company

- Abbott Laboratories

- Hain Celestial Group

- Reckitt

Recent Developments

-

In October 2021, Danone India introduced AptaGrow, its latest offering in the health drink category for children, aligning with its mission to enhance health through food accessibility. Designed specifically for children aged 3-6 years, AptaGrow addresses their nutritional needs with flavors like Tasty Chocolate and Vanilla. This product is tailored to support height gain with its formulation containing 100% milk protein and calcium. AptaGrow aims to meet the specific dietary requirements of growing children in India, ensuring they receive essential nutrients for their development.

Calcium-fortified Food Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.28 billion

Revenue forecast in 2030

USD 4.87 billion

Growth rate

CAGR of 6.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Nature, product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Danone; General Mills Inc.; Arla Foods amba; Nestlé S.A.; Lucerne Foods; Kellogg’s; Clif Bar & Company; Abbott Laboratories; Hain Celestial Group; Reckitt

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Calcium-fortified Food Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the calcium-fortified food market based on nature, product, distribution channel, and region

-

Nature Outlook (Revenue, USD Million, 2018 - 2030)

-

Organic

-

Conventional

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Bakery & Snacks Products

-

Dairy & Dairy Alternatives

-

Breakfast & Cereals Bars

-

Baby Food & Infant Formula

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global calcium-fortified food market was estimated at USD 3.10 billion in 2023 and is expected to reach USD 3.28 billion in 2024.

b. The global calcium-fortified food market is expected to grow at a compound annual growth rate of 6.8% from 2024 to 2030 to reach USD 4.87 billion by 2030.

b. North America dominated the calcium-fortified food market with a share of over 35.85% in 2023. The growth of the regional market is mainly driven by a growing awareness of bone health and the importance of calcium in preventing osteoporosis among the aging population.

b. Some of the key players operating in the calcium-fortified food market include Danone, General Mills Inc., Arla Foods amba, Nestlé S.A., Lucerne Foods, Kellogg's, Clif Bar & Company, Abbott Laboratories, Hain Celestial Group, and Reckitt.

b. Key factors that are driving the calcium-fortified food; market growth include the rising health consciousness, a growing elderly population concerned with bone health, dietary trends favoring fortified products, regulatory encouragement for nutrient enrichment, and consumer preference for functional foods.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."