BRIC Diabetes Care Devices Market Size, Share & Trends Analysis Report By Product (Blood Glucose Monitoring Devices), By Distribution Channel (Hospital Pharmacy), By End Use, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-909-8

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

BRIC Diabetes Care Devices Market Trends

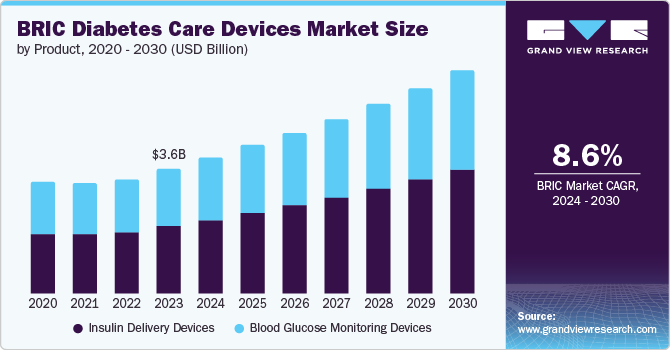

The BRIC diabetes care devices market size was valued at USD 3.60 billion in 2023 and is projected to grow at a CAGR of 8.6% from 2024 to 2030. The market has experienced lucrative expansion over the past few years, primarily driven by the rising diabetic population in BRIC nations, i.e., Brazil, Russia, India, and China. In addition, increasing recognition of diabetes treatment and control, along with supportive national health policies and schemes, are projected to expand the diabetes care devices (BRIC) market.

The growing incidence of diabetes in BRIC countries, as a result of inactive lifestyles and unhealthy eating habits leading to rising obesity levels, is contributing to the growing occurrence of diabetes, which is growing the demand for diabetes care devices. According to a report from the NCBI, if current forms continue, more than half of the world’s population will deal with overweight or obesity problems by 2035, with the majority of emerging diabetes cases of type 2 diabetes, mainly due to variations in obesity rates and dietary habits. Hence, with the number of diabetes cases on the rise, the market for devices that support managing the condition is expanding rapidly & propelling market growth.

Moreover, the increasing implementation of telemedicine and remote monitoring technologies allows healthcare practitioners to remotely monitor patient’s glucose levels and adjust treatment plans as required, improving patient care and convenience. Further, excellent & effective communication between patients and healthcare providers results in a quick and efficient diabetes management system and improved patient outcomes, giving significant opportunities for diabetes care device companies.

Product Insights

Insulin delivery devices dominated the market and accounted for a revenue share of 54.2% in 2023. The market for insulin delivery devices is segmented into insulin pens, insulin pumps, syringes, and jet injectors. Among these segments, the insulin pen segment held the largest market share owing to its user-friendly design and ease of use; monitoring blood sugar levels is also an essential aspect for determining whether a person is meeting glucose levels, which can reduce the unpleasant symptoms associated with high and low blood sugar levels and also prevent long-term complications of diabetes. Continuous progressions in the product, the widespread adoption, and the rising number of diabetes patients who need multiple daily dosages of insulin lead to market growth.

Furthermore, blood glucose monitoring devices are expected to grow at a CAGR of 8.0% over the projected years. This growth is attributed to favorable healthcare insurance policies and the increasing diabetic population, especially those with type 2 diabetes, driving the demand for glucometers to monitor blood glucose levels. In addition, the introduction of innovative gadgets such as glucometers connected to smartphones and equipped with long-lasting batteries is also contributing to the segment's growth.

Distribution Channel Insights

Hospital pharmacies dominated the market and accounted for a revenue share of 54.1% in 2023. Hospital pharmacies have become the preferred choice for patients seeking comprehensive diabetes care, providing a convenient one-stop solution for all medical needs related to the condition. By offering consultations, treatments, and access to devices under one roof, hospitals streamline the process for individuals managing diabetes.

Furthermore, retail pharmacies are expected to grow at a CAGR of 9.6% over the forecast years, driven by the growing geriatric population and the increasing prevalence of adverse health conditions. The retail sector in pharmaceutical distribution and the diabetes care device market plays a vital role in availing such medications, displaying them as essential for older patients seeking healthcare.

End Use Insights

Hospitals led the market and accounted for a revenue share of 40.8% in the year 2023. This growth is attributed to the increasing rate of hospitalizations among diabetic patients, leading to a higher need for diabetes care devices. Individuals with diabetes are three times more prone to being admitted to hospitals compared to those without the condition. In recent years, significant advancements in diabetes care devices have been seen, focusing on enhancing diabetes management in medical facilities. Technological progress has resulted in a greater utilization of insulin pumps in hospitals and clinics.

Diagnostic centers are expected to grow at a CAGR of 9.2% over the projected years. There are important aspects of the rise in diagnostic centers, and these facilities are essential for the timely identification of diseases. Detectable diseases such as cancer, diabetes, and heart disease early on can lead to more effective treatment outcomes. These centers provide screening tests and health checkups to catch the early warning signs of such illnesses. Early detection enables healthcare providers to create effective treatment strategies to halt the progression or severity of the disease. As a result, diagnostic centers will have positive growth in the coming years.

Country Insights & Trends

China Diabetes Care Devices Market Trends

The China diabetes care devices marketdominated the BRICS market and accounted for the largest revenue share of 48.1% in 2023. This growth is driven by the rise in healthcare spending, hectic lifestyles with improper eating habits, and the expansion of private hospitals. Furthermore, the prevalence of chronic illnesses among individuals and the rising awareness among people has led to growth in diabetes care in China.

India Diabetes Care Devices Market Trends

The diabetes care devices market in India is expected to grow at a CAGR of 8.9% over the forecast period. This growth is driven by increasing government assistance and investment in the healthcare industry, the high prevalence of type 1 and gestational diabetes cases, and raising diabetes awareness through campaigns and screening camps.

Brazil Diabetes Care Devices Market Trends

Brazil's diabetes care devices market is expected togrow significantly over the projected years. The country has introduced a series of reformsto enhance healthcare professionals' distribution, create innovative service structures, adopt new financial strategies, and launch various quality enhancement programs and policy frameworks to address challenges like obesity and emerging health crises.

Russia Diabetes Care Devices Market Trends

The growth in the diabetes care devices market in France is driven by the country’s commitment to enhancing the reimbursement system for diabetes care, reducing out-of-pocket expenses, and averting households from facing overwhelming financial burdens. In addition, the government is set to launch a nationwide screening program to enhance the early detection of abnormal carbohydrate metabolism and establish a specialized diabetes health service under the Ministry of Health of the Russian Federation.

Key BRIC Diabetes Care Devices Company Insights

Some key companies in the BRIC diabetes care devices market include Medtronic plc, Abbott, F. Hoffmann-La-Ltd.; Bayer AG; Lifescan, IP Holdings; B Braun SE; Dexcom Inc.; Insulet Corporation; YPSOMED; Sanofi; Valeritas Holding Inc.; Novo Nordisk A/S; Arkray, Inc. in the market, focusing on development & to gain a competitive edge in the industry.

-

Abbott discovers and manufactures a diverse range of healthcare products, including diagnostic systems and tests, pediatric and adult nutritional products, and generic pharmaceuticals. They also offer numerous medical devices, including heart failure, rhythm management, electrophysiology, and vascular and structural heart devices.

-

ARKRAY, Inc. manufactures medical equipment on a large scale. It also offers diabetes testing, gene-checking, self-monitoring, urinalysis examination, and other equipment.

Key BRIC Diabetes Care Devices Companies:

- Medtronic plc

- Abbott

- F. Hoffmann-La-Ltd.

- Bayer AG

- Lifescan, IP Holdings

- B Braun SE

- Dexcom Inc.

- Insulet Corporation

- YPSOMED

- Sanofi

- Valeritas Holding Inc.

- Novo Nordisk A/S

- Arkray, Inc.

Recent Developments

-

In April 2024, Medtronic collaborated with Indian-based startup T-Hub. With this partnership, the global healthcare technology firm leveraged its relevant expertise and resources to assist and help health-tech startups internationally through the Innovation Center (MEIC) in Hyderabad and Medtronic Engineering.

-

In May 2024, Sanofi formed an AI-powered software to speed up drug development and more proficiently bring new medicines to patients together by merging with OpenAI and Formation Bio. The teams are expected to combine software, databases, and structured models to develop custom, purpose-built solutions alternatives across the drug development lifecycle.

BRIC Diabetes Care Devices Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 3.92 billion |

|

Revenue forecast in 2030 |

USD 6.42 billion |

|

Growth Rate |

CAGR of 8.6% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD Million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, distribution channel, end use, country |

|

Country scope |

Brazil, Russia, India, China |

|

Key companies profiled |

Medtronic plc; Abbott; F. Hoffmann-La-Ltd.; Bayer AG; Lifescan, IP Holdings; B Braun SE; Dexcom Inc.; Insulet Corporation; YPSOMED; Sanofi; Valeritas Holding Inc.; Novo Nordisk A/S; Arkray, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

BRIC Diabetes Care Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the BRIC diabetes care devices market report based on product, distribution channel, end use, and country.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Blood Glucose Monitoring Devices

-

Self-monitoring Devices

-

Blood Glucose Meter

-

Testing Strips

-

Lancets

-

-

Continuous Glucose Monitoring Devices

-

Sensors

-

Transmitters

-

Receiver

-

-

-

Insulin Delivery Devices

-

Pens

-

Pumps

-

Syringes

-

Jet Injectors

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Diabetes Clinics

-

Online Pharmacies

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Centers

-

Homecare

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Brazil

-

Russia

-

India

-

China

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."