- Home

- »

- Clinical Diagnostics

- »

-

Breast Cancer Liquid Biopsy Market Size, Share Report 2030GVR Report cover

![Breast Cancer Liquid Biopsy Market Size, Share & Trends Report]()

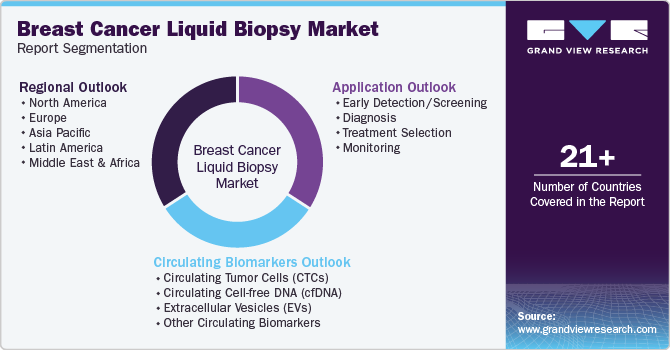

Breast Cancer Liquid Biopsy Market Size, Share & Trends Analysis Report By Circulating Biomarkers (Circulating Tumor Cells, Circulating Cell-free DNA, Extracellular Vesicles), By Application, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-991-9

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Breast Cancer Liquid Biopsy Market Trends

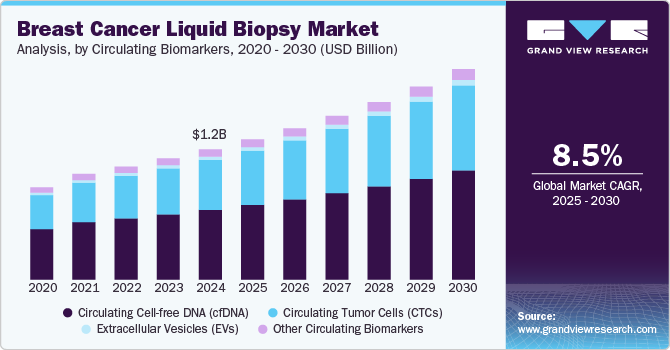

The global breast cancer liquid biopsy market size was estimated at USD 1.17 billion in 2024 and is projected to grow at a CAGR of 8.5% from 2025 to 2030. The growth can be attributed to factors such as the increasing prevalence of breast cancer among the population and the need to provide diagnosis solutions at a faster time than other tissue biopsy techniques making treatment decisions easier for doctors. Moreover, a majority of liquid biopsies used today are for breast and colorectal cancer, which further propels the demand. For instance, in 2022, according to the World Health Organization, breast cancer was one of the most commonly occurring cancers in 157 countries among 185 nations worldwide.

Rising screening rates are a priority for many hospitals and community health clinics. Traditional methods of screening have many drawbacks and are also inconvenient for many patients. In such a situation, there is increasing demand for non-invasive breast cancer diagnosis. In the last few years tremendous shift from traditional screening to advanced liquid biopsies has been observed, making it one of the prime factors to increase the market growth.

One of the major advantages associated with liquid biopsy is the less time consumption associated with the procedure. Tissue biopsy is derived from localized sources that limit the diagnostic information that the physicians may rely upon for determining and evaluating the patient’s response to treatment. Whereas results from liquid biopsies tend to provide an easier way to understand the recurrence of cancer than tissue biopsies help in determining and providing faster therapy decisions to doctors.

Breast cancer is one of the most common applications of liquid biopsy, helping in identifying appropriate targeted therapy on the basis of mutational analysis. For instance, determining the next course of treatment for patients with metastatic illness can be aided by testing for the PIK3CA mutation that exists in about 40% of all HR-positive breast tumors. Moreover, the evolving MRD detection through the circulating tumor DNA provides promising and transformative applications within oncology for liquid biopsy.

Technological advancements in breast cancer liquid biopsy and regulatory approvals from the authorities of different countries are making the test more accessible to patients. In March 2023, REVEAL GENOMICS, S.L., a Barcelona-based biotechnology start-up seeking to revolutionize precision oncology through biomarker innovation, announced a new addition to its pipeline consisting of a novel biomarker approach in liquid biopsy for patients with advanced cancer.

Circulating Biomarkers Insights

Based on circulating biomarkets, the circulating cell-free DNA (cfDNA) segment led the market with the largest revenue share of 53.6% in 2024. This growth is driven by the convenience of the non-invasive approach offered by cfDNA that simplifies prognosis and also diagnoses recurrence or progression of the condition. This technique offers several advantages over traditional tissue biopsies, including the detection of drug resistance, drug response, and real-time monitoring of tumor prognosis at multiple time points. Numerous businesses provide cfDNA-based products for use in scientific research. Consistent research and product launches are under progress to use cfDNA as the means of detecting cancer. For instance, in April 2023, QIAGEN announced the launch of QIAseq targeted cfDNA ultra panels to enable easy and speedy diagnosis of cancers, including breast cancer.

The circulating tumor cells (CTCs) segment is anticipated to grow at the fastest CAGR of 9.4% over the forecast period. There has been ongoing research to specify the utility of CTCs in early-stage breast cancer. In recent years, remarkable improvement has taken place in increasing the efficiency and accuracy of the isolation of CTCs from peripheral blood samples. Many players are actively introducing new kits to detect cancer using ctDNA. For instance, in November 2023, Illumina, Inc. launched version 2 of the TruSight Oncology 500 ctDNA kit to ensure precise genomic profiling of solid tumors. This version of the assay kit provides faster results with great analytical sensitivity.

Application Insights

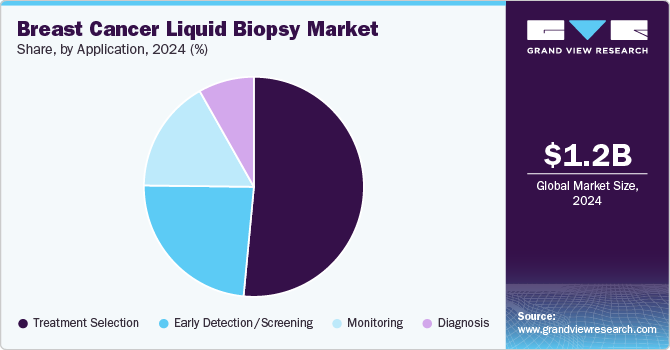

Based on application, the treatment selection segments led the market with the largest revenue share of 51.5% in 2024,attributed to the need to provide early treatment. Liquid biopsies have proved to be an essential tool for enhancing the importance of early detection, management, and characterization of breast cancer in the early stages. Delay in choosing an appropriate treatment increases the mortality due to breast cancer in several regions. Understanding the importance of time, key players in the industry are collaborating to provide faster diagnosis using liquid biopsy. For instance, in December 2022, Guardant Health, Inc. entered into a partnership with Susan G. Komen to develop clinical studies for identifying early-stage breast cancer patients with the help of Guardant Reveal, a blood-based test.

The early detection/screening segment is expected to grow at a significant CAGR of 9.7% during the forecast period, due to the increasing application of the use of liquid biopsy in the early detection of cancer. Liquid biopsy has notably changed the field of clinical oncology by providing ease of monitoring that gives a significantly better way to provide early detection of cancer. The growth in the segment is also attributed to the increasing technological advancements in liquid biopsy technology aided by increasing awareness about non-invasive and safer testing procedures. As per the article published by the American Society of Clinical Oncology in January 2024, there are currently five liquid biopsy companion diagnostic assays approved by the U.S. FDA for their clinical application in the diagnosis of cancer.

Regional Insights

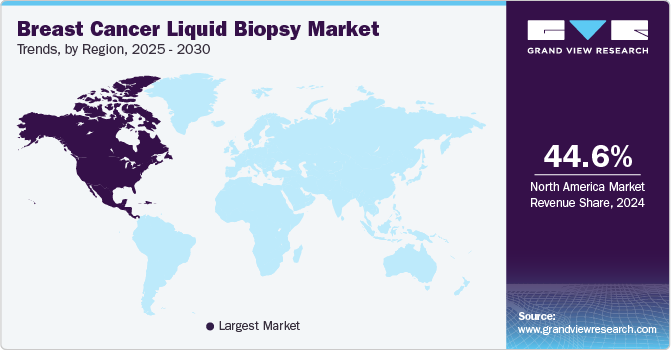

North America dominated the breast cancer liquid biopsy market with the largest revenue share of 44.64% in 2024. This growth is driven by rapid technological advancements, the adoption of liquid biopsies for diagnosis and treatment selection, and favorable government initiatives. Several companies are providing liquid biopsy tests in their oncology portfolio to provide targeted therapies for patients with cancer. In addition, increasing collaborations among manufacturers and growing approvals for new products further enhanced the North America market. For instance, in May 2023, Labcorp introduced Lapcorp Plasma Focus, a novel liquid biopsy test for patients with metastatic solid tumors that enables targeted therapy selection for patients.

U.S. Breast Cancer Liquid Biopsy Market Trends

The breast cancer liquid biopsy market in U.S. held a significant share of North America market in 2024, fueled by the increasing prevalence of breast cancer among women. According to an article published by the National Breast Cancer Foundation, Inc. in August 2024, one in eight women is diagnosed with cancer in a lifetime. It is projected that 310,720 women and 2,800 men will be diagnosed with invasive breast cancer by the end of 2024. The presence of key players in the region and favorable reimbursement policies boost the market growth.

Europe Breast Cancer Liquid Biopsy Market Trends

The breast cancer liquid biopsy market in Europe is anticipated to grow at a significant CAGR during the forecast period, driven by rising demand for effective diagnostic solutions amid the increasing prevalence of cancer. Several market players in the region are focusing on receiving funding from various government or non-governmental organizations to develop advanced liquid biopsy platforms. Moreover, increasing strategic initiatives by the European government to boost cancer screening tests will further strengthen regional growth over the forecast period. For instance, Guardant Health received EU IVDR certification for Guardant360 CDx Liquid Biopsy. This test is for tumor mutation profiling in patients having any solid cancerous tumor. This will expand the adoption of liquid biopsies for optimal therapy selection.

The UK breast cancer liquid biopsy market is anticipated to grow at a significant CAGR during the forecast period, due to healthcare improvements and technological advancements. Enhanced diagnostic technologies, such as more accurate and non-invasive tests, are driving better cancer management. These innovations, coupled with a focus on improving healthcare infrastructure, are significantly boosting the market's expansion in the UK.

The breast cancer liquid biopsy market in Germany is expected to grow at a significant CAGR during the forecast period, driven by increasing awareness and demand for accurate diagnostic tools. The German government is actively involved in funding research and clinical studies to improve cancer detection using liquid biopsy. For instance, the SURVIVE study was funded by the German Federal Ministry of Education and Research to investigate the potential survival benefit of a liquid biopsy-guided follow-up care in moderate as well as high-risk early breast cancer patients.

Asia Pacific Breast Cancer Liquid Biopsy Market Trends

The breast cancer liquid biopsy market in Asia Pacificis expected to grow at the fastest CAGR during the forecast period,driven by significant advancements in healthcare infrastructure and technology. Countries in the region are investing in modern diagnostic facilities, enhancing access to cutting-edge cancer screening tests, Technological innovations, such as more precise and less invasive diagnostic methods, are further propelling market expansion. For instance, as per the news published in June 2024, the CSIR, in collaboration with the clinicians of the Regional Cancer Centre (RCC) in Thiruvananthapuram (Kerala) found a liquid biopsy method for early detection of cancer. Also, a Nashik (India) based laboratory received FDA approval for its liquid biopsy test to detect early-stage breast cancer. Such constant innovations in the field of oncology will contribute to the market growth in the forecast timeframe.

The China breast cancer liquid biopsy market is growing, driven by the increasing prevalence of breast cancer and rising demand for accurate diagnostics. As urbanization and environmental changes contribute to higher cancer rates, more women are seeking reliable diagnostic solutions. This surge in cancer cases is fueling demand for advanced diagnostic tools, leading to significant market expansion in China as healthcare providers strive to meet this growing need.

Latin America Breast Cancer Liquid Biopsy Market Trends

The breast cancer liquid biopsy market in Latin Americais expected to grow at a significant CAGR during the forecast period, due to increasing cancer prevalence and enhanced awareness programs. Government support and initiatives are boosting market development. According to a news published by the International Atomic Energy Agency in July 2022, due to the installation of mammography units in Brazilian navy ships, access to breast cancer screening has increased among women staying in the Amazon River community. Such strategies will increase the adoption of liquid biopsy tests and propel the market in the coming years.

Middle East and Africa Breast Cancer Liquid Biopsy Market Trends

The breast cancer liquid biopsy market in Middle East & Africa is expanding, driven by increasing awareness and rising cases of breast cancer. Due to limited access to healthcare infrastructure, many breast cancer cases go unnoticed without diagnosis. According to the article published by the World Health Organization in July 2022, the survival rate after five years of breast cancer diagnosis.is 40 % in Saharan Africa, whereas it is about 90% in developed countries. This alarming situation in the region increases the necessity and demand for cancer diagnosis tests such as liquid biopsy.

The Saudi Arabia breast cancer liquid biopsy market is expanding due to increased healthcare investment and improved infrastructure. The government is boosting funding for advanced diagnostic technologies and healthcare facilities, enhancing the availability of cancer testing. These investments are driving market growth by addressing the rising prevalence of breast cancer in women.

Key Breast Cancer Liquid Biopsy Company Insights

The competitive scenario in the market is high, with key players undertaking various strategies, such as regional expansion, acquisitions, mergers, collaborations, and new product development, to serve the unmet needs of their customers.

Key Breast Cancer Liquid Biopsy Companies:

The following are the leading companies in the breast cancer liquid biopsy market. These companies collectively hold the largest market share and dictate industry trends.

- The Menarini Group

- NeoGenomics Laboratories

- F. Hoffmann - La Roche Ltd.

- Myriad Genetics, Inc.

- Thermo Fisher Scientific, Inc.

- QIAGEN

- Biocept, Inc.

- Sysmex Corporation

- Fluxion Biosciences, Inc.

- Epic Sciences, Inc.

Recent Developments

-

In August 2024, Illumina Inc. expanded its oncology portfolio for for NovaSeqX Series customers by offering high-throughput version of TruSight Oncology 500 and the second version of its liquid biopsy research assay, TruSight Oncology 500 ctDNA v2 in order to expand oncology testing

-

In February 2024, Twist Bioscience launched its cfDNA library preparation kit for liquid biopsy applications

Breast Cancer Liquid Biopsy Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.26 billion

Revenue forecast in 2030

USD 1.90 billion

Growth rate

CAGR of 8.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Circulating biomarkers, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

The Menarini Group; NeoGenomics Laboratories.; F. Hoffmann-La Roche Ltd.; Myriad Genetics, Inc.; QIAGEN; Biocept, Inc.; Sysmex Corporation; Fluxion Biosciences, Inc.; Epic Sciences, Inc.; Thermo Fisher Scientific, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Breast Cancer Liquid Biopsy Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global breast cancer liquid biopsy market report based on circulating biomarkers, application, and region.

-

Circulating Biomarkers Outlook (Revenue, USD Million, 2018 - 2030)

-

Circulating Tumor Cells (CTCs)

-

Circulating Cell-free DNA (cfDNA)

-

Extracellular Vesicles (EVs)

-

Other Circulating Biomarkers

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Early Detection/Screening

-

Diagnosis

-

Treatment Selection

-

Monitoring

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global breast cancer liquid biopsy market size was estimated at USD 1.17 billion in 2024 and is expected to reach USD 1.26 billion in 2025.

b. The global breast cancer liquid biopsy market is expected to grow at a compound annual growth rate of 8.5% from 2025 to 2030 to reach USD 1.90 billion by 2030.

b. North America dominated the breast cancer liquid biopsy market with a share of 44.64% in 2024. The dominance of the market is owing to rapid technological advancements, the adoption of liquid biopsies for treatment selection, and growing government initiatives.

b. Some key players operating in the breast cancer liquid biopsy market include The Menarini Group, NeoGenomics Laboratories, F. Hoffmann-La Roche Ltd., Myriad Genetics, Inc., QIAGEN, Biocept, Inc., Sysmex Corporation, Fluxion Biosciences, Inc., Epic Sciences, Inc., and Thermo Fisher Scientific Inc.

b. Key factors that are driving the market growth include the increasing prevalence of breast cancer among the population, and the need to provide diagnosis solutions at a faster time than other tissue biopsy techniques making treatment decisions easier for doctors.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."