- Home

- »

- Renewable Chemicals

- »

-

Brewing Enzymes Market Size, Share & Growth Report, 2030GVR Report cover

![Brewing Enzymes Market Size, Share & Trends Report]()

Brewing Enzymes Market (2025 - 2030) Size, Share & Trends Analysis Report By Source (Microbial, Plant), By Type (Amylase, Beta Glucanase), By Application (Beer, Wine), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-380-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Brewing Enzymes Market Size & Trends

“2030 brewing enzymes market value to reach USD 789.1 million”

The global brewing enzymes market size was estimated at USD 520.6 million in 2024 and is estimated to grow at a CAGR of 7.2% from 2025 to 2030. Brewing enzymes play an important role in the production of alcoholic beer and wine and are essential for the aroma and flavor of the product. Commercial brewing enzymes have aided in the development of new products and is driven by increased consumer interest in brewery.

Brewing is defined as the process of alcoholic production in which the sugars in starch are fermented to ethyl alcohol by using yeast. Commercial enzymes are used to hasten the brewing process and produce finer textures.

Drivers, Opportunities & Restraints

Competition amongst various end users across the world in capturing market share is attributed to the growing younger generation reaching the legal drinking age and the emerging cocktail trend. Beer and wine find a higher per capita rate of consumption per population category. With consumers showing increased preference towards value-based drinking, the emergence of specialized breweries that use artificial brewing enzymes have become popular. This is anticipated to drive the market over the coming years.

Owing to the various market drivers, players have been capitalizing on existing markets and tapping into new markets. Increasing their capacity has become more cost efficient and convenient owing to the use of brewing enzymes. These are used as a supplement to the mash containing barley for beer production. This enhances the brewing performance, and reduces dependence on malt, hence assisting in balancing production costs.

The low cost of malt is a key restraint for the growth of the brewing enzymes market. Traditional brewers widely prefer malt mash as the key ingredient for beer production. Hence, brewing enzymes directly compete with the traditional perception of home-brewed beer, and the population directly seeks naturally produced beer in favor of chemically produced types.

Source Insights & Trends

“Microbial based accounted for the highest revenue share of about 77.0% in 2023.”

Microbial-based brewing enzymes are easier to handle and have a high production rate. They are also found to be more cost effective than plant sources and are hence anticipated to account for the higher revenue share over the forecast period.

Plant-based enzymes play a vital role in alcoholic beverages. Safety of source organism is main factor to consider in assessing an enzyme product, and edible plants have known to have a history of safe use as enzyme source in food & beverages industry.

Type Insights & Trends

“Amylase accounted for the highest revenue share of more than 43.0% in 2023.”

Amylases are more cost effective than other types of brewing enzymes and are also produced in lesser time. They positively impact the production efficiency of the brewing process, and hence are the most preferred type of enzyme that is currently available in the market.

Beta glucanase enzymes are utilized in beer brewing for quick and complete removal of glucans, which is vital as the removal of glucans in brewing barley helps in reducing mash viscosity, enhances filtration, and yield of wort. It significantly speeds up the entire process while ensuring the exceptional quality of the malt and beer.

Application Insights & Trends

“Beer accounted for the highest revenue share of over 77.0% in 2023.”

Brewing enzymes are predominantly used in beer production. Beer is the most popular and preferred alcoholic beverage consumed worldwide, and the requirement for higher capacity has been spurring custom breweries to turn towards chemical processes.

In terms of regular consumption, beer is more preferred over wine owing its popularity amongst teenagers and millennials, its low alcohol content, and affordable pricing. China and the U.S. are the top producers of beer in the world, followed by Brazil and India. Growth in beer production is expected to augment demand for brewing enzymes. For instance, in September 2023, HEINEKEN Mexico announced constructing a brewery in Yucatán with an investment worth EUR 430 million (~USD 470 million).

Regional Insights

“China held over 42.0% revenue share of the overall APAC brewing enzymes market.”

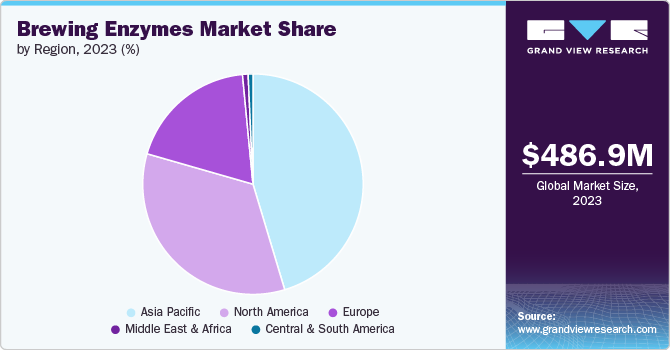

APAC dominated the global market and accounted for about 46.0% revenue share of the global market in 2023. This growth is anticipated to continue over the forecast period owing to the increasing number of artisan breweries that cater to a customer base that prefers value to volume-based drinking. Further, to balance raw material cost, various enzymes are utilized by breweries.

North America Brewing Enzymes Market Trends

North America is anticipated to witness a CAGR of 7.3% over the forecast period. It is expected to be driven by the increasing legal age population consuming alcoholic beverages.

U.S. Brewing Enzymes Market Trends

The U.S. is amongst the largest markets for brewing enzymes. The growing demand for craft brewing is a key driver.

Europe Brewing Enzymes Market Trends

Increasing product demand can be attributed to the increased production of wine and flavored beer. The traditionally consumer-driven European market is focused on attributes such as flavor and quality, which is enhanced by the use of brewing enzymes.

Key Brewing Enzymes Company Insights

Some of the key players operating in the market include Air Liquide and Total Energies

-

India-based Advanced Enzyme Technologies was founded in 1989 and is a manufacturer of enzymes and probiotics. It is one of the largest producers of brewing enzymes in the Asia Pacific region.

-

U.S.-based DuPont de Nemours, Inc. was founded in 1802 and is a global chemicals producer that is also engaged in the production of brewing enzymes.

Key Brewing Enzymes Companies:

The following are the leading companies in the brewing enzymes market. These companies collectively hold the largest market share and dictate industry trends.

- A.B. Enzyme Inc.

- Advanced Enzyme Technologies

- Associated British Food plc

- AumEnzymes

- BASF SE

- CBSBREW

- DSM-Firmenich

- DuPont de Neymours, Inc.

- Kerry Group plc

- Lesaffre

- LEVEKING

- Megazyme Ltd

- Nagase America LLC

- Novozymes A/S

- SternEnzym GmbH & Co. K.G.

Recent Developments

-

In May 2023 DSM merged with the Swiss company Firmenich for a transaction value of USD 19.3 billion to form a new entity named dsm-firmenich.

-

In January 2023, Weiss BioTech introduced two new variants of brewing enzymes that is expected to reduce fermentation time, improve levels of attenuation and results in reduced residual carbohydrates.

Brewing Enzymes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 556.6 million

Revenue forecast in 2030

USD 789.1 million

Growth rate

CAGR of 7.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Source, type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea

Key companies profiled

A.B. Enzyme Inc.; Advanced Enzyme Technologies; Associated British Food plc; AumEnzymes; BASF SE; CBSBREW; DSM-Firmenich; DuPont de Neymours, Inc.; Kerry Group plc; Lesaffre; LEVEKING; Megazyme Ltd; Nagase America LLC; Novozymes A/S; SternEnzym GmbH & Co. K.G.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Brewing Enzymes Market Report Segmentation

This report forecasts revenue growth at global, country, and regional levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global brewing enzymes market report based on source, type, application, and region:

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Microbial

-

Plant

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Amylase

-

Beta Glucanase

-

Protease

-

Xylanase

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Beer

-

Wine

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global brewing enzymes market size was estimated at USD 486.9 million in 2023 and is expected to reach USD 520.6 million in 2024.

b. The global brewing enzymes market size was estimated at USD 486.9 million in 2023 and is estimated to grow at a compound annual growth rate (CAGR) of 7.2% from 2024 to 2030.

b. Microbial based accounted for the highest revenue share of about 77.0% in 2023. Microbial-based brewing enzymes are easier to handle and have a high production rate. They are also found to be more cost effective than plant sources and are hence anticipated to account for the higher revenue share over the forecast period.

b. Key players in the brewing enzymes market include A.B. Enzyme Inc.; Advanced Enzyme Technologies; Associated British Food plc; AumEnzymes; BASF SE; CBSBREW; DSM-Firmenich; DuPont de Neymours, Inc.; Kerry Group plc; Lesaffre; LEVEKING; Megazyme Ltd; Nagase America LLC; Novozymes A/S; SternEnzym GmbH & Co. K.G.

b. The brewing enzymes market is driven by increased preference towards value-based drinking and the emergence of specialized breweries that use artificial brewing enzymes.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.