- Home

- »

- Consumer F&B

- »

-

Cake Market Size, Share, Growth And Trends Report, 2030GVR Report cover

![Cake Market Size, Share & Trends Report]()

Cake Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Cupcakes, Sponge Cakes), By Distribution Channel (Foodservice, Retail), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-883-1

- Number of Report Pages: 91

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cake Market Summary

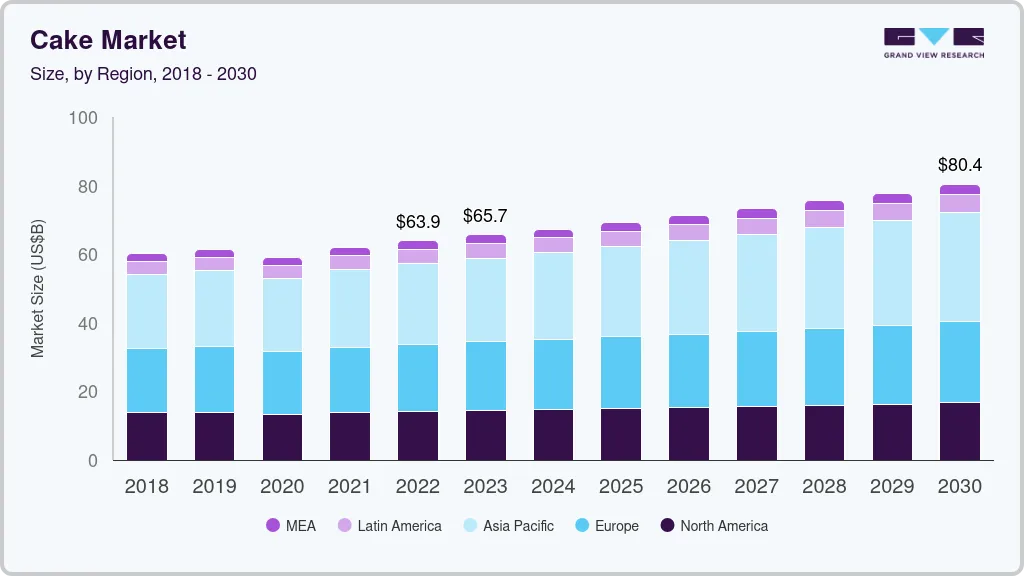

The global cake market size was estimated at USD 65.68 billion in 2023 and is projected to reach USD 80.42 billion by 2030, growing at a compound annual growth rate (CAGR) of 3.0% from 2024 to 2030. The popularity of celebrating various types of special occasions and success through cake cutting is expected to remain a key factor driving the market growth over the next few years.

Key Market Trends & Insights

- Asia Pacific region held a share of 37.2% with a market size of USD 24.46 billion in 2023.

- Based on product, the dessert cakes segment held the largest share of 50.3% with a market size of USD 33.06 billion in 2023.

- In terms of distribution channel, the retail channel segment held the largest revenue share of 83.8% with a market size of USD 55.05 billion in 2023.

Market Size & Forecast

- 2023 Market Size: USD 65.68 billion

- 2030 Projected Market Size: USD 80.42 billion

- CAGR (2024-2030): 3.0%

- Asia Pacific: Largest market in 2023

Furthermore, the rising demand for cakes as desserts post meals during dine-out and weekend parties among millennials and Gen Z consumers globally will further drive the growth of the market during the forecast period. Illnesses like gluten sensitivity and celiac disease have led to an increased adoption of gluten-free and organic diets. In addition, an increasing number of people have non-celiac gluten sensitivity, further expanding the consumer base seeking gluten-free options. This rise in health-conscious consumer behavior has driven the demand for cakes that are not only tasty but also compatible with gluten-restricted diets.

A study published by the University of Nebraska- Lincoln in 2023 estimated that 25% of Americans followed gluten-free diets. This has led to bakeries catering to the niche consumer segment. The surge in gluten-free bakeries has not only catered to individuals with gluten sensitivities but has also opened new avenues for innovation, thereby boosting the global market.

Gluten-free bakeries have responded to this demand with creativity and innovation. These establishments go beyond merely substituting traditional ingredients with gluten-free alternatives; they have mastered crafting indistinguishable cakes from their gluten-containing counterparts. From moist chocolate cakes to delicate sponge cakes, the gluten-free offerings are diverse and satisfying, dispelling the notion that gluten-free equals flavorless. The impact of the rise in gluten-free bakeries is not confined to niche markets; it has reverberated throughout the entire cake industry. Traditional bakeries and large-scale manufacturers have recognized the importance of catering to diverse dietary needs. As a result, many mainstream cake producers have incorporated gluten-free options into their product lines, acknowledging the demand for inclusivity in their offerings.

Beyond health considerations, those adopting a lifestyle choice have also embraced the gluten-free trend. Regardless of gluten sensitivity, many individuals opt for gluten-free products as part of their pursuit of healthier living. This broader acceptance has further driven the growth of gluten-free bakeries, expanding their customer base beyond those with specific medical conditions.

A growing preference for transparency in food labeling has also fueled the rise in gluten-free options. Consumers are more informed than ever about food ingredients and actively seek products with clean and easily understandable ingredient lists. Gluten-free cakes, often made with a focus on natural and minimally processed ingredients, align with this trend, contributing to their popularity among a wide range of consumers.

Market Concentration & Characteristics

The global market is characterized by a high degree of innovation, with companies experimenting with unique and exotic flavors or use innovative ingredients to differentiate their cakes. Moreover, with the increasing focus on health and wellness, some bakeries may offer cakes with healthier ingredients or alternative sweeteners

Merger and acquisition (M&A) activities have been notable in the market. Acquisitions in the global market can be a quick way to expand market reach and gain access to new geographic regions, customer segments, or distribution channels. This can help the acquiring company increase its market share and sales

Regulations governing food safety and quality standards ensure that cakes meet certain health and safety criteria. Compliance with these regulations is crucial for consumer protection and public health. In addition, regulations often dictate the information that must be included on product labels, such as ingredients, nutritional information, allergen warnings, and expiration dates

The market faces high direct substitutes such as cookies, brownies, cheesecakes, pies and tarts, among others. Each of these alternatives provides a unique culinary experience, and the choice often depends on the specific preferences of those enjoying the dessert

Product Insights

The dessert cakes segment held the largest share of 50.3% with a market size of USD 33.06 billion in 2023. Dessert cakes, such as wedding cakes and ice-cream cakes, remain popular for celebrations and special occasions, making them one of the most sought-after desserts in restaurants and parties. Moreover, dessert cakes can be customized and personalized according to individual preferences. This includes choosing from various flavors, fillings, and decorations and accommodating dietary preferences, significantly contributing to their market dominance and growth.

Distribution Channel Insights

The retail channel segment held the largest revenue share of 83.8% with a market size of USD 55.05 billion in 2023. Consumers are increasingly seeking unique and premium cakes, ranging from artisanal and specialty cakes to those catering to specific dietary needs, such as gluten-free, vegan, or low-sugar options.

The demand for variety and customization fuels the expansion of the retail distribution channel as it allows consumers convenient access to a wide range of cake options in one location. As a result, the retail distribution channel will continue to be the dominant sales platform for the market during the forecast period.

Regional Insights

Asia Pacific region held a share of 37.2% with a market size of USD 24.46 billion in 2023. In recent years, the region has witnessed rapid urbanization and rising disposable incomes, leading to a shift in consumer preferences towards indulgent and Western-style desserts, with cakes in particular becoming symbolic of celebration and festivity in the region.

Moreover, consumers' growing awareness and appreciation for premium and artisanal cakes indicate changing tastes and a willingness to explore unique flavor profiles. These factors have positioned the region in a dominant position, further driving the regional market growth during the forecast period.

Key Companies & Market Share Insights

Key players in the market are Pepperidge Farm (Campbell Soup Company), Bimbo Bakeries (Grupo Bimbo), Hostess Brands, Inc., McKee Foods, and Monginis. Manufacturers are adopting various strategies to maintain a competitive edge, with a primary focus on constantly developing new and exciting flavored cakes to satisfy evolving consumer preferences. Furthermore, the manufacturers are adopting sustainable practices, such as eco-friendly packaging and sourcing locally grown ingredients, to appeal to environmentally conscious consumers.

-

In November 2023, Bimbo Bakeries USA, a subsidiary of Grupo Bimbo, introduced Entenman’s first baked donut cake. These are made with ‘‘real ingredients” and contain no artificial colors or high fructose corn syrup, making them an acceptable snack that can be enjoyed as a breakfast, midday, or evening snack.

-

In March 2023, McKee Foods launched Little Debbie Cookies & Creme Brownies in the vending industry. This innovative offering combines two widely popular American classics: brownies and cookies. Each delightful fudge brownie is adorned with smooth, white icing and sprinkled with chocolate cookie crumbles, providing consumers with a delightful blend of rich flavors and a satisfying crunch.

-

In February 2023, Hostess Brands announced the launch of its latest innovation called Hostess Kazbars, a unique candy bar-inspired innovation in the snacks global market. The new Hostess innovation combines soft chocolate cake, cream, candy crunch, and layers of melting caramel or delicate fondant chocolate. The bar is covered in a rich chocolate-flavored coating and a delicious drizzle. Kazbars comes in two flavors: Chocolate Caramel and Triple Chocolate.

Key Cake Companies:

- Pepperidge Farm (Campbell Soup Company)

- Bimbo Bakeries USA (Grupo Bimbo)

- Hostess Brands, Inc.

- McKee Foods

- Balconi S.p.A.

- Monginis

- Merwans Confectioners Pvt. Ltd

- Britannia Industries Limited

- Bake’n Joy Foods, Inc.

- Bonn

Cake Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 67.34 billion

Revenue forecast in 2030

USD 80.42 billion

Growth rate

CAGR of 3.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Brazil; South Africa

Key companies profiled

Pepperidge Farm (Campbell Soup Company); Bimbo Bakeries USA (Grupo Bimbo); Hostess Brands, Inc.; McKee Foods; Balconi S.p.A.; Monginis; Merwans Confectioners Pvt. Ltd; Britannia Industries Limited; Bake’n Joy Foods, Inc.; Bonn

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cake Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global cake market based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Cupcakes

-

Sponge Cakes

-

Dessert Cakes

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Foodservice

-

Retail

-

Hypermarkets & Supermarkets

-

Specialty Stores

-

Online

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Asia Pacific dominated the cakes market with a share of 37.2% in 2023. In recent years, the region has witnessed rapid urbanization and rising disposable incomes, leading to a shift in consumer preferences towards indulgent and Western-style desserts, with cakes, in particular, becoming symbolic of celebration and festivity in the region.

b. Key factors that are driving the market growth include the high popularity of celebrating various types of special occasions and success through cake cutting the rising demand for the cakes as desserts post desserts during dine-out and weekend parties among millennials and Generation Z consumers across the globe.

b. The global cake market size was estimated at USD 65.68 billion in 2023 and is expected to reach USD 67.34 billion in 2024.

b. The global cake market is expected to grow at a compound annual growth rate of 3.0% from 2024 to 2030 to reach USD 80.42 billion by 2030.

b. Some key players operating in the cake market include Finsbury Food Group Plc; Yamazaki Baking Co., Ltd.; MCKEE FOODS; and Grupo Bimbo.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.