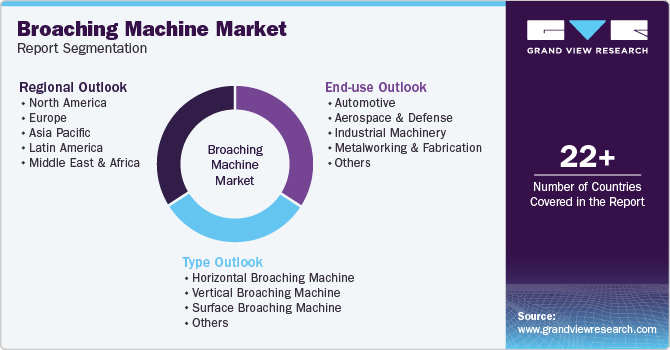

Broaching Machine Market Size, Share & Trends Analysis Report By Type (Horizontal Broaching Machine, Vertical Broaching Machine), By End-use (Aerospace & Defense, Industrial Machinery), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-452-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Broaching Machine Market Size & Trends

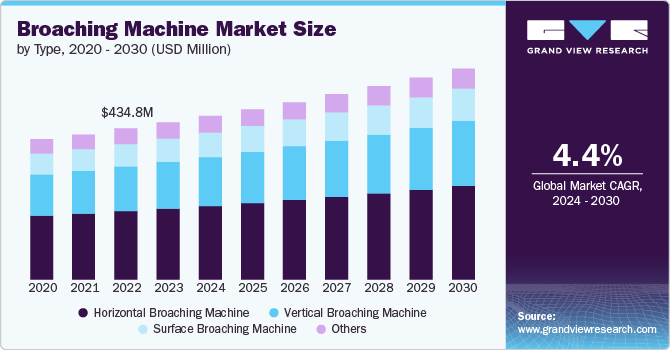

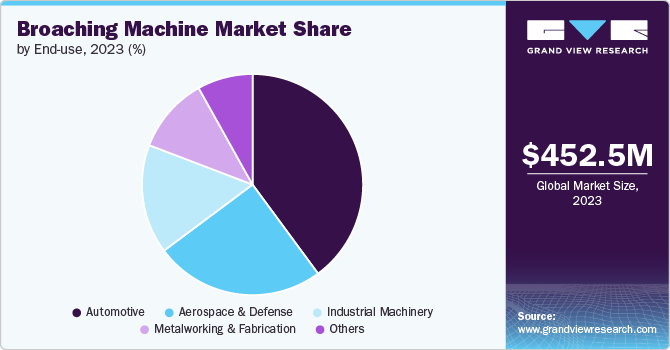

The global broaching machine market size was estimated at USD 452.5 million in 2023 and is projected to grow at a CAGR of 4.4% from 2024 to 2030.The growth of the broaching machine market is driven by the rising demand for precision machining solutions across various industries such as automotive, aerospace, metalworking, and industrial machinery. Broaching machines are highly valued for their ability to produce complex shapes with high precision and efficiency. These machines are widely used for machining internal and external surfaces such as keyways, splines, gears, and other components that require tight tolerances and smooth finishes. The growing adoption of automation in manufacturing, along with increasing investments in advanced machining technologies, is fueling market expansion globally.

Innovations in machine design, such as improved automation and precision controls, have enhanced the efficiency and effectiveness of broaching machines. These technological advancements enable industries to achieve higher production rates and better product quality, driving demand for modern broaching equipment

Drivers, Opportunities & Restraints

The growing trend of customization in automotive processes has spurred the need for versatile broaching machines. Industries are increasingly seeking machines that can handle a variety of materials and adapt to different processing requirements. This versatility allows companies to cater to a broader range of applications and market needs, driving the growth of the broaching machine market.

One of the primary restraints on the broaching machine market is the high initial investment required for purchasing and installing advanced equipment. The cost of cutting-edge broaching machines can be substantial, particularly for small and medium-sized enterprises (SMEs) that may lack the financial resources to make such investments. This financial barrier can limit the adoption of new technology and slow market growth.

Despite these restraints, there are several promising opportunities for growth in the broaching machine market. A significant opportunity is the increasing demand for automation and smart automotive technologies. The integration of Industry 4.0 principles, such as the use of IoT and artificial intelligence, presents a chance for broaching machines to become more intelligent and efficient. Companies that develop machines with these advanced features can capture a larger share of the market as industries seek to modernize their operations.

Type Insights

“The vertical broaching machine segment is expected to grow at a notable CAGR of 4.9% from 2024 to 2030 in terms of revenue”

The horizontal broaching machine segment dominated the market in 2023 accounting for a 45.1% market share. Horizontal broaching machines are driven by their ability to handle complex and large components with high precision. Their efficiency in producing intricate profiles and integration into automated production lines enhances productivity and reduces labor costs. The demand for consistent and precise Automotive in various industries supports the growth of horizontal broaching machines.

The demand for vertical broaching machines is driven by their ability to efficiently produce complex and precise components, especially in industries requiring high accuracy, such as automotive and aerospace. Their vertical orientation allows for better handling of larger and heavier workpieces, and their compact design often requires less floor space compared to horizontal machines. Additionally, the rise in automation and lean manufacturing practices supports their use, as vertical broaching machines can streamline production processes and reduce setup times. Enhanced capabilities for deep and intricate cuts also contribute to their growing adoption.

End-use Insights

"The demand for the aerospace & defense segment is expected to grow at a considerable CAGR of 4.9% from 2024 to 2030 in terms of revenue”

The automotive segment led the market in 2023 accounting for a 39.9% market share in 2023. The automotive industry drives the market due to its need for precise and reliable components. As industry adopts advanced technologies such as electric vehicles and autonomous systems, there is increased demand for high-quality parts. Upgrades to production lines to meet these new requirements further fuel the demand for advanced broaching machines.

The aerospace & defense industry drives the market due to its need for precise and reliable components. The aerospace & defense industry demands high precision and performance in its components. The focus on lightweight and high-strength materials, along with advancements in defense technology, drives the need for broaching machines capable of producing specialized and high-performance parts. Ongoing investments in these sectors ensure a steady demand for advanced broaching solutions.

Regional Insights

“India to witness fastest market growth at 6.6% CAGR”

The market growth for broaching machines in North America is propelled by technological innovation and the emphasis on advanced automotive practices. The region's strong focus on automation and Industry 4.0 technologies drives demand for high-precision broaching machines that integrate with smart automotive systems. In addition, the presence of a well-established aerospace & defense and aerospace sector, which requires high-quality, reliable components, further stimulates the market.

U.S. Broaching Machine Market Trends

The U.S. broaching machine market is driven by the increasing demand for precision metal cutting and shaping tools in industries such as automotive, aerospace, and general manufacturing. Broaching machines are crucial for producing complex parts with high accuracy and are widely used in manufacturing gears, splines, and keyways. Technological advancements, such as the integration of CNC systems, have enhanced the performance of broaching machines, contributing to their growing adoption. Additionally, the push towards automation in the U.S. manufacturing sector further supports the demand for advanced broaching machines, especially in high-volume production environments.

Asia Pacific Broaching Machine Market Trends

In Asia Pacific, market growth for broaching machines is driven by rapid industrialization and expansion in the automotive sector. The region’s significant investment in infrastructure and development of industrial hubs stimulates demand for advanced automotive equipment. In addition, the growing aerospace & defense and aerospace industries in countries such as China and India drive the need for precise and efficient broaching machines. Competitive labor costs and increasing adoption of automation technologies also contribute to the region's market growth, as manufacturers seek to enhance productivity and quality.

The broaching machine market in India is estimated to grow at 6.6% over the forecast period. The growth of the broaching machine market in India is driven by the country’s expanding manufacturing sector, particularly in automotive and aerospace industries, which require high-precision components.

Europe Broaching Machine Market Trends

Europe’s broaching machine market growth is driven by a strong emphasis on precision engineering and high automotive standards. The region's advanced aerospace & defense, aerospace, and industrial machinery sectors require sophisticated broaching solutions to meet stringent quality and performance requirements. In addition, Europe’s focus on sustainable and energy-efficient technologies creates demand for modern broaching machines that align with environmental goals. Moreover, the push for digitalization and automation in automotive processes contributes to market growth, as European manufacturers seek to enhance operational efficiency and productivity.

Key Broaching Machine Company Insights

Some of the key players operating in the market include Apex Broaching Systems and WSP among others.

-

Apex Broaching Systems is a U.S.-based company that manufactures broaching machines and also operates as a full-service provider of turnkey broaching systems. Their offerings encompass broaching machines, broach tooling, fixtures, automation, as well as parts and service. The company manages all aspects of production, from design and Automotive to assembly and customer support, all conducted at their facility in Warren, Michigan.

-

MITSUBISHI HEAVY INDUSTRIES, LTD. is a global manufacturer of a broad range of products that cater to industries such as energy, Aerospace & Defense, aerospace & defense, marine, and logistics among others. The company has a range of broaching machines and has a worldwide sales presence covering regions such as Asia Pacific, North America, Middle East, and Latin America.

Key Broaching Machine Companies:

The following are the leading companies in the broaching machine market. These companies collectively hold the largest market share and dictate industry trends.

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- Accu-Cut

- Apex Broaching Systems

- Broaching Machine Specialties

- Colonial tool group inc.

- The Ohio Broach & Machine Co.

- Pioneer Broach

- The Ohio Broach & Machine Co.

- AXISCO PRECISION MACHINERY CO., LTD.

- YAO SHENG MACHINERY CO., LTD.

- Power Broach

- YEOSHE HYDRAULICS TECHNOLOGY CO.,LTD

- Taizhou Chengchun Automation Co., Ltd.

Recent Developments

-

In December 2022, NIDEC CORPORATION introduced the Robot Camera SPEED for inspecting cutting tools used in hobbing machines and the Robot Camera MAX for broaching machines. These devices use digital cameras to rapidly and accurately capture images of cutting tool edges, storing this data for analysis. By inputting tool specifications, users can direct the cameras to inspect various tool shapes, detecting issues such as missing parts, coating detachment, and overall wear. The cameras are designed to enhance automation in Nidec's tool Automotive and regrinding processes, improving quality and reducing inspection time by up to 90%.

-

In September 2022, CNC Broach Tool LLC launched new indexable carbide spline cutting inserts that are compatible with the company’s existing tool holders. These inserts, coated with TiN and equipped two cutting edges, are designed for broaching both external and internal involute splines on mills or CNC lathes. They allow for single-machine finishing, reducing costs and lead times by avoiding subcontracting and eliminating the need for expensive pull broach machines. Additionally, they streamline setup and enable automation of blind hole broaching in CNC equipment.

Broaching Machine Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 471.1 million |

|

Revenue forecast in 2030 |

USD 608.3 million |

|

Growth rate |

CAGR of 4.4% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends |

|

Segments covered |

|

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE |

|

Key companies profiled |

MITSUBISHI HEAVY INDUSTRIES, LTD.; Accu-Cut; Apex Broaching Systems; Broaching Machine Specialties; Colonial tool group Inc.; The Ohio Broach & Machine Co.; Pioneer Broach; The Ohio Broach & Machine Co.; AXISCO PRECISION MACHINERY CO., LTD.; YAO SHENG MACHINERY CO., LTD.; Power Broach; YEOSHE HYDRAULICS TECHNOLOGY CO.,LTD; Taizhou Chengchun Automation Co., Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Broaching Machine Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global broaching machine market on the type, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Horizontal Broaching Machine

-

Vertical Broaching Machine

-

Surface Broaching Machine

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Aerospace & Defense

-

Industrial Machinery

-

Metalworking & Fabrication

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global broaching machine market size was estimated at USD 452.5 million in 2023 and is expected to reach USD 471.1 million in 2024.

b. The global broaching machine market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.4% from 2024 to 2030 to reach USD 608.3 million by 2030.

b. The Asia Pacific region dominated the market and accounted for 37.7% of the market share in 2023. The market is driven by the region's increasing industrialization, expanding automotive sector, and strong demand for high-precision machining solutions.

b. Some of the key players operating in the Broaching Machine market are MITSUBISHI HEAVY INDUSTRIES, LTD., Accu-Cut, Apex Broaching Systems, Broaching Machine Specialties, Colonial tool group inc., The Ohio Broach & Machine Co., Pioneer Broach, The Ohio Broach & Machine Co., AXISCO PRECISION MACHINERY CO., LTD., YAO SHENG MACHINERY CO., LTD., Power Broach, YEOSHE HYDRAULICS TECHNOLOGY CO.,LTD, and Taizhou Chengchun Automation Co., Ltd.

b. The key factors driving the broaching machine market include the growing demand for high-precision components aerospace; increased demand for precision machining in automotive, and growing adoption of CNC automation technologies.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."