Building Materials Market Size, Share & Trends Analysis Report By Type (Aggregates, Bricks, Cement, Others), By Application (Residential, Commercial, Industrial), By Region, And Segment Forecasts, 2023 To 2030

- Report ID: GVR455948

- Number of Report Pages: 80

- Format: PDF

- Historical Data: ---

- Forecast Period: 1 - 2030

- Industry: Advanced Materials

Building Materials Market Size & Trends

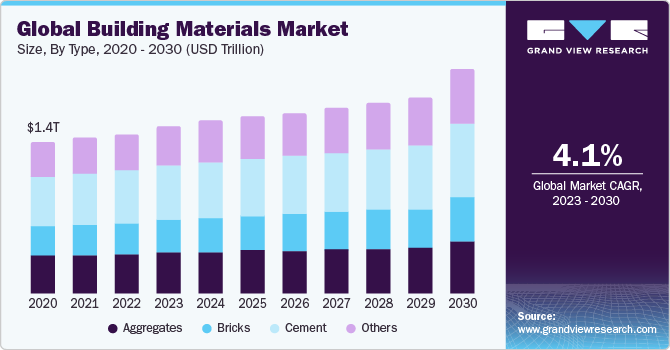

The global building materials market was valued at USD 1.5 trillion in 2022 and is expected to grow at a CAGR of 4.1% over the forecast period. The growth is attributed to high government investments in infrastructure projects, such as transportation systems, utilities, and public buildings. The continuous development of critical sectors, such as railways, mining, highways, non-residential buildings, and tunnels, makes the construction of novel infrastructure imperative.

Building materials provide key features including increased strength, improved durability, and reduced environmental impact. Demand for key products with speedy production schedules as well as decreased operational costs is driving the demand for innovative building materials. The utilization of precast components as well as ready-mix concrete considerably decreases the construction time.

The COVID-19 pandemic had a major impact on the construction industry globally. In the U.S., approximately 45% of construction contractors faced adverse impacts of the pandemic. Due to numerous lockdown measures and restrictions, construction activities were halted in China and India as well. Nearly 40% of construction companies in the European region, especially Italy, claimed that the outbreak hampered their work radically. The limited workforce, scarcity of raw materials, as well as construction restrictions, disrupted and impacted the supply chain of building materials. Additionally, due to salary cuts and job loss, the purchasing power of the end user also reduced substantially, resulting in low construction activities from the residential and commercial sectors.

Type Insights

Based on the type, the market is segmented into aggregates, cement, bricks, and others. The cement segment held the largest market share in 2022. Cement is a vital component in the manufacturing of concrete that is applied in the construction of bridges, roads, and other types of infrastructure. The European Cement Association anticipates that shipping cement costs roughly around USD 10.62 per ton for 100 km by road and about USD 15.93 per ton for 100 km by sea. The utilization of cement is thus projected to escalate as a result of its lengthy service life and cost-effectiveness.

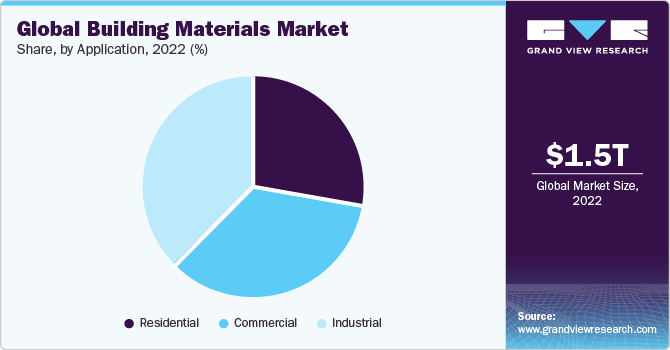

Application Insights

Based on application, the market is segmented into residential, commercial, and industrial. Building materials are witnessing higher demand, especially from the infrastructure and commercial sectors. Additionally, a surge in foreign direct investments for key infrastructure projects, including sports stadiums, public spaces, bridges, roads, and others, coupled with remodeling and expanding advancement in commercial spaces, the sector has witnessed notable expansion, thus triggering the demand for building materials.

The National Investment Promotion & Facilitation Agency states that NIP 2019–2025 budget of USD 1.4 trillion comprised of investments of 19% for motorways and roads, 16% for urban infrastructure and 17% for railways. According to U.S. Census Bureau, the consolidated spending on commercial building in U.S. was noted as USD 104,434 in February 2022 from USD 93,086 in May 2021. The number of infrastructure and commercial construction projects is growing rapidly, thus triggering the demand for building materials worldwide.

Regional Insights

Asia Pacific held the largest market share of nearly 40% in 2022. The growth is attributed to high foreign investments as well as rising government initiatives related to infrastructure projects, especially in China and India. Additionally, the Paris Climate Agreement, which India and China sanctioned in an attempt to fight the climate change, is also a key factor driving the demand of building materials.

In key emerging economies of Africa and Asia Pacific, the industrial and residential are expanding considerably. As per the India Brand Equity Foundation (IBEF), the country’s real estate sector is anticipated to account for approximately USD 1 trillion by 2030 and is predicted to hold for 18-20% of India's GDP. Consequently, growing investment in the real estate sector generates high demand for building materials including metal, sand, steel, bricks, and cement.

Key Companies & Market Share Insights

Some of the key players operating in the market are China National Building Material Company, CEMEX, Boral Limited, Lafarge Holcim, Dyckerhoff AG, Buzzi Unicem SpA, CSR Limited, CRH Plc, Aditya Birla Group and Ambuja Cements, among others. The players are focusing on partnerships/agreements and acquisitions in order to gain a higher share of the market. A few instances of the same are mentioned below:

-

In October 2022, Holcim acquired one of the key providers of construction material in the UK, i.e., Wiltshire Heavy Construction Materials, in order to increase Holcim's market share in the country’s construction materials sector

-

In August 2022, Kingspan and Aqua Trace partnered to offer solutions related to smart roof systems. Aqua Trace offers waterproofing monitoring technology whereas Kingspan offers high-performance flat roof insulation solutions

-

In August 2022, PPG, in agreement with the City of Temple, Temple EDC, and Bell country, invested approximately USD 9 million in order to extend an existing line in Texas

-

In January 2021, Gauge Brothers Concrete utilized precast concretes for the construction of a 440,000-square-foot N95 production facility in approximately 52 days

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."