Building And Construction Tapes Market Size, Share & Trends Analysis Report By Product, By Backing Material, By Application, By Function, By Distribution Channel, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-023-1

- Number of Report Pages: 137

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

The global building and construction tapes market size was estimated at USD 4.79 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.7% from 2024 to 2030. Market is expected to be driven by the rise of construction sector in emerging countries such as China, India, and Indonesia, which will increase demand for construction materials such as tapes throughout the projected period. Furthermore, rising demand for lightweight building materials is expected to fuel product growth. Building & construction tapes market is also expected to be driven primarily by increasing product demand by consumers and contractors in developed economies.

In addition, growing use of environment-friendly bonding solutions in North America and Europe is further expected to drive the product demand over the forecast period. Rapid growth of home renovating industry is likely to drive up product demand in the U.S. throughout the forecast period. Growing usage of tapes for bonding and protection is expected to boost the demand for lightweight materials throughout the projection period. Furthermore, introduction of innovative construction tapes by manufacturers in the country throughout the projected period is expected to drive product growth.

Building & construction tapes market value chain consists of raw material suppliers, product manufacturers, product distributors, and end-users. These tapes are used for interior and exterior applications in building & construction industry, such as HVAC, flooring, windows, walls & ceilings, doors, and roofing, among others. Different types of building & construction tapes such as double-sided, masking, and duct tapes are used for various construction applications.

Market Concentration & Characteristics

The building and construction tapes market growth stage is medium, and pace of the growth is accelerating. The market is characterized by a medium to high degree of innovation. The use of innovative adhesive tapes is increasingly replacing traditional bonding technologies such as flame-retardant adhesive foam tapes for lifting landing doors can help prevent the spread of fire in buildings.

Major players are prioritizing portfolio management through strategic acquisitions and divestitures. Since product innovation helps prevent price-based competition, a majority of companies emphasized building their technological capabilities to improve their product development capacity. Thus, the market is characterized by a high level of merger and acquisition (M&A) activity by the leading players.

The market is also subject to increasing regulatory scrutiny. The ASTM and EPA standards have set aside the regulations and tests for adhesives and pressure-sensitive adhesive tapes. Moreover, construction adhesive tapes are subject to frequent changes in regulations and standards, which act as a challenge for tape manufacturers.

The product exhibits a notable number of substitutes due to the use of adhesives, sealants, and metal fasteners in applications where adhesive tapes find use. However, these substitutes are expected to be diluted on account of the production of advanced tapes occupied with superior performance of such tapes. Low existing penetration levels for adhesive tapes in the building & construction industry due to the high adoption of alternate products are expected to magnify the threat of substitutes.

End-user concentration is a significant factor in the building and construction tapes market. End-users include construction companies as well as individuals or homeowners. The tapes are used by end-users on a large scale for a number of applications including decorative panels, partition walls, wall claddings, structural glazing, and water & vapor barriers. Some prominent end-users are Bechtel Corporation, Kiewit, VINCI, and Fluor Corp. among others.

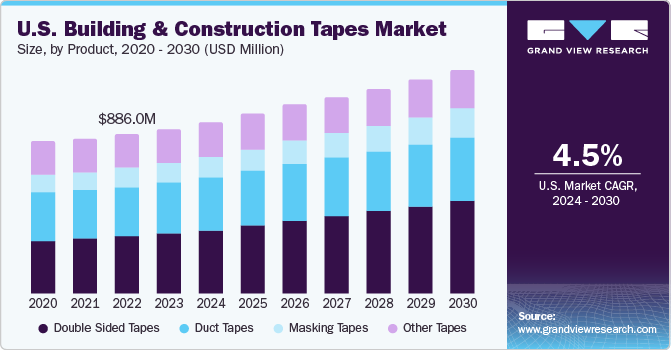

Product Insights

Double sided tapes are largest and fastest growing segment over the forecast period of 2024 to 2030 with a CAGR of 6.9%. Product growth in building & construction industry is expected to be driven by increasing penetration in Europe and North America. The product finds extensive use in bonding of trims and window attachments. In addition, such tapes are also used extensively in bonding door panels and mounting glass elements.

Duct tape is one of the major product types used in building & construction industry. The product finds extensive use in HVAC applications on account of superior properties such as insulation and protection. Companies such as 3M manufacture advanced duct tapes such as 3M Multi-Purpose Duct Tape 3900 which can be used across various applications and functions including wrapping, sealing, and protecting.

Backing Material Insights

Demand for foam-backed material is estimated to reach USD 2.02 billion by 2030. Shock absorption, vibration dampening, compensating for uneven surfaces, and thermal sealing across substrates with varying temperatures are all performance attributes of double-sided foam tapes. These tapes can also be used as seals to prevent air, gases, moisture, and humidity, thus growing overall demand for foam-backed tapes.

Foil-backed tapes find extensive use in HVAC applications due to requirement of high strength of the product. In addition, metal-backed tapes are used extensively to alter conductivity of the system. High malleability of product leads to increased product use across systems having multiple corners. Rising use of products for demanding applications is expected to drive product growth over the forecast period.

Application Insights

The use of tapes for flooring application is limited to protection against paints and other liquids and temporary bonding of wires during electrical installations. In addition, use of tapes on flooring for temporary bonding for commercial and industrial installations is expected to gain traction over the forecast period. Use of tapes on walls and ceilings for bonding is expected to emerge as one of the growing trends for building & construction industry in Asia Pacific on account of changing construction patterns.

The use of products for temporary or permanent mounting is expected to drive market growth over the forecast period. Demand for building and construction tapes in windows is estimated to witness growth at a CAGR of 6.8% in terms of revenue, from 2023 to 2030, on account of rising demand for adhesive tapes for mounting window panels and sealing gaps in window panels.

Function Insights

Tapes are used for bonding trims and panels in the building & construction industry. Use of advanced high-strength tapes in the industry for mounting window panels is expected to drive market growth over the forecast period. In addition, demand for adhesive tapes for temporary bonding and decorative bonding is expected to rise, as use of products for the aforementioned function is likely to gain traction driven by growth of industrial and commercial construction.

Tapes used in security glazing is expected to rise over the forecast period on account of rising use of tapes for dry. Increasing demand for room modifications in the building & construction industry has driven the demand for advanced tapes used for soundproofing. In addition, demand for tapes for cable management in Asia Pacific is expected to result in market growth. However, use of cable fasteners for the same application is anticipated to lead to high competition in the function segment.

End-use Insights

End-use is segmented into residential, commercial, and industrial industries, wherein residential accounted for the largest volume share of 49.6% in 2023. One of the major factors that are propelling product growth is its usage for bonding and barrier protection. Furthermore, customers in North America's residential industry indicate higher adoption of building & construction tapes due to increased preferences for aesthetics.

Industrial sector accounts for limited use of adhesive tapes as such construction requires use of high-strength applications which in certain cases are better fulfilled by adhesives. Demand for tapes in the industrial sector is expected to be driven by continuing use of the product in building envelope and HVAC systems, thereby propelling the overall product growth.

Distribution Channel Insights

Major distribution channels employed by the industry players include direct and third-party. Key players in developed markets such as the U.S., Germany, and the U.K. resort to use of direct distribution channels to distribute their products. Presence of a notable distribution network and infrastructure supplements efforts of the companies to engage in direct distribution.

Direct sales constituted USD 3.12 billion in 2023 as major companies are involved in engaging in direct sales through an extensive network. The distribution network comprises designated product distributors, which are involved in the sales of products to consumers. As a result, volume of products sold through direct channels is higher than volume sold through a third-party channel.

Regional Insights

Europe dominated the market accounting for over 30% in 2023. Region's rising building and construction industries have increased demand for construction materials such as tapes. The market is also predicted to grow throughout the forecast period due to a surge in residential constructions fueled by region's rising immigrant population.

North America is the fastest growing region over the forecast period with a CAGR of 7.3% in terms of revenue. Market is expected to register growth due to the presence of an extensive and organized building & construction industry. Building & construction industry is further expected to witness growth due to growing residential and commercial construction in the U.S. In addition, consumers in the economy have tended to opt for advanced products in residential, commercial, and industrial construction sectors.

Key Companies & Market Share Insights

Some of the key players operating in the market include 3M, DuPont de Nemours, Inc., tesa SE, and Avery Dennison Corporation:

-

3M manages its business through five business verticals, namely consumer, health care, industrial, safety & graphics, and electronics & energy. The company specializes in reflective abrasives, tapes, sheets, and safety apparel and equipment. It manufactures building & construction tapes under its industrial business segment.

-

Avery Dennison Corporation manages its business through five business verticals, namely consumer, health care, industrial, safety & graphics, and electronics & energy. The company specializes in reflective abrasives, tapes, sheets, and safety apparel and equipment. It manufactures building & construction tapes under its industrial business segment.

-

L&L Products Inc., Shurtape Technologies, LLC, and Lohmann GmbH & Co. KG are some of the emerging market participants in the building and construction tapes market.

-

Shurtape Technologies, LLC is engaged in the manufacturing and marketing of adhesive tapes, along with other consumer home and office products. The company serves various markets, including industrial/MRO, building & construction, packaging, electrical, stucco, HVAC, paint, automotive, marine, aerospace, arts & entertainment, graphic arts, sound control, medical, DIY, and retail. It offers products under several brand names, including FrogTape, Painter’s Mate, Duck, Shurtape, Kip, and T-REX.

-

Lohmann GmbH & Co. KG is engaged in the manufacturing, marketing, and distribution of double-sided adhesive tapes, transfer films, and adhesive systems. Its products are offered to numerous sectors, including transportation, building & construction, renewable energy, consumer goods & electronics, graphics, medical, and hygiene

Key Building And Construction Tapes Companies:

- L&L Products Inc.

- Tesa SE

- 3M

- PPG Industries, Inc.

- American Biltrite Inc.

- Avery Dennison Corporation

- Saint-Gobain S.A.

- Berry Global Group, Inc.

- LINTEC Corporation

- Jonson Tapes Ltd

- Scapa

- Shurtape Technologies, LLC

- Henkel AG & Co., KGaA

- Nitto Denko Corporation

- Lohmann GmbH & Co. KG

- Maxell Sliontec Ltd

- DuPont

- Bow Tape Co. Ltd.

Recent Developments

-

In August 2023, Avery Dennison Corporation announced a new line of high-performing adhesive tape for the building and construction industry. Cold Tough adhesive tape is designed for seaming and joining metal building assemblies that must operate efficiently in harsh environments. They are also utilized in the construction of roofs, external walls, ducting systems, doors and windows, overhead doors, gutters, and joists.

-

In March 2023, Rotunda Capital Partners completed the acquisition of Bron Tapes, one of the distributors and converters of pressure-sensitive tapes & adhesives. The Bron Tapes acquisition marked the second investment under Rotunda Capital Partners fund III, l.P.

-

In December 2022, Shurtape Technologies, LLC announced the acquisition of Pro Tapes & Specialties, Inc., a tape producer and converter serving a wide range of industries, including graphic arts, precision die-cutting and fabrication, contract and custom converting, retail and general industrial. The acquisition was aimed at improving product quality and better customer service.

Building And Construction Tapes Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 4.96 billion |

|

Revenue forecast in 2030 |

USD 6.94 billion |

|

Growth rate |

CAGR of 5.7% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

January 2024 |

|

Quantitative units |

Volume in million square meters, revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, backing material, application, function, end-use, distribution channel, region |

|

Region scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil |

|

Key companies profiled |

L & L Products Inc.; tesa SE; 3M; PPG Industries, Inc.; American Biltrite Inc.; Avery Dennison Corporation; Saint Gobain S.A.; Berry Global Group, Inc.; LINTEC Corporation; Godson Tapes Pvt. Limited; Scapa Group plc; Shurtape Technologies, LLC; Henkel AG & Co.; KGaA; Nitto Denko Corporation; Lohmann GmbH & Co. KG; Maxell Holdings Ltd.; DuPont de Nemours, Inc.; BowTape CO., LTD. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Building And Construction Tapes Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the building and construction market report based on product, backing material, application, function, end-use, distribution channel, and region:

-

Product Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Double Sided Tapes

-

Masking Tapes

-

Duct Tapes

-

Other Tapes

-

-

Backing Material Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Polyvinyl Chloride

-

Polyethylene Terephthalate

-

Polypropylene

-

Polyethylene

-

Foil

-

Paper

-

Foam

-

Others

-

-

Application Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Flooring

-

Walls & Ceiling

-

Windows

-

Doors

-

Roofing

-

Building Envelope

-

Electrical

-

HVAC

-

Plumbing

-

-

Function Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Bonding

-

Protection

-

Insulation

-

Glazing

-

Sound Proofing

-

Cable Management

-

-

End-use Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Distribution Channel Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Direct

-

Third-party

-

-

Regional Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global building and construction tapes market size was estimated at USD 4.79 billion in 2023 and is expected to reach USD 4.96 billion in 2024.

b. The global building and construction tapes market is expected to grow at a compound annual growth rate of 5.7% from 2024 to 2030 to reach USD 6.94 billion by 2030.

b. Duct tape dominated the building and construction tapes market with a volume share of 35.5% in 2023, owing to its rising usage in HVAC applications in insulation and protection.

b. Some of the key players operating in the building and construction tapes market include tesa SE, AVERY DENNISON CORPORATION, 3M, Dow, and Saint-Gobain.

b. The key factors that are driving the building and construction tapes market include the growing construction industry in economies such as China, India, and Japan, coupled with the rising usage of adhesive tapes for bonding applications.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."