- Home

- »

- Healthcare IT

- »

-

Burial Insurance Market Size, Share, Industry Report, 2030GVR Report cover

![Burial Insurance Market Size, Share & Trends Report]()

Burial Insurance Market (2024 - 2030) Size, Share & Trends Analysis Report By Coverage (Level Death Benefit, Guaranteed Acceptance, Modified Or Graded Death Benefit), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-959-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Burial Insurance Market Size & Trends

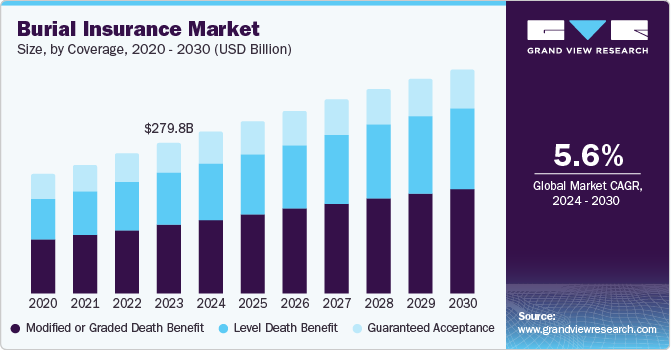

The global burial insurance market size was valued at USD 279.78 billion in 2023 and is projected to grow at a CAGR of 5.6% from 2024 to 2030. Burial insurance addresses the expenses and financial needs around end-of-life expenses. The growing significance of funeral services, last rituals, and the trend of buying burial insurance policies are significant growth drivers. Additionally, changing dynamics in the health insurance sector, technological dependence, and digital transformation positively influence market growth.

The rise in the aging population and morbid conditions has triggered the need for services like funeral cover and burial insurance. While life insurance covers the expenses associated with sudden hospitalization and medicines, burial insurance covers the funeral expenses for the deceased. This amount ranges from USD 5,000 to USD 20,000 in the United States. Also, metal caskets are growing popular in the U.S., a part of premium service offered during funerals. These policies can be purchased online, and there are a few exceptions. The policies do not require a stringent medical examination to avail of the benefits with immediate effect. However, generally, a normal premium-paying term of up to two years remains in force until the benefits are passed on further to the policyholder.

Furthermore, the popularity of burial insurance policies rose during the COVID-19 phase. The pandemic-induced changes have affected the insurance industry to a large extent. For instance, the buyers now prefer to cover funeral costs and pay life insurance premiums. Moreover, most of the major impacted countries, including the U.S., China, Spain, and Italy, have a scarcity of land for graveyards. This has emphasized awareness of the issue of paying for funeral costs. For instance, in the U.S., a report by the National Funeral Directors Association (NFDA) in 2023 found that the average funeral cost was USD 8,300. This price increases to USD 9,995 if a burial vault is included.

Some noteworthy government initiatives were also taken, including the FEMA Funeral Assistance in the U.S., which offers financial help for burial expenses related to deaths caused by major disasters. According to FEMA's recent update, it will continue to provide financial aid until September 2025 to families affected by the pandemic. The Funeral Expenses Payment program in the U.K. provides a one-time payment to help with funeral costs for certain low-income individuals.

Coverage Insights

The burial insurance market can be categorized into three primary coverages, level death benefit, guaranteed acceptance, and modified or graded death benefit. The modified or graded death benefit segment captured the largest revenue share at 45.9% in 2023. This dominance is primarily attributed to the dynamic nature of premiums within this category. Unlike level death benefit plans with fixed premiums throughout the policy term, modified or graded death benefit plans allow premium adjustments, typically after five to ten years. While the death benefit remains constant, premiums may increase over time, often experiencing a single hike during the premium payment term.

In contrast, a level death benefit option is expected to witness the fastest CAGR in the forecast period. It provides guaranteed coverage for the entire policy term. This ensures that the payout remains consistent regardless of whether the insured passes away early in the term or near its conclusion. Furthermore, level death benefit coverage offers prompt disbursement of the full death benefit. From a consumer standpoint, the relatively low premiums associated with level death benefit plans are likely to drive rapid adoption, contributing significantly to the overall growth of this segment.

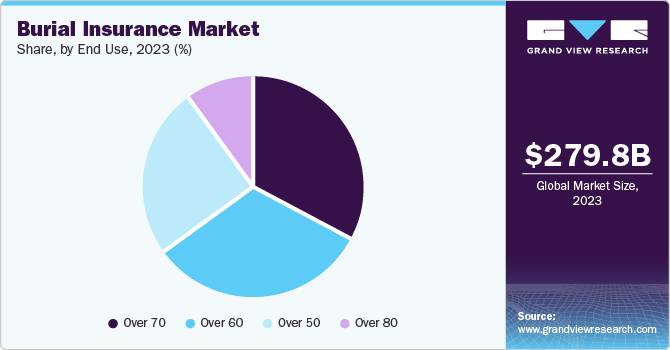

End User Insights

over 70 segment accounted for the largest revenue share of 32.7% in 2023. The segment is anticipated to maintain dominance in the forecast period mainly owing to the high prevalence of morbid conditions in this age group. Age is a key factor and has a direct influence on the costs of buying burial insurance. Funeral costs are relatively significant, particularly in the United States and Europe. As a measure, senior policyholders often seek comprehensive coverage encompassing all elements of final expense planning, including burial costs. Therefore, incorporating a funeral expense benefit within policy plans delivers substantial value to the individual and their family members mitigating the financial impact.

Over 80 segment is expected to witness the fastest CAGR during the forecast period. Senior individuals approaching or exceeding the age of 80 are more likely to be categorized under morbid conditions. This directly translates to a premium price increase for this demographic. Additionally, in developed nations, a significant portion of the population within this age group already possesses health insurance coverage. Consequently, the renewal rate for existing policies tends to be higher than the acquisition rate for new policies. This trend suggests that existing policyholders may opt to include or already have funeral expense coverage within their current plans, further contributing to the overall market growth.

Regional Insights

North America burial insurance market accounted for a market share of 38.8% in 2023 and is projected to dominate in the forecast period. The convergence of health, life, and funeral insurance products offered by numerous providers and the implementation of various government policies have mandated comprehensive health coverage, acting as a key driver for the insurance industry. This, in turn, is expected to fuel the expansion of the entire North American market throughout the forecast period.

U.S. Burial Insurance Market Trends

The U.S. Burial Insurance market is expected to witness a significant CAGR over the forecast period. The Affordable Care Act (ACA) in the U.S. has played a significant role in expansion of burial insurance market. This act mandates comprehensive health coverage for a large portion of the population. This creates a more insured environment, potentially leading individuals to consider adding funeral expense coverage as part of their existing plans or prompting them to explore comprehensive products offered by insurance companies.

Europe Burial Insurance Market Trends

Europe burial insurance market is expected grow at a significant CAGR during the forecast period owing to rapidly aging population in the region. For instance, SunLife's 2024 annual report on bereavement expenses highlights a substantial increase in average costs, reaching a record high of USD 12,000. It includes the professional fees for funeral services and other end-of-life expenses. Notably, this represents the highest cost recorded in the last 20 years. As life expectancy increases and birth rates decline, the need for end-of-life planning solutions rises.

Asia Pacific Burial Insurance Market Trends

The Asia Pacific region is projected to grow at a noteworthy CAGR from 2024 to 2030. It is driven by numerous factors, including a rising aging population, an increasing prevalence of chronic diseases, a vast demographic base, and growing end-of-life expense outlays. Furthermore, lucrative development potential exists within developed markets like China and Japan and emerging economies like India, fostering the global expansion of the burial insurance industry.

Japan burial insurance market is expected to grow rapidly in the coming years due to a significant share of the geriatric population in Japan with over 28% of their citizens being 65 or older. Due to its population figures, China's burial insurance market held a substantial market share in 2023. According to the National Bureau of Statistics, annual deaths rose to 10.4 million in 2022, a 6.7% increase from 2016. The Chinese capital faces several burial-related issues, ranging from the cost of burial to the availability of land.

Key Burial Insurance Company Insights

Some key companies in the burial insurance market include, Foresters Life Insurance and Annuity Company (acquired by Nassau Financial Group, L.P. also known as ‘Nassau’); Royal Neighbors of America; State Farm; Fidelity Life Association; Mutual of Omaha; New York Life Insurance Company; and Lemonade.

-

State Farm, a U.S.-based insurance company, offers a diversified portfolio of life insurance products, including term, whole, and universal life options. The company maintains a strong reputation for financial stability and customer service. Benefits include affordable rates, bundling discounts, and focused customer service.

-

New York Life Insurance Company (NYLIC) is a mutual life insurance company with a vast portfolio of wealth management, estate and retirement planning, investment services, life insurance, and other products.

Key Burial Insurance Companies:

The following are the leading companies in the burial insurance market. These companies collectively hold the largest market share and dictate industry trends.

- Gerber Life Insurance Company

- Zurich Insurance

- Ethos

- Globe Life.

- Allianz Life

- Colonial Penn

- The Baltimore Life

- Generali

- Ethos

- State Farm

- New York Life Insurance

- Lemonade

Recent Developments

-

In April 2024, New York Life Insurance announced the acquisition of a minor stake in Fairview Capital, a leader in private equity investing and venture capital. This acquisition is aimed at creating more opportunities for Fairview. For instance, the company plans to invest USD one billion to bridge the wealth gap for undercapitalized and underserved communities.

-

In February 2020, Canadian Premier Life Insurance Company, acquired U.S.-based Western & Southern Financial Group to purchase business blocks of Canadian Life Insurance business operating under Gerber Life brand. With this acquisition, the company plans to focus on expanding its operation in other areas of insurance.

Burial Insurance Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 299.84 billion

Revenue forecast in 2030

USD 416.07 billion

Growth Rate

CAGR of 5.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Coverage, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Royal Neighbors of America; State Farm; Gerber Life Insurance Company; Zurich Insurance; Globe Life; Mutual of Omaha; Fidelity Life Association; Allianz Life; Colonial Penn; The Baltimore Life; Generali; Ethos; Foresters Life Insurance and Annuity Company (acquired by Nassau Financial Group, L.P. also known as ‘Nassau’); New York Life Insurance; Lemonade

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Burial Insurance Market Report Segmentation

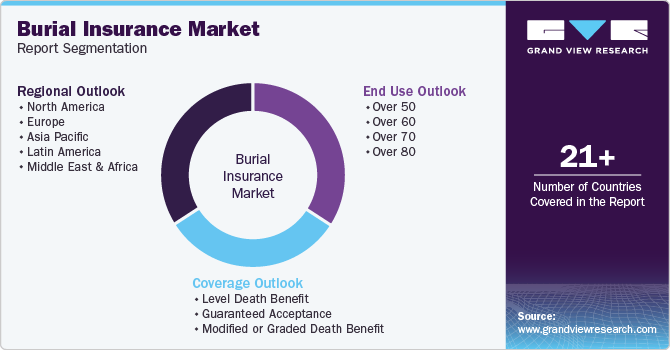

This report forecasts revenue growth at global, regional, & country levels, and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global burial insurance market based on coverage, end use, and region.

-

Coverage Outlook (Revenue, USD Billion, 2018 - 2030)

-

Level Death Benefit

-

Guaranteed Acceptance

-

Modified or Graded Death Benefit

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Over 50

-

Over 60

-

Over 70

-

Over 80

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

India

-

Thailand

-

China

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.