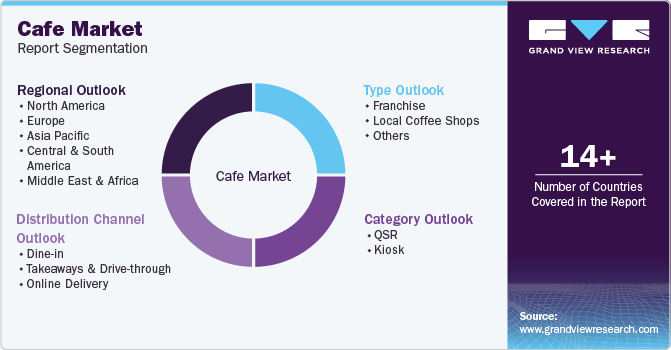

Cafe Market Size, Share & Trends Analysis Report By Type (Franchise, Local Coffee Shops, Others), By Category (QSR, Kiosk), By Distribution Channel (Dine-in, Takeaways & Drive-through, Online Delivery), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-463-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Café Market Size & Trends

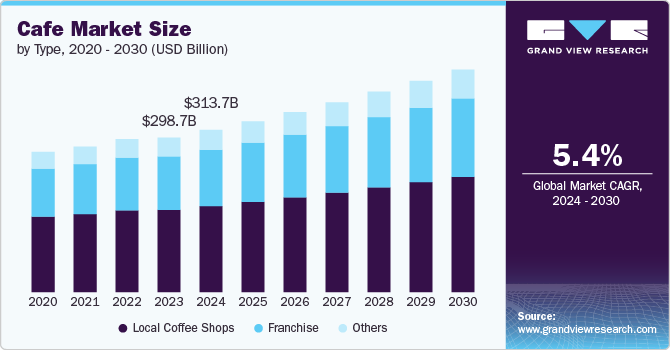

The global cafe market size was valued at USD 298.72 billion in 2023 and is expected to grow at a CAGR of 5.4% from 2024 to 2030 to reach USD 430.02 billion by 2030. One of the most significant factors driving the market is rapid urbanization, particularly in developing countries. As people flock to cities for work and education, their lifestyles tend to change, creating a higher demand for quick, convenient, and social dining experiences. In urban centers, cafes are more than just places to grab a coffee; they have evolved into social hubs where people work, relax, and meet friends. This shift is creating more demand for dining establishments like cafes that offer quick service and an inviting atmosphere.

As per the World Cities Report 2022 by the UN-Habitat, 55% of the world population resides in urban areas and this figure is expected to reach 68% by 2050. Urbanization also introduces a time-strapped workforce that increasingly values the convenience of coffee-to-go and fast service, propelling the growth of formats like Quick Service Restaurants (QSR) and takeaway coffee outlets. Another factor driving the market is the growing consumer preference for premium, artisanal, and specialty coffee products. Consumers, especially millennials and Gen Z, are seeking higher-quality coffee that goes beyond traditional fast food options. They are increasingly inclined toward hand-crafted beverages, exotic coffee blends, and specialty offerings like cold brew and pour-over coffee. This trend is particularly visible in North America and Europe but is gaining traction globally as consumers become more educated about coffee.

The integration of technology into the cafe industry is transforming how businesses operate and how consumers engage with them. From mobile ordering and contactless payments to loyalty apps and AI-driven personalization, technology is a significant driver of growth. As consumers increasingly rely on their smartphones for daily activities, cafes are integrating digital tools to enhance the customer experience. Mobile apps have revolutionized the ordering process, allowing customers to order ahead and skip the line. For instance, active membership on Starbucks’ mobile app increased by 15% year-over-year for U.S. sales, with over 31 million active users. Additionally, contactless payments and digital wallets, such as Apple Pay and Google Wallet, have become common, catering to the growing demand for touch-free transactions, especially in the post-COVID era.

Health and wellness trends have profoundly impacted the cafe industry. Consumers are now more health-conscious than ever, seeking organic, plant-based, and low-calorie options in their food and beverages. Cafés have responded by expanding their menus to include healthier alternatives such as plant-based milk (almond, oat, and soy milk), sugar-free syrups, and low-fat pastries. In addition to health concerns, there is a growing demand for sustainable and eco-friendly products. Consumers, particularly younger demographics, are increasingly concerned about the environmental impact of their consumption choices. As a result, cafes are adopting sustainability practices such as offering compostable cups, reducing plastic use, and sourcing coffee beans from ethically responsible and environmentally sustainable farms.

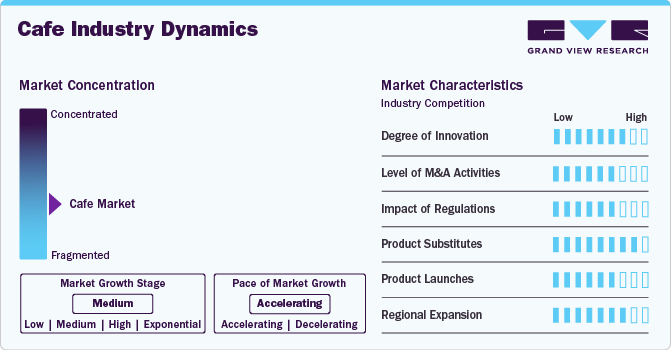

Market Concentration & Characteristics

The market is characterized by significant innovation, with brands introducing artisanal brewing methods, plant-based alternatives, and tech-driven services like mobile ordering and AI-driven personalization. Specialty coffees, cold brew, and nitro coffee have gained popularity. Additionally, sustainable practices, including eco-friendly packaging and ethical sourcing, have become central to product offerings, reflecting the market’s evolution toward health and environmental consciousness.

Mergers and acquisitions in the cafe industry are frequent, driven by both global expansion and market consolidation. Large brands like Starbucks, Dunkin’, and JAB Holdings have acquired smaller chains or coffee producers to increase market share and diversify offerings. These activities help major players gain access to new markets and technologies, while smaller brands benefit from additional resources and global reach.

The market faces various regulatory pressures, especially concerning health and safety standards, environmental sustainability, and labor laws. Governments are increasingly implementing regulations on plastic waste reduction, food safety, and ethical sourcing, compelling cafes to adopt greener and more transparent business practices. Stricter labor laws and minimum wage regulations also impact operational costs, particularly in markets with high employment regulations, like Europe and North America.

Product substitutes for cafes include ready-to-drink (RTD) coffee products, home brewing machines, and energy drinks, which offer convenience and lower costs for consumers. The growing popularity of RTD coffee, in particular, poses competition as consumers increasingly seek on-the-go alternatives. Home espresso machines and specialty coffee pods also allow consumers to recreate cafe-quality beverages at home, impacting foot traffic in traditional cafes.

Cafés are constantly launching new products to cater to shifting consumer preferences. Recent launches have focused on plant-based alternatives (like oat and almond milk), healthier low-sugar options, and exotic, artisanal coffee blends. Chains like Starbucks and Costa Coffee have introduced seasonal and limited-edition beverages, leveraging unique flavors and ingredients to attract and retain customers, especially during holidays or special promotions.

The market is expanding rapidly in emerging regions like Asia Pacific and the Middle East, where urbanization and rising incomes are driving demand for premium coffee experiences. Global brands such as Starbucks and Costa Coffee are increasingly focusing on China, India, and other emerging economies, where cafe culture is growing.

Type Insights

Local coffee shops held a revenue share of 53.2% in 2023. Unlike large franchises, local coffee shops often focus on creating unique atmospheres and tailor their product offerings to reflect local tastes. For example, these shops might use locally sourced ingredients or offer region-specific blends that cater to consumer preferences. Another key factor is the rise in demand for specialty coffee. As consumers increasingly seek high-quality, handcrafted beverages, they often turn to local coffee shops over mass-market franchises. This trend is particularly strong among millennials and Gen Z, who value unique experiences and support for local businesses.

Other cafes such as bakeries and patisseries are expected to grow at a CAGR of 6.2% from 2024 to 2030. Consumers are increasingly drawn to establishments that offer both high-quality beverages and fresh baked goods, making bakeries a one-stop destination for breakfast or a quick snack. This versatility is driving their faster growth rate compared to traditional coffee-focused outlets. The rise of the cafe-bakery hybrid model is a significant trend. Brands like Panera Bread, which offers a combination of coffee and freshly baked goods, have capitalized on this growing consumer preference. Additionally, these establishments often position themselves as premium or artisanal, attracting consumers willing to pay more for quality food and drink options.

Category Insights

QSR accounted for a revenue share of 77.1% in 2023. QSR cafes such as Starbucks and Dunkin’ have built expansive networks of stores, allowing them to capture a significant portion of the cafe market. Their ability to serve large volumes of customers quickly, coupled with aggressive expansion strategies, has solidified their market dominance. QSR cafes are also at the forefront of technological innovation, with many offering mobile ordering, loyalty programs, and contactless payment options, further enhancing customer convenience. The combination of high foot traffic, quick service, and affordable menu items makes QSR cafes the preferred choice for a broad segment of consumers, especially in urban areas where time is limited.

Kiosks are expected to grow at a CAGR of 5.0% from 2024 to 2030, due to their adaptability and lower operational costs. Kiosks are ideal for high-traffic areas such as shopping malls, airports, and train stations, where space is limited, and consumers prioritize convenience. Their small footprint allows operators to set up quickly and expand with minimal overhead, making them a popular choice for new market entrants and small entrepreneurs. Kiosks also cater to the growing trend of on-the-go consumption. With more consumers seeking quick, portable coffee options, kiosks can easily meet this demand without requiring extensive seating or amenities. Furthermore, the post-pandemic shift towards contactless and self-service models has spurred the adoption of automated kiosks, which offer coffee with minimal human interaction.

Distribution Channel Insights

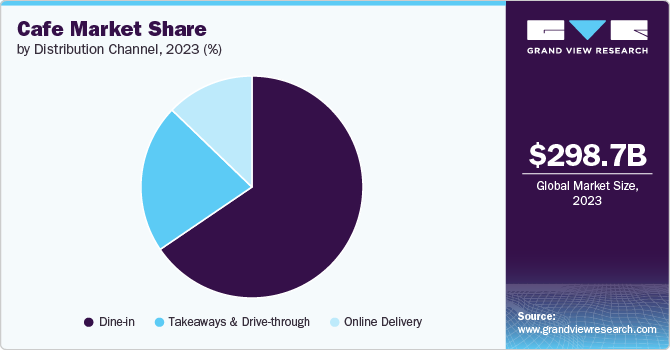

Dine-in sales accounted for a market share of 65.5% of the market in 2023. This is largely due to the social and experiential aspects of visiting a cafe, which can't be replicated through delivery or takeaway. Cafes have traditionally served as social hubs where people gather to work, meet friends, or simply relax. Dine-in options are also popular in premium or specialty cafes, where the focus is on creating a rich, immersive experience for customers. Cafés often invest in ambiance, with comfortable seating, free Wi-Fi, and curated music, enhancing the customer experience. This focus on the overall experience is particularly important for customers seeking to escape their daily routines or work in a cafe setting.

Online delivery is expected to grow at a CAGR of 6.2% from 2024 to 2030, driven by the increasing consumer preference for convenience and digitalization. The COVID-19 pandemic accelerated this trend as more customers began ordering coffee and food from the comfort of their homes, a behavior that is likely to persist post-pandemic. Delivery apps such as Uber Eats, DoorDash, and Grubhub have made it easier than ever for consumers to access cafe products without stepping out. Online delivery also appeals to time-conscious consumers, particularly urban professionals and busy families. By offering fast, reliable delivery services, cafes can reach a broader audience that may not have the time to visit a physical location. Furthermore, many cafes have optimized their menus for delivery, offering packaged beverages and baked goods that maintain quality during transit.

Regional Insights

North America cafe market accounted for a revenue share of 32.8% in 2023, due to several factors, including high coffee consumption, a well-established cafe culture, and the dominance of global cafe chains such as Starbucks, Dunkin’, and Tim Hortons. According to the National Coffee Association’s Spring 2024 National Coffee Data Trends (NCDT) study, 67% of adults in America reported drinking coffee the previous day-more than any other beverage, including bottled or tap water-up from 49% in 2004. 75% of adult Americans reported consuming coffee in the previous week, a 4% increase from the Spring 2023 NCDT.

U.S. Cafe Market Trends

The U.S. in particular is a global leader in cafe innovation, with chains offering a wide variety of coffee products, digital ordering platforms, and sustainable sourcing practices. Starbucks, for instance, has pioneered the cafe experience in North America, offering consumers premium coffee along with loyalty programs, mobile apps, and a consistent brand experience.

Asia Pacific Cafe Market Trends

Asia Pacific cafe market is expected to grow with a CAGR of 6.0% from 2024 to 2030driven by urbanization, rising incomes, and a shift towards Western-style coffee consumption. In countries like China, South Korea, and India, cafe culture is rapidly evolving, with both global brands and local players competing for market share. The rise of the middle class in Asia Pacific is a significant driver, as more consumers seek out premium coffee experiences. Global cafe chains like Starbucks have aggressively expanded in the region, opening thousands of new stores across major cities.

Key Café Company Insights

The market participants are constantly working towards new product launches, partnerships, M&A activities, and other strategic alliances to gain new market avenues.

Key Cafe Companies:

The following are the leading companies in the cafe market. These companies collectively hold the largest market share and dictate industry trends.

- Starbucks Coffee Company

- Tim Hortons

- Dunkin'

- Costa Coffee

- McCafé

- Biggby Coffee

- The Human Bean

- Café Barbera

- Cafe2U

- Gloria Jean’s Coffee

Recent Developments

-

In June 2023, McCafé discontinued its bakery items to focus on coffee. The products apple fritter, blueberry muffin, and cinnamon roll were withdrawn from menus across the globe.

-

In January 2023, Starbucks partnered with Doordash to improve their delivery across the U.S.

Cafe Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 313.65 billion |

|

Revenue forecast in 2030 |

USD 430.02 billion |

|

Growth Rate (Revenue) |

CAGR of 5.4% from 2024 to 2030 |

|

Actuals |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, Category, Distribution Channel, and Region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; and Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa |

|

Key companies profiled |

Starbucks Coffee Company; Tim Hortons; Dunkin'; Costa Coffee; McCafé; Biggby Coffee; The Human Bean; Café Barbera; Cafe2U; Gloria Jean’s Coffee |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Cafe Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global cafe market report on the basis of type, category, distribution channel, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Franchise

-

Local Coffee Shops

-

Others

-

-

Category Outlook (Revenue, USD Million, 2018 - 2030)

-

QSR

-

Kiosk

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Dine-in

-

Takeaways & Drive-through

-

Online Delivery

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cafe market size was estimated at USD 298.72 billion in 2023 and is expected to reach USD 313.65 billion in 2024.

b. The global cafe market is expected to grow at a compounded growth rate of 5.4% from 2024 to 2030 to reach USD 430.02 billion by 2030.

b. Local coffee shops dominated the cafe market with a share of 53.2% in 2023 owing to their personalized customer experiences, strong community connections, and artisanal offerings. Unlike large franchises, local coffee shops often focus on creating unique atmospheres and tailor their product offerings to reflect local tastes.

b. Some key players operating in cafe market include Starbucks Coffee Company, Tim Hortons, Dunkin', Costa Coffee, McCafé, Biggby Coffee, The Human Bean, Café Barbera, Cafe2U, Gloria Jean’s Coffee.

b. One of the most significant factors driving the café market is rapid urbanization, particularly in developing countries. As people flock to cities for work and education, their lifestyles tend to change, creating a higher demand for quick, convenient, and social dining experiences.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."