- Home

- »

- Advanced Interior Materials

- »

-

Cable Management System Market Size, Share Report, 2030GVR Report cover

![Cable Management System Market Size, Share & Trends Report]()

Cable Management System Market (2025 - 2030) Size, Share & Trends Analysis Report, By Product (Cable Trays, Cable Trunks, Conduits, Connectors), By Material (Metallic, Non-metallic), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-051-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cable Management System Market Trends

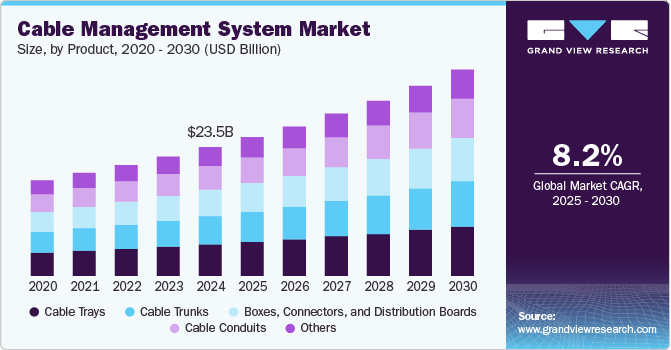

The global cable management system market size was valued at USD 23.5 billion in 2024 and is projected to grow at a CAGR of 8.2% from 2025 to 2030. The projected growth of this market is attributed to growing digital transformations coupled with an increasing number of data centers and high-speed internet networks, unceasing growth in urbanization in multiple countries, rising infrastructural developments, and an expanding need for enhanced safety and security of current cable networks.

Businesses from numerous industries are adopting innovation and advanced technologies such as Artificial Intelligence (AI), machine learning, the Internet of Things (IoT), robotic automation, and more. In addition, the growing dependency of industries on data-driven decision-making, data-enabled customer experiences, and a large number of newly developed data centers are adding to the growing demand for cable management systems. The growing network of high-speed internet connectivity in every continent, driven by unprecedented use of smartphones and connected devices technology, has contributed to the growth of this market in recent years.

Continuously increasing demand for enhanced networks, growing reliability on data availability and accessibility, increased need for sophisticated information and technology-based solutions for processes and operational excellence, and rising digital transformation initiatives embraced by key market participants in multiple industries are expected to develop an upsurge in demand for the cable management market during the forecast period.

Stringent regulations protect and secure cables where they might encounter sharp objects, frictional surfaces, or exposure to extreme heat. Regulations and compliance requirements for cable management based on the strength of the structure, corrosion resistance, and suitability with atmospheres, carrying capacities, and protection from fire vary in different countries and regions. However, these factors primarily influence the cable management system market worldwide.

Product Insights

The cable trays segment dominated the global market and accounted for the largest revenue share of 24.8% in 2024, mainly driven by factors such as infrastructure enhancement projects initiated by multiple governments and organizations, ongoing developments of commercial buildings, healthcare systems, and road infrastructure, and growth experienced by industries such as oil & gas, manufacturing, e-commerce, IT, and others. Cable trays offer a relatively inexpensive solution for routing and supporting cables compared to some conduit systems. Cable trays are easier and faster to install than complex conduit systems. Their open design allows easy access to cables during maintenance or modification, reducing downtime and labor costs.

The cable trunks segment is expected to experience the fastest CAGR during the forecast period. Substantial growth in demand for wires and rack systems has significantly influenced this segment. Cable trunks offer a modular design, allowing for easy expansion and modification as network requirements evolve. This scalability is crucial for businesses experiencing rapid growth or frequent infrastructure updates. Furthermore, Cable trunks effectively group and protect cables, preventing tangles, strain, and potential damage. This organized approach simplifies maintenance and troubleshooting procedures, making cable trunks the most sought-after segment during the forecast period.

Material Insights

Based on materials, the metallic segment held the highest revenue share in 2024, attributed to growing adoption and exceptional strength and durability offered by metal-based solutions. This ensures the protection and safety of cables in critical environments, leading to uninterrupted operations. This is significant in industrial settings, construction sites, and outdoor applications where cables are exposed to physical stress, heavy loads, and potential impact. Moreover, Metallic materials provide excellent electromagnetic interference (EMI) shielding. This shielding is crucial for safeguarding sensitive cables from electrical noise and signal disruption in critical applications such as power transmission and telecommunications.

The non-metallic segment is expected to experience the fastest CAGR during the forecast period. Non-metallic materials, such as fiberglass and high-grade plastics, are significantly lighter than traditional steel and aluminum metallic options, which makes them easy to handle, reduces installation costs, and puts less strain on supporting structures. Additionally, non-metallic materials are non-conductive and corrosion-resistant, making them ideal for applications exposed to moisture or harsh environments. This ease of handling, cost efficiency, and inert nature have increased the adoption of non-metallic alternatives.

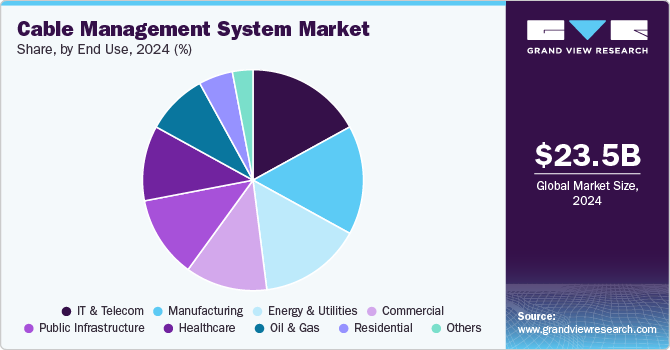

End Use Insights

The IT and telecom sector accounted for the largest revenue share of the global industry in 2024. IT and telecom infrastructure requires a large network of cables for data transmission, voice communication, and internet connectivity. This high cable density requires robust cable management systems to ensure organization, protection, and efficient maintenance. Moreover, downtime in IT and telecom networks can be highly disruptive and costly, as the entire ecosystem runs on these cables. Cable management systems promote network uptime and reliability by preventing cable damage and minimizing disruptions during maintenance.

The residential sector is expected to experience the fastest growth rate of 9.3% during the forecast period. This high rate is due to rapid urbanization, demand for improved aesthetics, efficiency, and safety concerns. Increasing population density in urban regions has led to the construction of high-rise towers. These residential complexes need large amounts of electricity and data cables. Efficient cable management systems enable ease of maintenance and troubleshooting. Additionally, household demand for cable management systems is increasing as concealed and neatly arranged cables contribute to a more streamlined and visually appealing living space.

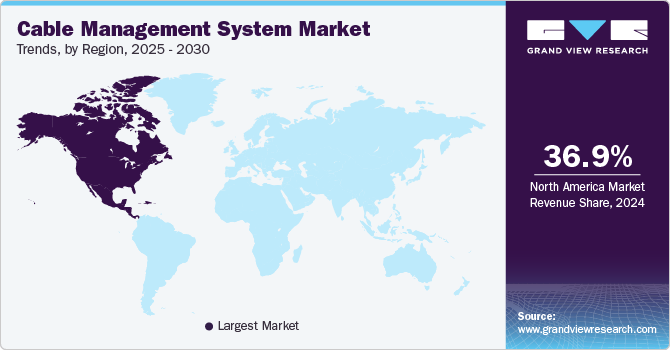

Regional Insights

North America dominated the global cable management system market and accounted for a revenue share of 36.9% in 2024, primarily influenced by factors such as a large number of data centers in North America, expanding communication networks, and higher adoption of technological advancements by numerous industries including manufacturing, construction, retail, shipping and logistics, food, hospitality, and others. This established ecosystem and technology-driven critical infrastructure management requires maintenance and upgrades, driving demand for reliable cable management solutions. Additionally, strict regulations concerning workplace safety and fire prevention compel the stakeholders to use advanced cable management systems, further propelling the market growth.

U.S. Cable Management System Market Trends

The U.S. cable management system market dominated the regional industry in 2024. The country is home to various industries, including automotive, e-commerce, information and technology, innovation, and others that heavily rely on technology and sophisticated infrastructural developments. In addition, emerging technologies such as 5G in the telecom industry have resulted in unprecedented growth in demand for enhanced networks that can ensure high-performance internet availability.

In addition, the growing adoption of robotic automation, drone technology, and machine learning has led to the increasing use of efficient cable management systems. Similarly, the growing focus on smart cities and renewable energy integration requires innovative cable management solutions to support these developments. These aspects are expected to influence this market during the forecast period.

Europe Cable Management System Market Trends

Europe is identified as one of the lucrative regions for the global cable management system market in 2024, primarily driven by stringent regulation scenarios in the region, growing digital transformation activities in multiple industries, and enhanced availability and accessibility of advanced cable management solutions offered by key market participants. In addition, increasing embracement of innovation-based technologies by sectors such as manufacturing and multiple government departments has developed a demand for an efficient cable management system market.

The UK cable management system market is expected to experience significant growth during the forecast period. Expanding the construction sector, encompassing residential, commercial, and industrial projects, is pivotal in increasing demand for this market. As new buildings and infrastructure developments increase, efficient and effective cable management solutions become paramount to ensure both safety and functionality. These systems are crucial for organizing and protecting electrical wiring, telecommunications cables, and other essential network components, preventing potential hazards such as electrical fires, equipment malfunctions, and safety risks associated with disorganized cabling.

Asia Pacific Cable Management System Market Trends

The Asia Pacific cable management system market is expected to experience the fastest CAGR of 9.3% during the forecast period owing to factors such as growing infrastructural developments in the region, unceasing urbanization in numerous countries, increasing demand for commercial buildings, growing new developments in the construction industry, and government projects in countries such India, China, and others. The availability of innovation-based cable management systems has ensured the safety and protection of increasing cable networks throughout multiple industries, including critical infrastructure management, construction, telecommunication, IT, and more.

India's cable management system market held a significant revenue share of the regional industry in 2024, attributed to factors such as the growing number of data centers, expanding telecommunication networks, and enhancing IT infrastructure in the country. The unprecedented growth in internet use by individuals, organizations, and governments has led to the construction of new data centers. This has increased demand for power, data transfer, and network connectivity cabling.

In addition, the rapid expansion of telecommunication networks driven by the rollout of 5G technology has resulted in demand for sophisticated cable management to support higher data speeds and improved network reliability. These developments require advanced cable management systems that ensure organized, accessible, and protected cabling, reducing the risk of downtime, enhancing operational efficiency, and ensuring compliance with stringent safety standards. This growing infrastructure underpins the digital transformation and connectivity essential for India's economic progress, further driving the demand for state-of-the-art cable management solutions.

Key Cable Management System Company Insights

Some key companies involved in the cable management system market include ABB, Schneider Electric, Eaton, Chatsworth Products, and LEGRAND. To address the growing competition and continuously growing demand, the major market participants have adopted strategies such as enhanced research and development efforts, increasing embracement of innovation, new product launches, and collaborations with other industry participants.

-

Eaton, one of the prominent companies in the power management products market, offers a wide range of solutions, including cable trays, ladder systems, assembled electrical boxes, covers, cable glands, conduit bodies, fire seals, and others. Its cable tray offerings include cable channel trays, pan trays, LCC cable tray conduit clamps, imperial trays, and more.

-

Schneider Electric, a major market participant in the automation and energy management industry, offers multiple cable management accessories, such as cable entries, cable glands, cable ducting, cable ties, fixing profiles, ducts, cable tubes, cable rails, and others. The fixing system and pre-cuts are key features of the accessories offered by the company, which ensure time savings during installation and usage.

Key Cable Management System Companies:

The following are the leading companies in the cable management system market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Schneider Electric

- Eaton

- Chatsworth Products

- HellermannTyton

- Panduit Corp.

- prysmian

- LEGRAND

- Leviton Manufacturing Co., Inc.

- Atkore

Recent Developments

-

In September 2024, LEGRAND, a key company in electrical and digital building infrastructure solutions, announced that it had acquired Mechanical Support Systems (MSS), one of the major companies in the cable management system market in New Zealand. This acquisition has added strength to LEGRAND's existing portfolio and supported the company’s strategy to invest more in Australia and New Zealand operations.

-

In August 2024, Goodfish Group Ltd., a key company in the contract manufacturing and service industry, announced that it had reached an agreement with a major market participant in the automation and energy management industry, Schneider Electric, to acquire its assembly and extrusion business segments in Flint, UK. After completing the process in October 2024, Goodfish is set to take over manufacturing and supply activities of Schneider Electric’s cable management products for the UK market.

-

In March 2024, Panduit Corp., a prominent organization in the electric infrastructure and network solutions industry, added to its advanced cable management solutions portfolio with the launch of the Wire Basket Cable Tray Routing System. This newly developed product has been designed for rapidly growing fiber optic networks, copper cables, and power cables within commercial spaces, industrial facilities, and data centers. Some of its key specifications include splice connectors, pathway sections, sidewalls, mounting brackets, and waterfalls.

Cable Management System Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 25.3 billion

Revenue Forecast in 2030

USD 37.6 billion

Growth rate

CAGR of 8.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Product, material, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, Australia, South Korea, India, Brazil, South Africa, Saudi Arabia, UAE

Key companies profiled

ABB; Schneider Electric; Eaton; Chatsworth Products; HellermannTyton; Panduit Corp.; prysmian; LEGRAND; Leviton Manufacturing Co., Inc.; Atkore

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

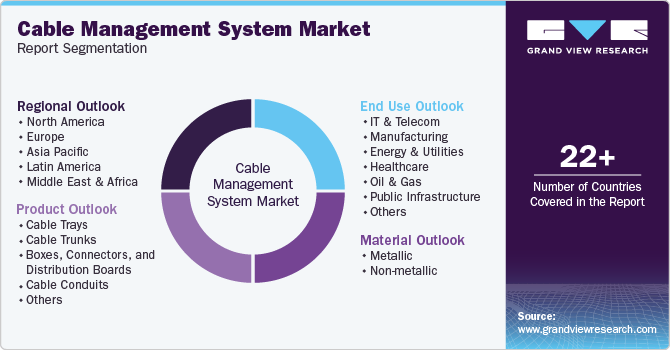

Global Cable Management System Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cable management system market report based on product, material, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Cable Trays

-

Cable Trunks

-

Boxes, Connectors, and Distribution Boards

-

Cable Conduits

-

Others

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Metallic

-

Non-metallic

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

IT & Telecom

-

Manufacturing

-

Energy & Utilities

-

Healthcare

-

Oil & Gas

-

Public Infrastructure

-

Commercial

-

Residential

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.