Brazil Veterinary Vaccines Market Size, Share & Trends Analysis Report By Product (Attenuated Live Vaccines, Inactivated Vaccines), By Animal Type (Production Animal, Companion Animal), By Route Of Administration, By Distribution Channel, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-621-9

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Brazil Veterinary Vaccines Market Trends

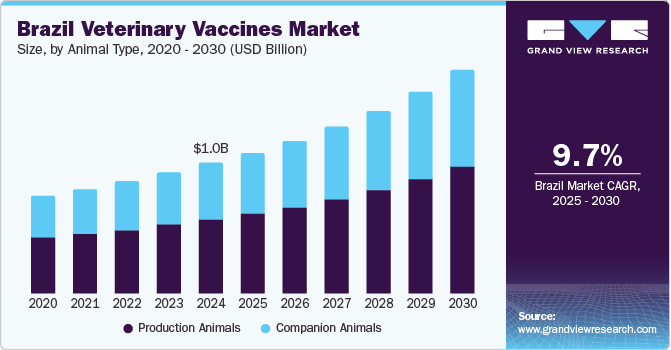

The Brazil veterinary vaccines market size was estimated at USD 1.03 billion in 2024 and is expected to grow at a CAGR of 9.70% from 2025 to 2030. The industry is primarily driven by the increasing outbreaks of cattle disease and the ever-expanding livestock population in the country. Moreover, the increasing demand for animal protein is one of the key factors responsible for the market growth. For instance, according to an article published by the OECD, Brazil was expected to consume more beef and veal meat, from 17.8 kg per person in 2022 to 18.1 kg per person in 2023. Hence, the increasing consumer focus on food safety and quality drives demand for healthy livestock, leading farmers to adopt biologics as part of standard animal health protocols.

The market in Brazil is significantly influenced by initiatives focused on the launch and development of biologics. These efforts are driven by the country's need to enhance livestock productivity, prevent zoonotic diseases, and maintain animal health, which is critical for its thriving agricultural and export-oriented economy. For instance, in January 2022, Brazilian scientists made substantial progress toward developing a vaccine for swine toxoplasmosis. The team claims to be the first in the world. The treatment makes use of recombinant proteins, a technique that is regarded as low-risk and effective. Professor João Luís Garcia of the State University of Londrina, PR, Brazil's Department of Preventive Veterinary Medicine, claims that the advancements are the outcome of extensive research and gradual global knowledge advancements.

The COVID-19 pandemic heightened awareness of zoonotic diseases, boosting interest in preventive veterinary measures, including vaccines, to mitigate disease risks in animals and humans. Brazil witnessed a rise in pet adoption during lockdowns, indirectly driving future demand for pet vaccines as more owners sought to ensure their pets' health. Moreover, Brazil’s robust livestock industry, especially poultry and cattle, continued to demand vaccines to maintain production levels and export quality, partially offsetting losses in other areas.

Increasing pet ownership and the growing pet population in Brazil are indeed creating significant opportunities for the industry in the country. With a rising number of pets, especially dogs and cats, the demand for routine vaccinations, such as rabies, distemper, and parvovirus vaccines, increases significantly. Moreover, pet owners are becoming more conscious about the health and well-being of their animals. Vaccinations are viewed as essential to prevent diseases, especially zoonotic ones, which pose risks to both pets and humans. According to an article published by USDA, in June 2024, in Brazil, there are four pets for every five individuals.

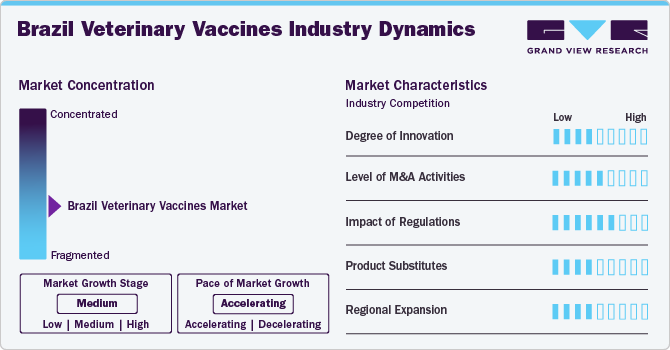

Market Concentration & Characteristics

The industry exhibits a moderate concentration. The market growth stage is medium, and the pace of the market growth is accelerating. One major factor is technological advancements in biologics. For instance, in 2023, Leish-Tec received a license in Brazil as a second-generation vaccine. A saponin adjuvant and recombinant protein A2 antigens from many Leishmania species are used in this vaccination. One month after immunization, the vaccine produces an anti-A2 IgG1 antibody, an IgG2 antibody, and a Th1 immunological response. It is also tolerated similarly to CaniLeish. This immunization lowers the risk of disease development and all-cause death in asymptomatic infected dogs and significantly inhibits the spread of Leishmania spp. by sandflies that feed on dogs that have received the anti-A2 seropositive vaccination.

The degree of innovation in the market is moderate, driven by advancements in oral vaccines in animals. Oral biologics provide substantial advantages over traditional injectable vaccines for immunizing livestock and animals due to their ease of use, high compliance, enhanced safety, and capacity to trigger mucosal immune responses and produce systemic protection against infections. There are many different kinds of oral vaccinations, such as recombinant vectored oral, oral attenuated, oral vaccines containing nanoparticles, and others.

The level of merger and acquisition activities in the market is moderate, with companies strategically acquiring or merging with others to expand their product portfolios, enhance their market presence, and gain competitive advantages. For instance, in September 2023, Mitsui & Co. acquired a 29.44% stake in Brazil's fourth-largest animal health company, Ouro Fino Saúde Animal, which serves both livestock and companion animal markets in Brazil and Latin America.

Since strict laws control the creation, production, marketing, and distribution of veterinary products, regulations have a significant impact on the market. The Brazilian regulatory authority in charge of vaccines and other veterinary products for animal usage is the Ministry of Agriculture, Livestock Production, and Food Supply (MAPA). Regulatory guidelines encourage manufacturers to invest in research and development (R&D) for novel vaccines. For instance, demand for vaccines targeting emerging diseases in poultry, swine, and cattle drives innovation.

The level of product substitutes in the market is low to moderate. For smaller-scale operations or pet owners with limited budgets, alternative solutions like antibiotics, probiotics, or non-pharmaceutical approaches might seem more cost-effective than vaccines. Moreover, in regions with limited veterinary infrastructure or access to vaccines, substitutes like traditional medicine or antimicrobial prophylaxis might be more prevalent.

Regional expansion in the market is moderate as companies seek opportunities to broaden their geographical footprint through strategic partnerships, collaborations, or establishing subsidiaries abroad. For instance, in July 2024, Biogénesis Bagó opened a new vaccine production plant in Campo Largo, Brazil, with a $30 million investment, making it the largest veterinary vaccine producer in Latin America. The facility will produce over 10 million doses annually for pets and livestock, strengthening Biogénesis Bagó's presence in Brazil’s animal health market and expanding its reach across Latin America.

Animal Type Insights

The production animals segment dominated the market with the largest revenue share in 2024. This can be due to the growing emphasis by government healthcare institutions on food safety and sustainability. About 40% of Brazil's meat exports are intended for international markets, making it one of the world's leading producers of beef and poultry, according to the Food and Agriculture Organization (FAO). Improving livestock productivity is crucial as the demand for animal products increases, and government regulations place a strong emphasis on increasing the output of animal healthcare to guarantee sustainability over the long run. Moreover, the large population of cattle, swine, and poultry in Brazil creates substantial demand for vaccines to prevent infectious diseases and improve overall herd immunity. As a leading exporter of meat products, Brazil adheres to stringent international health regulations, emphasizing the importance of disease prevention through vaccination.

The companion animal segment is anticipated to grow lucratively during the forecast period due to increased pet ownership, rising awareness, and demand for efficient animal care. The surge in companion animal ownership is mostly driven by health advantages, with pets playing an important part in improving their owners' mental and emotional well-being. Furthermore, rising urbanization and rising disposable income are responsible for a notable increase in the ownership of companion animals in both the developed and developing parts of Brazil. For example, a 2023 survey conducted by the Brazilian Institute of Geography and Statistics (IBGE) found that 40% of households in Brazil own at least one pet, and there are over 149 million pets in the country. Additionally, as more pet owners view their animals as members of the family, pet humanization is growing in popularity. As pets are incorporated into everyday routines more and more, this has increased demand for animal vaccines and medicines.

Product Insights

The attenuated live vaccines segment dominated the veterinary vaccines market in Brazil. These vaccines are developed by reducing the virulence of pathogens, typically through the mutation or disruption of one or more genes, rendering the pathogen incapable of causing disease while still triggering an immune response in the host. Live attenuated vaccines are commonly used to treat anthrax, anemia, rabies, and Newcastle disease. According to the Brazilian Ministry of Agriculture, Livestock, and Supply (MAPA), over 200 million doses of vaccines, including live attenuated vaccines, were administered to livestock and poultry in Brazil in 2023. This extensive usage underscores the demand for these vaccines, especially in the poultry and cattle sectors.

Autogenous vaccines are becoming an increasingly important part of Brazil's animal health landscape, particularly for controlling disease outbreaks in specific herds or flocks. These vaccines are custom-made for individual animals or specific populations by using pathogens isolated from the animals affected by a particular outbreak. In Brazil, autogenous vaccines are particularly beneficial in the livestock sector, where diseases such as bovine respiratory disease, swine flu, and salmonella outbreaks can significantly affect production and exports. For instance, a recent study showed that the use of autogenous vaccines in Brazilian pig farms led to a reduction of swine flu-related mortality rates by up to 25%. Similarly, cattle farms in Brazil utilizing autogenous vaccines to combat respiratory diseases saw a reduction in the incidence of outbreaks by 30%, directly improving herd health and productivity.

Route of Administration Insights

The subcutaneous segment dominated the market in 2024, driven by its use in administering vaccines, hormone treatments, and biologics, especially for livestock and companion animals. In addition, with the rise in hormone treatments for growth promotion and reproduction management in cattle and poultry, the subcutaneous route has become the preferred method due to its ease of use and effectiveness. The Brazilian pet market is also contributing to the growth of the subcutaneous segment, with the increasing use of subcutaneous vaccines and biologics for conditions such as diabetes and allergic reactions in companion animals. With government support and continuous vaccine and treatment formulation advancements, the subcutaneous segment is expected to continue its upward trajectory in the Brazilian animal health market. For instance, over 150 million doses of vaccines, including those for Bovine Viral Diarrhea (BVD) and Foot-and-Mouth Disease (FMD), were administered subcutaneously in cattle alone in 2023.

The intramuscular route of administration remains a critical segment in Brazil's animal health market, particularly in livestock management for cattle, poultry, and swine. Intramuscular injections are commonly used to rapidly deliver vaccines, antibiotics, and other therapeutic agents that require fast absorption into the bloodstream. Vaccines against avian influenza and Newcastle disease are routinely administered intramuscularly to ensure quick and widespread protection across large flocks in Brazil's poultry sector.

Distribution Channel Insights

Hospital/clinic pharmacies dominated the market with a share of over 47% in 2024. Veterinary hospitals and clinics in Brazil often stock a wide range of vaccines, making them easily accessible to pet owners, farmers, and livestock producers. This improves the availability of essential vaccines for both companion animals and livestock, boosting the market demand. With more people visiting veterinary clinics and hospitals, there is a greater awareness about the benefits of vaccinations, particularly as Brazil faces outbreaks of diseases like rabies, foot-and-mouth disease, and avian influenza. Clinics help increase public knowledge about the need for preventative care, including vaccinations.

The E-commerce segment is anticipated to grow at the fastest CAGR over the forecast period. E-commerce platforms enable veterinary vaccine suppliers to reach a broader audience, including rural and remote areas of Brazil, where veterinary clinics and pharmacies may be limited. This increased accessibility helps boost sales and distribution. E-commerce enables Brazilian veterinary professionals to access international brands and products that may not be available locally, giving them a wider selection of vaccines. This is particularly valuable in Brazil, where certain regions may lack access to advanced veterinary products.

Brazil Veterinary Vaccines Company Insights

The market is characterized by competitive rivalry among existing players. The key players undertake extensive mergers and acquisitions, product portfolios, geographical expansions, and collaborative research initiatives. For instance, in April 2019, Vetoquinol SA acquired Clarion Biociências, a Brazilian veterinary laboratory, to expand its business in Brazil.

Key Brazil Veterinary Vaccines Companies:

The following are the leading companies in the brazil veterinary vaccines market. These companies collectively hold the largest market share and dictate industry trends.

- Merck & Co., Inc.

- Elanco

- Boehringer Ingelheim GmbH

- Ceva Santé Animale

- Zoetis

- Biogénesis Bagó S.A.

- Phibro Animal Health Corporation

- Ourofino Saúde Animal

- Dechra Pharmaceuticals Plc (EQT)

Recent Developments

-

In October 2024, Amlan International entered into a partnership with VetPro to distribute its mineral-based feed additives, Calibrin-Z and Varium, in Northern Brazil. This alliance aims to strengthen Amlan's market presence in Brazil's expanding animal nutrition sector by leveraging VetPro's regional expertise to promote innovative feed solutions that enhance livestock health and productivity.

-

In October 2024, DSM-Firmenich opened a new factory in Sete Lagoas, Brazil, to produce 100,000 tons of cattle supplements annually, targeting improved livestock health and productivity. This facility strengthens DSM-Firmenich’s position in Brazil’s animal health market and supports Minas Gerais' agribusiness sector with advanced digital tools for precision livestock farming.

-

In October 2018, Sumitomo Corp. entered into a strategic partnership with Ourofino Saúde Animal to expand its veterinary medicine business.

Brazil Veterinary Vaccines Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 1.11 billion |

|

Revenue forecast in 2030 |

USD 1.77 billion |

|

Growth Rate |

CAGR of 9.70% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Animal type, product, route of administration, distribution channel |

|

Key companies profiled |

Merck & Co., Inc. , Elanco , Boehringer Ingelheim International GmbH, Ceva Santé Animale, Zoetis, Dechra Pharmaceuticals Plc (EQT), Biogénesis Bagó S.A., Phibro Animal Health Corporation, Ourofino Saúde Animal |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Brazil Veterinary Vaccines Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Brazil veterinary vaccines market report on the basis of animal type, product, route of administration, and distribution channel:

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Production Animals

-

Poultry

-

Swine

-

Cattle

-

Sheep & Goats

-

Others

-

-

Companion Animals

-

Dogs

-

Cats

-

Horses

-

Others

-

-

-

By Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Attenuated Live Vaccines

-

Inactivated Vaccines

-

Subunit Vaccines

-

DNA Vaccines

-

Recombinant Vaccines

-

Autogenous Vaccines

-

-

By Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Subcutaneous

-

Intramuscular

-

Intranasal

-

-

By Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail

-

E-commerce

-

Hospital/ Clinic Pharmacies

-

Frequently Asked Questions About This Report

b. The Brazil veterinary vaccines market size was estimated at USD 1.03 billion in 2024 and is expected to reach USD 1.11 billion in 2025.

b. The Brazil veterinary vaccines market is expected to grow at a compound annual growth rate of 9.70% from 2025 to 2030 to reach USD 1.77 billion by 2030.

b. Attenuated Live Vaccines dominated the Brazil veterinary vaccines market with a share of over 36% in 2024. This is attributable to the extensive use of these vaccines in livestock.

b. Some key players operating in the Brazil veterinary vaccines market include Merck & Co., Inc. , Elanco , Boehringer Ingelheim International GmbH, Ceva Santé Animale, Zoetis, Dechra Pharmaceuticals Plc (EQT), Biogénesis Bagó S.A., Phibro Animal Health Corporation, Ourofino Saúde Animal

b. Key factors that are driving the market growth include rising mandates for vaccination to curb livestock disease outbreaks and increasing demand for livestock-related food products

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."