- Home

- »

- Consumer F&B

- »

-

Buttermilk Powder Market Size, Share & Growth Report 2030GVR Report cover

![Buttermilk Powder Market Size, Share & Trends Report]()

Buttermilk Powder Market (2024 - 2030) Size, Share & Trends Analysis Report By Nature (Organic, Conventional), By Application (Foodservice, Household), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-407-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Buttermilk Powder Market Size & Trends

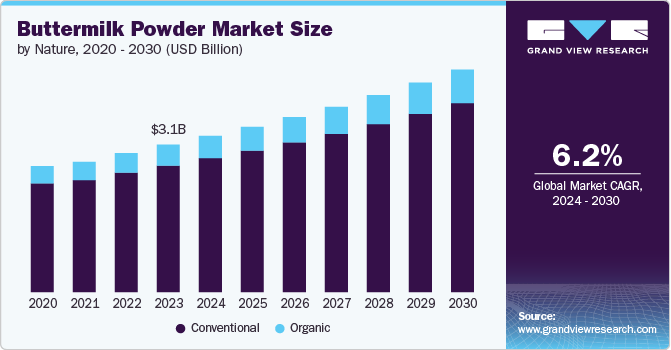

The global buttermilk powder market size was estimated at USD 3.07 billion in 2023 and is expected to grow at a CAGR of 6.2% from 2024 to 2030.The rapid increase in health-conscious consumers worldwide drives demand for low-fat and nutritious products like dry buttermilk. Its nutritional properties make it popular in bakery and confectionery items. The growing middle-class population, particularly in Asia, presents significant opportunities for food processing manufacturers. In addition, the working population's heightened awareness of health and wellness has led to a preference for nutritious, healthy, and ready-to-cook products.

Buttermilk powder's increasing demand and consumption can be attributed to several factors and trends. One major factor is the health and nutritional benefits that buttermilk powder offers. It is rich in essential nutrients like calcium, potassium, B vitamins, and proteins while being low in fat compared to other dairy products. In addition, it contains probiotics, promoting gut health and aiding digestion. Its lower lactose content makes it suitable for lactose-intolerant consumers, further broadening its appeal.

Buttermilk powder's versatility in culinary applications is another key driver of its market demand. It enhances the texture and flavor of baked goods such as cakes, bread, muffins, and pancakes, making it a staple in bakery and confectionery products. It adds creaminess and flavor to sauces, dressings, marinades, and gravies and is a valuable ingredient in smoothies, protein shakes, and other beverages. Moreover, it is used in various processed foods, including snacks, ready-to-eat meals, and instant mixes.

The trend towards clean labels and natural products is also boosting the popularity of buttermilk powder. Consumers increasingly prefer products with simple, natural ingredients, and buttermilk powder, which is often free from artificial additives and preservatives, aligns well with this preference. Organic and non-GMO buttermilk powder availability appeals to health-conscious consumers seeking transparency and purity in their food choices.

Buttermilk powder offers significant advantages in convenience and shelf stability. It has a longer shelf life than liquid buttermilk, reducing waste and making it a convenient pantry staple. Its ease of storage, transport, and use in various recipes makes it a favored choice for households and food manufacturers. The rise of home cooking and baking, especially during the COVID-19 pandemic, has increased demand as consumers look to enhance their homemade baked goods and create DIY recipes.

The growth of the food and beverage industry, along with expanding applications for buttermilk powder, is another driver of market demand. Food manufacturers continuously innovate, incorporating buttermilk powder into dairy blends, health drinks, and specialty foods. Moreover, growing urbanization and increasing disposable incomes in emerging markets drive demand for diverse, high-quality food ingredients like buttermilk powder.

Nature Insights

Conventional buttermilk powder accounted for a revenue share of 85.60% in 2023. It is versatile and used in a wide range of products, including bakery items, confectionery, sauces, dressings, and ready-to-eat meals. Its multifunctionality makes it a staple ingredient in many food processing operations. In addition, it is more readily available in the market due to established production and distribution networks. This accessibility ensures that consumers and manufacturers can easily source the product, contributing to its growing demand.

Organic buttermilk powder is expected to grow at a CAGR of 7.1% from 2024 to 2030. Consumers are increasingly prioritizing their health and seeking organic products, which are perceived as healthier and free from synthetic pesticides, herbicides, and GMOs. Organic buttermilk powder aligns with this preference for cleaner, more natural food options. Furthermore, organic buttermilk powder, produced from milk sourced from organically raised cows, is seen as more environmentally friendly. This includes better soil health, reduced chemical runoff, and more sustainable farming practices.

Distribution Channel Insights

Business to Business (B2B) accounted for a revenue share of 81.34% in 2023. Buttermilk powder has a longer shelf life compared to liquid buttermilk, making it easier and more cost-effective to store and transport. This stability reduces waste and logistical challenges for B2B buyers, such as food manufacturers and industrial kitchens.

B2C is expected to grow at a CAGR of 7.1% from 2024 to 2030. As consumers become more aware of the ingredients in their food, there is a growing preference for clean-label and natural products. Buttermilk powder, a natural dairy product, fits well with this trend, providing a recognizable and trusted ingredient for consumers who avoid synthetic additives and preservatives. B2C is further segmented into supermarkets & hypermarkets, convenience stores, online, and others.

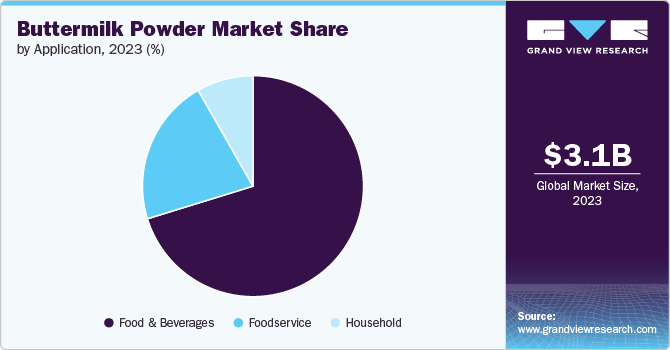

Application Insights

Food & beverage accounted for a revenue share of 70.24% in 2023. Buttermilk powder contributes to a richer flavor and improved texture in baked goods and confections. It provides a subtle tanginess and a tender crumb in cakes, muffins, bread, and other baked items, making them more appealing to consumers.Buttermilk powder reacts with baking soda to create leavening, which helps baked goods rise properly and achieve a light, fluffy texture. Moreover, it helps retain moisture, ensuring that baked products remain soft and moist for longer, enhancing their quality.

Foodservice is expected to grow at a CAGR of 6.5% from 2024 to 2030. Buttermilk powder is highly versatile and can be incorporated into various dairy products to enhance flavor, texture, and nutritional content. It is commonly used in yogurt, ice cream, cheese, and other dairy-based products to impart a tangy flavor profile and improve mouthfeel.Buttermilk powder can be more cost-effective than liquid buttermilk, especially when considering storage, transportation, and wastage.

Regional Insights

The buttermilk powder market in North America accounted for a revenue share of 36.20% in 2023. In recent years, North America has significantly shifted towards healthier eating and drinking habits. People are becoming increasingly conscious of their dietary choices; this awareness has fueled the popularity of buttermilk powder across the region. It is highly versatile and used in a wide range of applications, from baking and cooking to flavoring and thickening. This flexibility makes buttermilk powder a valuable ingredient in American kitchens and food products, contributing to its growing demand.

U.S. Buttermilk Powder Market Trends

The buttermilk powder market in the U.S. is facing intense competition and innovation.As more Americans seek clean-label products with minimal additives and preservatives, buttermilk powder's natural composition and absence of artificial ingredients align with these preferences. This trend supports its increasing use in both homemade and commercially processed foods.

Europe Buttermilk Powder Market Trends

The buttermilk powder market in Europe is expected to grow at a CAGR of 6.5% during the forecast period. The European bakery sector is expanding, with buttermilk powder used to improve the texture and flavor of various baked goods, including cakes, bread, and pastries.The rise in demand for dairy-based products, including those that are lactose-free or have a lower fat content, contributes to the increased use of buttermilk powder in specialized products.

Asia Pacific Buttermilk Powder Market Trends

The buttermilk powder market in Asia Pacific is expected to grow at a CAGR of 7.0% from 2024 to 2030. The rapid expansion of the food processing industry in Asia-Pacific is a major driver. Buttermilk powder is used in various processed foods, including baked goods, dairy products, and snacks, enhancing flavor and nutritional profile.Urbanization and changing lifestyles have led to a higher demand for convenient and ready-to-use food products. Buttermilk powder offers convenience and a longer shelf life compared to liquid buttermilk.

Key Buttermilk Powder Company Insights

The market is characterized by dynamic competitive dynamics shaped by a combination of factors including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective and quality product. Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Companies are also focusing on raising consumer awareness of the ambiguity of ingredients while strictly adhering to international regulatory standards.

Key Buttermilk Powder Companies:

The following are the leading companies in the buttermilk powder market. These companies collectively hold the largest market share and dictate industry trends.

- Agropur

- Fonterra Co-operative Group Limited

- Dairy Farmers of America, Inc.

- Arla Foods Ingredients Group P/S

- North Cork Creameries Ltd

- NOW Foods

- NUMIDIA BV

- California Dairies, Inc

- Valio Oy

- UELZENA eG

Recent Developments

-

In March 2023, Heritage Foods Ltd. launched a new range of buttermilk products under the brand name A-One' and a new range of milkshakes in convenient single-serve carton boxes. The Heritage A-One Spiced Buttermilk is a low-calorie, natural refresher from fermented fresh Heritage milk. It features a smooth, thick texture and a balanced sour and salty taste, enhanced with natural green chilies and ginger extracts for a refreshing on-the-go drink.

-

In April 2023, Sid's Farm launched a new buttermilk product, positioning it as a refreshing summer drink. This buttermilk is made from fresh, high-quality ingredients and is aimed at health-conscious consumers looking for nutritious beverage options. The product is rich in probiotics and offers various health benefits, including aiding digestion and boosting immunity.

Buttermilk Powder Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.25 billion

Revenue forecast in 2030

USD 4.68 billion

Growth rate

CAGR of 6.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Nature, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia & New Zealand; Brazil; South Africa

Key companies profiled

Agropur; Fonterra Co-operative Group Limited; Dairy Farmers of America, Inc.; Arla Foods Ingredients Group P/S; North Cork Creameries Ltd; NOW Foods; NUMIDIA BV; California Dairies, Inc.; Valio Oy; UELZENA eG

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Buttermilk Powder Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global buttermilk powder market report based on nature, application, distribution channel, and region:

-

Nature Outlook (Revenue, USD Million, 2018 - 2030)

-

Organic

-

Conventional

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Beverages

-

Bakery & Confectionery

-

Dairy Products

-

Others

-

-

Foodservice

-

Household

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

B2B

-

B2C

-

Hypermarkets & Supermarkets

-

Convenience stores

-

Online

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global buttermilk powder market size was estimated at USD 3.07 billion in 2023 and is expected to reach USD 3.25 billion in 2024.

b. The global buttermilk powder market is expected to grow at a compounded growth rate of 6.2% from 2024 to 2030 to reach USD 4.68 billion by 2030.

b. Conventional buttermilk powder accounted for a share of 85.6% in 2023. Conventional buttermilk powder is generally more affordable than its organic counterpart, making it an attractive option for budget-conscious consumers and manufacturers. This cost advantage enables wider adoption across various food and beverage applications.

b. Some key players operating in buttermilk powder market include Agropur, Fonterra Co-operative Group Limited, Dairy Farmers of America, Inc., Arla Foods Ingredients Group P/S, and others

b. Key factors that are driving the market growth include growing demand for convenience foods and urbanization and changing lifestyles

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.