- Home

- »

- Organic Chemicals

- »

-

Calcium Formate Market Size, Share & Growth Report, 2030GVR Report cover

![Calcium Formate Market Size, Share & Trends Report]()

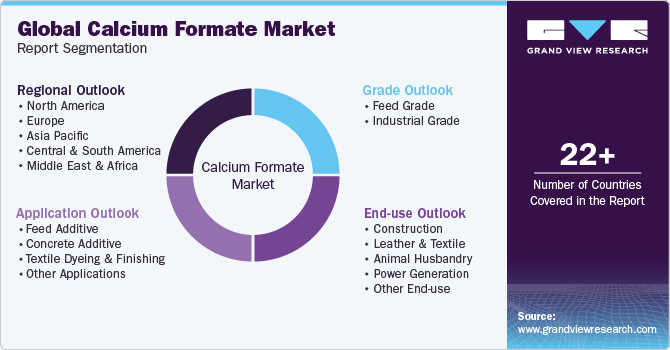

Calcium Formate Market (2023 - 2030) Size, Share & Trends Analysis Report By Grade (Industrial Grade, Feed Grade), By Application (Feed Additive, Concrete Additive), By End-use (Construction, Leather & Textile), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-151-0

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Calcium Formate Market Summary

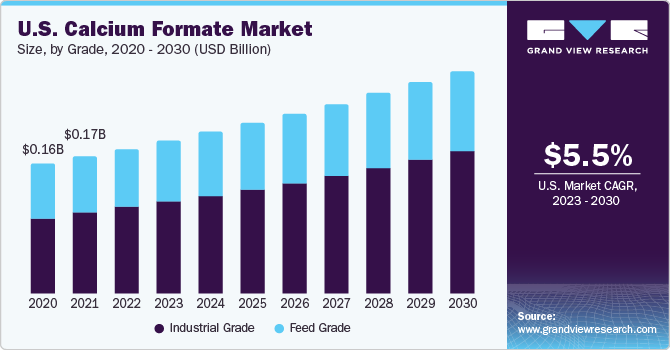

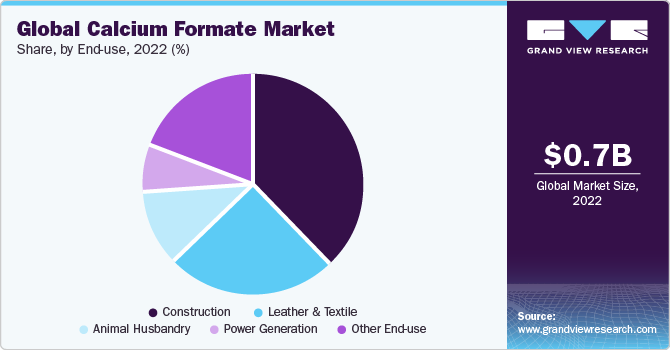

The global calcium formate market size was estimated at USD 0.75 billion in 2022 and is anticipated to reach USD 1.25 billion by 2030, expanding at a compound annual growth rate (CAGR) of 5.5% from 2023 to 2030. The construction industry plays a vital role in boosting product demand, as it is utilized as a cement additive, thus imparting improved properties such as increased strength, faster setting time, and reduced shrinkage.

Key Market Trends & Insights

- The Asia Pacific region dominated the market with the largest revenue share of more than 33.3% in 2022.

- By grade, the industrial grade segment dominated the market with a revenue share of more than 59.2% in 2022.

- By application, the concrete setting segment dominated the market in 2022 with the largest revenue share of more than 26.3%.

- By end-use, the construction segment dominated the market in 2022 with a revenue share of more than 38.0%.

Market Size & Forecast

- 2022 Market Size: USD 0.75 Billion

- 2030 Projected Market Size: USD 1.25 Billion

- CAGR (2023-2030): 5.5%

- Asia Pacific: Largest market in 2022

Ongoing infrastructure development projects, such as roads, airports, bridges, and railways, require the product to improve the performance of concrete. The market demand is projected to rise, as these infrastructure projects continue to expand worldwide.

The product is additionally utilized in commercial and residential construction projects. It helps improve the quality and durability of the concrete that is used in floors, foundations, walls, as well as other structural elements. The rising demand for this product in these sectors is driven by the requirement for stronger and more reliable construction materials.

The rising demand for the market in the U.S. is primarily driven by the construction industry and the consumption of animal-derived products. The product is used as an accelerator in concrete setting applications, which is essential in the construction industry. The increasing construction activities and infrastructure development in the U.S. contribute to the demand for the product in the construction sector. The product is used in feed additive in the animal husbandry sector to enhance animal growth and improve feed quality. It finds application in the leather industry for tanning processes.

Grade Insights

The industrial grade segment dominated the market with a revenue share of more than 59.2% in 2022. This is attributable to the use of feed grade in products as a feed additive for animals. It offers several benefits in animal nutrition and health such as helps improve digestion and reduce the incidence of diarrhea and others.

Feed grade is added to animal feed to improve its quality and enhance animal health. It acts as a preservative, preventing the growth of harmful bacteria and extending the shelf life of the feed. It helps maintain the pH balance in the digestive system of animals, promoting better digestion. It also exhibits antibacterial properties, reducing the risk of bacterial infections in animals.

Industrial grade is used in various industries for different applications such as setting accelerator in cement and concrete formulations, as a food additive, and preventive in food industry, and as a feed additive for animals. It possesses unique properties that make it suitable for specific purposes. Industrial grade finds application in the construction industry as a cement additive. It enhances the properties of concrete, such as setting time, strength, and shrinkage control. This grade helps improve the performance and durability of concrete in construction projects.

Industrial grade is utilized in the textile and leather industries. It acts as a catalyst in dyeing and printing process improving color retention and dye penetration in fibers and fabrics. It also serves as a pH regulator and buffering agent, ensuring consistent and vibrant dyeing results.

Application Insights

The concrete setting segment dominated the market in 2022 with the largest revenue share of more than 26.3 %. This is attributable to the fact that it is utilized as a concrete additive in the construction industry. It acts as an accelerator in cement-based formulations, reducing the setting time of concrete and improving its early strength development. This property makes it valuable in applications where rapid setting and early strength gain are desired, such as in cold-weather concrete or for fast-track construction projects.

The product when used as a feed additive in animal nutrition serves as a source of calcium and formic acid, providing nutritional benefits to livestock. It helps in improving digestion, promoting growth, and enhancing overall animal health.

The product is employed in the textile industry for dyeing and finishing process. It acts as a buffering agent, helping to stabilize the pH of dye baths and ensuring consistent color results. The product can enhance the dye's affinity to the fabric, resulting in improved dye uptake and color fastness.

End-use Insights

The construction segment dominated the market in 2022 with a revenue share of more than 38.0%. The product is used as an additive in cement-based formulations, such as concrete, to accelerate the setting time and improve early strength development. This property is particularly beneficial in cold weather for concerts or for projects that require rapid setting and early strength gain.

The product is employed in the leather and textile industries as it serves as a buffering agent, helping to stabilize the pH of dye baths during the dyeing and finishing process. By maintaining the desired pH level, the product ensures consistent color results and enhances dye uptake, resulting in improved color fastness. It is also widely used as a feed additive for animal nutrition and helps improve digestion, promote growth, and enhance overall animal health. Calcium formate has applications in the power generation industry as it can be used as an additive in drilling fluids for oil and gas wells. In addition, it helps to control fluid loss and stabilize the rheological properties of the drilling fluid, ensuring efficient drilling operations.

Regional Insights

The Asia Pacific region dominated the market with the largest revenue share of more than 33.3% in 2022. This is on account of factors including infrastructural development, construction activities, and the growing demand for animal feed additives. The construction sector in Asia Pacific is booming, aided by population growth, urbanization, and economic development.

Calcium formate is used in several construction applications, such as cement-based mortars, tile adhesives, and self-leveling compounds. These applications greatly benefit from the properties of this product, such as its ability to accelerate the setting time of concrete, enhance its durability, and improve its strength. Additionally, regional infrastructure development projects, such as the construction of bridges, roads, buildings, and other public infrastructure, drive demand for the product. It is widely used as a concrete additive to improve the properties of concrete.

Furthermore, the Asia Pacific region has a significant agricultural sector, and there is a growing demand for animal feed additives to enhance animal health and productivity. Calcium formate is used as a feed additive in the region to improve the digestibility of feed, promote growth, and prevent diseases in livestock.

The market in North America is influenced by factors such as the increasing demand for public infrastructure, government initiatives for housing schemes and transportation infrastructure development, and rising urbanization. These factors contribute to the growth of the construction industry, which in turn drives the demand for concrete additive.

In Europe, the use of organic acids as food additives gained importance after the ban on antibiotic growth promoters (AGPs) in 2006. While this information is not directly related to the application in construction or other industries, it highlights the significance of organic acids in European markets.

Key Companies & Market Share Insights

The market is characterized by intense competition due to the presence of numerous multinational companies. Manufacturers and formulators in the supply chain are engaging in both backward and forward integration. To implement their long-term strategies, companies are prioritizing the establishment of subsidiaries and achieving end-to-end integration across the entire supply chain.

Players are investing in the expansion of production capacities owing to the rising demand for the product from the end-use industries. Furthermore, key market participants are enchanting their global presence through mergers, acquisitions, expansion, partnership, and collaboration. For instance, in 2022, LANXESS announced the acquisition of the microbial control business from IFF Inc.

Also, in April 2021, LANXESS, a specialty chemicals company, successfully acquired the French Theseo group. Theseo group is a prominent manufacturer of animal health and biosecurity solutions. The acquisition was finalized after LANXESS, and the seller signed a binding purchase agreement on February 9, 2021. Approval from the relevant antitrust authorities was obtained in mid-March, allowing the transaction to proceed.

Key Calcium Formate Companies:

- LANXESS

- Perstorp Holding AB

- Chongqing Chuandong Chemical (Group) Co. Ltd.

- Zibo ruibao chemical Co., LTD.

- Henan Botai Chemical Building Material Co., Ltd.

- Shandong Baoyuan Chemical Co. Ltd

- Jiangxi Kosin Frontier Technology Co., Ltd.

- SIDLEY CHEMICAL CO., LTD.

- Zouping Fenlian Biotech Co., Ltd.

- American Elements

- Wujiang yingchuang chemical co., ltd.

- Minerals Technologies Inc.

- Cerne Calcium Company

Calcium Formate Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 0.86 billion

Revenue forecast in 2030

USD 1.25 billion

Growth rate

CAGR of 5.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2023 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Grade, applications, end-use, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, U.K., France, Spain, Italy, Russia, China, India, Japan, South Korea, Malaysia, Australia, Brazil, Argentina, South Africa, Saudi Arabia, UAE

Key companies profiled

LANXESS, Perstorp Holding AB, Chongqing Chuandong Chemical (Group) Co. Ltd., Zibo ruibao chemical Co., LTD., Henan Botai Chemical Building Material Co., Ltd., Shandong Baoyuan Chemical Co. Ltd, Jiangxi Kosin Frontier Technology Co., Ltd.

SIDLEY CHEMICAL CO., LTD., Zouping Fenlian Biotech Co., Ltd., American Elements, Wujiang yingchuang chemical co., ltd., Minerals Technologies Inc., Cerne Calcium Company

Customization scope

fhbdfhdFree report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Calcium Formate Market Report Segmentation

This report forecasts revenue & volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global calcium formate market report based on grade, applications, end-use, and region:

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Feed Grade

-

Industrial Grade

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Feed Additive

-

Concrete Additive

-

Textile Dyeing & Finishing

-

Other Applications

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Construction

-

Leather & Textile

-

Animal Husbandry

-

Power Generation

-

Other End-use

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Malaysia

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global calcium formate market size was estimated at USD 0.75 billion in 2022 and is expected to reach USD 0.86 billion in 2030.

b. The global calcium formate market is expected to grow at a compound annual growth rate of 5.5% from 2022 to 2030 to reach USD 1.25 billion by 2030.

b. Asia Pacific dominated the calcium market with a share of 33.3% in 2022. This is attributed to factors such as infrastructure development, construction activities, and the rising demand for animal feed additives.

b. Some key players operating in the calcium formate market include LANXESS, Perstorp Holding AB, Chongqing Chuandong Chemical (Group) Co. Ltd., Zibo ruibao chemical Co., LTD., Henan Botai Chemical Building Material Co., Ltd., Shandong Baoyuan Chemical Co. Ltd, Jiangxi Kosin Frontier Technology Co., Ltd. SIDLEY CHEMICAL CO., LTD., Zouping Fenlian Biotech Co., Ltd., American Elements, Wujiang yingchuang chemical co., ltd., Minerals Technologies Inc., Cerne Calcium Company.

b. Key factors that are driving the market growth include the construction industry plays a significant role in driving the demand for calcium formate as it is used as a cement additive, contributing to improved properties such as faster setting time, increased strength, and reduced shrinkage.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.