- Home

- »

- Communications Infrastructure

- »

-

Business-to-Business E-commerce Market Size Report, 2030GVR Report cover

![Business-to-Business E-commerce Market Size, Share & Trends Report]()

Business-to-Business E-commerce Market (2024 - 2030) Size, Share & Trends Analysis Report By Product Category, By Deployment (Intermediary-oriented, Supplier-oriented, Buyer-oriented), By Region, And Segment Forecasts

- Report ID: 978-1-68038-090-3

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Business-to-Business E-commerce Market Summary

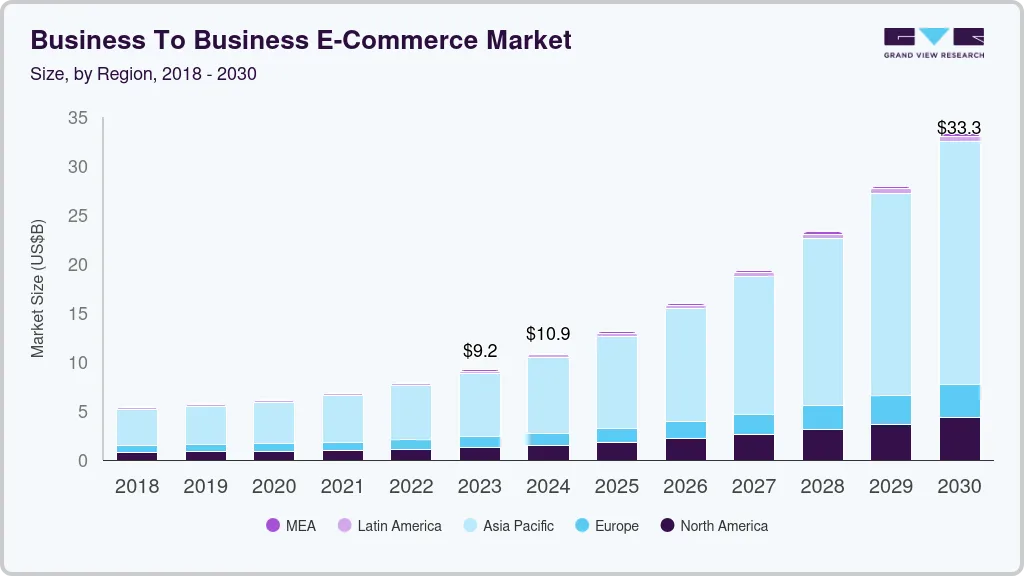

The global business-to-business e-commerce market size was estimated at USD 18,665.95 billion in 2023 and is projected to reach USD 57,578.97 billion by 2030, growing at a CAGR of 18.2% from 2024 to 2030. Rapid technology improvements are crucial for the expansion of the B2B e-commerce market.

Key Market Trends & Insights

- North America dominated the market and accounted for around 40% share in 2023.

- By product category, home & kitchen segment accounted for the largest market share around 22% in 2023.

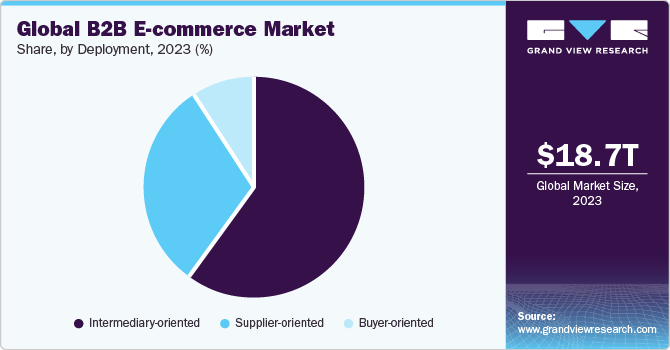

- By deployment, the intermediary-oriented segment accounted for the largest market share, around 60%, in 2023.

Market Size & Forecast

- 2023 Market Size: USD 18,665.95 Billion

- 2030 Projected Market Size: USD 57,578.97 Billion

- CAGR (2024-2030): 18.2%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The incorporation of cutting-edge technology such as AI, machine learning, and data analytics improves the functioning and capabilities of B2B platforms. These technologies provide businesses with capabilities for individualized customer experiences, predictive analytics for forecasting future demand, and process automation, resulting in higher productivity and competitiveness in the market. A major driver of B2B e-commerce adoption is automatic integration with enterprise systems such as Enterprise Resource Planning (ERP), automated order processing, supply chain visibility, and Customer Relationship Management (CRM). Integration improves connectivity among diverse business processes, streamlines workflows, and ensures consistent information across the enterprise.

Several businesses are adopting digital technologies to automate procedures, increase productivity, and enhance customer experience. The continued rollout of high-speed internet networks and the proliferation of smartphones are making it easy for companies to conduct business online. B2B e-commerce platforms have increased as a result, thereby providing companies with a simple and efficient way to interact with clients and partners. At the same time, continued globalization is allowing enterprises to engage in B2B e-commerce transactions with customers and suppliers worldwide, which is driving cross-border trade.

The advancement in artificial intelligence (AI), machine learning (ML), and Internet of things (IoT), among other latest technologies, are allowing organizations to automate procedures, obtain deeper insights into customer behavior, increase operational efficiency, boost operations, and enhance the consumer experience. Moreover, in an increasingly competitive landscape, businesses are highlighting efficiency and cost-effectiveness. B2B e-commerce platforms offer tools and solutions that automate processes, reduce manual errors, and optimize supply chain operations which is anticipated to foster market growth.

Market Concentration & Characteristics

The market growth stage is moderate, and the pace of the market growth is accelerating. The B2B e-commerce competitive landscape is characterized by an extensive spectrum of competitors, ranging from established industry titans to innovative startups specialized in niche markets. This variety reflects the wide range of industries and firms involved in B2B transactions. Market players are implementing mobile-first strategies in response to the increased use of mobile devices in corporate transactions. Businesses may establish themselves as global players by offering smooth cross-border e-commerce solutions such as multilingual websites, multiple currency alternatives, and worldwide shipping.

Companies that make cross-border transactions relatively easy can enhance the level of competitiveness. B2B e-commerce sites are responding to local preferences and rules while retaining an international perspective. Customized, localized experiences ensure that organizations can navigate varied marketplaces, meet local standards, and connect with a global client base. AI-powered customization elevates B2B e-commerce to new heights by adjusting suggestions for products, pricing models, and marketing methods based on individual consumer patterns.

Regulations that recognize digital signatures and electronic contracts as legally binding can typically help businesses settle transactions online without having to make any paper contracts or in-person signatures. This would particularly help in speeding up B2B e-commerce transactions while minimizing expenses. Regulations that safeguard the privacy and security of personal and business data, such as regulations encouraging organizations to acquire consent before collecting or utilizing personal data and security processes designed to counter data breaches, would play a decisive role in building trust in B2B e-commerce transactions. Favorable consumer protection and cross-border trade rules can also help in building trust in B2B e-commerce transactions, encouraging trade between enterprises domiciled in different economies, and stimulating economic growth.

Instances of data breaches show no signs of abating. There have been several instances of hackers penetrating organizational networks, systems, and databases and gaining unauthorized access to critical data. Data breaches can leave businesses with financial losses, legal responsibilities, and a tarnished reputation. Nevertheless, given that online is the way ahead, B2B security priorities have evolved rapidly and may come as a respite to both vendors and end customers alike. Virtual platforms are gaining popularity in the B2B e-commerce industry in line with the growing preference for online shopping.

AR can particularly offer a ‘try before you buy’ digital experience to customers and help retailers reduce the rate of returns significantly. At its core, AR offers an experience that combines both physical and digital environments. As such, companies are particularly exploring the potential of AR technology to offer customers a customized and interactive experience. Several B2B online stores have deployed solutions based on AR and VR to enable customers to view the product in a virtual environment, have a clear idea about the features of the products, and enjoy a personalized shopping experience. AR and VR are poised to create significant opportunities, particularly as efficiency and convenience emerge as vital factors in the B2B e-commerce market.

Product Category Insights

Home & kitchen segment accounted for the largest market share around 22% in 2023. The Home & Kitchen industry has benefited from digital platforms as companies move their procurement procedures online to make large purchases simpler, optimize supply chains, and improve overall operational efficiency. The B2B purchasing process has been transformed by the incorporation of cutting-edge technology, such as blockchain for transparent transactions, IoT-enabled devices, and AI-driven product ideas. The B2B e-commerce home & kitchen segment market has made the process more streamlined and customized. Furthermore, IoT-enabled smart gadgets and appliances will open the door for connected homes and kitchens, enabling predictive maintenance, real-time monitoring, and customized user experiences while promoting sustainability and efficiency.

The clothing segment growth can be attributed to the growing awareness of issues related to the environment, ethical considerations, and the demand for eco-friendly clothing products have led to an increased focus on sustainability, ethical sourcing, and ethical consumption. By allowing consumers to virtually put items on and imagine them, augmented reality and virtual try-on technology have completely changed the way consumers shop. It has decreased the number of returns and increased customer loyalty. Furthermore, adopting rapid supply chain models will allow firms to respond quickly to shifting market trends, consumer preferences, and demand changes, optimizing inventory levels, cutting delivery times, and lowering costs.

Deployment Insights

The intermediary-oriented segment accounted for the largest market share, around 60%, in 2023. Technological developments and digital integration have aided growth in the intermediary-focused B2B e-commerce sector, allowing intermediaries to utilize data-driven insights, automate procedures, and improve interaction within the business ecosystem. Intermediaries connect firms to worldwide markets, allowing companies to explore new geographies, develop international relationships, and profit from cross-border trade opportunities, promoting globalization and market diversification campaigns. In the forecast period, the intermediary-oriented B2B e-commerce market will be dictated by customer-centric innovation and personalization, with an emphasis on addressing the segment's individual needs, preferences, and expectations.

The supplier-oriented segment growth can be attributed to the rapid technology improvements and digital integration drive innovation, improve customer experience, and boost efficiency in operations within the business ecosystem, fueling the expansion of the supplier-oriented market. Suppliers use AI-driven insights, data analytics, and predictive modeling to optimize inventory management, predict shifts in demand, and provide personalized solutions, boosting customer experience, driving sales growth, and stimulating segment innovation. Moreover, suppliers focused on platform integration and connectivity, allowing for easy data sharing, process automation, and stakeholder participation, hence improving efficiency, connectivity, and value generation within the B2B e-commerce ecosystem.

Regional Insights

North America dominated the market and accounted for around 40% share in 2023. The rapid growth of the North America Business-to-Business (B2B) e-commerce market can be attributed to the increased adoption of digital technologies, shifting consumer behavior, and the requirement for companies to streamline their procurement processes. The increasing use of AI and ML technologies to automate and improve various operations is one of the key trends in the North American B2B e-commerce sector. Moreover, the U.S. government has been actively promoting digital trade through initiatives such as the Digital Trade Agreements Act and the United States-Mexico-Canada Agreement (USMCA), which include measures to facilitate cross-border e-commerce. Therefore, regulations in the U.S. are anticipated to propel the growth of the market by protecting consumers and promoting fair competition.

Asia Pacific is anticipated to witness significant growth in the market. Asia Pacific is one of the fastest-growing markets for B2B e-commerce management. The region's huge and diverse economies, coupled with the availability of digital technology and infrastructure, is driving the usage of B2B e-commerce across various businesses and sectors. Small and Medium-sized Enterprises (SMEs) are the primary drivers of economic growth in most of the Asia Pacific countries. In China, digital payment systems such as Alipay and WeChat Pay are widely used, making it easier for enterprises to conduct business-to-business transactions online. Overall, technological advancement, changing consumer behavior, and increasing competition are driving the development of the market in the Asia Pacific.

Key Business-to-Business E-commerce Company Insights

Some of the key players operating in the market include Flipkart.com.; Amazon.com, Inc.; and Walmart among others.

-

Flipkart.com is primarily based on a marketplace concept in which it links vendors and consumers while offering a diverse range of items and services. Flipkart has grown its business by launching its own private logistics and supply chain network (eKart) and introducing value-added services such as Flipkart Plus, a reward program, and Flipkart Wholesale, which caters to B2B e-commerce customers.

-

Walmart, the company's e-commerce platform, provides a wide range of products, convenient shopping experiences, and value-added services to online customers, enhancing its physical retail operations and reaching a larger client base. The company’s product portfolio comprises home and furniture, sports and fitness, beauty and personal care, toys, and electronics among others.

Quill Lincolnshire, Inc., Wayfair LLC, and KOMPASS are some of the emerging market participants in the business-to-business (B2B) e-commerce market.

-

Quill Lincolnshire, Inc. is a B2B e-commerce company that sells office supplies to medium and small-scale businesses. The company offers free shipping and free online delivery on all the products, irrespective of quantity and price. The company delivers products ranging from ink to cleaning supplies, along with fabric protection and cleaning services.

-

KOMPASS is a global export and B2B matchmaking service provider that offers access to rich information. The company also offers B2B information services that enable clients to reach the right contacts. It helps clients generate new business opportunities with sales implementation and smart data marketing solutions.

Key Business-to-Business E-commerce Companies:

The following are the leading companies in the business-to-business e-commerce market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these B2B e-commerce companies are analyzed to map the supply network.

- Amazon.com, Inc.

- Alibaba.com

- ASOS

- Costco Wholesale Corporation

- Dangdang

- eBay Inc.

- Flipkart.com

- JD.com

- Lazada

- MercadoLibre S.R.L.

- Shopify

- Shopee

- Walmart

- Wayfair LLC

- Zalando

Recent Developments

-

In November 2023, Amazon.com, Inc. and West Bengal Industrial Development Corporation (WBIDC) signed a Memorandum of Understanding (MoU) to increase West Bengal exports. Through this collaboration, the focus would be on leveraging Amazon.com, Inc.'s platform to foster and accelerate the export of merchandise from West Bengal organizations.

-

In October 2023, Flipkart launched the 'Flipkart Commerce Cloud,' a retail intelligence service for international retailers and e-commerce firms. This initiative aims to deliver complete retail intelligence and AI-driven services tailored to the specific needs of retail organizations. The platform provides a variety of solutions that improve the capabilities of merchants and e-commerce businesses across the globe.

-

In June 2023, techstars and eBay Inc. announced a strategic partnership that will result in the introduction of "techstars Future of Ecommerce powered by eBay Inc." Through this partnership the firms aimed to capitalize on both organizations' strengths to stimulate innovation and support companies in the ecommerce sector. The program, supported by eBay Inc., will empower developing entrepreneurs with guidance, tools, and opportunities to shape the future of e-commerce.

Business-to-Business E-commerce Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 21,088.01 billion

Market Value forecast in 2030

USD 57,578.97 billion

Growth rate

CAGR of 18.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

February 2024

Quantitative units

Market Value in USD billion, and CAGR from 2024 to 2030

Report coverage

Market Value forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product category, deployment, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Amazon.com, Inc.; Alibaba.com; ASOS; Costco Wholesale Corporation; Dangdang; eBay Inc.; Flipkart.com; JD.com; Lazada; MercadoLibre S.R.L.; Shopify; Shopee; Walmart; Wayfair LLC; Zalando

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Business-to-Business E-commerce Market Report Segmentation

This report forecasts market value growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global business-to-business e-commerce market report based on product category, deployment, and region.

-

Product Category Outlook (Market Value, USD Billion, 2018 - 2030)

-

Home & Kitchen

-

Consumer Electronics

-

Industrial & Science

-

Healthcare

-

Clothing

-

Beauty & Personal Care

-

Sports Apparel

-

Books & Stationery

-

Automotive

-

Others

-

-

Deployment Outlook (Market Value, USD Billion, 2018 - 2030)

-

Supplier-oriented

-

Buyer-oriented

-

Intermediary-oriented

-

-

Regional Outlook (Market Value, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global business-to-business e-commerce market size was estimated at USD 18,665.95 billion in 2023 and is expected to reach USD 21,088.01 billion in 2024.

b. The global business-to-business e-commerce market is expected to grow at a compound annual growth rate of 18.2% from 2024 to 2030 to reach USD 57,578.97 billion by 2030.

b. North America emerged as a dominant regional B2B e-commerce market capturing 40.44% of the overall B2B revenue share in 2023. The increasing use of AI and ML technologies to automate and improve various operations is one of the key trends in the North American B2B e-commerce sector.

b. Some key players operating in the B2B e-commerce market include Amazon.com, Inc.; Alibaba Group Holding Limited; ASOS; eBay Inc.; Flipkart.com; FirstCry.com; FARFETCH UK Limited; JD.com, Inc.; Jumia; MercadoLibre SRL; Rakuten Group, Inc.; Rappi Inc.; Shopee.; Zalando.

b. Key factors that are driving the business-to-business e-commerce market adoption are automatic integration with enterprise systems such as Enterprise Resource Planning (ERP), automated order processing, supply chain visibility, and Customer Relationship Management (CRM).

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.