- Home

- »

- Consumer F&B

- »

-

Cake Mixes Market Size, Share And Growth Report, 2030GVR Report cover

![Cake Mixes Market Size, Share & Trends Report]()

Cake Mixes Market (2024 - 2030) Size, Share & Trends Analysis Report By Product, By Distribution Channel (Hypermarkets/Supermarkets, Convenience Store, Online and Others), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-288-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cake Mixes Market Summary

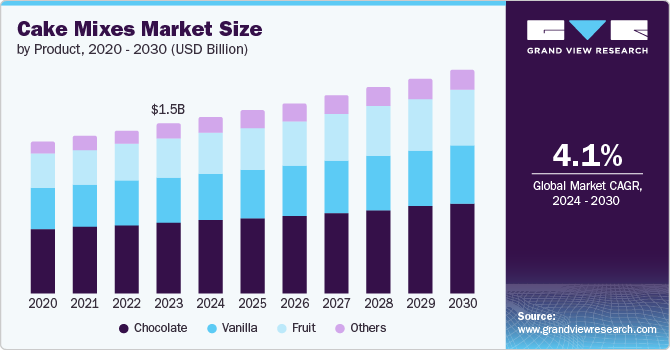

The global cake mixes market size was estimated at USD 1.49 billion in 2023 and is projected to reach USD 1.97 billion by 2030, growing at a CAGR of 4.1% from 2024 to 2030. The increasing population and change in consumer lifestyles and the rising trend of home baking and DIY cooking projects has expanded the cake mixes market.

Key Market Trends & Insights

- North America dominated the global cake mixes market with the largest revenue share of 34.2% in 2023.

- By product, the chocolate segment led the market, holding the largest revenue share of 42.0% in 2023.

- By distribution channel, the online segment is expected to grow at the fastest CAGR from 2024 to 2030.

Market Size & Forecast

- 2023 Market Size: USD 1.49 Billion

- 2030 Projected Market Size: USD 1.97 billion

- CAGR (2024-2030): 4.1%

- North America: Largest market in 2023

With social media platforms showcasing various baking trends and recipes, more consumers are inspired to bake. Cake mixes provide an accessible entry point for novice bakers who may not have the skills or time to bake from scratch, thus driving market growth.

The proliferation of e-commerce sites has played a pivotal role in the market's growth. The rise of non-store-based sales channels, such as online retail platforms, has made cake mixes more accessible to a wider consumer base. The convenience of ordering cake mixes online, along with the availability of a diverse range of flavors and organic options, has contributed to the market's expansion, catering to consumers' evolving preferences.

The increasing preference for ready-to-bake products and food ingredients has contributed to the growth of the global cake mix market. Advancements in packaging technology and distribution channels have played a crucial role in driving the growth of the market. Improved packaging designs highlighting product features and benefits attract consumers at retail stores. Additionally, online platforms and e-commerce channels have made it easier for consumers to purchase a wide range of cake mix products, further contributing to market expansion.

Product Insights

The chocolate segment dominated the market and accounted for a market revenue share of 42.0% in 2023. The increasing consumer preference for indulgent and premium dessert options has fueled the demand for chocolate-based products in cake mixes. The trend of premiumization in the food industry has led to the development of high-quality and indulgent chocolate cake mixes. Consumers are increasingly looking for premium and gourmet baking experiences at home, leading to a rise in demand for premium chocolate cake mixes made with high-quality ingredients. This has expanded the consumer base for chocolate cake mixes and contributed to the segment's overall market growth.

The fruit segment is expected to register the fastest CAGR of 5.3% during the forecast period. The versatility of fruit-based cake mixes catering to different dietary preferences and restrictions has further fueled their market growth. With increasing consumers following vegan, gluten-free, or other specialized diets, manufacturers have introduced fruit-based cake mixes that align with these dietary requirements.

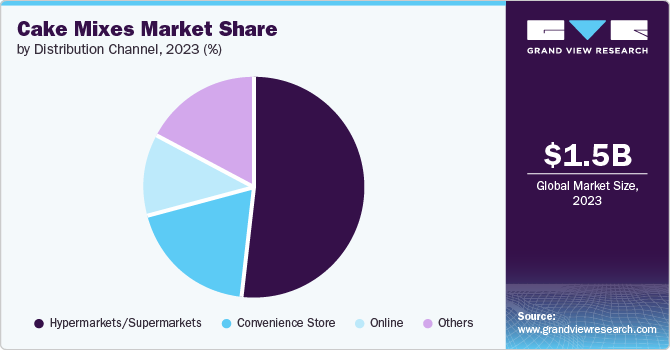

Distribution Channel Insights

Hypermarket/supermarket accounted for the largest market revenue share in 2023. The availability of various cake mixes, including different flavors and types, in hypermarkets and supermarkets has been a significant driver of market growth. These retail formats offer consumers a diverse range of cake mixes, catering to various preferences and dietary needs, thereby attracting a broad consumer base and contributing to the market's overall growth.

The online distribution channel is expected to register the fastest CAGR during the forecast period. The rise of e-commerce platforms selling a variety of organic products in different flavors is driving the market segment. Furthermore, online retailers offering home delivery and substantial discounts on well-known brands are expected to boost non-traditional distribution channels.

Regional Insights

North America cake mixes market dominated the market revenue share with 34.2% in 2023. The soaring consumption of bakery products, changing dietary habits, and the rise in demand for ready-to-eat and ready-to-cook instant products have significantly contributed to the expansion of the cake mixes market in the region. The growing trend of home baking and DIY cooking among consumers in North America, with social media platforms such as Instagram and Pinterest popularizing baking trends and inspiring people to try new recipes at home, has contributed to the surge in demand for cake mixes.

U.S. Cake Mixes Market Trends

The U.S. dominated the North America cake mixes market in 2023. The U.S. market for cake mixes benefits from the busy lifestyles of individuals who seek quick and easy options for baking at home. With the growing trend of home baking and an increasing number of consumers interested in creating customized baked goods, cake mixes offer a practical solution by providing pre-mixed dry ingredients that simplify the baking process. The introduction of innovative and diverse cake mix products has proliferated the market in the U.S. Brands such as Duncan Hines have expanded their product lines to include premium cake mixes with unique flavor combinations and add-ins. This innovation has captured consumers' attention, seeking novel and indulgent baking experiences, thereby driving the market growth of cake mixes in the U.S.

Europe Cake Mixes Market Trends

Europe cake mixes market was identified as a lucrative region in 2023. Consumers are more frequently seeking products that are easy to use, can be prepared quickly, and require minimal effort. Furthermore, the growing popularity of online shopping is driving the market, allowing consumers to easily buy cake mixes from their homes. This has also resulted in a rise in the number of businesses providing cake mixes through online platforms.

The UK cake mixes market is expected to grow rapidly in the coming years. The growing preference for packaged bakery items like cakes, cupcakes, and muffins among UK consumers is also fueling the growth of the cake mixes market. Consumers opt for pre-made mixes that offer consistent quality and taste compared to homemade baked goods. British consumers increasingly seek easy-to-use products to help them quickly prepare baked goods at home without the hassle of measuring and mixing individual ingredients.

Asia Pacific Cake Mixes Market Trends

Asia Pacific cake mixes market is anticipated to witness significant growth in the cake mixes market. The rising population and the increasing disposable income levels in many Asian countries have made premium cake mixes more affordable and accessible to a more extensive consumer base. Consumers are likely to spend more on high-quality cake mixes with superior taste, texture, and convenience. Ultimately, there is a rise in online stores in the Asia Pacific area selling cake mixes, simplifying the process for customers to purchase them from their residences.

China cake mixes market held a substantial market share in 2023. Increasing urbanization drives the need for convenient food choices such as cake mixes. Additionally, western-style desserts are increasingly popular, and using cake mixes provides a simple way to start baking at home. The rapid growth of e-commerce platforms in China has significantly boosted the accessibility and availability of cake mixes to a broader consumer base. Online shopping offers convenience, variety, and competitive pricing, making it easier for consumers to purchase cake mixes and other baking products, thereby driving market growth.

Key Cake Mixes Company Insights

Some of the key companies in the cake mixes market include General Mills, Inc., Dr. Oetker, Conagra Brands, Inc., European Gourmet Bakery, Chelsea Milling Co., Continental Mills, Inc., Pamela's Products, Bob's Red Mill Natural Foods, Inc., Wild Rye Baking Co., SOUTHERN FOOD SYSTEMS LLC. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives.

-

General Mills provides a wide variety of cake mixes, including traditional flavors such as chocolate, vanilla, and red velvet, as well as more unique options such as funfetti, spice cake, and buttermilk pancake mixes. They also provide options for gluten-free and sugar-free dietary restrictions.

-

Dr. Oetker offers cake mixes that cater to convenience and dietary needs. Their main strength lies in eggless cake mixes, perfect for those who avoid eggs or have allergies. They offer classic flavors like chocolate, vanilla, and brownie mixes in individual serving sizes or quantities suitable for multiple cakes.

Key Cake Mixes Companies:

The following are the leading companies in the cake mixes market. These companies collectively hold the largest market share and dictate industry trends.

- General Mills, Inc.

- Dr. Oetker

- Conagra Brands, Inc.

- European Gourmet Bakery

- Chelsea Milling Co.

- Continental Mills, Inc.

- Pamela's Products

- Bob's Red Mill Natural Foods, Inc.

- Wild Rye Baking Co.

- SOUTHERN FOOD SYSTEMS LLC.

Recent Developments

-

In November 2023, General Mills, Inc. initiated the construction of a new baking plant in Nashik, Maharashtra. This facility is set to serve as the primary production center for Pillsbury baking mixes tailored to meet the specific demands of the Indian market. It is scheduled to become operational by August 2024.

-

In April 2023, Continental Mills, Inc. expanded its product line by introducing four new baking and waffle mixes. The new products include Krusteaz Gluten-Free Vanilla Muffin Mix, Krusteaz Vanilla Pound Cake Mix, Krusteaz Churro Belgian Waffle Mix, and Krusteaz Gluten-Free Meyer Lemon Bar Mix.

Cake Mixes Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.55 billion

Revenue forecast in 2030

USD 1.97 billion

Growth rate

CAGR of 4.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia, Brazil, South Arabia, and South Africa

Key companies profiled

General Mills, Inc., Dr. Oetker, Conagra Brands, Inc., European Gourmet Bakery, Chelsea Milling Co., Continental Mills, Inc., Pamela's Products, Bob's Red Mill Natural Foods, Inc., Wild Rye Baking Co., SOUTHERN FOOD SYSTEMS LLC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cake Mixes Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cake mixes market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Chocolate

-

Vanilla

-

Fruit

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets/Supermarkets

-

Convenience Store

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

South Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.