Business Process Management Market Size, Share & Trends Analysis Report By Solution (Automation, Process Modelling), By Deployment, By Enterprise Size, By Application, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-1-68038-040-8

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

Market Size & Trends

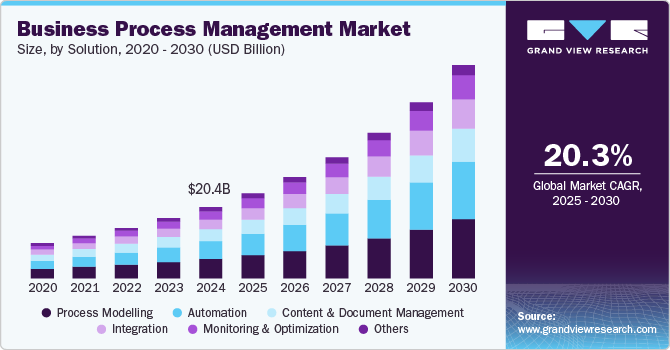

The global business process management market size was estimated at USD 20.38 billion in 2024 and is anticipated to grow at a CAGR of 20.3% from 2025 to 2030, driven by technological advancements, organizational needs for efficiency, and the increasing complexity of business operations. Organizations are increasingly leveraging BPM solutions to streamline workflows, automate repetitive tasks, and integrate advanced technologies like artificial intelligence (AI), machine learning (ML), and robotic process automation (RPA) into their operations. These solutions enhance productivity, reduce costs, and provide actionable insights, making them indispensable in the modern business landscape.

The 2024 State of the Automation Professional Report by UiPath, a U.S.-based software company, highlights the widespread adoption of AI among automation professionals. According to the report, 90% of professionals are either already using AI or planning to implement it within the next year. The primary driver for AI integration is to boost productivity, cited by 66% of respondents. Professionals are leveraging AI for tasks such as coding (67%), creating documentation (57%), and conducting testing (47%).

The increasing complexity of regulatory compliance requirements is also fueling the adoption of business process management (BPM) systems. Industries such as healthcare, finance, and manufacturing are subject to stringent regulations that require meticulous process tracking and documentation. BPM solutions help organizations maintain compliance by ensuring adherence to standardized workflows, generating audit trails, and reducing the risk of non-compliance penalties. This capability is particularly critical in sectors with high legal and regulatory oversight stakes.

In addition, the proliferation of cloud-based BPM solutions has made process management more accessible and scalable. Cloud platforms enable organizations of all sizes to implement BPM tools without significant upfront investments in infrastructure. They also facilitate remote collaboration, a feature that has gained prominence in the wake of widespread hybrid and remote work models. This accessibility has expanded the market reach of BPM solutions to include small and medium-sized enterprises (SMEs) alongside larger organizations.

Solution Insights

The process modeling segment dominated the market and accounted for a revenue share of over 26.0% in 2024, owing to the rising demand for improved customer experience. Businesses prioritize customer satisfaction as a strategic goal in a competitive global market. BPM solutions enable organizations to optimize processes such as customer onboarding, support services, and complaint resolution. By ensuring consistency and reducing process inefficiencies, BPM tools enhance service delivery and contribute to stronger customer loyalty.

The automation segment is expected to grow at a significant CAGR of 21.8% over the forecast period. The increasing adoption of low-code and no-code platforms makes automation more accessible to non-technical users. These platforms empower business users to design and deploy automated workflows without the need for extensive programming expertise, democratizing automation and driving adoption across organizations of all sizes.

Deployment Insights

The cloud segment accounted for the largest revenue share of nearly 63.0% in 2024 due to the rise of remote and hybrid work environments. Cloud BPM solutions allow employees and stakeholders to access processes and collaborate from anywhere, ensuring business continuity and productivity. The cloud’s centralized architecture supports real-time collaboration and process updates, fostering efficiency in geographically distributed teams and enabling better decision-making.

The on-premise segment is expected to grow significantly over the forecast period. Organizations with legacy systems that are deeply integrated into their operations also support the preference for on-premise BPM systems. In such cases, transitioning to cloud-based BPM solutions may be challenging or resource-intensive. On-premise solutions offer compatibility with existing infrastructure, allowing businesses to modernize their processes without disrupting operations or incurring significant migration costs.

Enterprise Size Insights

The large enterprise segment accounted for the largest revenue share of over 72.0% in 2024 due to the increasing demand for process standardization and optimization. Large enterprises often operate across multiple geographies and business units, resulting in diverse and complex workflows. BPM solutions help standardize these processes, ensuring consistency, reducing inefficiencies, and enabling organizations to achieve higher levels of operational excellence.

The SMEs segment is expected to grow significantly over the forecast period. The rise of low-code and no-code BPM platforms is making process management more accessible to SMEs. These platforms empower business users to design, implement, and modify workflows without extensive technical expertise, enabling SMEs to adapt quickly to changing market conditions and customer needs.

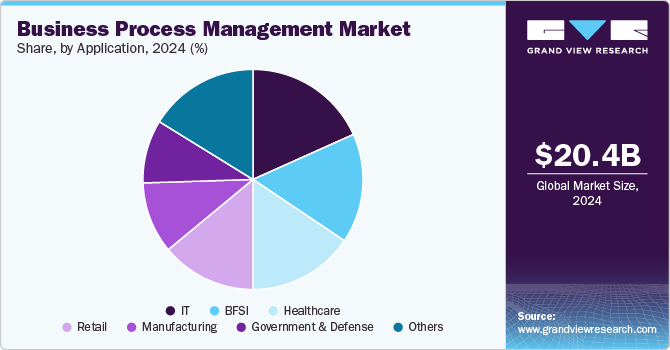

Application Insights

The IT segment accounted for the largest revenue share of over 18.0% in 2024, owing to the growing adoption of DevOps and agile methodologies. As organizations strive to accelerate software development lifecycles and improve time-to-market, BPM tools enable IT teams to automate and standardize processes like code deployment, testing, and continuous integration/continuous deployment (CI/CD). These capabilities not only enhance operational speed but also improve the quality and reliability of IT outputs.

The healthcare segment is expected to grow significantly over the forecast period. The increasing adoption of electronic health records (EHRs) and digital health solutions drives BPM adoption in healthcare. BPM systems enable seamless integration of EHRs and other digital tools into existing workflows, ensuring efficient data sharing, improved care coordination, and real-time access to patient information. This integration enhances the overall quality of care and supports better clinical decision-making.

Regional Insights

The business process management market in North America held the largest share of nearly 39.0% in 2024. Organizations in the region are leveraging BPM solutions to streamline workflows, automate repetitive tasks, and integrate advanced technologies like artificial intelligence (AI), machine learning (ML), and robotic process automation (RPA) into their operations. These solutions enhance productivity, reduce costs, and provide actionable insights, making them indispensable in the modern business landscape.

U.S. Business Process Management Industry Trends

The business process management market in the U.S. is expected to grow significantly at a CAGR of 20.8% from 2025 to 2030. The demand for enhanced collaboration and communication within organizations is augmenting the adoption of process modeling solutions. These tools act as a common language across departments, helping teams align their goals, understand dependencies, and work cohesively towards shared objectives. This is particularly important in geographically dispersed or hybrid work environments, where clear communication about processes is critical.

Europe Business Process Management Industry Trends

The business process management market in Europe is anticipated to register considerable growth from 2025 to 2030. Sustainability initiatives are an emerging driver in the Europe BPM market. Many organizations focus on optimizing their processes to reduce waste, improve energy efficiency, and support environmentally sustainable practices. BPM tools enable businesses to analyze and refine their operations to align with sustainability goals, contributing to their overall growth and competitiveness.

The UK business process management market is expected to grow rapidly in the coming years, driven by these platforms' scalability, flexibility, and cost-effectiveness. Small and medium-sized enterprises (SMEs) particularly benefit from cloud BPM solutions, eliminating the need for extensive IT infrastructure and providing real-time access to processes.

Thebusiness process management market in Germany held a substantial market share in 2024. Automotive, electronics, and machinery companies are using BPM tools to optimize complex supply chains, enhance production workflows, and integrate smart technologies such as IoT and robotics into their operations. BPM solutions play a critical role in enabling manufacturers to achieve precision, efficiency, and scalability in their processes.

Asia Pacific Business Process Management Industry Trends

The business process management market in Asia Pacific is growing significantly at a CAGR of 21.3% from 2025 to 2030. The rapid pace of digital transformation across APAC is one of the primary drivers of BPM adoption. As businesses seek to modernize their operations and integrate emerging technologies such as artificial intelligence (AI), machine learning (ML), robotic process automation (RPA), and big data analytics, BPM solutions serve as an essential tool. These platforms help organizations automate routine tasks, optimize workflows, and enhance decision-making, enabling them to stay competitive in a fast-evolving digital landscape.

Japan business process management market is expected to grow rapidly in the coming years. Japan faces demographic challenges, including an aging population and a shrinking workforce. This has led to a growing demand for automation and process optimization to maintain productivity with fewer workers. BPM solutions help businesses automate repetitive tasks, reduce reliance on manual labor, and increase operational efficiency, which is crucial to address labor shortages. Adopting BPM tools allows businesses to do more with less while maintaining high output and service levels.

The business process management market in China held a substantial market share in 2024. As China’s businesses face increasing domestic and international competition, there is a strong emphasis on improving operational efficiency and reducing costs. BPM solutions are essential in automating routine processes, streamlining workflows, and improving resource management. By enhancing productivity and reducing the need for manual intervention, BPM platforms enable organizations to cut operational costs and optimize performance, which is crucial for staying competitive.

Key Business Process Management Company Insights

Key players in the business process management industry are SAP SE, Red Hat, Inc., Genpact, IBM Corporation, and Accenture. These companies focus on various strategic initiatives, including new product development, partnerships, collaborations, and agreements, to gain a competitive advantage over their rivals.

Key Business Process Management Companies:

The following are the leading companies in the business process management market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture

- Appian

- BP Logix, Inc.

- Genpact

- Infosys Limited

- IBM Corporation

- Kissflow Inc.

- Nintex

- Open Text Corporation

- Pegasystems Inc.

- Red Hat, Inc.

- SAP SE

- Software GmbH

- TATA Consultancy Services Limited

View a comprehensive list of companies in the Business Process Management Market

Recent Developments

-

In November 2024, Red Hat, Inc. announced the launch of Red Hat Enterprise Linux 9.5, the newest version of the enterprise Linux platform. This update helps organizations deploy applications and workloads faster and more reliably, enabling cost reductions and better management of workloads across hybrid cloud environments. It also assists in mitigating IT risks across a range of infrastructures, from data centers to public clouds and edge computing.

-

In September 2024, SAP SE completed the acquisition of WalkMe Ltd., a U.S.-based company specializing in digital adoption platforms. WalkMe’s technology facilitates workflow execution across business applications, enhancing user experience and promoting greater software adoption while supporting business transformation. As part of the acquisition, WalkMe’s AI capabilities will be integrated into SAP’s Copilot Joule, offering context-sensitive and proactive assistance throughout workflows, ultimately helping users boost productivity.

Business Process Management Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 24.26 billion |

|

Revenue forecast in 2030 |

USD 61.17 billion |

|

Growth rate |

CAGR of 20.3% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report services |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Solution, deployment, enterprise size, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa |

|

Key companies profiled |

Accenture; Appian; BP Logix, Inc.; Genpact; Infosys Limited; IBM Corporation; Kissflow Inc.; Nintex; Open Text Corporation; Pegasystems Inc.; Red Hat, Inc.; SAP SE; Software GmbH; TATA Consultancy Services Limited |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Business Process Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global business process management market report based on solution, deployment, enterprise size, application, and region:

-

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Automation

-

Process Modeling

-

Content & Document Management

-

Monitoring & Optimization

-

Integration

-

Others

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

SMEs

-

Large Enterprise

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

IT

-

Retail

-

Manufacturing

-

Healthcare

-

Government & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global business process management market is expected to grow at a compound annual growth rate of 20.3% from 2025 to 2030 to reach USD 61.17 billion by 2030.

b. North America dominated the business process management market with a share of nearly 39.0% in 2024. Organizations in the region are leveraging BPM solutions to streamline workflows, automate repetitive tasks, and integrate advanced technologies like AI/ML, and robotic process automation (RPA) into their operations. These solutions enhance productivity, reduce costs, and provide actionable insights, making them indispensable in the modern business landscape.

b. Some key players operating in the business process management market include Accenture, Appian, BP Logix, Inc., Genpact, Infosys Limited, IBM Corporation, Kissflow Inc., Nintex, Open Text Corporation, Pegasystems Inc., Red Hat, Inc., SAP SE, Software GmbH, TATA Consultancy Services Limited.

b. Key factors driving market growth include the surging need for automation to reduce product or service costs and the growing business necessity for cross-functional collaboration.

b. The global business process management market size was estimated at USD 20.38 billion in 2024 and is expected to reach USD 24.26 billion in 2025.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."