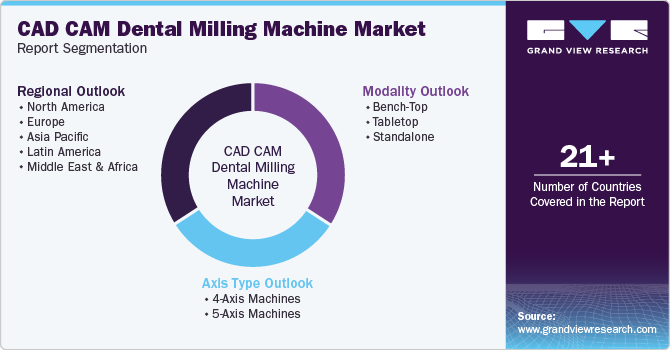

CAD CAM Dental Milling Machine Market Size, Share & Trends Analysis Report By Axis Type (4-Axis Machines, 5-Axis Machines), By Modality (Bench-Top, Tabletop, Standalone), By Region (North America, Europe), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-598-4

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

The global CAD CAM dental milling machine market size was valued at USD 1.96 billion in 2023 and is anticipated to grow at a CAGR of 9.1% from 2024 to 2030. An increase in the number of dental diseases and growing innovations in the technologies used in dentistry for better surgeries to patients are majorly driving the market. According to the Federal Interagency Forum, the number of individuals above 65 years is estimated to reach nearly 72 million by 2030, which is double the number in 2000. The geriatric population is prone to dental disorders due to the use of various medications and their drug interactions along with the inability to maintain good oral hygiene due to old age. For instance, nearly 30% of patients aged above 65 years have xerostomia while 10% of older patients between 75-84 years have secondary coronal caries. Thus, the growing geriatric population is anticipated to fuel the market growth.

CAD/CAM dental milling is highly beneficial for restorative dentistry as the restorations produced using CADCAM are more aesthetically appealing, more adaptive marginally, more durable, and are fabricated faster when compared to the traditional restorations. Furthermore, this technology also reduces outsourcing costs. Thus, the various benefits of CAD/CAM technology are anticipated to boost the market demand.

Technological advancements in CAD/CAM technology are anticipated to fuel market growth. For instance, nearly 30% of the CAD developers are actively involved in the development of a platform that provides data access on mobile platforms thus, enabling mobility and remote access to CAD. Furthermore, the number of developers is estimated to increase by nearly 10% annually, thereby, further propelling the market growth.

Axis Type Insights

Based on axis type, CAD/CAM dental milling machine industry is categorized as 4-axis machines and 5-axis machines. The 4-axis machines segment held the maximum share of 59% of in 2023 and is expected to witness lucrative growth over the forecast period. Majority of restorations such as bridges, inlays/Onlays, copings, crowns, can be milled using a 4-axis machine. Furthermore, these mills are also useful when cut-outs and holes are required to be made around a cylinder or on the side of a piece. Such wide applications of 4 axis mills are anticipated to fuel the market demand.

The 4-axis mills are also cost-effective as compared to 5 axis machines. For instance, a 4-axis mill by vhf Inc costs nearly USD 30,000 while a 5 axis mill costs nearly USD 50,000. Thus, increasing demand of the 4 axis machines amongst many dental laboratories and clinics especially the ones with low percentages of complex restoration cases.

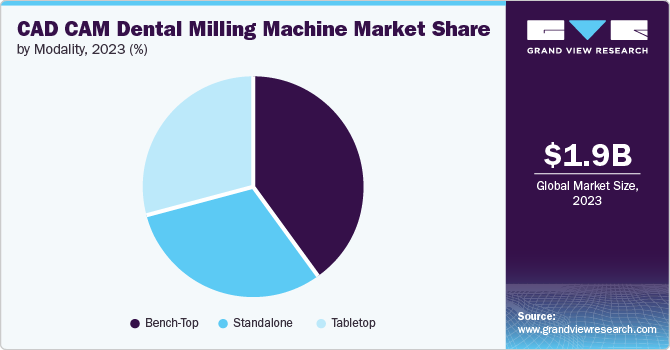

Modality Insights

By Modality, the market is categorized into tabletop, bench-top, and standalone. Amongst different modalities of mills, the bench-top segment dominated the market in 2023 with a share of 39.7% and is anticipated to grow significantly over the forecast period. This can be attributed to the benefits of the such as it is more robust when compared to tabletop and is less expensive than a standalone device.

Moreover, in some specific configurations, most bench-top mills can efficiently mill glass and metal ceramics. Milling spindles are moved with the help of heavy-duty screws and thus are more robust as compared to tabletop mills. These factors are expected to increase the preference of the end-users, thereby driving the CAD/CAM dental milling machine market.

A tabletop mill is normally small in Modality and offers better mobility than others. They make use of the belts for moving stock or milling spindles. Most tabletop mills are attached with fixed tooling that needs manual change during the milling process. Also, the portable feature of these mills help maintain the system cost low.

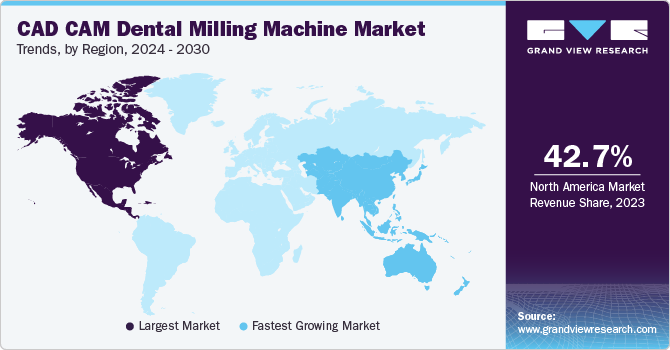

Regional Insights

North America dominated the market with the largest revenue share of 42.74% in 2023.North America CAD/CAM dental milling machine market growth can be attributed to various factors that reflect changes in demographics, technology, awareness, and economic conditions. There is growing interest in cosmetic dentistry, including teeth whitening, veneers, and orthodontics, as people become more conscious of their appearance. This has led to an increase in elective dental procedures aimed at improving aesthetics. Furthermore, efforts to improve access to dental care, such as expanded insurance coverage, government-funded programs, and the establishment of more dental clinics, have made it easier for people to receive dental treatments.

U.S. CAD/CAM Dental Milling Machine Market Trends

The CAD/CAM dental milling machine market in the U.S. is growing as the rising number of dental diseases and procedures is augmenting the market growth. The aging U.S. population requires more dental care. Older adults often need more complex dental treatments, such as implants, crowns, and dentures, leading to an increase in dental procedures. Furthermore, Efforts to improve access to dental care, including expanded insurance coverage and the establishment of more dental clinics, have made it easier for people to receive necessary treatments.

Europe CAD/CAM Dental Milling Machine Market Trends

The CAD/CAM dental milling machine market in Europe was the second dominating market in 2023 and is expected to grow in future as well owing to the presence of a large number of industry players and high quality of products. The high geriatric population in Europe with dental disorders is also anticipated to fuel market growth. For instance, nearly 30% of Europeans between 65 and 74 years have lost their natural teeth due to either periodontal disease or dental caries.

Asia Pacific CAD/CAM Dental Milling Machine Market Trends

The CAD/CAM dental milling machine market in Asia Pacific is projected to witness remunerative growth over the forecast period due to the rise in spending power, increasing geriatric population and growing awareness among end-users regarding technologically advanced equipment. In addition, increasing availability and accessibility of dental milling machines is another driver of the market in the region.

Key CAD CAM Dental Milling Machine Company Insights

Some of the players profiled in the market include Amann Girrbach, Dentsply Sirona, Planmeca OY, Ivoclar Vivadent, 3M Company, Straumann, Zimmer, Dentium, Roland DGA Corporation, and DATRON. These players are focusing on growth strategies, such as partnership, mergers and acquisition, new product development, innovations, awareness campaigns, and more for better market presence and providing end-users with optimal milling solutions.

In the 15th Annual Dental Lab CAD/CAM Expo, vhf Inc introduced its K5+ dental milling machines. It is equipped with several user-friendly features. With the credit of DirectDiscTechnology that enables blank clamping with no tools, the machine can load materials more easily and speedily. An integrated ionizer is also attached to equalize the static charge. Upgraded air circulation in the work area is manufactured to streamline the cleaning process.

Key CAD CAM Dental Milling Machine Companies:

The following are the leading companies in the CAD CAM mental milling machine market. These companies collectively hold the largest market share and dictate industry trends.

- Amann Girrbach

- Dentsply Sirona

- Planmeca OY

- Ivoclar Vivadent

- 3M Company

- Straumann

- Zimmer

- DATRON

CAD CAM Dental Milling Machine Market Report Scope

|

Report Attribute |

Details |

|

Market Modality value in 2024 |

USD 2.16 billion |

|

Revenue forecast in 2030 |

USD 4.34 billion |

|

Growth rate |

CAGR of 9.1% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Axis type, modality, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Sweden, Denmark, Norway, Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Amann Girrbach; Dentsply Sirona; Planmeca OY; Ivoclar Vivadent; 3M Company; Straumann; Zimmer; Dentium; Roland DGA Corporation; DATRON |

|

Customization scope |

Free report customization (equivalent to up to 8 analyst's working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Global CAD CAM Dental Milling Machine Market Report Segmentation

This report forecasts revenue growth at the global, regional and country levels, and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global CAD CAM dental milling machine market report on the basis of axis type, modality, and region:

-

Axis Type Outlook (Revenue, USD Million, 2018 - 2030)

-

4-Axis machines

-

5-Axis machines

-

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

Bench-Top

-

Tabletop

-

Standalone

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global CAD CAM dental milling machine market size was estimated at USD 1.96 billion in 2023 and is expected to reach USD 2.16 billion in 2024.

b. The global CAD CAM dental milling machine market is expected to grow at a compound annual growth rate of 9.1% from 2024 to 2030 to reach USD 4.34 billion by 2030.

b. The 4-axis machines segment dominated the CAD CAM dental milling machine market with share of 59.0% in 2023. This can be attributed to the cost-effectiveness of the machine.

b. Some of the key players operating in the CAD CAM dental milling machine market include Amann Girrbach, Dentsply Sirona, Planmeca OY, Ivoclar Vivadent, 3M Company, Straumann, Zimmer, Dentium, Roland DGA Corporation, and DATRON

b. Key factors that are driving the market growth include growing number of dental disorders technological advancements, and rise in spending power of consumers for treating oral diseases.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."