- Home

- »

- Automotive & Transportation

- »

-

Business Jet Market Size & Share, Industry Report, 2030GVR Report cover

![Business Jet Market Size, Share & Trends Report]()

Business Jet Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Light, Medium, Large), By Business Model (On-demand Service, Ownership), By Region (North America, Europe, Asia Pacific, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-3-68038-794-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Business Jet Market Summary

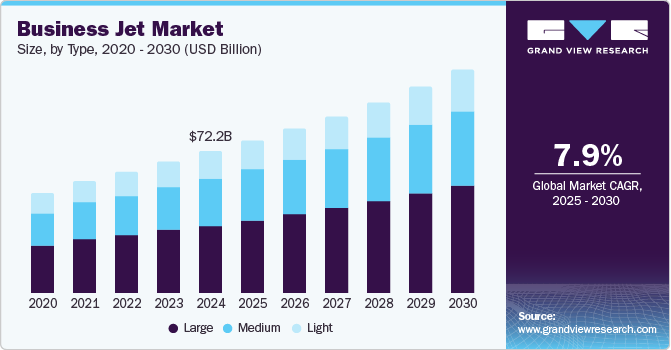

The global business jet market size was estimated at USD 72.15 billion in 2024 and is projected to reach USD 113.48 billion by 2030, growing at a CAGR of 7.9% from 2025 to 2030. The consistently increasing number of high-net-worth individuals and multinational corporations globally is a major factor driving the demand for business jets.

Key Market Trends & Insights

- The North America business jet market accounted for the largest global revenue share of 37.8% in 2024.

- The U.S. accounted for a dominant revenue share in the regional market in 2024.

- Based on type, the large business jet segment accounted for a leading revenue share of 48.1% in the global market in 2024.

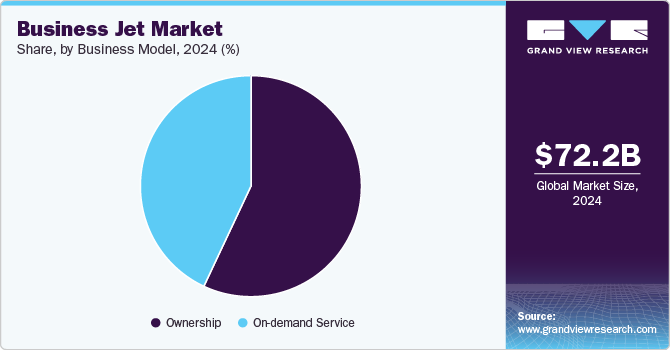

- Based on business model, the ownership segment accounted for the largest revenue share in the global business jet market.

Market Size & Forecast

- 2024 Market Size: USD 72.15 Billion

- 2030 Projected Market Size: USD 113.48 Billion

- CAGR (2025-2030): 7.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The use of private aircraft for business and personal utilization is considered a status symbol highlighting the net-worth and lifestyle of wealthy individuals. The use of business jets is highly desired among wealthy executives and business leaders. Such individuals usually have busy schedules and rely on business jets to maximize productivity by traveling between multiple destinations within a limited time interval. Using business jets also helps such individuals to eliminate the inefficiencies associated with commercial air travel including long security lines, unexpected delays, and constraints to limited flight schedules.

Business jets have the capability to land at smaller regional airports or private terminals. Such airports and private terminals can be built in proximity to the desired locations, allowing quicker access and fewer conveyance problems. This feature is highly desired in regions with less-developed commercial aviation infrastructure. Furthermore, business jets allow executives to fly as per desired schedules, thus reducing downtime and flexibility of accommodating last-minute changes in travel plans. Business jets can be used for both long and short-range flights, with companies such as Boeing, Gulfstream, and Dassault being the leading Original Equipment Manufacturers (OEMs) presenting a wide range of business jet offerings. Business jets offer greater security and control over the travel environment compared to commercial flights. Additionally, for high-profile individuals or companies involved in sensitive affairs, the ability to control the travel environment is of great importance, particularly in sensitive geographical regions. These factors contribute significantly to the growth of the business jet industry.

Rising sustainability concerns associated with the frequent use of business jets for short travel distances posed a major challenge to market expansion. According to a study published in the Nature Journal that used flight tracker data to calculate carbon dioxide emissions, private aviation accounted for a minimum of 15.6 metric tons of CO2 emissions in 2023. This amounted to around 3.6 tons of emission per flight, with 48% of these flights covering less than 500 kilometers. Furthermore, the emission from business jets grew by almost 46% between 2019 to 2023, thus highlighting the need to introduce sustainability in these operations. Business jet manufacturers are striving to introducing better and fuel-efficient aircraft and are exploring sustainable aviation fuels (SAF) to reduce emissions. Consistent developments in this space research program are expected to create a more positive perception regarding business jets, thus aiding market expansion.

The business jet industry is highly competitive, leading to an increased frequency of new jet launches with innovative features by major manufacturers such as Gulfstream, Bombardier, and Dassault. For instance, in October 2024, Bombardier announced the start of manufacturing components for its ‘Global 8000’ long-range business jet at its facilities in Québec, Texas, and Querétaro (Mexico). The aircraft has been claimed by the company to be the fastest civil aircraft after the Concorde, having a maximum speed of Mach 0.94 and a flying range of 8,000 nautical miles. It is expected to come into service during the second half of 2025. Meanwhile, in December 2024, Gulfstream Aerospace announced the first flight for its newly outfitted Gulfstream G800 to evaluate cabin functionality of the jet. This test was aimed at validating the cabin design and performance, with further tests expected to monitor the reliability of systems during different flight phases and scenarios, including overnight flights, turbulence, and cold and hot weather performance.

Type Insights

The large business jet segment accounted for a leading revenue share of 48.1% in the global market in 2024. Growing demand for long-distance air travel and the need to accommodate a higher number of passengers has boosted the use of larger jet models. Innovations in aerodynamics, fuel efficiency, and technology are helping build quieter engines, achieve longer flight ranges, and offer sophisticated avionics, thus making these aircraft more appealing. Furthermore, financing options such as fractional ownership and leasing have made large business jets more accessible to companies or individuals who do not prefer full ownership while still seeking private aviation benefits.

The medium-size aircraft segment is expected to advance at a substantial CAGR from 2025 to 2030 in the business jet industry. Medium-sized business aircraft offer ideal features combining performance, comfort, and affordability. Such features make business jets appealing to consumers demanding comfortable private air travel without incurring the higher operating costs of larger jets. Such aircraft typically offer seating capabilities for 8-10 passengers, making them well-suited for small business teams, executives, or family groups traveling together. Recent collaborations between aviation companies to add business jets to their fleet have led to an increase in the production of medium-sized aircraft. For instance, in February 2025, Sirius India Airlines announced the acquisition of 20 Cessna Citation Longitude jets from Textron Aviation. This acquisition is expected to include a combination of medium and small-sized business jets and group charters, which would help strengthen the company's presence in the business aviation sector.

Business Model Insights

The ownership model accounted for the largest revenue share in the global business jet market, with the segment including fractional or partial ownership and full ownership models. In full ownership, the owner has complete control over the aircraft's schedule, maintenance, and usage. This includes deciding when and where the aircraft is flown, as well as customization of the jet to fit specific needs. According to The Jet Traveler Report published by VistaJet, full ownership is usually possible for those with an average net worth exceeding USD 1.5 billion, with 35% of private jet owners being worth more than USD 500 million. In the fractional ownership model, the flier owns a share of a business jet via a third-party provider. This model is popular among individuals or businesses that seek the benefits of private jet travel without the full financial commitment and responsibility of owning an entire aircraft. NetJets is a well-known organization that offers fractional ownership shares in private business jets. In September 2023, the company announced the purchase of around 1,500 Cessna Citation business jets from Textron Aviation, enabling it to provide enhanced services to its customers.

Meanwhile, the on-demand service segment in the business jet industry is expected to advance at the fastest CAGR from 2025 to 2030. This business model includes air taxis, branded charters, and jet-card programs. The concept of air taxis has gained significant attention, particularly with the development of Urban Air Mobility (UAM), which involves aircraft such as electric vertical takeoff and landing (eVTOL) vehicles and its integration with more traditional business jet services. Air taxis are often considered a way to make business jet-style travel more accessible and efficient, especially for urban or regional routes. On the other hand, chartering involves renting an aircraft through a charter company or brokerage, with most flights taken on an improvised basis. Recent technological advancements have enabled new entrants to offer more efficient and transparent methods, with providers leveraging digital platforms to make it easier for customers. Moreover, improved access to information has enabled these platforms to offer cost-effective ways for affluent flyers to travel on-demand.

Regional Insights

The North America business jet market accounted for the largest global revenue share of 37.8% in 2024. The region has been known for being home to some of the leading global industrialists and technological leaders, which has driven the demand for private jets among this population. The strong economic growth, particularly in the U.S. and Canada, has contributed to the consistently expanding demographic of high-net-worth individuals and corporate executives who are more likely to invest in business aviation to optimize their time and increase productivity. According to a report by Honeywell published in October 2024, North America is expected to see around 66% of new jet deliveries by the end of 2025. Moreover, 30% of survey respondents in this report, consisting of business aviation operators, anticipated flying more in 2025, showcasing a healthy demand growth for business jets in the region. Several regional companies are rapidly expanding their operations globally, which has increased the frequency of their travel and led to rising sales of these types of aircraft.

U.S. Business Jet Market Trends

The U.S. accounted for a dominant revenue share in the regional market in 2024, owing to the rapidly expanding population of high-income individuals in the economy. According to the National Business Aviation Association (NBAA), around 3% of registered business jets in the country are operated by Fortune 500 organizations, with the remaining flown by organizations across different industries. TV and movie celebrities, pop stars, and athletes from the U.S. have achieved a significant global following, leading them to frequently travel privately to other countries for movie premieres, concerts and shows, and meet-and-greets. For instance, singer-songwriter Taylor Swift held ‘The Eras Tour’ across five continents between March 2023 and December 2024. This involved significant amounts of travel across various U.S. venues, as well as those in international cities such as Tokyo, Paris, Madrid, Munich, and Rio de Janeiro. Such instances highlight the substantial demand for business jets, as they help artists and celebrities travel from one location to another without the challenges associated with commercial flights, helping to maximize their performance schedule.

Europe Business Jet Market Trends

The European business jet industry accounted for the second-largest revenue share globally in 2024, owing to the presence of a significant number of high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs), especially in the UK, Germany, France, and Switzerland. These individuals often invest in business jets to optimize their time, enjoy greater comfort, and travel privately. Moreover, Europe’s proximity to regions with political instability or security risks makes private jets a viable option for high-profile individuals and corporate executives. They can avoid potential threats at commercial airports and reduce exposure to political unrest, particularly when traveling to high-risk regions. The region is also a major hub for luxury tourism, with wealthy travelers seeking to visit multiple countries in a short period. Business jets provide the convenience required for affluent tourists to travel between popular destinations such as the French Riviera, the Alps, or historic cities across the continent.

Asia Pacific Business Jet Market Trends

The Asia Pacific region is expected to advance at the fastest CAGR during the forecast period in the global market. Increasing urbanization and industrialization in developing economies such as China, India, and South Korea have created promising growth avenues for business jet operators. According to projections by Knight Frank, the number of regional UHNWIs is expected to rise by more than 37.0% between 2023 and 2028. Consequently, sales of business jets are also expected to grow substantially to cater to the travel and business requirements of such wealthy individuals. Moreover, the region is geographically vast, with countries and cities spread over great distances. Commercial flights, particularly in regions with limited direct connections or infrastructure, can be time-consuming and inconvenient. Business jets provide a faster and more flexible means to move between key business hubs, including Hong Kong, Seoul, Shanghai, Mumbai, and Tokyo.

China accounted for a dominant revenue share in the regional market in 2024 and is expected to maintain its position from 2025 to 2030. In recent years, the country has accounted for a noticeable proportion of billionaires globally, with many investing in business jets for personal and business purposes. Chinese companies, particularly in sectors such as technology, manufacturing, and finance, are rapidly expanding domestically and internationally. As these companies expand their geographical reach, executives increasingly depend on business jets to travel quickly and efficiently to other regions, avoiding issues such as time constraints and inefficiencies associated with commercial air travel. A report by the private jet charter broker ‘Air Charter Service’ showed that between January 2024 and September 2024, Shanghai witnessed a 40% increase in charter bookings from 2023, while Hong Kong saw a growth of 18%. This shows the growing popularity of the business aviation sector in the economy.

Key Business Jet Company Insights

Some of the major companies involved in the global business jet industry include Textron Aviation, Bombardier, and Dassault Aviation, among others.

-

Textron Aviation is a U.S.-based manufacturer of general aviation aircraft that combines the Textron-owned Cessna with the previously acquired Beechcraft and Hawker Aircraft businesses. The company sells a range of aircraft under the Cessna and Beechcraft brands, which include Cessna single-engine piston and turboprop aircraft and jets and Beechcraft piston and turboprop aircraft. Textron Aviation has additional brands involved in component production and services, including Able Aerospace Services, AeroMotion, McCauley propeller systems, and TRU Simulation + Training.

-

Dassault Aviation is a France-based aerospace company that designs and builds military aircraft, business jets, and space systems. The company's business aviation offerings come under the Falcon brand, which includes the Falcon 10X, Falcon 8X, Falcon 6X, Falcon 900LX, and Falcon 2000LXS. These jets offer a flying range from 7,400 kilometers to 13,900 kilometers, with the current inventory including over 2,100 Falcons flown in 90 countries by around 1,300 operators.

Key Business Jet Companies:

The following are the leading companies in the business jet market. These companies collectively hold the largest market share and dictate industry trends.

- Airbus SE

- Textron Aviation, Inc.

- The Boeing Company

- Bombardier, Inc.

- Dassault Aviation SA

- Embraer S.A

- Gulfstream Aerospace Corporation

- Pilatus Aircraft Ltd.

- SyberJet LLC

- Jet Linx Aviation

- Magellan Jets, LLC

- NetJets IP, LLC

Recent Developments

-

In February 2025, Embraer Executive Jets, part of Embraer S.A., signed a purchase agreement with the global private jet operator Flexjet. This deal involves the supply of various Embraer business jet models to Flexjet, including the Praetor 500, Praetor 600, and Phenom 300E, along with an advanced services and support agreement. This order of 182 aircraft, with a potential option for 30 more in the future, is projected to expand Flexjet's fleet significantly by 2030.

-

In October 2024, Textron Aviation announced the addition of new light business jets to its Cessna Citation range, with the introduction of the Cessna Citation M2 Gen3, CJ3 Gen3, and CJ4 Gen3. The CJ4 Gen3 is expected to begin operations in 2026, followed by the remaining two models in 2027. These jets leverage the advanced Garmin Emergency Autoland technology, with the Citation CJ4 Gen3 featuring the cutting-edge Garmin G3000 PRIME avionics to ensure seamless control and convenience for pilots.

-

In August 2024, Dassault displayed its extra widebody business jet, Falcon 6X, at the Latin American Business Aviation Conference and Exhibition (LABACE) event at the Congonhas Airport in São Paulo. The company has stated that the jet has the largest cabin cross-section and can cover 5,500 nautical miles, with a carrying capacity of 16 passengers. Moreover, the company's Falcon Jet affiliate inaugurated a service center at the new Catarina Executive Airport in the city, which would improve customer support for Latin American flight operators. The facility has the capacity to accommodate five Falcons simultaneously, including the new Falcon 10X.

Business Jet Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 77.53 billion

Revenue forecast in 2030

USD 113.48 billion

Growth Rate

CAGR of 7.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

February 2025

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, business model, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Spain, Switzerland, China, Japan, India, South Korea, Brazil, UAE, Saudi Arabia, South Africa

Key companies profiled

Airbus SE, Textron Aviation, Inc., The Boeing Company, Bombardier, Inc., Dassault Aviation SA, Embraer S.A., Gulfstream Aerospace Corporation, Pilatus Aircraft Ltd., SyberJet LLC, Jet Linx Aviation, Magellan Jets, LLC, and NetJets IP, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Business Jet Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global business jet market report based on type, business model, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Light

-

Medium

-

Large

-

-

Business Model Outlook (Revenue, USD Million, 2018 - 2030)

-

On-demand Service

-

Air Taxis

-

Branded Charters

-

Jet-card Programs

-

-

Ownership

-

Fractional Ownership

-

Full Ownership

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Switzerland

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.