Business Rules Management System Market Size, Share & Trends Analysis Report By Component (Platforms, Services), By Deployment, Enterprise Size, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-364-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

BRMS Market Size & Trends

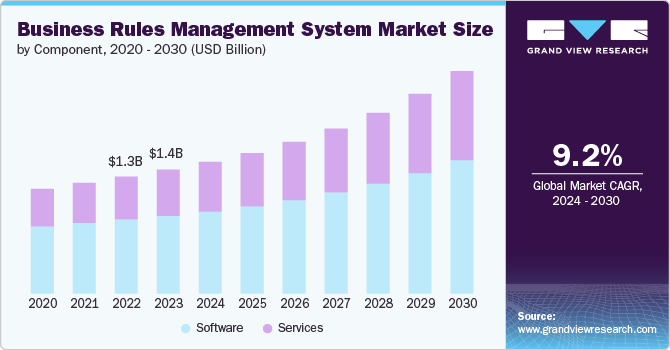

The global business rules management system market size was estimated at USD 1.42 billion in 2023 and is expected to grow at a CAGR of 9.2% from 2024 to 2030. The increasing need for organizational agility and the efficient management of complex business processes primarily drives the market. The rising adoption of digital transformation initiatives across industries necessitates systems that can automate decision-making processes and ensure compliance with regulatory standards. Furthermore, the growing demand for minimizing operational costs while enhancing productivity compels businesses to invest in business rules management system (BRMS) solutions.

The proliferation of big data and the increasing need for real-time analytics significantly drive the market by enabling organizations to handle vast amounts of data efficiently and make timely, informed decisions. As businesses accumulate extensive datasets from various sources, the complexity of managing and processing this information escalates, necessitating robust systems like BRMS to automate and streamline rule-based decision-making processes. According to Forbes, around 87.8% of the companies have expanded their investment in data. Real-time analytics, in particular, allows organizations to derive immediate insights from data, facilitating swift and accurate responses to dynamic market conditions and operational challenges. Consequently, BRMS solutions integrating advanced analytics capabilities become indispensable as they empower companies to enhance operational efficiency, improve customer experiences, and maintain a competitive edge in a data-driven landscape.

The increasing need for organizational agility and the efficient management of complex business processes is a pivotal driver for the BRMS market. Organizations must adapt quickly to remain competitive in an environment characterized by rapid technological advancements and evolving market demands. BRMS solutions facilitate this agility by enabling businesses to swiftly modify and implement rules and policies without extensive coding or system overhauls. Additionally, as companies contend with intricate business processes involving numerous variables and regulations, BRMS provides a streamlined approach to managing these complexities, ensuring consistency, accuracy, and compliance. By automating decision-making and operational workflows, BRMS enhances efficiency and reduces the risk of errors, thereby supporting the organization's strategic goals and responsiveness to change.

Component Insights

Software held the largest revenue share of around 63.0% in 2023. Several key factors, including the imperative for enhanced organizational agility and the efficient handling of intricate business processes, propel the market. The surge in digital transformation initiatives compels companies to adopt BRMS software to automate decision-making and ensure compliance with ever-evolving regulatory requirements. Additionally, the exponential growth of big data and the necessity for real-time analytics drive demand for BRMS solutions that can process and leverage vast datasets for informed decision-making. Artificial intelligence and machine learning advancements further augment BRMS capabilities, making them crucial for sophisticated and strategic business operations.

The services segment is expected to register the fastest CAGR from 2024 to 2030. The growing need for organizational agility, the efficient management of complex processes, and the imperative for regulatory compliance drives the market. Increased digital transformation initiatives and the proliferation of big data necessitate robust BRMS services for automated, real-time decision-making. Additionally, advancements in artificial intelligence and machine learning enhance BRMS functionalities, further driving market demand. The focus on minimizing operational costs while maximizing productivity also fuels adopting BRMS services as organizations seek to optimize their decision-making processes and operational workflows.

Deployment Insights

The cloud segment accounted for the largest revenue share of around 57.0% in 2023. The need for enhanced scalability, flexibility, and cost-efficiency drives the deployment of business rules management systems on the cloud. Cloud-based BRMS solutions enable organizations to rapidly adjust resources in response to fluctuating demands, ensuring optimal performance and reliability. The reduced upfront investment and maintenance costs associated with cloud deployment make it an attractive option for businesses seeking to minimize capital expenditures. Additionally, the seamless integration capabilities of cloud platforms facilitate more accessible updates and access to advanced features, further driving the adoption of BRMS on the cloud. The ability to support remote work and ensure business continuity also underscores the growing preference for cloud-based BRMS solutions.

The on-premise segment is expected to register a significant CAGR from 2024 to 2030. The need for greater data security, control, and compliance with stringent regulatory requirements drives the on-premise deployment of BRMS. Organizations handling sensitive information, such as those in finance, healthcare, and government sectors, often prefer on-premise solutions to ensure their data remains within their infrastructure, mitigating risks associated with data breaches and unauthorized access. In addition, the desire for complete control over system customization and integration with existing on-premise IT ecosystems further propels the adoption of on-premise BRMS. These factors and concerns over data sovereignty and latency issues inherent in cloud-based solutions underscore the continued preference for on-premise deployments in specific industries.

Enterprise Size Insights

The large enterprises segment accounted for the largest revenue share in 2023. This is primarily driven by the need for enhanced operational efficiency, regulatory compliance, and agile decision-making processes. Large organizations face complex and dynamic business environments that consistently require sophisticated solutions to manage extensive rules and policies. BRMS enables these enterprises to automate decision-making, reduce errors, and ensure compliance with regulatory standards across various jurisdictions. Furthermore, the integration of advanced technologies like artificial intelligence and machine learning within BRMS enhances predictive analytics and real-time processing capabilities, making them indispensable for large-scale operations. The imperative also fuels this adoption to remain competitive by quickly adapting to market changes and optimizing resource allocation.

The SME segment is expected to register the highest CAGR of around 10.0% over the forecast period. The adoption of BRMS among SMEs is driven by the need to enhance operational efficiency, streamline decision-making processes, and ensure regulatory compliance. SMEs seek to leverage BRMS to automate routine tasks, reduce manual errors, and optimize resource utilization, improving overall productivity. Moreover, the scalability, and cost-effectiveness of modern BRMS solutions make them accessible and attractive to smaller enterprises. The increasing pressure to remain competitive and agile in dynamic markets further compels SMEs to adopt BRMS, enabling them to respond swiftly to changing business conditions and customer demands.

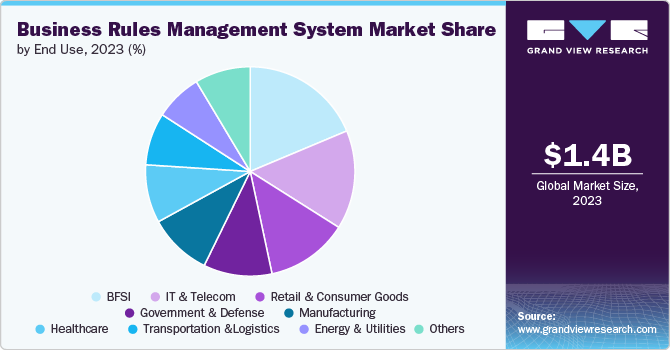

End-use Insights

The BFSI segment accounted for the largest revenue share of around 18.0% in 2023. The need for stringent regulatory compliance, risk management, and enhanced customer services in the BFSI sector accelerates its adoption. BRMS enables financial institutions to automate complex decision-making processes, ensuring consistent adherence to regulations and policies while minimizing the risk of human error. This automation also facilitates faster response times and personalized services, improving customer satisfaction and operational efficiency. Additionally, the dynamic nature of financial markets requires systems that can quickly adapt to regulatory changes, making BRMS an essential tool for maintaining agility and competitiveness.

The energy & utility segment is expected to grow significantly from 2024 to 2030. In the energy & utility industry, the adoption of BRMS is propelled by the need for efficient management of complex operational processes, regulatory compliance, and the integration of renewable energy sources. BRMS helps streamline decision-making in areas such as resource allocation, grid management, and customer billing, ensuring accuracy and consistency. The industry's regulatory environment necessitates rigorous compliance and reporting, which BRMS can automate, reducing the burden on human resources. Furthermore, as the sector increasingly incorporates renewable energy and smart grid technologies, BRMS provides the flexibility and real-time analytics required to manage these evolving complexities effectively.

Regional Insights

The business rules management system market in North America accounted for a share of around 36.0% of the global revenue and dominated the market in 2023. In North America, the adoption of business rules management systems is primarily driven by the region's strong focus on regulatory compliance and the need for agility in decision-making processes. Companies increasingly seek efficient ways to ensure adherence to complex regulations while maintaining operational flexibility and competitive advantage.

U.S. Business Rules Management System Market Trends

The business rules management system market in the U.S. is expected to grow at a significant CAGR from 2024 to 2030. The BRMS adoption is propelled by the nation's advanced technological infrastructure and the high demand for automation in various industries in the U.S. Organizations are leveraging BRMS to enhance efficiency, reduce errors, and streamline operations, which is essential in a highly competitive market environment.

Asia Pacific Business Rules Management System Market Trends

The Asia Pacific business rules management system market is expected to grow at the highest CAGR of 10.7% from 2024 to 2030. Rapid economic growth and digital transformation initiatives are the key drivers for BRMS adoption in the Asia Pacific region. For instance, the Government of India's Digital India initiative has played a pivotal role in driving the nation's digital transformation objectives. The initiative has been extended with a total budget allocation of approximately INR 14,903 crore (USD 1,784.5 million) for the period from 2021-22 to 2025-26. Businesses are investing in BRMS to manage their operations' growing complexity and leverage data-driven decision-making, which is crucial for sustaining a competitive edge in the dynamic market landscape.

Europe Business Rules Management System Market Trends

The business rules management system market in Europe is expected to grow at a significant CAGR from 2024 to 2030.In Europe, the emphasis on stringent regulatory frameworks and data protection laws is a significant factor driving the adoption of BRMS. Companies are implementing these systems to ensure compliance with regulations such as GDPR and to enhance transparency and consistency in business processes, thereby fostering trust and operational efficiency.

Key Business Rules Management System Company Insights

Key players operating in the market include ACTICO GmbH, Broadcom, FICO, International Business Machines Corporation, Oracle, Pegasystems Inc., Progress Software Corporation, SAP SE, SAS Institute Inc., and Software AG. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In May 2024, Analytics software provider, FICO formed a partnership with Net. Bit, an IT consultancy firm, to strengthen security measures, enhance operational efficiency, and ensure regulatory compliance for financial institutions across the Middle East, Africa, and Europe. Net. Bit will be responsible for selling and implementing FICO’s decision management solutions, mainly the robust FICO Blaze Advisor decision rules management system.

-

In May 2023, FICO introduced 19 significant enhancements to the FICO Platform, a leading applied intelligence platform in the market, aimed at helping clients achieve critical and strategic business outcomes throughout their customer lifecycle. These landmark improvements encompass the platform’s optimization, transactional analytics, simulation, composability, and decision capabilities, all designed to enhance enterprises’ competitive edge and deliver exceptional customer experiences. The FICO Platform enables enterprises to establish an intelligence network that dismantles silos across teams, empowering the workforce to drive customer-focused digital transformation.

Key Business Rules Management System Companies:

The following are the leading companies in the business rules management system market. These companies collectively hold the largest market share and dictate industry trends.

- ACTICO GmbH

- Broadcom

- FICO

- International Business Machines Corporation

- Oracle

- Pegasystems Inc.

- Progress Software Corporation

- SAP SE

- SAS Institute Inc.

- Software AG

Business Rules Management System Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.51 billion |

|

Revenue forecast in 2030 |

USD 2.56 billion |

|

Growth rate |

CAGR of 9.2% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market share , competitive landscape, growth factors, and trends |

|

Segments covered |

Component, deployment, enterprise size, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

ACTICO GmbH; Broadcom; FICO; International Business Machines Corporation; Oracle, Pegasystems Inc.; Progress Software Corporation; SAP SE; SAS Institute Inc.; Software AG |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Business Rules Management Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the global business rules management system market report based on component, deployment, enterprise size, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-Premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Government & Defense

-

Healthcare

-

IT & Telecom

-

Manufacturing

-

Retail and Consumer Goods

-

Transportation &Logistics

-

Energy & Utilities

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global business rules management system market size was estimated at USD 1.42 billion in 2023 and is expected to reach USD 1.51 billion in 2024

b. The global business rules management system market is expected to grow at a compound annual growth rate of 9.2% from 2024 to 2030 to reach USD 2.56 billion by 2030

b. North America dominated the business rules management system market with a market share of 36.0% in 2023. In North America, the adoption of business rules management systems is primarily driven by the region's strong focus on regulatory compliance and the need for agility in decision-making processes. Companies increasingly seek efficient ways to ensure adherence to complex regulations while maintaining operational flexibility and competitive advantage.

b. Some key players operating in the business rules management system market include ACTICO GmbH, Broadcom, FICO, International Business Machines Corporation, Oracle, Pegasystems Inc., Progress Software Corporation, SAP SE, SAS Institute Inc., and Software AG.

b. The business rules management system market is driven by several key factors. The increasing need for organizational agility and the efficient management of complex business processes primarily drives the business rules management system (BRMS) market. The rising adoption of digital transformation initiatives across industries necessitates systems that can automate decision-making processes and ensure compliance with regulatory standards.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."