- Home

- »

- Consumer F&B

- »

-

Caffeinated Beverage Market Size And Share Report, 2030GVR Report cover

![Caffeinated Beverage Market Size, Share & Trends Report]()

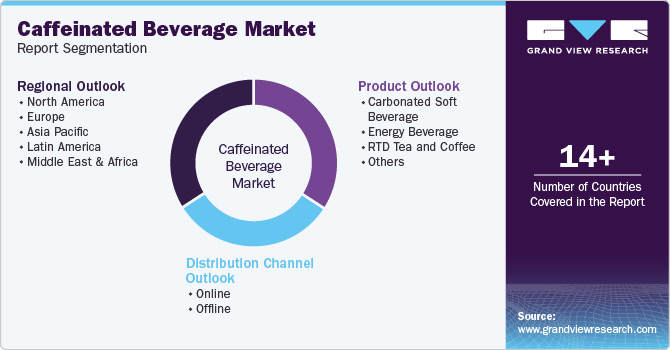

Caffeinated Beverage Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Carbonated Soft Beverage, Energy Beverage, RTD Tea And Coffee, Others), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-553-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Caffeinated Beverage Market Summary

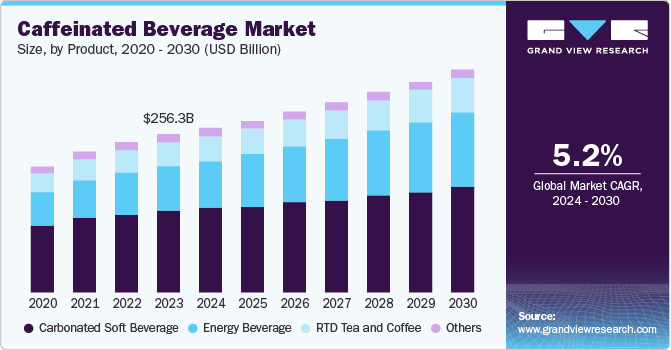

The global caffeinated beverage market size was estimated at USD 256,262.9 million in 2023 and is projected to reach USD 361,716.8 million by 2030, growing at a CAGR of 5.2% from 2024 to 2030. Rising awareness about the health benefits of caffeine drinks, such as increased market and strength, is expected to boost product demand, thereby augmenting the market growth.

Key Market Trends & Insights

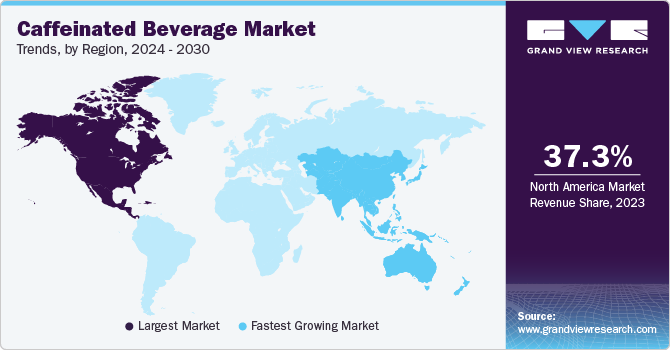

- In terms of region, North America was the largest revenue generating market in 2023.

- In terms of segment, carbonated soft beverage accounted for a revenue of USD 256,262.9 million in 2023.

- Carbonated Soft Beverage is the most lucrative product segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 256,262.9 Million

- 2030 Projected Market Size: USD 361,716.8 Million

- CAGR (2024-2030): 5.2%

- North America: Largest market in 2023

Moreover, rising income levels and improved standards of living in emerging regions, such as China and India, are anticipated to positively influence market growth. In addition, the rapidly expanding e-commerce sector globally provides numerous growth opportunities to the market.

Global companies, such as Nestlé S.A., PepsiCo Inc., and Red Bull GmbH, are entering the emerging markets, which, in turn, is expected to support the overall market growth. Moreover, increased R&D and usage of natural sweeteners in caffeinated beverages is expected to fuel their demand. Furthermore, these manufacturers' extensive marketing campaigns and promotional activities through offline and online platforms is anticipated significantly affect industry growth. However, awareness about the adverse health effects of high consumption of these beverages, such as insomnia and stomachache, may hinder the growth.

Caffeinated beverages are considered a healthier alternative to sugary drinks, perceived as unhealthy and detrimental to overall well-being. This shift in consumer preferences drives demand for caffeinated beverages that are low in sugar and calories but high in caffeine and other health-beneficial ingredients. Furthermore, the rising popularity of coffee culture has also contributed to the growing demand for the caffeinated beverages.

In addition, increasing economic growth, urbanization, and rising disposable income in developing economies also contribute to market growth. Effective distribution strategies adopted by the key brands in this industry are projected to result in enhanced growth rate. Brands have been distributing the products through various points of sale such as hypermarkets, supermarkets, cafes, restaurants, hotels, malls, convenience stores, gas station stores, pharmacies and more. In addition, innovation and sustainability strategies have been contributing to the improved sale. For instance, In June 2024, Coca-Cola India introduced 100% recycled PET (rPET) in India by launching 1005 recycled PET in 250ml bottles.

Product Insights

Based on product, the carbonated soft drinks segment accounted for the largest market share, more than 51.4%, in 2023. The segment is projected to remain dominant over the forecast period due to the high demand for ready to drink (RTD) and carbonated soft drinks globally. Moreover, product innovation in terms of flavors and growing inclusion of natural sweeteners, such as stevia and organic flavors such as honey, berry hibiscus, mint, peach and more is anticipated to attract more consumers in the coming years. For instance, Tim Hortons, one of North America's largest quick service restaurant chains, launched a new summer menu equipped with novel flavors in July 2024. It includes Cocoa Caramel Crunch ICED CAPP, Butter Pecan Cold Brew and other beverages.

The energy beverage segment is expected to experience the fastest CAGR of 7.9% during the forecast period. The major growth-driving factor is the demand for these beverages due to hectic lifestyles and increased health consciousness. Moreover, a separate section for these drinks in hypermarkets and supermarkets is expected to positively influence the segment's growth and enhance brand visibility to key market participants in the next few years. The rising growth of this segment is also driven by increasing demand for performance enhancements to keep up with changing urban lifestyles that include extended work hours, road traffic, stressful travel, and more.

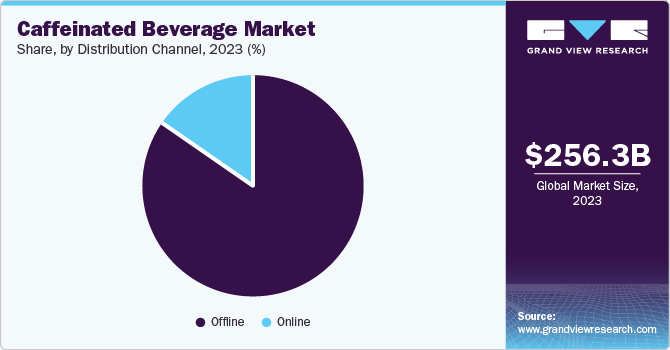

Distribution Channel Insights

The offline distribution segment dominated the global industry in 2023 based on distribution channels. The availability of branded products at convenience stores is anticipated to be the critical factor driving the segment's growth. In addition, an increasing number of specialty stores, convenience stores, hypermarkets, and supermarkets across the globe is anticipated to support the segment's growth. The rise in vending machines installed across multiple locations such as metro stations, gas stations, government and private organizational offices, schools, healthcare facilities, military bases, and most importantly, manufacturing sites across developed countries are expected to contribute to the growth of this segment.

The online distribution segment is anticipated to experience the fastest CAGR from 2024 to 2030. The rising number of e-commerce websites, such as Bakery Cart, Natures Basket Ltd., and Amazon, offering various soft, drives the segment growth and energy drinks of different brands. Such platforms provide doorstep delivery services and offer branded products at discounted prices, which is expected to boost product sales through online channels. Moreover, online services offered by Quick Service Restaurants (QSRs), such as McDonald's and Wendy's, have positively affected the segment growth. Unceasing response to food delivery platforms in several countries operated through consumer-friendly smartphone applications is projected to develop rapid growth for the segment.

Regional Insights

North America caffeinated beverage market dominated the market and accounted for a revenue of 37.3% in 2023. Some of the key growth driving factors for this market are rapid urbanization and growing demand for energy drinks. In addition, the presence of key market participants in the region contributes to the growth of this regional industry. According to the Coca-Cola Company, the region is home to nearly 325 million consumers of the company. High disposable income levels, vast networks of quick service restaurants in numerous towns and cities, and consumer behavior that prefers consumption of caffeinated beverages are expected to develop growth for this industry in approaching years.

U.S. Caffeinated Beverage Market Trends

The U.S. caffeinated beverage market dominated the regional industry in 2023. This market is primarily influenced by factors such as increasing disposable income levels of millennials and Gen Z consumers, ease of accessibility and availability, increasing number of online food delivery platforms, innovative strategies adopted by the key market participants, and the presence of large enterprises that manufacture the range of products in caffeinated beverages market. The country is home to renowned brands that provide caffeinated drinks to a large base of existing consumers.

Europe Caffeinated Beverage Market Trends

Europe caffeinated beverage market held a significant share of the global industry in 2023. The region boasts a diverse and well-established caffeinated beverage market, encompassing many countries with multiple consumer preferences and presence of regulatory landscapes as well. Changing lifestyles, extended hours at work followed by travel time and growing participation in outdoor activities have contributed to the growth in demand for caffeinated beverages in the region. In addition, emergence of new entrants in the food & beverages industry that value innovation and new product developments is anticipated to drive growth for this industry in approaching years. For instance, yfood, one of the prominent companies in smart food solutions market offers nutritious and healthy meal solutions, which include variety of products such as RTD beverages, meal replacement powders, bars and more. One of its offering includes Cold Brew Coffee (caffeine) offered in 500 ml packaging.

The UK caffeinated beverages market is expected to experience a noteworthy growth rate during the forecast period. The projected growth is attributed to a large population aged 15 to 64. According to the World Bank Group, in 2023, the population of individuals aged 15 to 64 accounted for 63.0% of the total population in the UK. Increasing availability of a wide range of products offered by domestic and international brands in the country is also expected to assist the growth of this industry in the approaching years.

Asia Pacific Caffeinated Beverage Market Trends

Asia Pacific caffeinated beverage is expected to witness the fastest growing CAGR of 6.9% during the forecast period. This regional industry is primarily driven by the growing demand for caffeinated drinks from younger customers in countries such as India and China. The increasing market penetration accomplished key brands of caffeinated beverages, growing response to online food delivery platforms, ease of availability and accessibility, and enhanced distribution attained by the major market participants are expected to deliver growth for this market during forecast period.

India caffeinated beverage market held significant revenue share of the global industry in 2023. A rise in disposable income levels, growing availability through multiple offline distribution channels and online product delivery platforms, emergence of domestic industry participants and ease of accessibility are anticipated to assist this market in terms of growth. Furthermore, the region is a significant producer of coffee which is also expected to influence the growth of this market in approaching years.

Key Caffeinated Beverage Company Insights

Some key companies operating in the caffeinated beverage market include Nestlé, The Coca‑Cola Company, Monster Energy Company, Dr Pepper Snapple Group, PepsiCo and others. To address the unceasing competition, the key market participants have adopted strategies such as innovation, enhanced sustainability goals, effective distribution, geographical expansions, mergers & acquisitions, and expansion of product portfolios.

-

Nestlé, one of the prominent companies in the food & beverages industry offers multiple products and numerous brands. The company operates through 340 facilities in 76 countries. Some of its ready to drink offerings include Nescafé Smoovlatte, Nescafé Shakissimo, NESCAFÉ Iced Latté Can, NESCAFÉ Hazelnut Coffee, NESCAFÉ Intense Can, NESCAFÉ® Intense Café and others.

-

PepsiCo, Inc., a multinational food, snack, and beverage corporation is home to several brands and operates in more than 200 counties. The diverse range of caffeinated beverages products offered by the company include Starbucks Doubleshot Energy Coffee, Starbucks Doubleshot Energy Coffee Mocha, Starbucks Doubleshot Energy Coffee Vanilla, Starbucks Doubleshot Energy White, Starbucks Doubleshot Energy Hazelnut, Starbucks Doubleshot Energy Coffee Caramel, Starbucks Nitro Cold Brew Splash of Sweet Cream, Starbucks Nitro Cold Brew Pumpkin Cream LTO and others.

Key Caffeinated Beverage Companies:

The following are the leading companies in the caffeinated beverage market. These companies collectively hold the largest market share and dictate industry trends.

- Dr Pepper Snapple Group

- Monster Energy Company

- Nestlé

- PepsiCo

- Red Bull

- Rockstar, Inc. (Pepsi Energy Co.)

- Taisho Pharmaceutical Holdings Co., Ltd.

- The Coco-Cola Company

- AriZona Beverages USA

- 5-hour ENERGY (Living Essentials LLC)

Recent Developments

-

In June 2024, the Starbucks Corporation, one of the renowned brands in caffeinated beverages industry launched new range of Caramel Vanilla Swirl Iced Coffee, handcrafted energy drinks and few other products. Starbucks Tripleshot Energy drink, recently launched offering is characterized by 65mg of caffeine content, protein, B vitamins. The products is provided in three flavor choices including dark caramel, bold mocha, and rich vanilla.

-

In February 2024, Dunkin’, one of the applauded brands in food & beverages industry introduced SPARKD' Energy by Dunkin’, iced beverages equipped with minerals, vitamins and some amount of caffeine. The flavors include berry burst entailing strawberry and raspberry, and peach sunshine featuring lychee and juicy peach flavors.

Caffeinated Beverage Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 267.54 billion

Revenue Forecast in 2030

USD 361.72 billion

Growth rate

CAGR of 5.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Brazil, Argentina, South Africa, Saudi Arabia

Key companies profiled

Dr Pepper Snapple Group; Monster Energy Company; Nestlé; PepsiCo; Red Bull; Rockstar, Inc. (Pepsi Energy Co.); Taisho Pharmaceutical Holdings Co., Ltd.; The Coco-Cola Company; AriZona Beverages USA; 5-hour ENERGY (Living Essentials LLC)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Caffeinated Beverage Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global caffeinated beverage market report based on product, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Carbonated Soft Beverage

-

Energy Beverage

-

RTD Tea and Coffee

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

India

-

China

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.