- Home

- »

- Organic Chemicals

- »

-

Butylated Hydroxytoluene Market Size & Share Report, 2030GVR Report cover

![Butylated Hydroxytoluene Market Size, Share & Trends Report]()

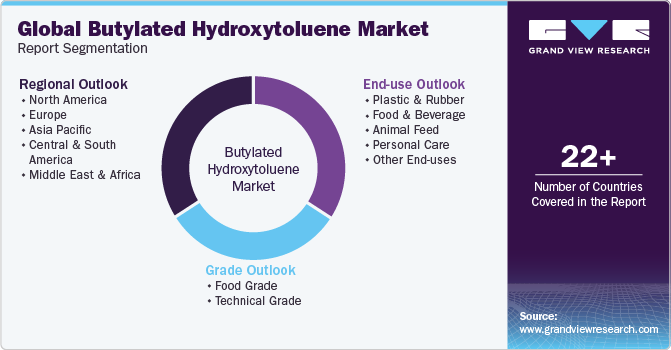

Butylated Hydroxytoluene Market Size, Share & Trends Analysis Report By Grade (Food Grade, Technical Grade), By End-use (Plastic & Rubber, Food & Beverage, Animal Feed, Personal Care), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-162-4

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Butylated Hydroxytoluene Market Trends

The global butylated hydroxytoluene market size was estimated at USD 232.06 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.6% from 2024 to 2030. This is attributed to its ability to prevent the oxidation of fats, oils, and other substances, thereby extending the shelf life and preserving the quality of products. It is commonly used in the food and cosmetic industries to prevent rancidity in fats and oils, and in the production of polymers and plastics to prevent degradation caused by exposure to oxygen. It is also used in the formulation of certain pharmaceuticals and is found in some packaging materials to protect against oxidation damage.

Butylated hydroxytoluene (BHT) is known for its stability under various conditions, making it a reliable choice for preserving the quality of products. Its cost-effectiveness further contributes to its widespread use in industries such as food, plastic, and cosmetics, where preventing oxidation and maintaining product integrity are crucial factors. Furthermore, BHT’s versatility as an antioxidant, protecting against oxidative damage, makes it a valuable component in various formulations across different sectors.

Manufacturers of BHT are adopting more environment-friendly methods such as optimizing synthesis routes to reduce waste or exploring greener solvents. Continuous improvement in efficiency and yield is a common trend, aiming to enhance productivity and reduce costs. Moreover, there is a rise in the focus on ensuring quality and purity of BHT, meeting stringent regulatory requirements. Continuous research and development may lead to innovations in BHT production, exploring alternative sources or refining existing methods.

Advanced analytical techniques such as high performance liquid chromatography (HPLC) or mass spectrometry, may be employed to ensure the purity and quality of BHT. This contributes to meeting the standards and quality control. Further, nanotechnology also plays a role in enhancing the properties and applications of BHT. Nanoparticles of BHT could be designed for specific uses, potentially improving its efficiency as an antioxidant.

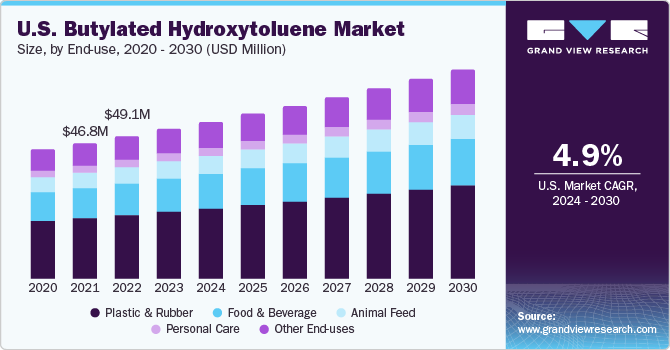

End-use Insights

The plastic & rubber segment accounted for the largest revenue share of 43.5% in 2023. This is attributed to its wide utilization as an antioxidant, inhibiting the oxidation process and helps in extending the shelf life of rubber products. In October 2022, Bridgestone Corporation announced that it approved plans to invest USD 26.7 million to strengthen its investments in its rubber plantations in Southeast Asia. The investments aim to ensure a sustainable natural rubber supply for producing tires. Such initiatives are likely to positively impact the BHT market in the coming years.

Rubber compounds often face challenges during storage and transportation. BHT contributes to the storage stability of rubber materials, preventing premature aging and ensuring that the rubber retains its intended properties until it is used in manufacturing processes. In food & beverage industry, BHT is used to prevent the oxidation of fats and oils in food products such as baked goods, snacks, and cooking oils, helping to extend shelf life and maintain product quality. It helps prevent these lipids from becoming rancid due to exposure to oxygen and other environmental factors.

BHT is often used in processed foods, including cereals, and convenience foods, where it serves to protect the flavors and freshness by inhibiting lipid oxidation. It may also be incorporated into packaging materials, especially those in direct contact with fatty foods. This helps prevent oxidation and maintain the quality of packaged products. While BHT is not as commonly used in beverages, it may be employed in certain products containing fats such as nutritional beverages or flavored milk drinks.

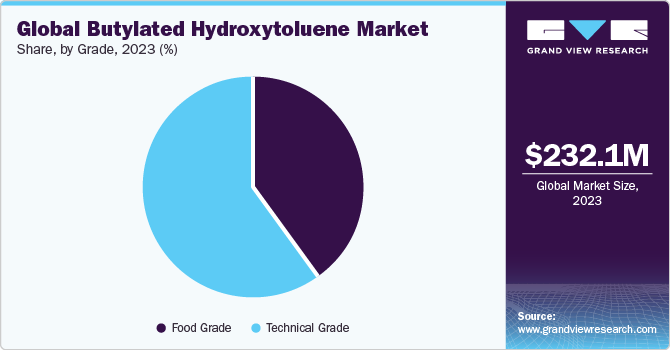

Grade Insights

Based on grade, the technical segment accounted for the largest revenue share of 59.8% in 2023. This is attributed to its wide usage in food, cosmetics, and industrial applications. In food and cosmetic industries, technical grade BHT is used as a preservative to maintain the quality and freshness of products by inhibiting the oxidative deterioration of fats and oils. Technical grade BHT may have impurities and variations in composition, so it’s important to check with the specific supplier for the detailed specifications of the product.

Food grade BHT meets the specific safety and purity standards required for use in the food industry. They are commonly used as an antioxidant in the food industry to improve the oxidation of oils and fats. It also helps extend the shelf life of products by inhibiting the development of off-flavors, odors, and discoloration caused by rancidity.

Food grade BHT must comply with regulations set by food safety authorities, such as the U.S. FDA or the EFSA. These agencies establish acceptable limits for BHT in different food categories to ensure its safety for consumption. Regulatory authorities specify maximum allowable levels of BHT in different food products to prevent excessive usage. Adhering to these guidelines ensures that BHT remains within safe limits for consumers.

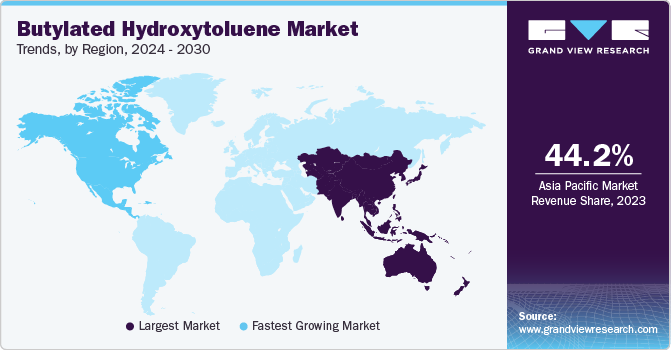

Regional Insights

Asia Pacific dominated the market with a revenue share of 44.21% in 2023 with the emerging economies expected to witness significant growth in the plastics and rubber sector due to rapid economic development and government initiatives toward economic development. Most of the rubber products, such as tires, are a blend of natural and synthetic rubber. India is the sixth-largest producer of natural rubber globally, with a production capacity of approximately 775,000 metric tons in 2022. India was the second largest consumer of natural rubber worldwide in 2021, behind China. India's natural rubber consumption decreased by almost 10% in 2020 but rebounded by 21% in 2021 to 1.3 million metric tons.

According to the National Bureau of Statistics of China, in January 2022, the retail trade revenue of cosmetics in China amounted to about USD 9.18 billion. It reached about USD 9.76 billion in January 2023. As the demand for cosmetic products expands further in second and third-tier cities of China, the butylated hydroxytoluene industry is expected to maintain its growth momentum shortly. In addition, the changing attitude among men toward skin care fosters the booming men's cosmetics market in China.

Over the next five years, the Indian e-retail industry is projected to exceed ~300-350 million shoppers, propelling the online Gross Merchandise Value (GMV) to USD 100-120 billion by 2025. The increase in internet penetration and the change in government policies allowing 100% foreign direct investments in the e-commerce sector are expected to boost the consumption of plastics. Therefore, the factors above, coupled with government support, are expected to contribute to the increasing demand for the butylated hydroxytoluene (BHT) market in the Asia-Pacific region during the forecast period.

North America is the fastest-growing region, due to the growing consumption of natural gas, petrochemicals, and petroleum products. Further, significant growth in the automotive sector is expected to boost the demand for rubber products for the products of automotive parts, tires, and mechanical rubber goods.

Key Companies & Market Share Insights

The butylated hydroxytoluene sector is fragmented with the presence of various players in the marketplace. Manufacturers invest in innovation, product launches, mergers, and acquisitions to improve their share and gain a competitive edge. For instance, in February 2023, Eastman Chemical Company completed its acquisition of Dalian Ai-Red Technology Co., Ltd., a paint protection and window film manufacturer with an aim to expand their product portfolio in the paint protection materials market.

Key Butylated Hydroxytoluene Companies:

- Sasol Limited

- Lanxess

- Eastman Chemical Company

- Oxiris Chemicals S.A.

- Camlin Fine Science

- Finoric LLC

- Dycon Chemicals

- Honshu Chemical Industry Co., Ltd.

Butylated Hydroxytoluene Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 236.8 million

Revenue forecast in 2030

USD 346.9 million

Growth rate

CAGR of 5.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Grade, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Sasol Limited; Lanxess; Eastman Chemical Company; Oxiris Chemicals S.A.; Camlin Fine Science; Finoric LLC; Dycon Chemicals; Honshu Chemical Industry Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Butylated Hydroxytoluene Market Report Segmentation

This report forecasts volume and revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global butylated hydroxytoluene market report based on grade, end-use, and region:

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food Grade

-

Technical Grade

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Plastic & Rubber

-

Food & Beverage

-

Animal Feed

-

Personal Care

-

Other End-uses

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global butylated hydroxytoluene market size was valued at USD 232.06 million in 2023 and is expected to reach USD 236.8 million in 2024.

b. The global butylated hydroxytoluene market is projected to grow at a compound annual growth rate (CAGR) of 5.6% in terms of revenue from 2024 to 2030 to reach USD 346.9 million by 2030.

b. The technical segment accounted for the largest revenue share of 59.8% in 2023. This is attributed to its wide usage in food, cosmetics, and industrial applications. In food and cosmetic industries, technical grade BHT is used as a preservative to maintain the quality and freshness of products by inhibiting the oxidative deterioration of fats and oils.

b. Some prominent players include: • Sasol Limited • Lanxess • Eastman Chemical Company • Oxiris Chemicals S.A. • Camlin Fine Science • Finoric LLC • Dycon Chemicals

b. The plastic & rubber segment accounted for the largest revenue share in 2023. This is attributed to its wide utilization as an antioxidant, inhibiting the oxidation process and helps in extending the shelf life of rubber products. In October 2022, Bridgestone Corporation announced that it approved plans to invest USD 26.7 million to strengthen its investments in its rubber plantations in South East Asia. The investments aim to ensure a sustainable natural rubber supply for producing tires. Such initiatives are likely to positively impact the BHT market in the coming years.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."