- Home

- »

- Medical Devices

- »

-

Breast Ultrasound Market Size, Share & Growth Report, 2030GVR Report cover

![Breast Ultrasound Market Size, Share & Trends Report]()

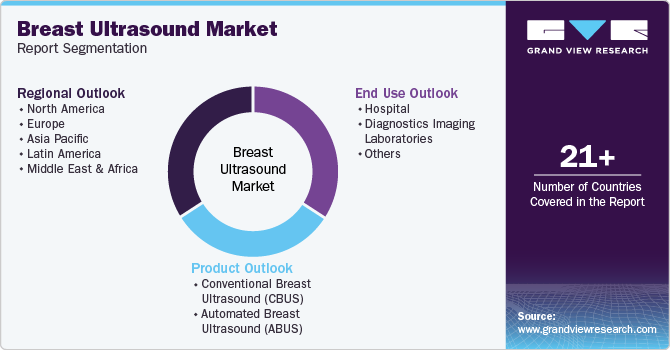

Breast Ultrasound Market Size, Share & Trends Analysis Report By Product (Conventional Breast Ultrasound (CBUS), Automated Breast Ultrasound (ABUS)), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-745-2

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Breast Ultrasound Market Size & Trends

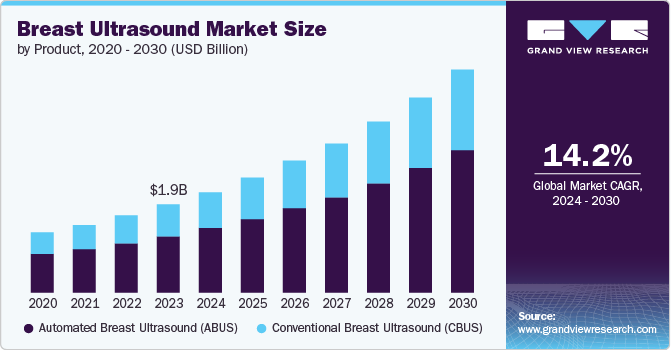

The global breast ultrasound market size was valued at USD 1.98 billion in 2023 and is projected to grow at a CAGR of 14.2% from 2024 to 2030. The increasing incidence of breast cancer, rise in demand for breast ultrasound, technological advancements, and various awareness initiatives undertaken by the governments as well as non-profit organizations. are among the factors driving the market growth. According to an article published in NBC UNIVERSAL in April 2024, experts from the U.S. Preventive Services Task Force (USPSTF) recommended that people with breasts should undergo an annual mammogram from age 40.

The rising prevalence of breast cancer across the globe is anticipated to fuel product demand. Cancer is one of the leading causes of death globally, and breast cancer is the second most common cancer worldwide. In the case of women, breast cancer tops the list of most prevalent cancers. According to the World Cancer Research Fund International, 2,296,840 new breast cancer cases were reported in 2022. The top three regions with the highest disease incidence rate were France, the U.S., and UK. Such high incidence rate is anticipated to drive the market for breast ultrasound.

Rise in sedentary lifestyle, obesity, and changes in eating habits are some of the major factors contributing to breast cancer. Moreover, rising alcohol consumption is also expected to increase the risk of the disease. The risk increases by around 7% to 10% per unit of alcohol consumption per day. Such increasing prevalence of the disease is expected to boost the demand for breast ultrasound shortly.

Due to the rising demand for the prevention and treatment of this disease, key companies and research organizations are launching technologically advanced products to strengthen their foothold in the breast ultrasound market. For instance, in August 2023, researchers from MIT developed a wearable ultrasound device that detects breast cancer. This can detect the condition early to increase the patients' survival rate.

Product Insights

Automated breast ultrasound (ABUS) segment dominated the market and accounted for a share of 64.1% in 2023 owing to the availability of many products, rapid technological advancements, regulatory approvals, and user-friendly features of this device. For instance, Siemens Healthineers AG announced the FDA approval for its MAMMOMAT B.brilliant Mammography System on April 2024 to improve user ergonomics and patient comfort and enhance workflow. Various advantages of automated breast ultrasound promote the adoption of devices and fuel the market growth. For instance, GE HealthCare published a study in October 2023 that stated that automated breast ultrasound improved cancer detection rates. This can significantly reduce the mortality rate due to breast cancer.

The conventional Breast Ultrasound (CBUS) segment is expected to grow at the fastest CAGR over the forecast period because it detects tumors and other breast abnormalities. Many hospitals and other diagnostic centers still use conventional breast ultrasound due to various reasons. Many organizations adopted traditional machines to detect breast abnormalities, which is expected to continue and contribute to the segment's growth in the coming years.

End Use Insights

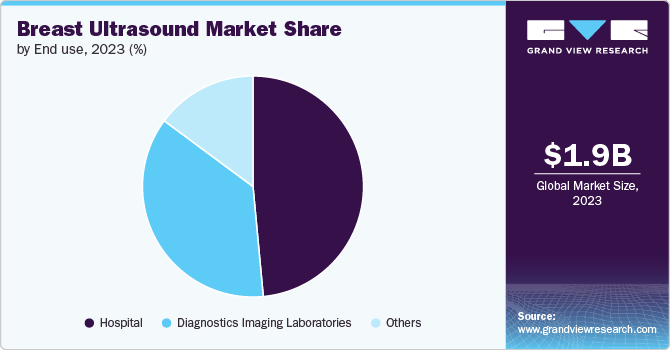

The hospitals segment dominated the market and accounted for a share of 48.5% in 2023. Several hospitals are strengthening their oncology department with the addition of advanced breast ultrasound systems. For instance, in May 2024, Mercy Breast Health Hospital in Cape Girardeau introduced a technology, "automated breast ultrasound," to enable groundbreaking progress in women's health. Similarly, Eve Wellness Clinic in San Francisco uses FDA-approved AI to detect breast cancer via. Ultrasound. Such increasing adoption of breast ultrasound systems by hospitals augments the market growth.

Diagnostics imaging laboratories segment is expected to grow at the fastest CAGR of 14.5% over the forecast period due to the increasing number of diagnostic centers, rising demand for imaging techniques, and high global prevalence of the disease. Such factors are expected to further boost the growth of the segment.

Regional Insights

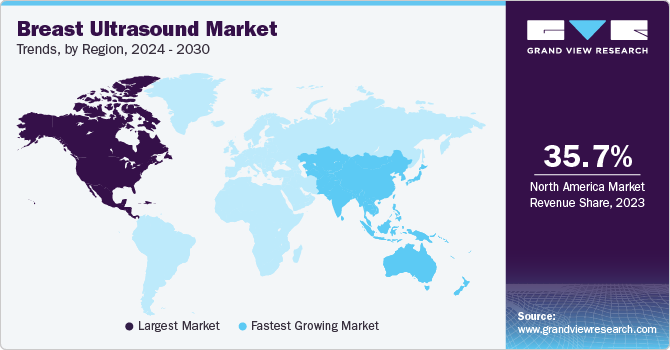

North America accounted for the largest revenue share in the breast ultrasound market with a share of 35.7% in 2023, owing to the presence of developed infrastructure. The rising cases of breast cancer in the region, attributed to lifestyle factors such as smoking and insufficient exercise, along with supportive government initiatives and increased healthcare investments, are driving the market's expansion. According to the American College of Radiology, in May 2024, many bills were introduced in the legislative sessions focused on health insurance plans. Many states, such as Wisconsin, Virginia, Vermont, South Dakota, Rhode Island, Pennsylvania, North Carolina, Nebraska, Mississippi, Michigan, Massachusetts, Kansas, Indiana, Florida, Arizona, Alaska, New Hampshire, and West Virginia., passed the bill to cover breast imaging services under insurance plans.

U.S. Breast Ultrasound Market Trends

The U.S. breast ultrasound market dominated the North America with a share of 78.1% in 2023 due to the presence of world class medical facilities, renowned diagnostic centers, and increasing prevalence of breast cancers leading to rising demand for breast examination. According to the National Breast Cancer Foundation, Inc., in July 2024, in 2024, it was projected that around 310,720 cases of invasive breast cancer and approximately 56,500 cases of non-invasive breast cancer would be identified in the U.S.

Europe Breast Ultrasound Market Trends

Europe breast ultrasound market was identified as a lucrative region in this industry and is anticipated to grow significantly in the coming years. The presence of leading players in the region, government initiatives, fundraising, and investments in developing the healthcare system are major factors driving the market growth. For instance, the European Society of Radiology (ESR) collaborated with GE HealthCare for the upcoming 2024 congress titled “Next Generation Radiology”. At this conference, GE HealthCare was expected to launch a women’s breast cancer detection solution. This was expected to improve the quality and completeness of cancer registry data across the region.

Asia Pacific Breast Ultrasound Market Trends

The Asia Pacific breast ultrasound market is expected to grow at the fastest CAGR of 15.4% over the forecast period, owing to the rising awareness regarding breast cancer and its treatment procedure. For instance, in February 2024, JW Medical announced the launch of the ARIETTA 750 DeepInsight (AR750DI), a high-end ultrasound imaging device featuring advanced high-resolution imaging technology. Developed by FUJIFILM Corporation (Japan), the AR750DI builds on the existing ARIETTA 750 model by incorporating Deep Insight technology to enhance imaging capabilities. This device offers improved image quality for medical diagnostics.

Latin America Breast Ultrasound Market Trends

The Asia Pacific breast ultrasound market was identified as a lucrative region in this industry and is anticipated to grow significantly in the coming years, owing to the rising the rising incidence of breast cancer in the region and the demand for advanced imaging technologies such as breast ultrasound. As more cases are detected, there is an increased need for effective screening and diagnostic tools to manage and treat the disease. This trend is fueling the growth of the breast ultrasound market in the region.

Middle East and Africa Breast Ultrasound Market Trends

Middle East and Africa breast ultrasound market is anticipated to grow significantly over the forecast period. Authorities in the region are taking various strategic initiatives to strengthen cancer detection and treatment. Organizations in the region's adoption of advanced technologies contribute to market growth. For instance, in June 2024, Qatar's Primary Health Care Corporation (PHCC) started implementing an AI-powered breast cancer detection solution, Lunit INSIGHT MMG, to improve early detection of breast cancer.

Key Breast Ultrasound Company Insights

Some of the key companies in the breast ultrasound market include GE HealthCare., Koninklijke Philips N.V., Siemens Healthineers AG, CANON MEDICAL SYSTEMS CORPORATION, Telemed Medical Systems Srl, Hologic, Inc., FUKUDA DENSHI, Supersonic Imagine, Lunit Inc., Delphinus Medical Technologies, Inc. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

GE HealthCare is a company that deals with medical technology, intelligent devices, and care solutions with an extensive range of products and services. The company offers mammography solutions under the imaging category of the product segment. In contrast, the ultrasound category offers systems such as Voluson Women's Health Ultrasound to detect early stages of cancer.

-

Hologic, Inc. specializes in women's health products, such as breast health, sexual health, and gynecological health. The breast health segment includes a variety of devices in categories such as biopsy, diagnostics, screening, and others. The company provides various devices as well as software systems to diagnose breast cancer and other abnormalities.

Key Breast Ultrasound Companies:

The following are the leading companies in the breast ultrasound market. These companies collectively hold the largest market share and dictate industry trends.

- GE HealthCare.

- Koninklijke Philips N.V.

- Siemens Healthineers AG

- CANON MEDICAL SYSTEMS CORPORATION

- Telemed Medical Systems Srl

- Hologic, Inc.

- FUKUDA DENSHI

- Supersonic Imagine

- Lunit Inc.

- Delphinus Medical Technologies, Inc.

Recent Developments

-

In November 2023, Hologic, Inc. introduced Genius AI Detection 2.0 solution to improve breast cancer detection and reduce false-positive markings

-

In September 2023, Hologic Inc. partnered with Bayer to develop and deliver contrast-enhanced mammography (CEM) solutions to improve breast cancer detection across many countries.

Breast Ultrasound Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.26 billion

Revenue forecast in 2030

USD 5.02 billion

Growth rate

CAGR of 14.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

GE HealthCare.; Koninklijke Philips N.V.; Siemens Healthineers AG; CANON MEDICAL SYSTEMS CORPORATION; Telemed Medical Systems Srl; Hologic, Inc.; FUKUDA DENSHI; Supersonic Imagine; Lunit Inc.; Delphinus Medical Technologies, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Breast Ultrasound Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global breast ultrasound market report based on product, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Conventional Breast Ultrasound (CBUS)

-

Automated Breast Ultrasound (ABUS)

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital

-

Diagnostics Imaging Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."