- Home

- »

- Petrochemicals

- »

-

1,3 Butadiene Market Size, Share And Growth Report, 2030GVR Report cover

![1,3 Butadiene Market Size, Share & Trends Report]()

1,3 Butadiene Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (SBR, Butadiene Rubber, SB Latex, ABS, HMDA, NBR, Others), By Region, And Segment Forecasts

- Report ID: 978-1-68038-200-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

1,3 Butadiene Market Summary

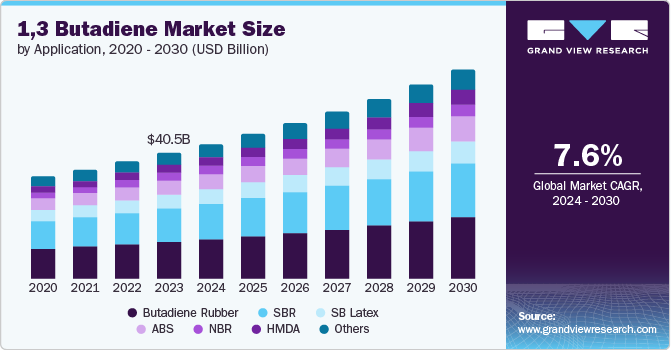

The global 1,3 butadiene market size was estimated at USD 40.48 billion in 2023 and is projected to reach USD 67.39 billion by 2030, growing at a CAGR of 7.6% from 2024 to 2030. The compound's significant role in producing synthetic rubber, mainly for automotive tires, drives the demand.

Key Market Trends & Insights

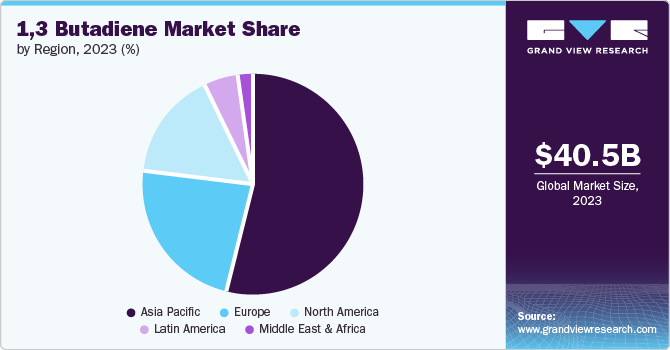

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- Country-wise, the U.S. held a revenue share of 63.14% in 2023 in the NA region.

- In terms of application, butadiene rubber segment dominated the market and accounted for 29.8% market share in 2023.

- The HMDA segment is expected to grow at the fastest CAGR of 10.1% over the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 40.48 Billion

- 2030 Projected Market Size: USD 67.39 Billion

- CAGR (2024-2030): 7.6%

- Asia Pacific: Largest market in 2023

With the expansion of the automotive industry in developing regions such as Asia-Pacific and Latin America, the need for synthetic rubber has surged. As economies expand and infrastructure grows, vehicles on the road increase, leading to a higher demand for durable and high-performance tires.

Moreover, 1,3 butadiene (BD) is also used to produce various plastics and resins, including acrylonitrile butadiene styrene (ABS) and styrene-butadiene rubber (SBR). These materials are widely used in the construction, electronics, and consumer goods industries. The construction industry, in particular, has seen robust growth, with increased investments in residential, commercial, and infrastructural projects. This growth necessitates a steady supply of construction materials, many of which are derived from 1,3 butadiene, contributing to its rising demand.

In addition, the advancements in manufacturing processes and the development of more efficient production technologies for 1,3 butadiene have also increased its demand. These advancements have made the production process more cost-effective and sustainable, encouraging more manufacturers to adopt 1,3 butadiene-based materials in their products. This has mainly been noticeable in regions where industrialization is rapidly progressing, with a growing emphasis on adopting modern manufacturing practices.

Furthermore, the global shift towards lightweight and fuel-efficient vehicles has propelled the need for high-performance plastics and elastomers, where 1,3 butadiene is extensively utilized. As automotive manufacturers strive to meet stringent environmental regulations and consumer demand for fuel efficiency, using materials that can reduce vehicle weight without compromising safety and performance has become critical. This trend has significantly fueled the demand for 1,3 butadiene, which is necessary for producing these advanced materials.

Lastly, the increasing focus on sustainable and eco-friendly products has led to exploring bio-based alternatives for traditional petrochemical-derived materials. While this is still an emerging trend, the potential of bio-based 1,3 butadiene to reduce the environmental impact of synthetic rubber and plastics production is garnering interest. This adds another dimension to the demand dynamics of 1,3 butadiene as industries seek to innovate and adopt more sustainable practices.

Application Insights

Butadiene rubber segment dominated the market and accounted for 29.8% market share in 2023. The growth of the 1,3 butadiene (BD) market is being fueled by various factors, Butadiene rubber offers better resistance to abrasion and low-temperature flexibility, making it appropriate for diverse climatic conditions and operational environments. This adaptability enhances its use across global markets, especially in regions experiencing rapid industrialization and infrastructure development. Additionally, advancements in polymer technology have spurred innovations in butadiene rubber formulations, leading to improved product attributes such as higher tensile strength, reduced rolling resistance in tires, and enhanced adhesion to various substrates. These developments further widen its application scope, attracting manufacturers across different sectors to integrate butadiene rubber into their product offerings.

HMDA segment is expected to grow at the fastest CAGR of 10.1% over the forecast period. HMDA serves as a crucial primary ingredient in the manufacturing of nylon 66. Nylon 66, which is produced using HMDA and adipic acid, finds extensive application in the textile sector. It imparts durability, tear resistance, and reinforcement to textiles used in outdoor equipment. HMDA plays a crucial role in water treatment procedures by acting as a corrosion inhibitor. Its primary function is to safeguard water pipes, boilers, and cooling systems from corrosion. With industries increasingly prioritizing sustainable practices, the demand for HMDA has surged due to the growing emphasis on efficient water treatment.

Regional Insights and Trends

North America 1,3 Butadiene (BD) market is expected to grow significantly over the forecasted period. The automotive sector drives the market growth for 1,3 butadiene in the region. As vehicle production increases to meet consumer demand, particularly in the United States and Canada, there is a corresponding rise in the need for high-performance tires and other rubber components. These components are vital for improving fuel efficiency, enhancing safety, and extending the lifespan of vehicles, thus propelling the demand for 1,3 butadiene upwards. Polymer technology advancements have expanded synthetic rubber's applications beyond automotive uses. Industries such as construction, electronics, and healthcare rely heavily on materials like acrylonitrile-butadiene-styrene (ABS) and styrene-butadiene rubber (SBR) derived from 1,3 butadiene. These materials offer superior properties such as durability, flexibility, and resistance to heat and chemicals, making them indispensable for a wide range of products, from household appliances to medical equipment.

U.S. 1,3 Butadiene Market Trends

The U.S. dominated the regional market with a revenue share of 63.14% in 2023. The surge in disposable income and consumer buying capacity has increased the demand for products that use 1,3 butadiene. Furthermore, population growth and evolving lifestyles have also contributed to the increased need for goods that depend on this compound. The automotive industry, in particular, drives the strong demand for 1,3 butadiene. It plays a crucial role in manufacturing materials such as styrene-butadiene rubber, acrylonitrile butadiene styrene resin, and nitrile rubber, essential for producing tires used in automobiles and trucks.

Asia Pacific 1,3 Butadiene Market Trends

Asia Pacific dominated the global market in 2023 and is expected to maintain its dominance throughout the forecast period. The Asia Pacific 1,3 butadiene (BD) market dominated the market in 2023. Asia-Pacific is currently the leading player in the butadiene market and is expected to experience the highest growth rate in the coming years. 1,3 Butadiene is a crucial raw material used to produce synthetic rubbers, particularly styrene-butadiene rubber (SBR) and polybutadiene rubber (PBR). These synthetic rubbers are used extensively in the automotive industry to manufacture tires, hoses, and various parts. As the Asia-Pacific region, especially countries such as China and India, continues to witness rapid industrialization and urbanization, the demand for automobiles and automotive components is expected to rise in the region. This growth has increased the demand for synthetic rubbers, thus driving the demand for 1,3 butadiene.

Furthermore, 1,3 butadiene (BD) is also a key ingredient in producing other necessary chemicals, such as adiponitrile, used to manufacture nylon 6,6, a vital material in the textile and automotive sectors. Additionally, the region's chemical manufacturing sector has been expanding significantly, supported by favorable government policies, infrastructural developments, and petrochemical investments. This growth has enhanced the capacity and capability of the Asia-Pacific region to produce and consume 1,3 butadiene in larger quantities.

China 1,3 Butadiene (BD) market held a substantial market share in 2023. The growth of the automotive sector in China drives the market growth. China is one of the largest consumers of synthetic rubber, a major product derived from 1,3 butadiene. As China expands its automotive manufacturing capabilities and domestic vehicle production, the demand for synthetic rubber for tires and other automotive components has increased. In addition to its role in the automotive sector, 1,3 butadiene is also used in producing other synthetic materials, such as ABS (acrylonitrile butadiene styrene) plastics, which are widely used in electronics, appliances, and consumer goods manufacturing. The rapid growth of China's manufacturing sector and the expanding middle-class population have spurred demand for these products, thereby boosting the consumption of 1,3 butadiene as a critical component in ABS production.

India 1,3 Butadiene (BD) market is expected to grow rapidly in the coming years. India's construction sector is significantly raising the demand for 1,3 butadiene. With ongoing infrastructure projects and urban development initiatives across the country, there is a continuous need for various rubber products in construction materials, such as seals, gaskets, and adhesives. These products rely heavily on synthetic rubber, driving up the consumption of 1,3 butadiene. Moreover, the Indian manufacturing sector, including electronics, consumer goods, and machinery, also contributes to the demand for synthetic rubber. Many of these industries utilize rubber components in their production processes, further fueling the demand for 1,3 butadiene as a feedstock.

Europe 1,3 Butadiene Market Trends

Europe is anticipated to witness significant growth in the 1,3 butadiene (BD) market over the forecast period. Butadiene is an essential ingredient in the production of synthetic rubber. Styrene-butadiene rubber (SBR) is commonly used in various industrial products such as tires, hoses, belts, and others. SBR polymer finds application in a wide range of products, including molded goods, carpet backing, and shoe soles. The addition of butadiene enhances the flexibility of different types of plastics. Butadiene is crucial in producing synthetic rubbers and elastomers like polybutadiene rubber (PBR) and nitrile rubber (NR). The demand for tires, footwear, and consumer goods is a key factor influencing the production and consumption of butadiene in Europe.

The UK 1,3 Butadiene (BD) market is expected to grow rapidly in the coming years. The electronics and electrical industry significantly drives demand for 1,3 butadiene in the UK. Synthetic rubbers produced from 1,3 butadiene are utilized to manufacture electronic components, cables, and wires. These materials provide insulation and protection against environmental factors and enhance the longevity and performance of electronic devices. With the continuous advancement in technology and increasing consumer adoption of electronic gadgets, there is a growing requirement for reliable and high-performance materials, increasing the demand for 1,3 butadiene.

Germany 1,3 Butadiene (BD) market held a substantial market share in 2023. One significant driver of increased demand in Germany is the automotive industry's reliance on synthetic rubbers for tire production. As Germany remains a powerhouse in automotive manufacturing, with brands such as Volkswagen, BMW, and Mercedes-Benz, there is a consistent need for high-performance tires. 1,3 butadiene enhances these tires' durability, elasticity, and overall performance.

Key 1,3 Butadiene Company Insights

Some key companies in the 1,3 Butadiene Market include BASF; Evonik Industries; LyondellBasell Industries Holdings B.V; and Lanxess AG.

-

BASF manufactures a diverse array of chemicals, including solvents, amines, resins, adhesives, electronic-grade chemicals, industrial gases, basic petrochemicals, and inorganic chemicals like Z-Cote. Key clients in this sector include the pharmaceutical, construction, textile, and automotive industries.

-

Evonik Industries is a specialty chemical company owned by RAG-Stiftung. It offers a wide range of products, such as surfactants, polymers, resins, additives, and more. These products cater to diverse industries, such as agriculture, renewable energy, paints and coatings, paper and printing, metals and oil, electronics, food and animal feed, personal care, pharmaceuticals, plastics, rubber, automotive, and construction.

Recent Developments

-

In January 2024, Evonik announced the expansion of its capacities for hydroxyl-terminated polybutadienes (HTPB) in Central and South America. This expansion aims to meet the growing demand for these specialized polybutadiene products, crucial in aerospace, defense, and electronics for applications like solid rocket fuels and adhesives. The increased capacity is part of Evonik's strategic effort to strengthen its market position and support customers in the region with reliable supply.

1,3 Butadiene Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 43.42 Billion

Revenue forecast in 2030

USD 67.39 Billion

Growth rate

CAGR of 7.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Brazil, Argentina, Saudi Arabia, and South Africa

Key companies profiled

BASF SE; Lyondell Basell Industries Holdings B.V; Lanxess AG; LG Chem; Evonik Industries; Braskem S.A.; TPC Group Inc.; SABIC; Praxair India; Haldia Petrochemicals Limited.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 1,3 Butadiene Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global 1,3-butadiene (BD) market report based on application, and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

SBR

-

Butadiene Rubber

-

SB Latex

-

ABS

-

HMDA

-

NBR

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.