- Home

- »

- Distribution & Utilities

- »

-

Cable Conduit Systems Market Size & Share Report, 2030GVR Report cover

![Cable Conduit Systems Market Size, Share & Trends Report]()

Cable Conduit Systems Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Rigid, Flexible), By End-use (Manufacturing, Construction, IT & Telecommunication, Healthcare), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-412-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cable Conduit Systems Market Trends

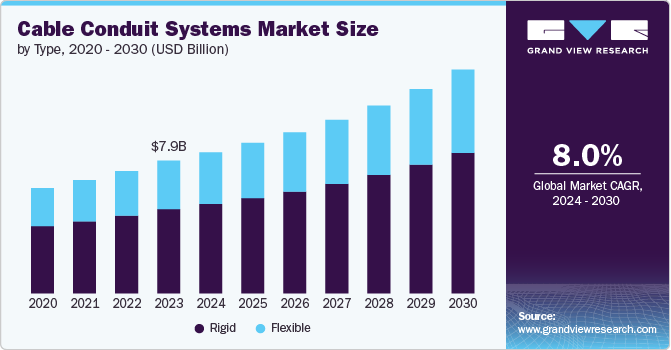

The global cable conduit systems market size was estimated at USD 8,387.7 million in 2024 and is projected to grow at a CAGR of 8.3% from 2025 to 2030. The global infrastructure development, particularly in emerging economies, has been a significant driver for the market growth. As countries invest in building new roads, railways, buildings, and other public utilities, the demand for efficient and reliable cable management solutions has grown. Cable conduit systems provide a secure and organized way to route and protect electrical and communication cables, ensuring the integrity and safety of these critical infrastructure projects.

The rapid expansion of electrical and telecommunication networks, driven by the increasing demand for reliable power, internet, and communication services, has fueled the market growth. As more households, businesses, and industrial facilities require access to these essential services, the need for durable and versatile cable management solutions has become increasingly important. Cable conduit systems help ensure the smooth and secure installation of these networks, providing protection from environmental factors and physical damage.

Moreover, across various industries, including construction, manufacturing, and utilities, there are stringent safety and regulatory requirements that mandate the use of proper cable management solutions. Cable conduit systems play a crucial role in meeting these requirements, as they help mitigate the risks associated with exposed or unprotected cables, such as fire hazards, electrical shocks, and tripping hazards. Compliance with these regulations has driven the adoption of cable conduit systems, as they provide a cost-effective and reliable way to ensure the safety of workers and the public.

Type Insights

Based on the type, the market is segmented into rigid and flexible. The rigid segment led the market with the largest revenue market share of 63.51% in 2023. Rigid cable conduit systems are made from materials such as steel, aluminum, or rigid plastic, and are designed to provide a sturdy and durable pathway for electrical cables and wires. Rigid conduits are typically more expensive than flexible options, but they offer superior strength, fire resistance, and long-term reliability. They are commonly used in applications such as power distribution, industrial automation, and construction projects where the conduit system needs to withstand heavy loads, harsh environments, or potential physical damage.

The flexible segment is anticipated to grow at the fastest CAGR during the forecast period. These are made from materials such as corrugated metal, flexible plastic, or fabric-reinforced rubber. These conduits are designed to be bendable and adaptable, allowing them to navigate around obstacles and through tight spaces more easily than rigid conduits. Flexible conduits are often used in applications where the cable routing requires frequent changes or where the conduit system needs to be installed in areas with limited access. They are generally less expensive than rigid conduits and offer greater ease of installation, but they may not provide the same level of physical protection or environmental resistance.

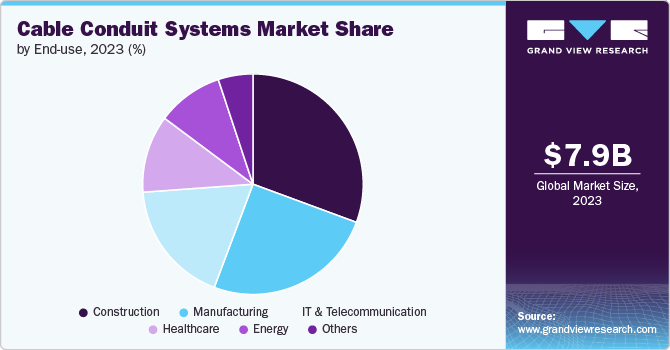

End-use Insights

Based on the end use, the market is segmented into manufacturing, construction, it & telecommunication, healthcare, energy, and other end use. The construction segment led the market with the largest revenue share of 30.63% in 2023. The construction industry is a major end use of cable conduit systems. These systems are employed in both residential and commercial construction projects to house and protect electrical, communication, and utility cables. Cable conduits are essential for ensuring the proper installation and maintenance of building services, such as lighting, HVAC, security systems, and data networks.

In manufacturing sector, these systems are used to protect and route electrical and communication cables within various manufacturing facilities, such as factories, assembly lines, and production plants. Cable conduits help maintain the safety and organization of electrical infrastructure, ensuring reliable power and data transmission for the smooth operation of manufacturing processes.

Moreover, in IT and telecommunication sector, these systems are used to route and protect the extensive network of cables and wires that support modern communication infrastructure, including data centers, telecommunication hubs, and networking equipment. Cable conduits help maintain the integrity and reliability of these critical communication systems.

Regional Insights

The cable conduit systems market in North America is anticipated to grow at the fastest CAGR during the forecast period. In North America market, especially the U.S., has some of the most stringent regulations and safety standards when it comes to the installation and usage of cable conduit systems. These regulations, such as the National Electrical Code (NEC) in the US, ensure that cable conduit systems meet the highest safety and performance standards, driving the demand for high-quality and compliant products.

Asia Pacific Cable Conduit Systems Market Trends

Asia Pacific dominated the cable conduit systems market with the largest revenue share of 39.13% in 2023. The Asia Pacific region has witnessed robust economic growth and industrialization over the past decade. Countries such as China, Japan, South Korea, and India have become major manufacturing hubs, driving the demand for cable conduit systems to support the electrical and automation needs of industrial facilities, factories, and commercial buildings.

The cable conduit systems market in China accounted the market with the largest revenue share in Asia Pacific in 2023. The market growth can be attributed to several key factors. Firstly, China has a massive domestic construction and infrastructure development market, which is a major driver of demand for cable conduit systems. With the country's continued urbanization and the government's emphasis on building out transportation networks, power grids, and other critical infrastructure, the need for reliable and high-quality cable conduit systems has grown exponentially. Chinese manufacturers have been able to capitalize on this surging domestic demand and achieve economies of scale that allow them to offer competitive pricing on their products.

Europe Cable Conduit Systems Market Trends

The cable conduit systems market in Europe has been actively investing in the modernization and expansion of its infrastructure, including power distribution networks, telecommunications, and transportation systems. This has created a significant demand for reliable and efficient cable conduit systems to support these projects. Countries like Germany, the United Kingdom, and France have been at the forefront of this infrastructure development, driving the market growth in the region.

Key Cable Conduit Systems Company Insights

The market is highly competitive, with a mix of both large, established players and smaller, specialized manufacturers. Major global companies compete for market share by offering a wide range of product options, investing in research and development to introduce innovative solutions, and leveraging their extensive distribution networks. Smaller regional players focus on niche applications, customized products, and localized customer service to carve out their own market segments. The market is also shaped by evolving industry standards, increasing demand for energy-efficient and smart building technologies, as well as the need to upgrade aging infrastructure in many parts of the world.

Key Cable Conduit Systems Companies:

The following are the leading companies in the cable conduit systems market. These companies collectively hold the largest market share and dictate industry trends.

- Hubbell Incorporated

- Schneider Electric SE

- ABB Group

- Legrand

- Aliaxis Group

- Atkore International

- Electri-Flex Company

- Eaton Corporation PLC

- Robroy Industries

- Champion Fiberglass Inc.

- Dura-Line Holdings Inc.

- Prime Conduit

- B.E.C. Conduits Pvt. Ltd.

- Southwire Company, LLC

Recent Developments

-

In May 2024, the Niedax Group and electrification and automation leader ABB entered into an agreement to form a new 50/50 joint venture. The collaboration will integrate the North American cable tray businesses of ABB’s Installation Products Division and Niedax Group into a new joint venture. The plan is to deliver advanced solutions and services to electrical contractors, distributors, and systems integrators across the United States, Canada, and Mexico

-

In April 23, 2024, ABB launched a pioneered cable protection crafted from 50% recycle-based polyamide using primarily recovered fishing nets. A sustainable alternative to conventional plastic-based systems used to protect critical power and data cables, ABB’s PMA EcoGuard PA6 RPPA conduit requires less energy and water to produce, reducing 30% of upstream Scope 3 greenhouse gas emissions and 50% of net freshwater use. ABB’s PMA EcoGuard cable protection products include Envalior’s Akulon RePurposed; a 100% recycled-based polyamide made of fishing nets recovered from coastlines

Cable Conduit Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8,946.2 million

Revenue forecast in 2030

USD 13,310.4 million

Growth rate

CAGR of 8.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America, Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; UAE

Key companies profiled

Hubbell Incorporated; Schneider Electric SE; ABB Group; Legrand; Aliaxis Group; Atkore International; Electri-Flex Company; Eaton Corporation PLC; Robroy Industries; Champion Fiberglass Inc.; Dura-Line Holdings Inc.; Prime Conduit; B.E.C. Conduits Pvt. Ltd.; Southwire Company, LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cable Conduit Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cable conduit systems market report based on type, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Rigid

-

Flexible

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Manufacturing

-

Construction

-

IT & Telecommunication

-

Healthcare

-

Energy

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.