- Home

- »

- Advanced Interior Materials

- »

-

Brewery Equipment Market Size, Industry Report, 2030GVR Report cover

![Brewery Equipment Market Size, Share & Trends Report]()

Brewery Equipment Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Macrobrewery Equipment, Craft Brewery Equipment), By Mode Of Operation (Automatic, Semi-automatic), By Region And Segment Forecasts

- Report ID: GVR-4-68039-058-0

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Brewery Equipment Market Size & Trends

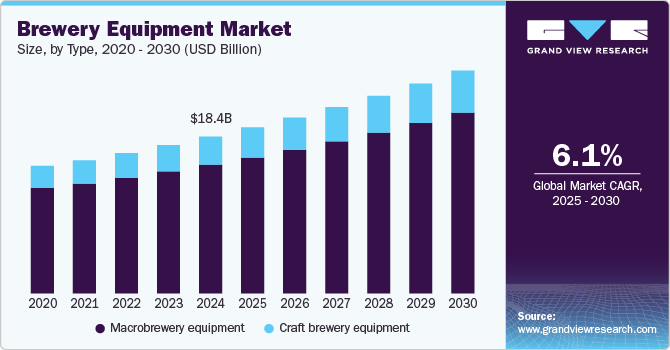

The global brewery equipment market size was estimated at USD 18.45 billion in 2024 and is anticipated to grow at a CAGR of 6.1% from 2025 to 2030. The increasing global demand for craft beer has spurred investment in new breweries and expanding existing ones, creating a need for advanced brewing equipment. As more consumers seek unique, high-quality beers, both large and small breweries are focusing on improving production capabilities, often turning to specialized equipment to cater to diverse tastes and brewing styles.

The rise of microbreweries and the trend toward smaller-scale, local production is fueling the need for more adaptable and modular brewing equipment that can be scaled based on production requirements.

Drivers, Opportunities & Restraints

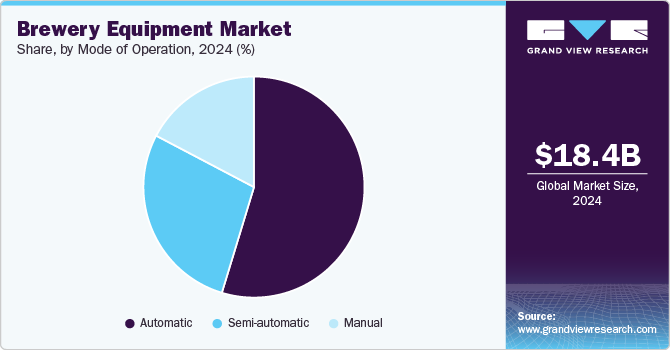

Technological advancements in brewery equipment, such as automation and more efficient brewing processes, are another major driver. These innovations allow for greater control over the brewing process, improving consistency and reducing operational costs. Automation in particular has gained popularity, as it reduces labor requirements and increases production speed, all while enhancing the precision of brewing processes.

A significant restraint of market growth is the high capital investment required for advanced brewing equipment. Smaller craft breweries, especially in emerging markets, may struggle to afford the initial cost of setting up state-of-the-art equipment, which can limit their ability to scale production or improve operational efficiency.

The growing global popularity of craft beer, particularly in regions like Asia, Africa, and Latin America, presents significant potential for market expansion. As consumers in these regions develop a taste for unique and locally brewed beer, new breweries are being established, driving demand for brewery equipment.

Type Insights

The macrobrewery equipment segment dominated the market with a revenue share of 82.0% in 2024. The increasing global demand for mass-produced beers largely drives segmental growth. Microbreweries, which focus on large-scale production, require sophisticated, high-capacity brewing equipment to meet the needs of international distribution. As beer consumption rises in developed and emerging markets alike, there is a corresponding need for equipment that can handle higher production volumes while maintaining efficiency and quality.

The craft brewery segment is driven by the rising consumer preference for unique, locally produced, and high-quality beers. As the craft beer movement continues to expand globally, both in developed markets and in emerging economies, breweries of all sizes require specialized equipment to create distinct and diverse beers. Craft brewers focus on small-batch, artisanal production, which requires more flexible and customizable brewing systems than those used by microbreweries.

Mode Of Operation Insights

Automatic systems are particularly attractive to both large and small breweries looking to scale production while maintaining product consistency. Automation also helps in reducing labor costs, making it a desirable investment for breweries looking to streamline operations and improve throughput.

The semi-automatic segment is expected to grow at significant CAGR from 2025 to 2030. Semi-automatic brewery equipment is popular with medium-sized breweries and craft brewers who need a balance between manual control and operational efficiency. These systems offer a degree of automation but still require some hands-on intervention, providing flexibility for brewers who value craftsmanship while benefiting from certain automated processes.

Regional Insights

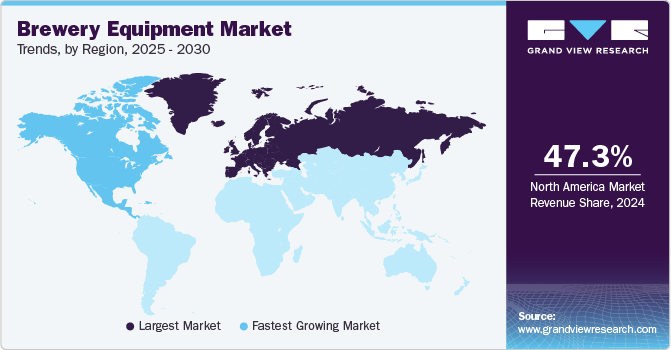

In North America brewery equipment market, the growth is primarily driven by the robust demand for craft beer and the ongoing expansion of microbreweries. The region's strong beer culture and willingness to experiment with new flavors and brewing techniques further fuel the demand for innovative brewing technologies.

U.S. Brewery Equipment Market Trends

The U.S. brewery equipment market accounted for 71.8% revenue share of the North American market in 2024, primarily driven by the country's strong craft beer culture. As craft breweries continue to grow in number and popularity, the demand for specialized brewing equipment has surged. U.S. consumers are increasingly drawn to unique, small-batch beers, which has led to a surge in the number of microbreweries and an expansion of craft beer offerings.

Europe Brewery Equipment Market Trends

Europe brewery equipment market is home to some of the world’s oldest and most established beer brands, and the region’s diverse beer culture is a key driver of brewery equipment demand. Germany, the Czech Republic, and Belgium, for example, are known for their traditional beer brewing methods, while countries like the UK, France, and Spain have seen a rise in craft breweries, expanding the market for specialized equipment.

The market in Italy is expected to expand at a CAGR of 6.2% over the forecast period. While Italy has traditionally been more focused on wine production, beer consumption is rising, particularly in the craft beer segment. As more consumers seek out locally brewed, high-quality beers, the demand for specialized brewery equipment has increased. Small and medium-sized craft breweries, in particular, are looking for equipment that allows for experimentation with unique beer styles and flavors, while still adhering to the high standards of quality that are central to Italian food and drink culture.

The brewery equipment market in Germany accounted for 39.7% of the market share in 2024 due to the presence of a substantial number of large-scale breweries, which creates a strong demand for high-capacity brewing equipment. These breweries need advanced systems that can handle large volumes while maintaining quality. Moreover, the growing popularity of craft beer in Germany is also driving demand for smaller-scale, specialized equipment designed for artisanal beer production. The increasing trend of craft beer consumption, particularly in urban areas, is pushing breweries to adopt more flexible brewing technologies that allow for greater creativity and experimentation with flavors.

Asia Pacific Brewery Equipment Market Trends

The Asia Pacific brewery equipment market is being driven by the rapid rise in beer consumption, particularly in countries like China, Japan, India, and South Korea. As beer becomes a mainstream alcoholic beverage, especially in emerging economies, there is a growing demand for both large-scale brewing equipment for mass production and smaller, specialized equipment for the increasing number of microbreweries and craft beer startups.

The brewery equipment market in India accounted for 15.7% of the Asia Pacific market in 2024. Indian market is being driven by a number of factors, including an expanding middle class, increased disposable incomes, and a shift in consumer preferences toward premium and imported beers. As more breweries enter the market, there is a rising need for modern brewing equipment to support both large-scale production and small-batch craft brewing. This includes systems that can handle diverse beer styles and ingredients, catering to a wide range of tastes.

China brewery equipment market is projected to expand at a rapid CAGR of 6.8% over the forecast period. The country's beer consumption is growing, particularly among younger consumers who are more open to trying new and premium beer styles. While traditional lagers continue to dominate the market, craft beer and imported beers are seeing increased popularity, especially in urban areas. This shift is creating a demand for more specialized equipment that can cater to diverse brewing styles and small-batch production.

Middle East Brewery Equipment Market Trends

The Middle East and Africa represent a relatively new but fast-growing market for brewery equipment. Beer consumption in the region has traditionally been lower due to cultural and religious factors, but this is changing in some countries, particularly in parts of North Africa, where there is a rising middle class and increased exposure to international beverage trends.

Latin America Brewery Equipment Market Trends

In Latin America, the brewery equipment market is being driven by an evolving beer culture and growing interest in craft brewing. While traditional beer consumption is still dominant in countries like Mexico, Brazil, and Argentina, the craft beer movement is gaining momentum. This is leading to a rise in the number of craft breweries and thus increasing demand for specialized brewing equipment.

Key Brewery Equipment Company Insights

Some key players operating in the market include Sumitomo Heavy Industries, Ltd. and RIX Industries.

-

Krones AG is engaged in the manufacturing of processing, filling, and packaging lines as well as individual machinery for filling beverages in cans or glass and plastic bottles. Moreover, the company offers brewery equipment such as seamers, inspection units, and others. The company has a strong global presence across multiple regions.

-

GEA Group Aktiengesellschaft is engaged in process technology suppliers for food and other major industries. Its product portfolio comprises brewing systems, centrifuges & separation equipment, automation & control systems, and others. The company operates through five business divisions, namely Separation & Flow Technologies, Liquid & Powder Technologies, Food & Semi-automatic Technologies, Farm Technologies, and Heating & Refrigeration Technologies. Through Separation & Flow Technologies division.

Key Brewery Equipment Companies:

The following are the leading companies in the brewery equipment market. These companies collectively hold the largest market share and dictate industry trends.

- ALFA LAVAL

- GEA Group Aktiengesellschaft

- Krones AG

- PAUL MUELLER COMPANY

- CRIVELLER GROUP

- DELLA TOFFOLA USA

- SCHULZ

- Hypro

- Praj Industries

- ABE Equipment

- Ampco Pumps Company

- BREWBILT MANUFACTURING INC

- LEHUI

- DEUTSCHE BEVERAGE TECHNOLOGY

- MEURA

Recent Developments

-

In September 2024, Brew Bomb Cold Brew Equipment announced a partnership with TORR Industries Inc., which acquired a controlling interest in Gunga LLC, the parent company of Brew Bomb. This collaboration is expected to enhance Brew Bomb's capabilities by merging their expertise in cold brew coffee with TORR's manufacturing and engineering strengths. The partnership aims to foster innovation and develop new cold coffee solutions

-

In November 2023, Ziemann Holvrieka acquired a majority stake in Künzel Maschinenbau, a German manufacturer known for specializing in malt management and grist mills, essential components for breweries. This acquisition enhances Ziemann's ability to offer comprehensive brewery solutions and aligns with its strategy to expand its product offerings.

Brewery Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 19.52 billion

Revenue forecast in 2030

USD 26.21 billion

Growth rate

CAGR of 6.1% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; UK; Germany; Italy; China; India; Japan; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia.

Key companies profiled

ALFA LAVAL; GEA Group Aktiengesellschaft; Krones AG; PAUL MUELLER COMPANY; CRIVELLER GROUP; DELLA TOFFOLA USA; SCHULZ; Hypro; Praj Industries; ABE Equipment; Ampco Pumps Company; BREWBILT MANUFACTURING INC; LEHUI; DEUTSCHE BEVERAGE TECHNOLOGY; MEURA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Brewery Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global brewery equipment market report based on the type, mode of operation, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Macrobrewery equipment

-

Milling equipment

-

Brewhouse

-

Cooling equipment

-

Fermentation equipment

-

Filtration & filling equipment

-

Others (cleaning systems, spent grain silos, generators, bright beer tanks, compressors, and pipes)

-

-

Craft brewery equipment

-

Mashing equipment

-

Fermentation equipment

-

Cooling equipment

-

Storage equipment

-

Compressors

-

Others (pumps, filters, and separators)

-

-

-

Mode Of Operation (Revenue, USD Million, 2018 - 2030)

-

Automatic

-

Semi-automatic

-

Manual

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global brewery equipment market size was estimated at USD 18,451.1 million in 2024 and is expected to reach USD 19,523.0 million in 2025.

b. The global brewery equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.1% from 2025 to 2030 to reach USD 26,213.8 million by 2030.

b. The macrobrewery equipment segment dominated the market in 2024 accounting for 82.0% of overall revenue share. Technological innovations such as automation and process optimization are crucial for large-scale breweries to lower costs, improve consistency, and scale production to meet demand. Moreover, the consolidation of the beer industry, where larger brewing companies are acquiring smaller breweries, leading to increased demand for advanced brewing systems and higher production capacities

b. Some of the key players operating in the brewery equipment market are ALFA LAVAL, GEA Group Aktiengesellschaft, Krones AG, PAUL MUELLER COMPANY, CRIVELLER GROUP, DELLA TOFFOLA USA, SCHULZ, Hypro, Praj Industries, ABE Equipment, Ampco Pumps Company, BREWBILT MANUFACTURING INC, LEHUI, DEUTSCHE BEVERAGE TECHNOLOGY, and MEURA

b. The key factors driving the brewery equipment market are the increasing demand for craft beer, technological advancements in automation and sustainability, and the growing trend of premium and eco-friendly beer production. Additionally, the expansion of breweries globally, especially in emerging markets, is boosting the need for advanced brewing systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.