Building And Construction Sheets Market Size, Share & Trends Analysis Report By Product (Metal, Polymer), By Application (Flooring, Roofing), By Function (Protection, Water Proofing), By End Use (Residential, Commercial), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-2-68038-233-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Market Size & Trends

The global building and construction sheets market size was estimated at USD 166.92 billion in 2024 and is expected to grow at CAGR of 5.2% from 2025 to 2030. The growing construction industry across the globe coupled with rising population, rapid urbanization, and industrialization in emerging economies is expected to drive market growth over the forecast period. Increasing construction spending by governments in various countries, especially in China and India, to meet rising industrial and public infrastructure requirements is expected to be a major factor driving the demand for the product in building & construction applications over the forecast period. As a result, Asia Pacific is expected to remain the fastest-growing construction market.

Technological advancements in building materials also play a significant role in driving the market. Innovations in material science have led to the development of high-performance construction sheets that offer enhanced durability, fire resistance, weatherproofing, and insulation. These features are critical in regions with extreme weather conditions, where builders require materials that can withstand environmental stresses. The rise of prefabricated and modular construction, which requires precision-engineered sheets for easy assembly, is another factor propelling the market forward, as these sheets simplify the construction process and reduce labor costs.

The market is also driven by the increasing demand for lightweight and versatile building materials. Traditional materials like concrete and brick are being supplemented by lighter options that are easier to handle and transport. Lightweight sheets, often made from composite materials, are being widely adopted in both residential and commercial construction projects. Furthermore, the market is supported by the expanding adoption of these sheets in sectors such as healthcare, education, and retail, where modern, aesthetically pleasing materials are in high demand.

Product Insights

Metal sheets accounted for 36.0% of the revenue share in 2024 on account of the availability of a wide range of metal deposits and the high durability of metal components. Metals used in building & construction products include lead, aluminum tin, zinc, copper & its alloys, and iron & its alloys; however, aluminum is the widely used metal due to its lightweight and anti-corrosion properties.

Polymer is expected to grow at the fastest CAGR of 6.3% over the forecast period. The increased emphasis on sustainability and eco-friendly building practices is driving the adoption of polymer sheets. Many polymer sheets are recyclable and can be manufactured with lower carbon footprints compared to traditional materials like metal or concrete. This aligns with the growing trend toward sustainable building practices and green certifications, as construction companies seek materials that contribute to energy savings and reduce environmental impact.

Application Insights

Roofing accounted for 22.9% of the revenue share in 2024. The roofing segment of the global building and construction sheets market is driven by an increase in residential and commercial construction, along with increasing investments in infrastructure. As urban areas expand and populations grow, the need for durable, efficient, and aesthetically pleasing roofing materials is rising. Construction sheets designed specifically for roofing are favored due to their durability, energy efficiency, and weather resistance, making them ideal for both new constructions and renovations. In emerging economies, rapid urbanization and government-backed housing projects are also accelerating the adoption of roofing sheets, which provide a cost-effective solution for both urban and rural projects.

HVAC is expected to grow at the fastest CAGR of 6.1% over the forecast period. The HVAC segment within the global building and construction sheets market is experiencing growth driven by the rising demand for energy-efficient and sustainable building solutions. As energy costs increase and environmental concerns grow, there is a stronger focus on HVAC systems that improve building insulation, reduce energy consumption, and lower carbon emissions. Construction sheets play a crucial role in enhancing HVAC efficiency by providing improved thermal insulation and minimizing air leaks, which are critical for maintaining energy-efficient heating, ventilation, and cooling systems.

Function Insights

The protection segment accounted for 23.9% of the revenue share in 2024. The protection segment in the global building and construction sheets market is primarily driven by the increasing need for materials that enhance structural durability and safety in construction projects. As climate change leads to more frequent and severe weather events, there is a growing demand for sheets that provide protective functions, such as water resistance, UV protection, and fire resistance. These protective features are crucial for safeguarding buildings against environmental stresses, especially in regions prone to extreme temperatures, heavy rainfall, and high UV exposure. Builders and developers are increasingly prioritizing sheets that can protect structures from these elements, ensuring long-term durability and reducing maintenance costs, which makes protection-focused materials highly desirable.

The insulation segment is expected to grow at the fastest CAGR of 6.4% over the forecast period. Technological advancements in insulation materials have accelerated market growth, as manufacturers develop innovative products that offer improved thermal performance and durability. The development of materials like high-performance foam and aerogel sheets enhanced insulation properties, allowing buildings to maintain stable internal temperatures in extreme climates. Furthermore, the growing popularity of prefabricated and modular construction methods supports the demand for insulation sheets, as these construction methods rely on precise, high-quality insulation to meet energy and regulatory standards efficiently.

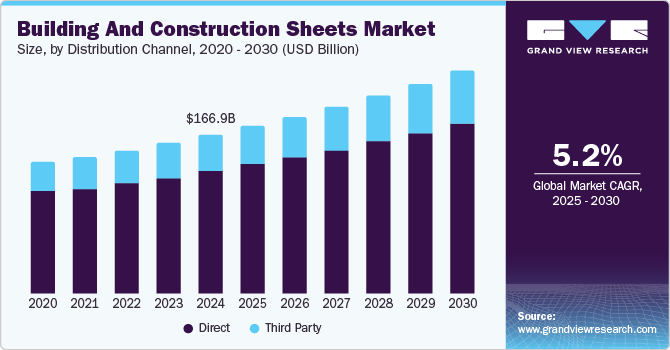

Distribution Channel Insights

Direct segment accounted for 77.2% of the revenue share in 2024. The direct segment in the global building and construction sheets market is driven by the growing preference for streamlined, efficient supply chains that enable manufacturers to directly reach end-users. By bypassing intermediaries, companies can offer competitive pricing, improve customer service, and foster long-term relationships with builders, contractors, and large construction firms.

Third-party segment is expected to grow at the fastest CAGR of 6.4% over the forecast period. The flexibility and scalability of third-party distribution channels make them an appealing choice for manufacturers. As the construction industry experiences fluctuating demand due to seasonality, economic cycles, or project timelines, third-party distributors offer a way to quickly scale operations up or down without incurring high fixed costs. This adaptability is particularly advantageous for smaller manufacturers or new entrants, allowing them to navigate market volatility while expanding their footprint.

End Use Insights

The residential segment accounted for 47.8% of the revenue share in 2024. The segment is driven by the ongoing expansion in residential construction, fueled by urban population growth, rising incomes, and a shift towards modern housing solutions. As more people migrate to urban centers, the demand for residential buildings, particularly in high-density cities, is on the rise. This drives the need for durable, lightweight, and cost-effective materials like construction sheets, which can be quickly installed and provide both functional and aesthetic benefits to residential projects. Additionally, governments in many regions are implementing affordable housing initiatives to accommodate growing populations, which further supports the demand for construction sheets in residential applications.

The commercial segment is expected to grow significantly at a CAGR of 5.4% over the forecast period. Advancements in materials technology are enhancing the performance and appeal of construction sheets in the commercial segment. Modern construction sheets now offer enhanced durability, impact resistance, and weatherproofing, which are critical features for high-traffic commercial environments. These sheets are also available in various textures, colors, and finishes, allowing architects and designers to create visually appealing facades and interiors that meet the aesthetic demands of commercial clients. The adoption of modular and prefabricated construction methods, which rely heavily on precisely engineered construction sheets, is further driving the segment, as these approaches offer faster, cost-effective solutions that are particularly beneficial for large-scale commercial projects.

Regional Insights

Asia Pacific building and construction market dominated the global market and accounted for 49.2% of revenue in 2024. The Asia-Pacific (APAC) region is experiencing significant growth in the building and construction sheets market, driven by several key factors. One of the primary drivers is rapid urbanization and population growth, particularly in countries like China, India, and Indonesia. As cities expand and infrastructure development accelerates to accommodate rising urban populations, the demand for building materials, including construction sheets, is on the rise. The need for residential, commercial, and industrial buildings in APAC is contributing to the increasing use of these materials for roofing, cladding, insulation, and flooring applications.

With rising environmental concerns, the building and construction sheets market in China has been promoting the use of energy-efficient and eco-friendly building materials. Construction sheets made from recyclable, non-toxic, and energy-efficient materials are gaining traction, as they align with China's stricter environmental regulations and sustainability goals. The trend toward green buildings and energy-efficient construction is fostering the adoption of construction sheets that offer superior thermal insulation, moisture resistance, and low environmental impact.

CSA Building And Construction Sheets Market Trends

The CSA building and construction sheets market is anticipated to grow significantly at a CAGR of 5.4% over the forecast period. Canada and South America are witnessing increasing attention to sustainability in construction. As environmental concerns grow, there is a shift towards energy-efficient buildings, eco-friendly construction materials, and sustainable building practices. Building and construction sheets made from recycled, energy-efficient, and low-carbon materials are gaining popularity. This trend aligns with government policies and regulations that promote sustainability, contributing to market growth.

North America Building And Construction Sheets Market Trends

The building and construction sheets market in North America is driven by the technological innovations in construction materials, such as lightweight and durable sheets which further driving the demand in the region. The use of high-performance materials like fiberglass, polycarbonate, and advanced composites in roofing, cladding, and insulation is growing due to their superior properties. Government regulations, including energy efficiency standards and building codes, are encouraging the use of innovative materials in construction. Additionally, tax incentives and grants for green construction projects boost demand for building and construction sheets.

U.S. Building And Construction Sheets Market Trends

The U.S. building and construction sheets market is growing due to the adoption of sustainable construction materials in line with green building certifications (such as LEED) and is driving demand for eco-friendly building sheets made from recycled or sustainable materials. Building codes and regulations related to safety, energy efficiency, and sustainability are also boosting the demand for advanced building sheets that meet these requirements. Advances in manufacturing and logistics have increased the availability and reduced costs of raw materials used in building sheets, further boosting market demand.

Europe Building And Construction Sheets Market Trends

The adoption of modern construction techniques, including prefabrication and modular construction, is increasing the demand for standardized building materials like pre-cut or ready-to-install sheets, which facilitate faster and more efficient construction. Technological advancements in construction materials, including the development of lightweight, durable, and energy-efficient building sheets, are enhancing market growth. Innovations like fire-resistant, moisture-resistant, and soundproof sheets have found wide applications in both new builds and renovations.

Key Building And Construction Sheets Company Insights

Some key players operating in the market include Paul Bauder GmbH & Co. KG, GAF Materials Corporation, Others

-

Paul Bauder GmbH & Co. KG is a German company specializing in the development, production, and distribution of high-quality roofing and waterproofing systems for the building and construction industry. With a strong focus on sustainability and innovation, Bauder provides a wide range of products including bitumen, synthetic membranes, and green roofing solutions. The company offers roofing systems for flat and pitched roofs, as well as insulation and drainage solutions designed to optimize energy efficiency.

-

GAF Materials Corporation, a manufacturer in the building and construction industry, specializes in the production of roofing materials and other related products. The company is renowned for its high-quality roofing solutions, including asphalt shingles, commercial roofing systems, and underlayments, offering durable, energy-efficient, and sustainable products. GAF's product offerings also include ventilation systems, roofing accessories, and insulation materials, providing a comprehensive range of solutions designed to meet the needs of both residential and commercial construction projects.

Key Building And Construction Sheets Companies:

The following are the leading companies in the building and construction sheets market. These companies collectively hold the largest market share and dictate industry trends.

- Paul Bauder GmbH & Co. KG

- GAF Materials Corporation

- Atlas Roofing Corporation

- CertainTeed Corporation

- Owens Corning Corp.

- Etex

- Fletcher Building Limited

- North American Roofing Services, Inc.

- Icopal ApS

- EURAMAX

Building And Construction Sheets Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 176.29 billion |

|

Revenue forecast in 2030 |

USD 233.73 billion |

|

Growth rate |

CAGR of 5.2% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Volume in million square meters and revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, function, end use, distribution channel, region |

|

Regional Scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Germany; UK; China; India; Japan; Brazil |

|

Key companies profiled |

Paul Bauder GmbH & Co. KG; GAF Materials Corporation; Atlas Roofing Corporation; CertainTeed Corporation; Owens Corning Corp.; Etex; Fletcher Building Limited; North American Roofing Services, Inc.; Icopal ApS; EURAMAX |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Building And Construction Sheets Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global building and construction sheets market based on the product, application, function, end use, distribution channel, and region:

-

Product Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Bitumen

-

Rubber

-

Metal

-

Polymer

-

-

Application Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Flooring

-

Walls & Ceiling

-

Windows

-

Doors

-

Roofing

-

Building Envelop

-

Electrical

-

HVAC

-

Plumbing

-

-

Function Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Bonding

-

Protection

-

Insulation

-

Glazing

-

Water Proofing

-

-

End-use Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Distribution Channel Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Direct

-

Third party

-

-

Regional Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global building and construction sheets market size was estimated at USD 166.91 billion in 2024 and is expected to reach USD 176.29 billion in 2025.

b. The global building and construction sheets market is expected to grow at a compound annual growth rate of 5.2% from 2025 to 2030 to reach USD 233.73 billion by 2030.

b. Metal sheets dominated the building and construction sheets market with a share of 36.0% in 2024 owing to the availability of a wide range of metal deposits and the high durability of metal components.

b. Some of the key players operating in the building and construction sheets market include Paul Bauder GmbH & Co. KG, GAF Materials Corporation, Atlas Roofing Corporation, and CertainTeed Corporation.

b. The key factor which is driving Building and Construction Sheets market is rising civil engineering and construction activities due to rapid urbanization and industrialization across the globe.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."