- Home

- »

- Medical Devices

- »

-

Bronchoscopes Market Size & Share, Industry Report, 2030GVR Report cover

![Bronchoscopes Market Size, Share & Trends Report]()

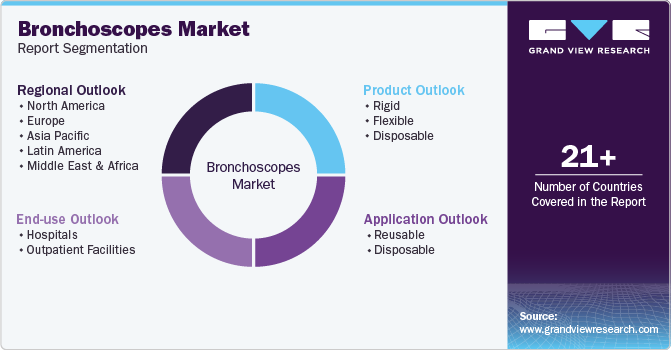

Bronchoscopes Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Rigid, Flexible & Disposable), By End Use (Hospitals, Outpatient Facilities), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-192-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Bronchoscopes Market Summary

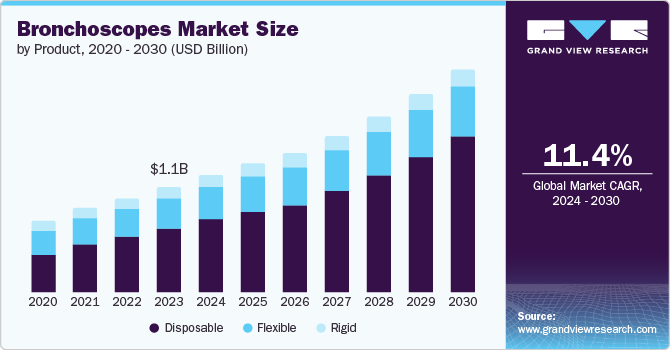

The global bronchoscopes market size was estimated at USD 873.0 million in 2024 and is projected to reach USD 1,297.9 million by 2030, growing at a CAGR of 6.8% from 2025 to 2030. The rising incidence of respiratory disorders and growing awareness regarding early diagnosis drive demand for bronchoscopes.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, Canada is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, disposable accounted for a revenue of USD 464.3 million in 2024.

- Disposable is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 873.0 Million

- 2030 Projected Market Size: USD 1,297.9 Million

- CAGR (2025-2030): 6.8%

- North America: Largest market in 2024

For instance, according to the National Health Service (NHS) in England, 1.2 million individuals are affected by chronic obstructive pulmonary disease (COPD) in the UK. Bronchoscopes are primarily used to assess and manage multiple respiratory and airway diseases. Conditions such as COPD, blockages, tumors, bronchopulmonary hemorrhage, inflammatory conditions, and airway stenosis are detected and diagnosed through these devices.

The field of bronchoscopy is evolving, with technological advancements leading to the development of more precise, efficient, and safer bronchoscopes. Recent innovations include virtual bronchoscopy, which utilizes 3D imaging to provide a more detailed view of the airways, and robotic bronchoscopes, which offer improved maneuverability and control during procedures. Thus, such benefits provided by bronchoscopes boost their demand in the market.

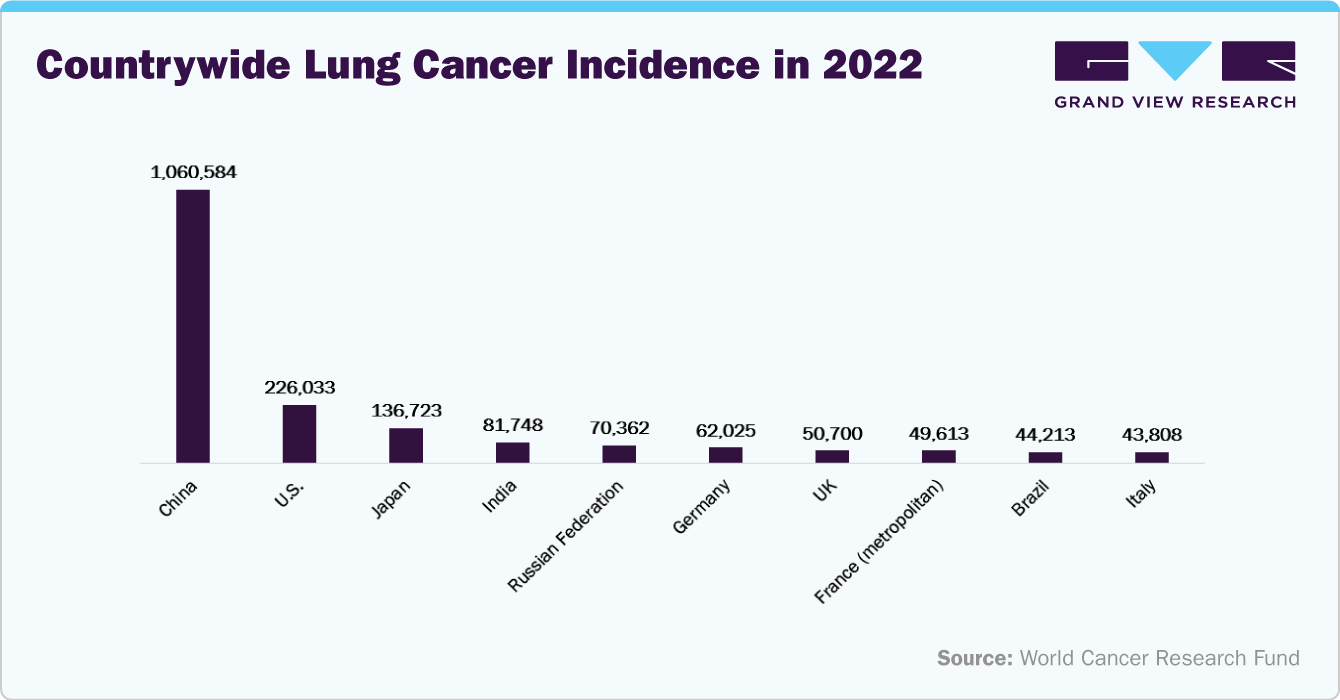

The increasing prevalence of lung cancer and cancer-related mortality globally is one of the factors expected to drive the market. For instance, according to the American Cancer Society's estimated number of lung cancer cases for 2024, which was 234,580 new lung cancer cases (118,270 in women and 116,310 in men) and 125,070 deaths from lung cancer (59,280 in women and 65,790 in men). The following graph shows the countrywide lung cancer incidence in 2022,

Moreover, increasing preference for minimally invasive surgeries increases the demand for bronchoscopes. Minimally invasive or keyhole surgeries, which utilize small incisions to diagnose and treat various conditions, are gaining widespread acceptance globally. Surgeons are increasingly favoring robotic and endoscopic surgeries over conventional open surgeries due to the numerous benefits they offer.

Following are some benefits provided by minimally invasive surgeries:

-

Reduced Postoperative Complications

-

Shorter Hospital Stay and Recovery Time

-

Decreased Blood Loss

-

Economic Viability

The bronchoscope market has witnessed a significant surge in FDA and regulatory approvals and the launch of new products. Moreover, innovations in imaging technology are facilitating the trend of new product launches, enhancing the precision & effectiveness of diagnostic and therapeutic procedures. For instance, in November 2023, Johnson & Johnson, a MedTech company, received regulatory approval for MONARCH Platform and MONARCH Bronchoscope in China. It is a robotic-assisted technology approved in China for peripheral lung procedures.

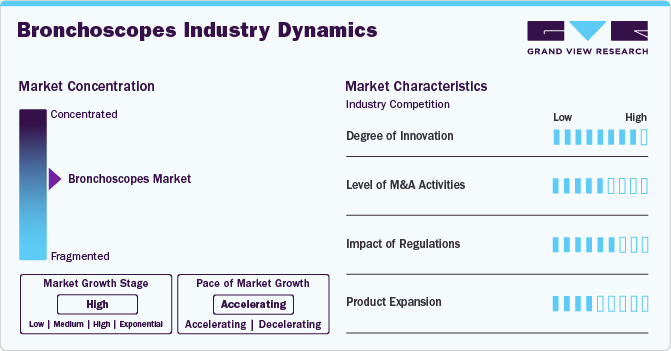

Market Concentration & Characteristics

The global bronchoscope market is characterized by a high degree of innovation, owing to rising investments, growing research activities, and the launch of new educational programs to enhance healthcare infrastructure and advance research in this field. For instance, in July 2023, Delray Medical Center, a part of the Palm Beach Health Network, launched the Ion Robotic Bronchoscopy Program to bring novel technology to the platform for lung cancer care.

The bronchoscope market is characterized by medium merger and acquisition activity. Market players, such as Ambu A/S, Olympus, Boston Scientific Corporation, Fujifilm Holdings Corporation, and Karl Storz GmbH & Co., KG, are involved in mergers and acquisitions. Through M&A activity, these companies expand their geographic reach and enter new territories. For instance, in July 2024, Mary Washington Hospital (MWH), a hospital in Virginia, acquired the ion robotic bronchoscope system for the early detection of lung cancer through a bronchoscopy.

Regulations play an essential role in shaping the global market and ensuring the efficacy, safety, and quality of implants available to patients. For instance, the Medical Devices Bureau of the Therapeutic Products Directorate (TPD) regulates medical devices, including endoscopes (bronchoscopes). In addition, the Public Health Agency of Canada (PHAC) creates national guidelines for preventing and controlling infections. These guidelines are based on evidence and are meant to support the efforts of provincial & territorial governments in monitoring, preventing, and controlling healthcare-associated infections.

Several market players are expanding their business by launching new products to strengthen their market position and expand their product portfolio. For instance, in May 2021, Pentax Medical Europe (HOYA Corporation) received a CE mark from European regulatory authorities for PENTAX Medical ONE Pulmo, a disposable bronchoscope used in pulmonary care.

Product Insights

By product, the disposable segment dominated the market with a 49.0% revenue share in 2024 and is anticipated to witness the fastest CAGR growth over the forecast period. Disposable bronchoscopes eliminate the need for reprocessing, reducing turnaround time between procedures and allowing for faster patient care. Since they are single-use, they eliminate the risk of cross-contamination associated with reusable bronchoscopes, a major concern in healthcare facilities. For instance, in April 2023, Verathon, a provider of medical devices, introduced BFlex 2, a disposable bronchoscope, to help clinicians better serve pediatric and adult patients across hospital departments.

The flexible segment is anticipated to witness a significant CAGR growth over the forecast period owing to its thin and flexible design, which allows easier navigation through the intricate bronchial airways. This makes it ideal for various diagnostic and therapeutic procedures. The superior imaging quality provided by flexible bronchoscopes is a key factor driving their increasing usage. For instance, in August 2021, Boston Scientific Corporation , a manufacturer of medical devices, received a U.S. FDA 510(k) clearance for the EXALT Model B Single-Use Bronchoscope. It is used in ICU and operating room (OR) bedside procedures.

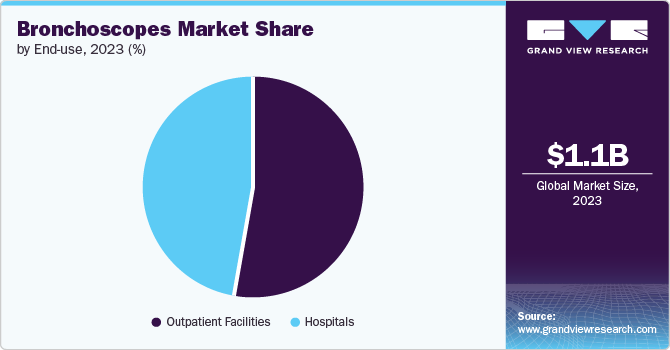

End Use Insights

By end use, outpatient facilities dominated the market with a revenue share of 53.6% in 2024 and are anticipated to witness the fastest CAGR growth over the forecast period. Advancements in technology have led to the development of portable and user-friendly bronchoscopes suitable for outpatient settings. Moreover, the convenience and cost-effectiveness of bronchoscopy procedures in outpatient settings drive healthcare providers to invest in these devices for their facilities. At University College London Hospitals, an NHS Foundation Trust, more than 90% of endobronchial ultrasound (EBUS) and navigational and image-guided bronchoscopy are performed outpatient.

The hospitals segment is anticipated to witness a significant CAGR growth over the forecast period. The increasing incidence rate of respiratory diseases globally leads to a higher demand for diagnostic tools such as bronchoscopes in hospital settings. Furthermore, hospitals often have more resources and expertise to perform complex bronchoscopy procedures, making them a preferred surgery location. For instance, according to Boston Scientific Corporation, more than 3 million bedside procedures involving a bronchoscope are performed annually in the OR and ICU across the globe, and over 1.2 million are performed in the U.S.

Regional Insights

North America bronchoscopes industry dominated with a 40.6% share in 2024 and is anticipated to witness the fastest CAGR growth over the forecast period. The rising prevalence of cancer, the growing geriatric population susceptible to chronic illnesses requiring endoscopic procedures, and the increasing importance of timely disease diagnosis & early interventions are driving the demand for bronchoscopes. Furthermore, many industry players in the U.S. initially pursued approval from the FDA to introduce their products in the country, promoting market growth. For instance, in July 2022, Ambu A/S obtained U.S. FDA approval for its fifth-generation bronchoscope.

U.S. Bronchoscopes Market Trends

The bronchoscope industry in the U.S. dominated in terms of revenue share in 2024 due to a large patient pool with respiratory illnesses, which necessitates frequent diagnostic procedures. The presence of key market players in the country contributes to the accessibility and availability of bronchoscopy devices, further propelling market growth. In the U.S., around 500,000 bronchoscopy procedures are conducted annually using reusable flexible bronchoscopes or single-use flexible bronchoscopes.

Europe Bronchoscopes Market Trends

The bronchoscope market in Europe was identified as a lucrative region in 2024. Ongoing technological advancements in endoscopy and a rise in demand for minimally invasive procedures drive the market. Over 1.5 million bronchoscopy procedures are performed across Europe annually.

The UK bronchoscopes market is anticipated to register a considerable growth rate during the forecast period. Physicians and patients are increasingly aware of and prefer disposable bronchoscopes to improve post-procedure outcomes and reduce the risk of cross-contamination. Moreover, the increasing number of patients suffering from chronic diseases requiring minimally invasive surgical procedures for diagnosis and treatment contributes to market growth.

Asia Pacific Bronchoscopes Market Trends

The bronchoscopes market in Asia Pacificis anticipated to witness significant CAGR growth over the forecast period, owing to its rapidly improving healthcare infrastructure, a less stringent regulatory framework, and economic development attracting foreign investments. India and China are considered the most populous countries, providing a large patient pool and elderly population, especially in China. The growing patient pool in these countries is expected to boost the market. Furthermore, the ever-increasing medical tourism in India and China positively impacts market growth.

India bronchoscopes market is anticipated to register a considerable growth rate during the forecast period due to several factors, such as the high burden of respiratory diseases and the increasing awareness about respiratory health and its early diagnosis. According to the All India Institute of Medical Science (AIIMS), over 2500 bronchoscopy procedures are performed in the Department of Pulmonary, Critical Care, and Sleep Medicine.

Latin America Bronchoscopes Market Trends

The bronchoscopes market in Latin America is anticipated to witness considerable CAGR growth over the forecast period. Increasing awareness and preference among physicians and patients for enhanced post-procedure outcomes and minimized cross-contamination risk are key factors driving bronchoscope demand.

Argentina bronchoscopes market is anticipated to register a considerable growth rate during the forecast period. The market is driven by an increasing preference for minimally invasive surgeries and the implementation of pivotal screening programs for effective cancer diagnosis. The availability of training centers for educating healthcare professionals about recent bronchoscope advancements is boosting market growth.

Middle East & Africa Bronchoscopes Market Trends

The bronchoscopes marketinthe Middle East and Africa is anticipated to register significant growth during the forecast period. Advancements in healthcare infrastructure, growing healthcare expenditures, and increasing awareness of available diagnostic and therapeutic solutions drive the regional market's growth.

South Africa bronchoscopes market is anticipated to register a considerable growth rate during the forecast period. South Africa has a well-developed healthcare sector focused on providing advanced medical services and technologies to its population. The need to deliver high-quality healthcare services, accurate diagnoses, and minimally invasive treatments is increasing the demand for bronchoscopes in South Africa. In addition, the rising concern for patient safety and the trend of preventive care are some factors expected to contribute to the market growth.

Key Bronchoscopes Company Insights

Key participants in the bronchoscopes market are focusing on devising innovative business growth strategies in the form of partnerships & collaborations, product portfolio expansions, mergers & acquisitions, and geographical expansions.

Key Bronchoscopes Companies:

The following are the leading companies in the bronchoscopes market. These companies collectively hold the largest market share and dictate industry trends.

- Olympus Corporation

- Ambu A/S

- Teleflex Incorporated.

- KARL STORZ SE & Co. KG

- FUJIFILM Holdings Corporation

- Boston Scientific Corporation

- Richard Wolf GmbH

- Pentax Medical (HOYA Corporation)

- Cook Medical

- Broncus Medical, Inc.

Recent Developments

-

In May 2024, Olympus Corporation launched two bronchoscopes compatible with EVIS X1 Endoscopy System. The EVIS X1 Endoscopy System is the newest technology for diagnosing and treatment. Designed using advanced imaging, the two bronchoscopes provide doctors with a slim outer diameter in comparison to previous models.

-

In April 2024, Moffitt Cancer Center's Interventional Pulmonology Program introduced its new Ion Robotic Bronchoscopy platform. This cutting-edge technology utilizes fiber optics and the smallest catheter available, allowing it to access all areas of the lung.

-

In August 2023, Ambu announced that it has received 510(k) regulatory clearance from the U.S. Food and Drug Administration (FDA) for two smaller sizes of its fifth-generation bronchoscope series, the Ambu aScope 5 Broncho. These two single-use bronchoscopes are designed for use in high-complexity procedures within the bronchoscopy suite.

-

In February 2023, FUJIFILM Holdings Corporation introduced the PB2020-M2, a compact ultrasonic probe system for bronchoscopy, at BRONCHUS 2023. This new device, due to its small size and high-resolution ultrasound capabilities, allows for real-time imaging of lung lesions.

Bronchoscopes Market Report Report Scope

Report Attribute

Details

Market size value in 2025

USD 932.56 million

Revenue forecast in 2030

USD 1.30 billion

Growth rate

CAGR of 6.8% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Report updated

January 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Olympus Corporation; Ambu A/S; Teleflex Incorporated.; KARL STORZ SE & Co. KG; FUJIFILM Holdings Corporation; Boston Scientific Corporation; Richard Wolf GmbH; Pentax Medical (HOYA Corporation); Cook Medical; Broncus Medical, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Bronchoscopes Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the bronchoscopes market report based on product, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Rigid

-

Flexible

-

Disposable

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Mexico

-

Canada

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Thailand

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global bronchoscopes market size was estimated at USD 873.01 million in 2024 and is expected to reach USD 932.56 million in 2025.

b. The global bronchoscopes market is expected to grow at a compound annual growth rate of 6.84% from 2025 to 2030 to reach USD 1.30 billion by 2030.

b. Disposable bronchoscopes segment dominated the bronchoscopes market with a share of 49.0% in 2024. This is attributable to high video quality and significant cost effectiveness.

b. Some key players operating in the bronchoscopes market include Teleflex Incorporated; Olympus Corporation; Ambu A/s; Karl Storz; Fujifilm Holdings Corporation; Boston Scientific Corporation; and Cogentix Medical.

b. Key factors that are driving the market growth include increasing demand for bronchoscopes due to increasing prevalence of respiratory diseases, improving reimbursement policies, and technological advancements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.