Caffeine Supplements Market Size, Share & Trends Analysis Report By End-user (Men, Women), By Application, By Form (Liquid, Powder, Capsules/Tablets, Gummies), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-433-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Caffeine Supplements Market Size & Trends

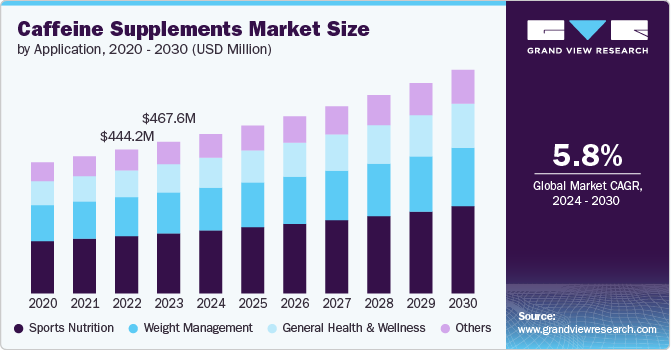

The global caffeine supplements market size was estimated at USD 467.6 million in 2023 and is projected to grow at a CAGR of 5.8% from 2024 to 2030. The demand and consumption of caffeine supplements are rising, driven by a growing focus on health and fitness. Many consumers are turning to caffeine for its well-known benefits, such as enhanced energy levels, improved endurance, and reduced fatigue, making it a popular choice among athletes and fitness enthusiasts. Additionally, caffeine is commonly found in weight management products due to its metabolism-boosting properties, appealing to those looking to maintain a healthy lifestyle.

Caffeine is widely recognized for its ability to improve mental alertness, focus, and memory, making it a sought-after nootropic. This trend is particularly prevalent among busy professionals and students who seek to enhance their cognitive functions. Moreover, some caffeine supplements are designed to help manage stress and improve mood, further driving their popularity.

The convenience and accessibility of caffeine supplements have also contributed to their rising demand. With the availability of various formats such as pills, powders, energy shots, and gummies, consumers find it easier to incorporate caffeine into their daily routines. The growth of e-commerce has further facilitated access to a wide range of caffeine supplements, boosting their consumption.

Innovation in product formulation is another key driver. Consumers are increasingly seeking clean and natural ingredients, leading to a demand for caffeine derived from sources like green tea extract, guarana, or organic coffee beans. Additionally, manufacturers are creating blended supplements that combine caffeine with other beneficial ingredients like L-theanine, adaptogens, and vitamins, enhancing the overall effect and reducing side effects such as jitters.

Additionally, consumers are increasingly opting for sugar-free or low-calorie caffeine supplements, driven by a growing awareness of the health risks associated with high sugar intake. Moreover, there is a preference for products that are sustainably sourced and ethically produced, which is shaping the demand for caffeine supplements.

End-user Insights

Caffeine supplements for women accounted for a share of 53.2% in 2023. Women increasingly seek caffeine supplements for their cognitive benefits, such as improved focus, memory, and mental clarity. These supplements are particularly popular among women in demanding careers or academic pursuits. Additionally, the trend towards using dietary supplements to support various aspects of a healthy lifestyle, including energy management and weight loss, is driving more women to explore caffeine as a supplement. Marketing strategies targeted towards women and endorsements by fitness influencers and celebrities also play a significant role in increasing demand.

Caffeine supplements for men is expected to grow at a CAGR of 6.0% from 2024 to 2030. Many men turn to caffeine supplements to improve athletic performance, endurance, and stamina. Caffeine is known to boost energy levels, making it a popular choice for pre-workout supplements among men aiming to enhance their exercise routines. Men in high-stress environments or demanding jobs may turn to caffeine supplements for their cognitive benefits. Caffeine can enhance focus, concentration, and reaction times, making it a popular choice for men who need to maintain sharp mental acuity throughout the day.

Application Insights

Caffeine supplements for sports nutrition accounted for a revenue share of 39.7% in 2023. Caffeine is well-known for its ability to improve athletic performance by increasing endurance, reducing perceived exertion, and delaying fatigue. Athletes and fitness enthusiasts often use caffeine supplements to push their limits during intense workouts and competitions. In sports and training, maintaining focus and mental clarity is crucial. Caffeine stimulates the central nervous system, enhancing alertness and concentration. This mental edge can be vital for athletes during competitions or intense training sessions, helping them stay motivated and perform at their best.

Caffeine supplements for general health & wellness is expected to grow at a CAGR of 6.6% from 2024 to 2030. Many individuals use caffeine supplements as part of their weight management strategy, given caffeine's ability to boost metabolism and support fat burning. This is particularly appealing for those focused on maintaining a healthy weight. Also, some caffeine supplements are formulated to provide energy, help manage stress, and improve mood. These dual benefits make caffeine supplements attractive to those looking to enhance their overall well-being.

Distribution Channel Insights

Sales through offline channel accounted for a revenue share of 64.4% in 2023. In-store shopping provides the opportunity for personal interaction with knowledgeable staff who can offer recommendations and answer questions about different caffeine supplements. This personalized service can enhance the shopping experience and help consumers make informed choices. Consumers often seek reassurance about the safety and efficacy of caffeine supplements. In-store shopping allows them to engage with knowledgeable staff who can provide guidance on product selection and usage. This direct interaction can build trust and confidence in the products being purchased, further driving demand for offline sales channels

Online is expected to grow at a CAGR of 6.0% from 2024 to 203. Online platforms offer a broader selection of caffeine supplements compared to brick-and-mortar stores. Consumers can easily browse and compare different brands, formulations, and types of supplements to find what best suits their needs. Online retailers often offer a more extensive range of caffeine supplement options compared to physical stores. Consumers can find a diverse selection of brands, formulations, and dosages tailored to their specific needs and preferences. This wide variety caters to the diverse demands of health-conscious consumers seeking alternative energy sources.

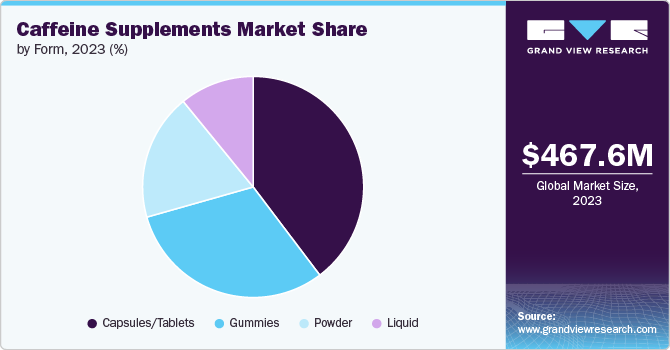

Form Insights

Capsules/tablets accounted for a share of 39.7% in 2023. Capsules and tablets offer precise dosage, enabling consumers to know exactly how much caffeine they are ingesting. This is particularly important for individuals who want to manage their caffeine intake for specific needs, such as energy boosts or weight management. Tablets and capsules are easy to carry and consume, making them a convenient option for individuals with busy lifestyles who need a quick and reliable source of energy on the go. They do not require any preparation or special storage conditions, making them suitable for travel or use throughout the day.

Gummies is expected to grow at a CAGR of 6.3% from 2024 to 2030. Gummies offer a flavorful and enjoyable way to consume caffeine, making them more appealing than traditional pills or powders. The taste and chewable texture can make taking supplements a more pleasant experience. Gummies are perceived as a fun and trendy way to take supplements, especially among younger consumers who are drawn to innovative and non-traditional product formats. This novelty factor has contributed to their popularity, particularly among millennials and Gen Z who are more inclined towards unique and enjoyable experiences.

Regional Insights

North America caffeine supplements market accounted for a revenue share of 37.5% in 2023 worldwide. There is a rising awareness of health and wellness across North America, with more people seeking products that can enhance their physical and mental performance. Caffeine supplements are popular for their ability to boost energy, improve focus, and support weight management, aligning with the health-conscious mindset of many consumers. The availability of caffeine in various supplement formats, such as gummies, powders, and capsules, makes it easier for consumers to incorporate caffeine into their daily routines. These convenient options cater to busy lifestyles, allowing individuals to quickly and easily consume caffeine without the need for traditional beverages like coffee or energy drinks

U.S. Caffeine Supplements Market Trends

The caffeine supplement market in the U.S. faces intense competition due to innovation in caffeine supplement varieties. The growing interest in fitness and sports nutrition has contributed to the increased consumption of caffeine supplements. Athletes and fitness enthusiasts in the U.S. often use caffeine to enhance workout performance, endurance, and recovery, making it a staple in their dietary regimen. Additionally, the increasing demand for functional foods and beverages that offer health benefits is driving the caffeine market. Consumers are seeking products that provide energy and contribute to overall wellness. This trend has led to the incorporation of caffeine into a wide range of products, including energy bars, pre-workout supplements, and ready-to-drink functional beverages

Europe Caffeine Supplements Market Trends

The caffeine supplement market in Europe is expected to grow at a CAGR of 6.0% during the forecast period. The European market is seeing a trend toward natural and functional supplements, with consumers preferring products that offer specific health benefits. Caffeine, especially when sourced from natural ingredients like green tea or coffee, aligns with this preference, boosting its popularity. With busy lifestyles becoming the norm, consumers are seeking convenient and quick energy-boosting solutions. Caffeine supplements, including powders and gummies, provide an easily consumable form of caffeine that fits into the fast-paced routines of modern life. This convenience appeals to a wide demographic, including working professionals and students, who are looking for effective ways to maintain energy levels throughout the day

Asia Pacific Caffeine Supplements Market Trends

The caffeine supplement market in Asia Pacific is expected to grow at a CAGR of 6.6% from 2024 to 2030. In the Asia-Pacific region, there is growing recognition of the cognitive benefits of caffeine, such as improved focus, alertness, and mental clarity. Students, professionals, and others in demanding roles are consuming caffeine supplements to boost their cognitive performance. Coffee consumption has risen throughout South and East Asia, and this expanding market is likely to fuel the caffeine industry. In most Asia Pacific countries, including China and India, busy lifestyles and longer working hours have contributed to an increase in caffeine use to combat drowsiness and exhaustion.

Key Caffeine Supplements Company Insights

The caffeine supplements market is characterized by dynamic competitive dynamics shaped by a combination of factors, including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective and quality products.

Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Companies are also focusing on raising consumer awareness of the ambiguity of the ingredients used while strictly adhering to international regulatory standards.

Key Caffeine Supplements Companies:

The following are the leading companies in the caffeine supplement market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- CSPC Pharmaceutical Group Limited

- Aarti Industries Limited

- Jilin Province Synthetic Pharmaceutical Co., Ltd.

- Taj Pharma Group

- Shandong Xinhua Pharmaceutical Co., Ltd.

- Spectrum Laboratory Products, Inc.

- Ravago Group

- JoinTown Pharmaceutical Group Co., Ltd.

- Caesar & Loretz GmbH

Recent Developments

-

In May 2023, Gummy supplement manufacturer TopGum introduced Gummiccino, a new line of high-dosage caffeine gummies. This product is the first to utilize TopGum’s proprietary microencapsulation technology, which is designed to enhance flavor and improve absorption. These functional gummies are infused with an extract from robusta coffee beans (Coffea robusta), capturing the authentic aroma, flavor, and color of coffee.

Caffeine Supplements Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 491.7 million |

|

Revenue forecast in 2030 |

USD 690.1 million |

|

Growth rate |

CAGR of 5.8% from 2024 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

End-user, application, form, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia & New Zealand; Brazil; UAE |

|

Key companies profiled |

BASF SE; CSPC Pharmaceutical Group Limited; Aarti Industries Limited; Jilin Province Synthetic Pharmaceutical Co., Ltd.; Taj Pharma Group; Shandong Xinhua Pharmaceutical Co., Ltd.; Spectrum Laboratory Products, Inc.; Ravago Group; JoinTown Pharmaceutical Group Co., Ltd.; Caesar & Loretz GmbH |

|

Customization scope |

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Caffeine Supplements Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global caffeine supplements market report based on end-user, application, form, distribution channel, and region:

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Men

-

Women

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

General Health and Wellness

-

Weight Management

-

Sports Nutrition

-

Others

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Liquid

-

Powder

-

Gummies

-

Capsules/Tablets

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

Hypermarkets & Supermarkets

-

Specialty Stores

-

Pharmacies

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global caffeine supplements market size was estimated at USD 467.6 million in 2023 and is expected to reach USD 491.7 million in 2024.

b. The global caffeine supplements market is expected to grow at a compounded growth rate of 5.8% from 2024 to 2030 to reach USD 690.1 million by 2030.

b. Gummies is expected to grow at a CAGR of 6.3% from 2024 to 2030. Gummies offer a flavorful and enjoyable way to consume caffeine, making them more appealing than traditional pills or powders. The taste and chewable texture can make taking supplements a more pleasant experience.

b. Some key players operating in caffeine supplements market include BASF SE, CSPC Pharmaceutical Group Limited, Aarti Industries Limited, Jilin Province Synthetic Pharmaceutical Co., Ltd., and others.

b. Key factors that are driving the market growth include rising caffeine consumption among athletes and increasing health consciousness among consumers

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."