- Home

- »

- Advanced Interior Materials

- »

-

Bronze Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![Bronze Market Size, Share & Trends Report]()

Bronze Market Size, Share & Trends Analysis Report By Alloy Type (Aluminum, Phosphor, Silicon), By Application (Architectural Parts, Musical Instruments, Transportation, Industrial), By Region, And Segment Forecasts, 2023 To 2030

- Report ID: GVR455960

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Data: ---

- Forecast Period: 1 - 2030

- Industry: Advanced Materials

Bronze Market Size & Trends

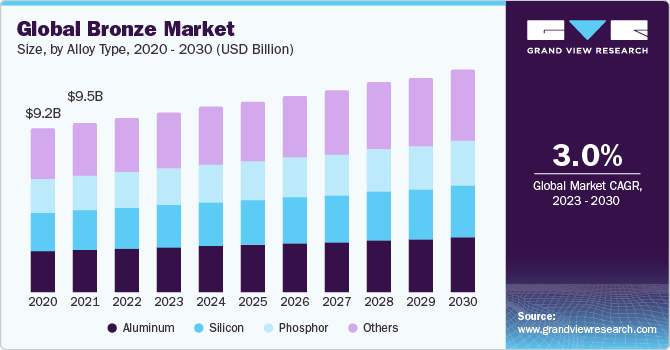

The global bronze market size was valued at USD 9.77 billion in 2022 and is expected to grow at a CAGR of 3.0% over the forecast period. Rising investments in the construction and automotive industries are anticipated to augment market growth over the forecast period. Properties such as unique color and corrosion resistance aid the product’s penetration in applications, including furniture, ceiling, wall panels, and automobile parts. Rapid urbanization and increasing production of vehicles are, thus, expected to push demand for bronze alloys over the forecast period.

Bronze is an alloy with copper as its key element. The pandemic in 2020 impacted the copper mining operations, which eventually affected bronze production. The lockdown and quarantine measures compelled the companies to halt their mining operations. As per USGS, on a y-o-y basis, the global copper mine production witnessed meager growth of 0% and 1% in 2019 and 2020, respectively. Low production and diminished demand resulted in reduced imports of bronze. As per the Indian Minerals Yearbook, on a y-o-y basis, the world brass & bronze imports declined by 21.4% and 17.3% in FY 2019-20 and 2020-21, respectively.

Bronze finds vital significance in industrial applications such as gibs, nuts, fasteners, piston rings, bridge pins, valve & pump components, etc. As a result, the manufacturing output has a direct influence on the market. The global manufacturing output faced consecutive declines in 2019 and 2020 of ~1% and ~3%, respectively. As a result, the demand for bronze-based products in the industrial sector struggled to gain traction owing to low demand.

Alloy Type Insights

Based on the alloy type, aluminum-based bronze alloys held the largest revenue share in 2022, of the global market. These are mainly used in industrial machinery, marine hardware, and electronic components. Also, their rich golden color and resistance to tarnishing make them useful in jewelry and architecture as well. However, manufacturers find it difficult to deal with these alloys because the exceptional properties of these alloys, including high temperature conductivity, high strength, high copper content, and high abrasiveness, make the machining process difficult by impacting the cutting tools and machines. Hence, in order to make use of these alloys, it becomes important to select proper machining parameters and cutting tools.

Another vital segment is silicon bronze. The properties making this alloy remarkable are corrosion resistance, appealing surface finish, and ease of pouring. Its casting ability makes it applicable in aerospace & automotive industries for bearing cages, raceways, and spacers. The growing investments in the aerospace industry on account of the rising need for aviation & defense amidst the increasing population and territorial disputes are anticipated to positively influence segment growth over the forecast period. For instance, in October 2023, the New Zealand government announced funding of USD 3.21 million for sealed runway and hangar facilities to support the country’s aerospace industry.

Application Insights

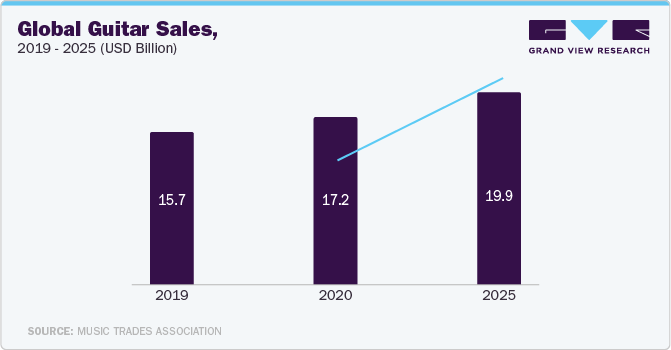

Musical instruments is an important segment of the market, as penetration of bronze alloys is expanding in the industry. They find use in making cymbals, bells, tambourines, and gongs. Also, they are applicable to guitar and piano strings. The COVID-19 pandemic gave people the opportunity to enhance their interests in music, as they were forced to stay indoors. This, in turn, augmented the demand for musical instruments globally. For instance, the guitar is amongst the most popular instruments. Its sales witnessed an increase of over 9% from 2019 to 2020 at a global level. Growth in its sales & production is eventually anticipated to boost bronze demand over the coming years.

Regional Insights

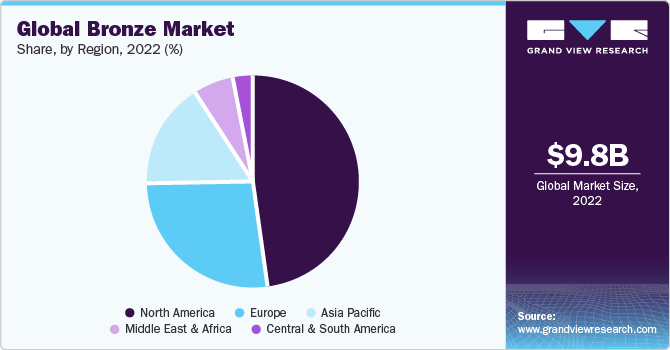

Asia Pacific held the largest share in 2022, of the global market. The GDP of Asia Pacific is expected to grow at 4.4% in 2023, as per IMF. Increasing manufacturing activities and surging foreign investments are the key drivers fueling the GDP of the region. The market finds huge growth potential in the region owing to the expansion in manufacturing output, construction activities, and production of musical instruments. For instance, in the first half of FY 2022-23, India exported USD 22 million worth of musical instruments amid growing demand for drums, flutes, and guitars worldwide.

Key Companies & Market Share Insights

The competitive rivalry is high in the market. Copper being the key raw material in bronze, has immense significance in various end-use industries, as a result, the companies engaged in copper mining and producing its alloys are adopting strategies like mergers & acquisitions and expansions to stay competitive in the market. The following are some instances of strategic initiatives:

-

In April 2023, Wieland Group acquired Heyco Metals and National Bronze Manufacturing. This acquisition led to the addition of a manufacturing site for bronze bushings and industrial components in the U.S.

-

In August 2023, Wieland Group acquired Farmers Copper Ltd., a leading bronze alloys supplier in North America. This acquisition further expands Wieland’s footprint in North America and will increase penetration in end-use industries such as marine, aerospace, and defense.

-

In August 2022, Chicago-based Temple Hall Group purchased Minnesota-based Reliable Bronze and Manufacturing Inc. (RBMI). The latter is a manufacturer of quality bearings and bar stock products. The former aims at carrying forward RBMI’s legacy and success.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."