Bronchial Biopsy Devices Market Size, Share & Trends Analysis Report By Product (Biopsy Forceps, Transbronchial Needle Aspiration Needles, Cytology Brushes, Cryobiopsy Devices), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-126-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Bronchial Biopsy Devices Market Trends

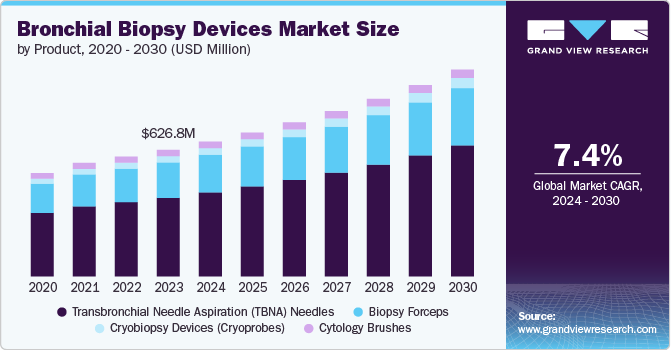

The global bronchial biopsy devices market size was valued at USD 626.83 million in 2023 and is expected to grow at a CAGR of 7.39% from 2024 to 2030. Rising utilization of bronchial biopsies for diagnosing lung cancer and related conditions, rising adoption of disposable devices, rapid technological advancements, and increasing awareness & screening initiatives by organizations are some of the factors contributing to market growth.

The increasing utilization of bronchial biopsies for diagnosing lung cancer and related conditions is a significant factor driving the growth of the bronchial biopsy market. This surge can largely be attributed to the rising global incidence of lung cancer, which has necessitated more accurate and early diagnostic methods. According to WHO’s February 2024 insights, lung cancer is the most prevalent cancer globally, with 2.5 million new cases, representing 12.4% of all newly diagnosed cases. Moreover, the rising prevalence of smoking and exposure to environmental pollutants, including occupational hazards, have contributed to the increasing incidence of lung cancer, driving the demand for bronchial biopsies. According to WHO June 2023 statistics, smoking is the primary cause of lung cancer, accounting for approximately 85% of all cases and nearly 90% of all lung cancer deaths.

Furthermore, the increasing adoption of disposable devices is significantly driving the growth of the market. Disposable bronchial biopsy devices, such as single-use needles and forceps, are becoming more popular due to their ability to reduce the risk of cross-contamination & infections. This is particularly important in procedures such as Endobronchial Ultrasound-Guided Transbronchial Needle Aspiration (EBUS-TBNA), where sterility is crucial for patient safety. In developed countries such as the U.S., physicians in outpatient and office settings are being trained in bronchial biopsies, leading to a rise in the adoption of disposable devices to save time.

Conversely, in economically sensitive countries like India, reusable devices are preferred. Moreover, the adoption of newer diagnostic techniques like endobronchial ultrasound-guided transbronchial needle aspiration (EBUS-TBNA) still needs to be improved in India. According to a 2019 article titled “Endobronchial Ultrasound-Guided Transbronchial Needle Aspiration: Techniques and Challenges,” only 27% of surveyed respiratory physicians in India performed EBUS-TBNA, while 74% used conventional TBNA. Although EBUS-TBNA offers cost-effectiveness and safety advantages over invasive surgical procedures, it still entails significant expenses.

The COVID-19 pandemic had a limited negative impact on revenue, as companies such as Olympus Corporation, Boston Scientific, and CONMED reported sales volume growth in late 2020. Moreover, this growth was driven by the recovery of deferred & elective procedures and the easing of restrictions, especially in countries such as the U.S. For instance, Olympus Corporation revealed revenue recovery in the H2 of 2020, with a significant slowdown in year-on-year revenue decline.

The launch of the ViziShot 2 25 G EBUS-TBNA Needle for lung cancer staging and diagnosis in July 2020 further supported the company's revenue recovery.

“As the only company manufacturing and selling both bronchoscopes and needles, Olympus is proud to expand our EBUS-TBNA product family portfolio with the 25 G EBUS-TBNA needle. Our comprehensive pulmonary solutions bring great value to our physician customers striving to advance diagnosis and staging capabilities for lung disease and lung cancer.”

- Lynn Ray, Vice President, General Manager, Global Respiratory, Olympus.

Market Concentration & Characteristics

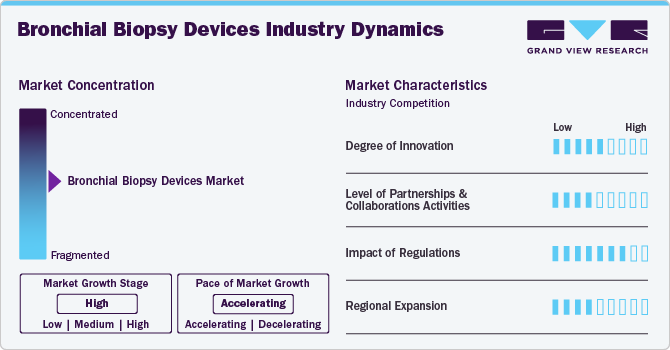

The degree of innovation in the industry is moderate. Companies and research institutes are continuously investing in research and development (R&D) to create new products that enhance diagnostic accuracy while minimizing patient discomfort. For instance, in April 2024, Prothea Technologies, established by the collaboration of the Universities of Bath and Edinburgh, received an investment of more than USD 13 million to develop a medical device for the diagnosis and staging of lung cancer. The team further seeks funding for developing a laser-ablation catheter to treat lesions immediately after diagnosis. Such investments foster R&D and encourage new product launches.

"Establishing Prothea Technologies is essential to bring our unique fibre optic technology into the clinic so it can benefit patients.

Prothea pulls together world-leading fibre-optic development from the University of Bath and clinical excellence from the University of Edinburgh, adding in commercial, insight, expertise and know-how to form a fantastic team.”

-Dr Jim Stone, Department of Physics at Bath, and Prothea’s chief technical officer.

The industry's level of partnerships & collaborations is moderate. This is due to several factors, including the desire to gain a competitive advantage in the industry, enhance technological capabilities, and the need to consolidate in a rapidly growing market. However, companies are engaged in merger and acquisition activities to expand their distribution network and gain a competitive advantage in the market. For instance, in May 2019, Argon Medical Devices acquired Mana-Tech, Ltd., an Ireland and UK distributor. As a result, the entire Mana-Tech team, including its customer service, sales, management, and distribution groups, became part of Argon Medical Devices.

The market is significantly influenced by stringent regulations to ensure that medical devices meet high safety and efficacy standards before they can be marketed. To be marketed in Europe, bronchial biopsy devices must obtain CE marking, indicating compliance with MDR requirements. Furthermore, the U.S. FDA classifies bronchial biopsy devices into two main categories: Class II and Class III. Manufacturers must comply with the Quality System Regulation (QSR), also known as Good Manufacturing Practice (GMP), to ensure that devices are produced consistently and meet high-quality standards.

The level of regional expansion in the industry is moderate, driven by an increasing customer base for bronchial biopsy devices. The rising prevalence of respiratory diseases and increasing healthcare spending expedite the need for advanced biopsy devices for diagnosis. Moreover, the increasing awareness and screening initiatives led by various organizations are significantly driving the demand for bronchial biopsy devices, thereby compelling companies to expand their regional presence

Product Insights

Based on product, transbronchial needle aspiration (TBNA) needles held the largest revenue share of 62.18% in 2023 and are expected to register the highest CAGR over the forecast period. The growth of this segment can be attributed to the advantages of EBUS-TBNA over conventional TBNA and other biopsy methods like mediastinoscopy. The increasing preference for EBUS-TBNA, driven by its greater accuracy, is fueling market demand.

However, EBUS-TBNA needles are more expensive than conventional TBNA needles. Nevertheless, adopting EBUS-TBNA in developed regions such as North America and Europe is expected to drive revenue growth for competitive market players and contribute to overall market expansion. The portable medical oxygen concentrators segment is expected to experience the fastest growth, with a CAGR of 7.0% during the forecast period. This growth is driven by increasing awareness of the benefits associated with the use of portable concentrators.

The adoption of EBUS-TBNA has been supported by recommendations from the American College of Chest Physicians, which endorse its use as an initial step in the mediastinal staging of lung cancer and provide technical guidelines for successful procedures. These recommendations have been in place since 2015, leading to an increasing preference for EBUS-TBNA over conventional methods in the U.S. Furthermore, in 2022, EBUS-TBNA accounted for the majority of revenue in the U.S. market, surpassing the revenue share of the Conventional TBNA sub-segment.

The biopsy forceps product segment is divided into disposable and reusable sub-segments. The disposable sub-segment is expected to dominate the market and hold the fastest CAGR of 7.6% during the forecast period.

Regional Insights

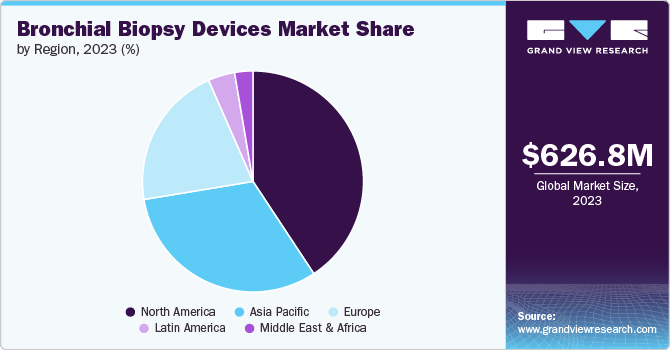

North America bronchial biopsy devices market dominated the global industry and held the largest revenue share of 40.72% in 2023. This is due to the rising prevalence of respiratory diseases, technological advancements, and a shift toward disposable devices for enhanced safety. As healthcare providers continue to adopt innovative diagnostic tools, the market is expected to expand, providing opportunities for established players and new entrants.

U.S. Bronchial Biopsy Devices Market Trends

The bronchial biopsy devices marketin the U.S. held the largest revenue share in 2023, owing to the increasing prevalence of lung cancer. According to the American Cancer Society, the number of new lung cancer cases is projected to rise, necessitating more frequent diagnostic procedures, including bronchial biopsies. In addition, as per the data published by the Lung Cancer Research Foundation, 1 in 16 people in the U.S. will be diagnosed with lung cancer during their lifetime. Moreover, leading players are continuously launching new products & kits to expand their offerings and maintain market dominance, thereby harnessing market growth.

Europe Bronchial Biopsy Devices Market Trends

The bronchial biopsy devices market in Europe is likely toexperience lucrative growth over the forecast period. The increasing prevalence of lung cancer remains one of the leading causes of cancer-related deaths across the region. The region’s advanced healthcare infrastructure supports adopting cutting-edge diagnostic technologies, including bronchial biopsy devices. Moreover, there is a rising trend toward early diagnosis and screening programs for lung diseases, boosting the demand for bronchial biopsy devices.

UK bronchial biopsy devices market is characterized by a strong focus on the early detection & diagnosis of lung diseases. This is driven by national healthcare initiatives such as the NHS Long Term Plan, which emphasizes the importance of early cancer detection. The growing incidence of lung cancer in the UK, one of the highest in Europe, is another major factor expected to improve the demand for bronchial biopsy procedures. In addition, specialized training programs for healthcare professionals in bronchial procedures contribute to the adoption of advanced devices across the country.

The bronchial biopsy devices market in Germany is expected to grow over the forecast period. This growth can be attributed to the country’s leading position in medical technology innovation and manufacturing. Germany’s robust healthcare system and high healthcare spending ensure widespread access to advanced bronchial biopsy devices across urban and rural areas. Moreover, German manufacturers, including Karl Storz and Richard Wolf GmbH, are some of the key players in the market, offering cutting-edge biopsy devices widely used in hospitals and clinics.

Asia Pacific Bronchial Biopsy Devices Market Trends

The bronchial biopsy devices marketinAsia Pacific is expected to witness the fastest growth over the forecast period. The prevalence of respiratory diseases, including lung cancer and COPD, is rising across Asia Pacific due to high smoking rates, urban pollution, and industrialization. In addition, governments across the region are investing in healthcare improvements as part of broader economic and social development plans. Moreover, countries like South Korea and Singapore are making substantial investments in healthcare infrastructure and technology upgrades, further fueling market growth.

China bronchial biopsy devices market is a rapidly expanding sector within the country's healthcare industry, driven by significant investments in healthcare infrastructure, increasing prevalence of respiratory diseases, and advancements in medical technology. For instance, the number of lung cancer cases has been increasing in China, which is expected to drive the demand for advanced diagnostic tools like bronchial biopsy devices. As per the data published by World Cancer Research Fund International, around 1060,584 new lung cancer cases were diagnosed in 2022. This growing disease burden is expected to drive the demand for effective diagnostic tools, including bronchial biopsy devices.

The bronchial biopsy devices market in Indiai s expected to register rapid growth from 2024 to 2030, driven by the country’s expanding healthcare infrastructure and rising demand for advanced diagnostic technologies. India’s healthcare sector is undergoing significant transformation with increasing investments in healthcare infrastructure and technology. The government’s initiatives, such as the National Health Mission and Ayushman Bharat, aim to improve healthcare access and quality across the country. Some of the major hospitals, such as AIIMS and Apollo Hospital, are adopting advanced medical technologies, including bronchial biopsy devices.

Latin America Bronchial Biopsy Devices Market Trends

The bronchial biopsy devices market in Latin America is experiencing growth due to the rising prevalence of respiratory diseases, technological innovations, and growing awareness of the benefits of early diagnosis. According to a study published in July 2022 by NCBI, COPD is prevalent in Latin America, with a prevalence of 8.9% in the general population over the age of 35. Moreover, there is a growing adoption of EBUS, which allows for real-time imaging and precise biopsy of lymph nodes & other structures within the bronchial system. In addition, several Latin American countries are developing & expanding lung cancer screening programs that utilize advanced bronchial biopsy techniques to improve early detection and treatment outcomes, which drives market growth further.

Brazil bronchial biopsy devices market is anticipated to grow significantly over the forecast period. The use of EBUS has become more widespread in Brazil, offering real-time imaging and improved accuracy in biopsies of lymph nodes & other structures within the lungs. For instance, Hospital Sírio-Libanês, located in São Paulo, has been at the forefront of adopting innovative diagnostic tools, including EBUS. Moreover, companies are collaborating with hospitals and healthcare institutions, which are key strategies for gaining a competitive edge in the market.

Middle East & Africa Bronchial Biopsy Devices Market Trends

The bronchial biopsy devices market in the Middle East & Africais expected to grow significantly as the region witnesses a notable increase in respiratory conditions, including asthma, COPD, and lung cancer. In addition, there is a growing emphasis on public health campaigns aimed at increasing awareness of respiratory diseases and the importance of regular health check-ups. These initiatives are expected to drive the demand for bronchial biopsy procedures as more patients seek early diagnosis and treatment options.

Saudi Arabia bronchial biopsy devices market is anticipated to grow significantly over the period owing to the growing preference for minimally invasive diagnostic procedures. Technologies such as rEBUS are becoming more popular due to their benefits of reduced recovery times and lower risk of complications. In addition, facilities like King Saud Medical City are increasingly utilizing rEBUS technology to enhance diagnostic precision and patient comfort. Moreover, Saudi Arabia is significantly investing in the modernization of its healthcare infrastructure, which supports the adoption of advanced bronchial biopsy devices.

Key Bronchial Biopsy Devices Company Insights

The market is fragmented, with several large players and emerging players operating in this space adopting various strategies such as collaborations, acquisitions, and partnerships. Additionally, the market is poised for positive expansion, driven by strategies employed by key market players to introduce new products and expand their networks. For instance, Praxis Medical gained entry into the market with its EndoCore EBUS-TBNA fine needle biopsy device, which received FDA 510(k) clearance in October 2023. The Endocore system is powered by a motor and works on the principle of rotary motion to collect large tissue samples with higher cellularity. Furthermore, the popularity of EBUS-TBNA continues to grow, and it is expected to attract new entrants to the market.

Key Bronchial Biopsy Devices Companies:

The following are the leading companies in the bronchial biopsy devices market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Boston Scientific Corporation

- CONMED Corporation

- Olympus Corporation

- Becton, Dickinson and Company (BD)

- Cook Medical

- Telemed Systems, Inc.

- HOBBS MEDICAL INC

- Argon Medical Devices (WEIGAO GROUP)

- Horizons International Corp.

- Erbe Elektromedizin GmbH.

Recent Developments

-

In September 2023, Broncus Medical, Inc. launched BioStar Transbronchial Needle Aspiration (TBNA) for minimally invasive diagnostic procedures. Healthcare practitioners use this needle to acquire accurate tissue samples & specimens for diagnosing and staging lung cancer.

-

In May2023, Argon Medical Devices introduced the SuperCore Advantage Semi-Automatic Biopsy Instrument, a new addition to its soft tissue biopsy product portfolio in the U.S.

-

In September 2022, Serpex Medical received U.S. FDA 510(k) clearance for its Compass Steerable Needles. These steerable biopsy needles allow accurate precision and access to enhance the diagnosis & treatment of lung cancer.

-

In July 2020, Olympus Corporation launched ViziShot 2 25 G needle for Endobronchial Ultrasound Transbronchial Aspiration (EBUS-TBNA) for lung cancer staging and diagnosis.

Bronchial Biopsy Devices Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 667.64 million |

|

Revenue forecast in 2030 |

USD 1.02 billion |

|

Growth Rate |

CAGR of 7.39% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

September 2024 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait |

|

Medtronic; Boston Scientific Corporation; CONMED Corporation; Olympus Corporation; Becton, Dickinson and Company (BD); Cook Medical; Telemed Systems, Inc.; HOBBS MEDICAL INC; Argon Medical Devices (WEIGAO GROUP); Horizons International Corp.; Erbe Elektromedizin GmbH. |

|

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Bronchial Biopsy Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bronchial biopsy devices market report based on product, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Biopsy Forceps

-

Durability

-

Disposable

-

Reusable

-

-

Transbronchial Needle Aspiration (TBNA) Needles

-

Conventional

-

EBUS-TBNA

-

-

Cytology Brushes

-

Cryobiopsy Devices (Cryoprobes)

-

Durability

-

Disposable

-

Reusable

-

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global bronchial biopsy devices market size was estimated at USD 626.83 million in 2023 and is expected to reach USD 667.64 million in 2024.

b. The global bronchial biopsy devices market is expected to grow at a compound annual growth rate of 7.39% from 2023 to 2030 to reach USD 1.02 billion by 2030.

b. North America dominated the bronchial biopsy devices market with a share of 40.72% in 2023. This is attributable to its advanced healthcare infrastructure, high investment in R&D, and availability of the latest technologies. The increase in product launches and positive clinical outcomes associated with these new products is also expected to drive regional market growth and expansion during the forecast period.

b. Some key players operating in the bronchial biopsy devices market include Medtronic; Boston Scientific Corporation; CONMED Corporation; Olympus Corporation; Becton, Dickinson and Company (BD); Cook Medical; Telemed Systems, Inc.; HOBBS MEDICAL INC; Argon Medical Devices (WEIGAO GROUP); Horizons International Corp.; and Erbe Elektromedizin GmbH.

b. Key factors driving the market growth include increasing awareness and screening initiatives by organizations, which have increased demand for bronchial biopsies over other biopsy types. In addition, the rising utilization of bronchial biopsies for diagnosing lung cancer and related conditions would likely propel the market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."