- Home

- »

- Consumer F&B

- »

-

Breakfast Cereal Market Size, Share & Growth Report, 2030GVR Report cover

![Breakfast Cereal Market Size, Share & Trends Report]()

Breakfast Cereal Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Hot Cereals, and Ready-to-Eat), By Distribution Channel (Supermarkets & Hypermarkets, Convenience Stores, E-commerce), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-111-5

- Number of Report Pages: 108

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Breakfast Cereal Market Summary

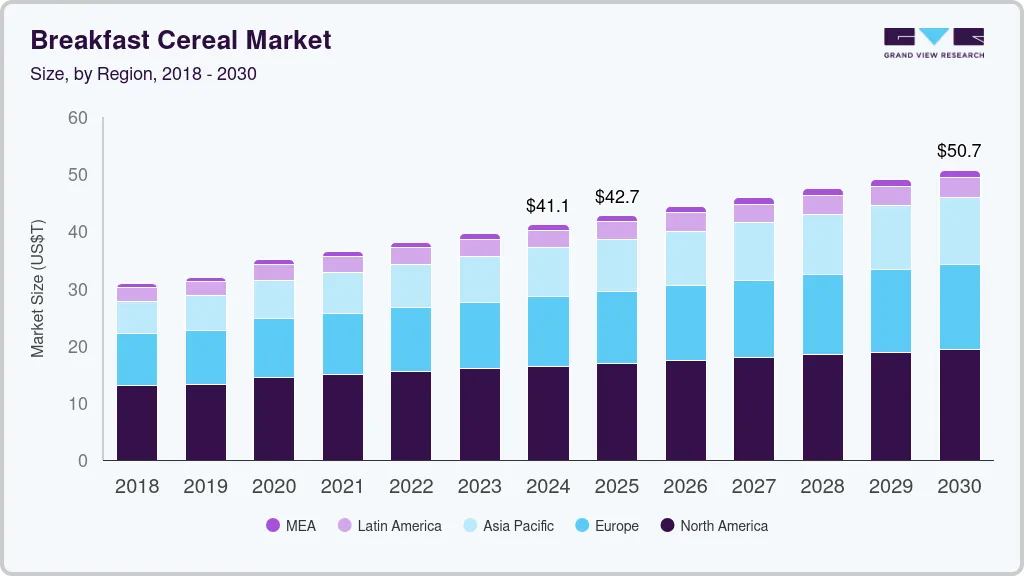

The global breakfast cereal market size was estimated at USD 41.12 billion in 2024 and is projected to reach USD 50.66 billion by 2030, growing at a CAGR of 3.5% from 2025 to 2030. Consumers are favoring nutrient-rich cereals with health benefits, driving demand for specialized dietary options and portable breakfasts, shaping market trends.

Key Market Trends & Insights

- North America dominated the breakfast cereal market with the revenue share of 40.0% in 2024.

- The U.S. breakfast cereal market holds a share of 82.4% of the North American revenue in 2024.

- By product, The ready-to-eat (RTE) segment led the market with the largest revenue share of 86.72% in 2024.

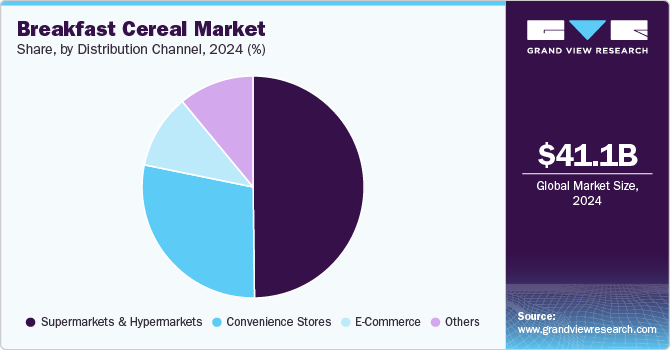

- Based on distribution channel, the supermarkets & hypermarkets segment led the market of 49.8% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 41.12 Billion

- 2030 Projected Market Size: USD 50.66 Billion

- CAGR (2025-2030): 3.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Another significant trend in the global market is the growing popularity of plant-based breakfast cereals. Veganism and vegetarianism are becoming more popular, and consumers are looking for breakfast cereals that are free from animal products. This has led to the growth of plant-based breakfast cereals made from ingredients such as oats, quinoa, and almond milk. Besides, the increasing number of single-person households is also contributing to the market growth, as these households are more likely to purchase breakfast cereals that are convenient and easy to prepare.

Consumers across the globe are increasingly looking for breakfast cereals that are easy to prepare and consume. This has led to the growth of pre-packaged breakfast cereals and on-the-go breakfast solutions. Moreover, the growing prevalence of celiac disease and other food intolerances has also fueled demand for gluten-free and specialty cereals. Rapid urbanization and growth of the middle-class population in developing economies have resulted in changing lifestyles and increased demand for easy-to-prepare and on-the-go options of breakfast cereals.

The market is witnessing a surge in demand for organic cereals, driven by increasing awareness of their health benefits and a growing preference for natural and sustainable food choices. Consumers are becoming more discerning about the ingredients in their food, seeking options that are free from artificial additives, preservatives, and genetically modified organisms (GMOs). This shift toward organic foods reflects a broader trend of prioritizing health and well-being, with consumers actively seeking food products that align with their values and contribute to a healthier lifestyle.

Product Insights

The ready-to-eat (RTE) segment led the market with the largest revenue share of 86.72% in 2024. The demand for convenient and on-the-go breakfast solutions has boosted the popularity of single-serve cereal packs and ready-to-eat granola bars, making it easier for busy individuals to grab nutritious breakfast options. Moreover, the availability of RTE cereals across various retail channels, including supermarkets and hypermarkets, convenience stores, and online platforms, has increased product accessibility and contributed to the overall market growth.

The hot cereal breakfast segment is expected to grow at the fastest CAGR of 4.7% from 2025 to 2030. The rising adoption of nutritious breakfast options is spurring the demand for multigrain cereals, including grains, seeds, and beans. The vast benefits of incorporating these organic and whole-grain-based cereals into diets are further driving the market growth. Moreover, the incorporation of exotic flavors in these breakfast cereal variants, offering better-tasting food options, is likely to augment the product demand in the kids segment over the forecast period.

Distribution Channel Insights

Based on distribution channel, the supermarkets & hypermarkets segment led the market of 49.8% in 2024. Consumers are also seeking convenience and variety, fueling the popularity of ready-to-eat cereals and multi-grain options. Supermarkets and hypermarkets play a crucial role in meeting these demands by offering convenient shopping experiences and a wide selection of breakfast cereals from both established and emerging brands. Initially, their presence was concentrated in the developed markets of North America and Europe, but now they have expanded their presence across Asia Pacific and the Middle East & Africa.

The e-commerce segment is expected to grow at the fastest CAGR of 5.5% from 2025 to 2030. The rise of online grocery delivery services like Instacart, Walmart, and Amazon Fresh has further accelerated e-commerce penetration in the global market. This has made it easier for consumers to purchase breakfast cereals online. Moreover, the proliferation of smartphones and high-speed internet access has enabled consumers to access and purchase products online, including breakfast cereals easily. This convenience factor has fueled the growth of e-commerce sales. Besides, the COVID-19 pandemic also played a significant role, as consumers sought contactless shopping options.

Regional Insights

North America dominated the breakfast cereal market with the revenue share of 40.0% in 2024. The increasing health consciousness and convenience-oriented lifestyles characterize the North American market. Consumers are increasingly seeking nutritious and convenient breakfast options that align with their busy schedules. This has led to a rise in demand for fortified breakfast cereals with high fiber content, whole grains, and added vitamins and minerals. In addition, the growing popularity of plant-based diets has fueled the demand for vegan and gluten-free breakfast cereals. Moreover, growing health concerns and increasing health issues, such as diabetes, obesity, and digestive disorders, are major factors contributing to the regional industry growth.

U.S. Breakfast Cereal Market Trends

The breakfast cereal market in the U.S. is facing intense competition due to massive product innovation from categories including energy bars, breakfast biscuits, yogurts, and fruit and nut bars. It holds a share of 82.4% of the North American revenue in 2024. While traditional breakfast cereals remain popular, particularly among families with children, there is a rising demand for healthier and more innovative options. This includes cereals with added protein, fiber, and whole grains, catering to the active lifestyle and health-conscious consumers. For instance, in April 2023, Bob's Red Mill Natural Foods, Inc. launched protein oats, made with whole grain rolled protein oats. These high-protein oats have no added protein powder and are grown from a special conventionally bred variety that contains up to 60 percent more protein than regular oats. They are also non-GMO project verified and gluten-free. Furthermore, the trend towards convenient and on-the-go breakfast options has led to increased demand for ready-to-eat breakfast cereals, particularly single-serving pouches and snack-sized boxes.

Asia Pacific Breakfast Cereal Market Trends

The breakfast cereal market in Asia Pacific is expected to witness at the fastest CAGR of 5.3% from 2025 to 2030. The market in the Asia Pacific region is driven by factors including the rising popularity of convenience foods, the increasing workforce, and the changing lifestyles of consumers. As more people enter the workforce, they seek convenient and nutritious breakfast options that can be eaten on the go. Moreover, increasing urbanization, industrialization, the rising disposable incomes of consumers, and the growing awareness of the health benefits of breakfast cereals will further boost product consumption across the countries in the region.

The China breakfast cereal market is expected to witness at a significant CAGR of 5.2% from 2025 to 2030. The rising income and rapid urbanization in China have led to changes in consumer lifestyles, which have, in turn, promoted the shift in food consumption trends in the country. China has witnessed a significant increase in its per capita consumption of breakfast cereals in recent years. The growing urban expenditure on healthy food in the country is predicted to be a key driver of the market growth in China. The Chinese consumers of breakfast cereals are highly influenced by Western eating habits and are likely to account for a significant demand. Moreover, they are willing to spend on premium and imported products, including breakfast cereals.

The breakfast cereal market in Japan is expected to witness at a substantial CAGR of 4.7% from 2025 to 2030. The Japanese market presents a mix of traditional eating habits and evolving consumer preferences. While rice remains the cornerstone of most breakfasts, cereal has established a niche driven by factors like convenience, health consciousness, and a growing appreciation for Western breakfast options. The demand for breakfast cereals is increasingly driven by younger generations, who are more receptive to Western influences and appreciate the convenience and variety cereal offers. This is reflected in the growing popularity of granola, muesli, and other 'healthier' cereal options that cater to the rising trend of health-conscious eating.

The India breakfast cereal market is expected to witness at the fastest CAGR of 6.5% from 2025 to 2030. The increasing urbanization and the rise of nuclear families in India have created a need for convenient and time-saving breakfast options. Cereals, with their ready-to-eat format and quick preparation time, have become an attractive choice for busy individuals and families. Moreover, the growing awareness of nutrition and health has spurred demand for fortified cereals, particularly amongst health-conscious consumers. Furthermore, the growing presence of multinational brands in the Indian market has introduced a wider variety of breakfast cereals, catering to diverse consumer preferences. These brands have invested heavily in marketing and advertising campaigns, creating awareness and stimulating demand. The availability of premium and imported cereals has further expanded the market, appealing to consumers who seek unique and indulgent breakfast options.

Europe Breakfast Cereal Market

The breakfast cereal market in Europe is expected to witness at the fastest CAGR from 2025 to 2030. Increasing health consciousness and convenience-driven lifestyles are likely to be key factors for the breakfast market’s growth in Europe. Consumers are becoming more aware of the nutritional benefits of breakfast cereals, particularly their high fiber and nutrient content, which aligns with the growing demand for healthy and balanced diets. In addition, the convenience of breakfast cereals makes them an attractive option for busy individuals and families who seek quick and nutritious meal solutions. Established cereal brands are facing increasing competition from emerging brands that are capitalizing on consumer trends toward healthier and more innovative products. The growing presence of private-label brands is also putting pressure on prices and driving market consolidation. To stay competitive, cereal manufacturers are focusing on product innovation, strategic partnerships, and marketing campaigns that highlight the unique benefits of their products.

The Germany breakfast cereal market is expected to witness at a substantial CAGR of 3.3% from 2025 to 2030. While traditional breakfast cereals, like cornflakes and muesli, continue to hold their ground, the market is witnessing a growing demand for healthier and more convenient options. This shift is driven by increasing health consciousness among German consumers, who prioritize nutritional value, natural ingredients, and reduced sugar content. This has led to an upsurge in the popularity of organic, whole-grain cereals, fortified with vitamins and minerals. The demand for plant-based and gluten-free options is rising, catering to specific dietary requirements and growing concerns about food sensitivities. In addition, the rise of online shopping and home delivery services has further contributed to the convenience factor, allowing consumers to access a wide range of breakfast cereal options without leaving their homes.

The breakfast cereal market in the UK is expected to witness at a significant CAGR of 3.1% from 2025 to 2030. Health consciousness is a key driver for market growth in the U.K., with consumers increasingly seeking healthier options with lower sugar content and whole grains. This trend has led to a surge in demand for granola, muesli, and other 'better-for-you' cereals, often fortified with added nutrients and fibers. Kellogg’s Inc., Cereal Partners UK Ltd., and Weetabix Ltd. are among the major players in the UK market. Popular brands include Corn Flakes, Coco Pops, Special K, Cheerios, and Crunchy Nut.

Central & South America Breakfast Cereal Market Trends

The breakfast cereal market in the Central & South America is anticipated to grow at the fastest CAGR during the forecast period. The growing emphasis on health and wellness is driving demand for fortified cereals, with consumers seeking options rich in vitamins, minerals, and high-fiber content. This is particularly evident in markets like Brazil and Argentina, where consumers are increasingly conscious of healthy eating habits. Concerns about obesity and chronic diseases have driven consumers towards healthier food choices. Breakfast cereals are perceived as a healthier alternative to traditional high-fat and sugary breakfast options. The presence of essential vitamins and minerals, fiber, and low sodium content in many breakfast cereals has attracted health-conscious consumers. Furthermore, gluten-free and low-sugar options have emerged to cater to specific dietary needs, further boosting market growth in Central & South America.

Middle East & Africa Breakfast Cereal Market Trends

The breakfast cereal market in the Middle East & Africa is witnessing a rising trend of urbanization, leading to busier lifestyles and increased demand for convenient and time-saving breakfast options. This trend is particularly pronounced in major cities like Dubai, Cairo, and Johannesburg, where consumers are increasingly seeking ready-to-eat breakfast solutions. In addition, westernization and exposure to global food trends are driving interest in breakfast cereals, particularly among younger consumers who seek healthier and more diverse breakfast options.

Key Breakfast Cereal Company Insights

The market is characterized by dynamic competitive dynamics shaped by a combination of factors including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective and quality products. Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Companies are also focusing on raising awareness among consumers regarding the ambiguity concerning the ingredients used, while strictly adhering to international regulatory standards.

Key Breakfast Cereal Companies:

The following are the leading companies in the breakfast cereal market. These companies collectively hold the largest market share and dictate industry trends.

- Kellogg Co.

- General Mills Inc.

- Post Holdings, Inc.

- Nestlé S.A.

- PepsiCo

- Nature's Path Foods

- Calbee

- B&G Foods, Inc.

- Bob’s Red Mill Natural Foods

- Marico Limited

Recent Developments

-

In April 2024, GHOST, a lifestyle brand known for its sports nutrition products, energy drinks, dietary supplements, and apparel, entered the food category with a new high-protein cereal line. This venture was developed in collaboration with General Mills, experts in the cereal industry. The line includes GHOST PROTEIN CEREAL "PEANUT BUTTER" and GHOST PROTEIN CEREAL "MARSHMALLOW," both touted as the "Breakfast of Legends" due to their epic flavors and high protein content

-

In January 2024, Kellogg Co. ventured into the vegan space with its new Eat Your Mouth Off cereal brand, aiming to cater to the snacking habits of Gen Z shoppers. Eat Your Mouth Off, launched by the US food giant known for staples like Corn Flakes and Rice Krispies, is a plant-based, sugar-free, and protein-packed cereal. Available in two flavors, this brand was introduced as the company pivoted towards health-conscious younger consumers

-

In October 2023, The Quaker Oats Co., a subsidiary of PepsiCo, Inc., launched its first breakfast cereal under the Quaker Chewy brand: Quaker Chewy Granola. This new cereal is available in two flavors-chocolate and strawberry. Quaker Chewy Granola is made with 100% whole grains, providing 34 grams of whole grains per serving, and features a mix of granola clusters and rice crisps. Each serving also contains 5 grams of protein and is free from artificial colors, preservatives, and flavors

Breakfast Cereal Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 42.69 billion

Revenue forecast in 2030

USD 50.66 billion

Growth rate

CAGR of 3.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia & New Zealand; Brazil; and South Africa

Key companies profiled

Kellogg Co.; General Mills Inc.; Post Holdings, Inc.; Nestlé S.A.; PepsiCo.; Nature's Path Foods.; Calbee; B&G Foods, Inc.; Bob’s Red Mill Natural Foods; and Marico Limited

Customization scope

Free Report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Breakfast Cereal Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global breakfast cereal market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Hot Cereals

-

Ready-to-Eat

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global breakfast cereals market size was estimated at USD 41.12 billion in 2023 and is expected to reach USD 42.69 billion in 2025.

b. The global breakfast cereals market is expected to grow at a compounded growth rate of 3.5% from 2025 to 2030 to reach USD 50.66 billion by 2030.

b. The breakfast cereal market in North America captured a revenue share of over 40.0% in the market. The increasing health consciousness and convenience-oriented lifestyles characterize the North America breakfast cereal market. Consumers are increasingly seeking nutritious and convenient breakfast options that align with their busy schedules.

b. Some key players operating in the market include Kellogg Co., General Mills Inc., Post Holdings, Inc., Nestlé S.A., PepsiCo., Nature's Path Foods., Calbee, B&G Foods, Inc., Bob’s Red Mill Natural Foods, and Marico Limited

b. Consumers are increasingly seeking high-protein, whole-grain cereals with added benefits like fiber, probiotics, and vitamins. This shift has led to an influx of new products tailored to specific dietary needs, including gluten-free, vegan, and organic options.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.