- Home

- »

- Animal Health

- »

-

Brazil Veterinary Artificial Insemination Market Report, 2030GVR Report cover

![Brazil Veterinary Artificial Insemination Market Size, Share & Trends Report]()

Brazil Veterinary Artificial Insemination Market (2025 - 2030) Size, Share & Trends Analysis Report By Solution (Semen, Services), By Distribution Channel (Private, Public), By Animal (Bovine, Swine), By Sector (Meat, Dairy), And Segment Forecasts

- Report ID: GVR-4-68040-381-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

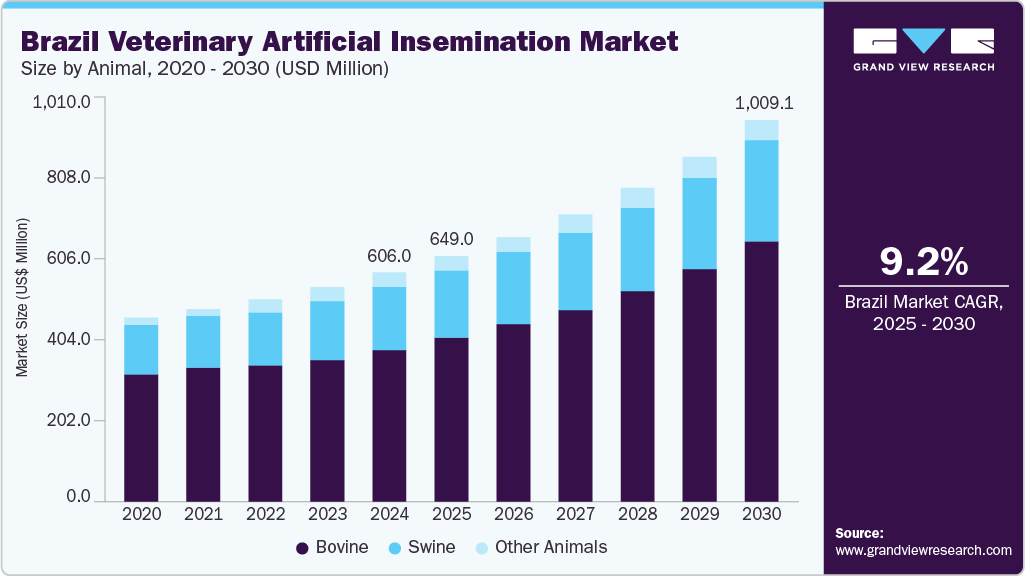

The Brazil veterinary artificial insemination market size was estimated at USD 606.0 million in 2024 and is anticipated to grow at a CAGR of 9.2% from 2025 to 2030. Key factors expected to drive the growth include the rising export activities, emerging innovative research activities, and the increasing livestock production, awareness & training initiatives, and applications of artificial intelligence. One of the important factors driving this market's growth prospects is the increasing applications of artificial intelligence in veterinary AI. Researchers and veterinary professionals from the country are attempting to adopt this disruptive technology into artificial insemination practices. For instance, according to a 2024 article published in MDPI, scientists from Brazil and the USA collaborated to explore the use of artificial intelligence in bovine breeding practices.

This research combined environmental and cow-specific factors with automated activity monitoring (AAM) data to create a predictive model that will boost cows' conception rate. Incorporating on-farm data such as parity, health history, and environmental conditions significantly improved the pregnancy prediction accuracy compared to using AAM data alone, according to the model, which compared pregnancy outcomes between two AI timings. These results imply that by assisting animal owners in selecting the most beneficial time for artificial insemination of cattle, the combination of on-farm and AAM data can greatly enhance reproductive management.

Table 1 Brazil bovine semen imports by country, 2024

Countries

Trade Value, 1000 USD

United States

19,227.80

Canada

6,609.63

Argentina

752.94

Netherlands

660.19

France

211.63

Australia

109.57

Source: WITS, Grand View Research

Moreover, Brazil is one of the largest exporters of meat types, such as beef and pork, to more than 100 countries. In the recent past, disease outbreaks in the country have affected its meat exports. Countries like China, the largest importers of Brazilian beef, stopped the imports due to disease outbreaks among the livestock population. However, exports have recently been increasing again, acting as a driving factor. For instance, according to an article published by Sylvia Schandert, in April 2025, Brazil's exports of bovine semen and embryos generated $6.11 million last year, an increase from $4.7 million the previous year, according to data from the Agriculture Ministry's Agrostat system. Embryo sales experienced the highest percentage growth in revenue, surging by 73.3% to $1.41 million, up from $818,900. In terms of volume, exports of genetic material rose to 1,450 kilograms, compared to 942 kilograms in 2023.

Similarly, according to the Brazilian Association of Artificial Insemination (Asbia) index, Brazil produced 20,539,086 doses of semen last year, representing a 6% year-over-year increase. Of this total, 833,276 doses were exported to 31 countries, showing a nearly 5% decline from the previous year. In contrast, semen imports significantly outpaced exports, reaching 5,741,702 doses, a 14% increase. In total, 26,280,788 doses were traded, indicating a 7.4% growth in the market.

Also, many other countries are increasing their meat imports from Brazil. For instance, in March 2024, Brazil and Thailand signed a new partnership to export several products, including meat, from Brazil to Thailand. Increasing exports lead to a rise in meat production, which in turn causes an increasing need for artificial insemination to increase the animal population to be slaughtered, driving the market growth.

Apart from meat exports, the country is also actively exporting semen doses to other countries to boost livestock production in those countries. For example, according to data from January 2024, the NDDB or National Dairy Development Board of India imported over 40,000 bull semen doses from Brazil to boost the milk production in native breeds of India. Additionally, in January 2024, Brazil has also initiated exports of livestock as well as bull semen to other South Asian countries like Pakistan. Such activities greatly boost the country's market, boosting the demand for livestock and semen production.

Brazil’s ongoing efforts to diversify its agricultural exports, opening 222 new markets in 2024, including 35 for bovine products, significantly drive the country’s veterinary artificial insemination (AI) market. Also, according to an article published by USDA, in February 2025, by mid-February 2025, Brazil had opened an additional seven bovine-related markets. With expanded access to countries like Nigeria, Kenya, Suriname, Bhutan, and Vietnam for products such as bovine semen and in vitro/in vivo embryos, demand for Brazilian genetic material is rising. This growth boosts domestic AI production, encourages investment in advanced reproductive technologies, and enhances Brazil’s global reputation for high-quality cattle genetics. As a result, the AI sector experiences increased competitiveness, export revenues, and rural economic development, solidifying Brazil’s position as a global leader in veterinary genetics.

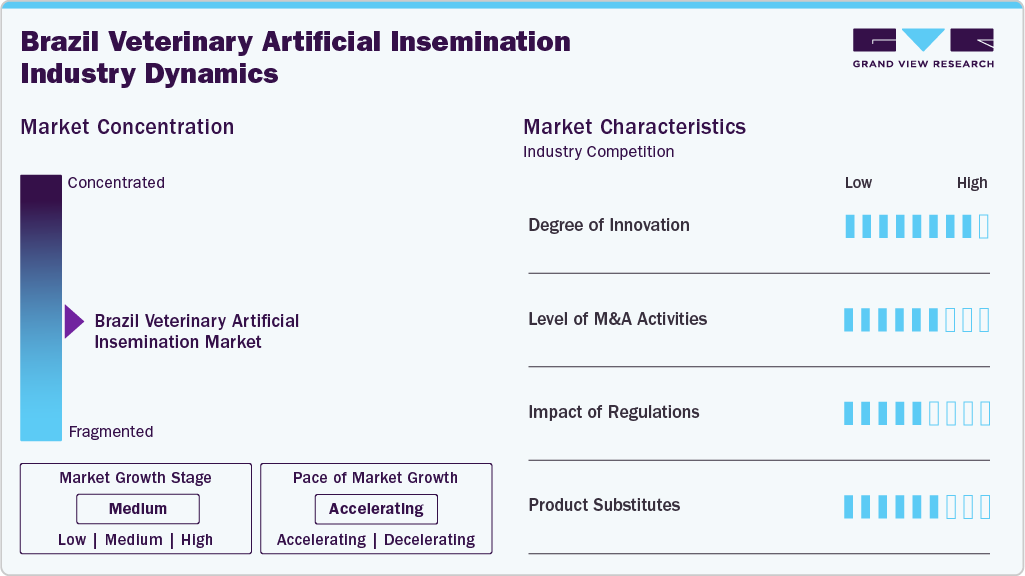

Market Concentration & Characteristics

Researchers and veterinary professionals in the Brazil veterinary artificial insemination (AI) industry are actively involved in conducting research studies to develop innovative solutions for improving the efficiency of livestock production in the country through international collaborations.

A moderate impact of merger & acquisition activities on the Brazil veterinary artificial insemination (AI) industry can be seen due to attempts by international players to enter the country’s market space. For example, in December 2023, Axiom acquired three subsidiaries of Choice Genetic: Poland, Brazil, and France. This acquisition was done with the intent to increase research and development activities in swine genetics.

The country's regulations have been undergoing constant changes, reducing their impact. Despite being one of the first countries to draft regulations for veterinary AI, even before Europe, there have been many changes in the final drafts of the regulations. This has made the guidelines too broad and stringent without specific guidance. However, the future looks lucrative for the country as these regulations are being amended to make them more flexible by taking inspiration from the EU laws.

The impact of internal product substitutes in this market is high due to the presence of several normal vs. sexed semen providers, suppliers of equipment & consumables, as well as AI service providers that compete to gain market share within their segments. External product substitutes include alternative methods of breeding, such as natural mating. The threat due to external substitutes is low as AI offers numerous advantages regarding genetic improvement, disease control, and reproductive efficiency. These benefits make AI a preferred method for many farmers and reduce the likelihood of significant substitution. Overall, the threat of product substitutes is moderate.

Solution Insights

The services segment accounted for the largest revenue share of 42.57% in 2024. This dominance can be attributed to the developing knowledge of the advantages of artificial insemination among the farmers, enabling them to breed more cows using the semen of a single bull, thus reducing the need to keep numerous bulls on the farm. This improves breeding efficiency while saving time and resources. Furthermore, farmers can maintain precise records of their herds' genetic makeup and performance thanks to artificial insemination. This information can guide breeding decisions and eventually increase the herd's productivity. Furthermore, increasing breeding program efficiency and lowering the requirement for large herds can aid in mitigating the environmental impact of the bovine industry.

The semen segment of the Brazil veterinary artificial insemination (AI) industry is anticipated to grow at the fastest CAGR of 9.88% over the forecast period due to several factors. This segment is bifurcated into normal & sexed semen. The main driving factor is the rising adoption of sexed semen among industry professionals. Some of the prominent advantages of sexed semen are as follows. Farmers can select the sex of their progeny through the use of sexed semen, which is crucial in the dairy and meat industry since female calves are more valuable than male ones. Farmers can select for particular genetic traits, like growth rate or milk production, using sexed semen, which can enhance the overall quality of their herd. Farmers may reduce the quantity of unwanted male calves by selecting the desired sex, which can save resources and lessen the operation's negative environmental effects.

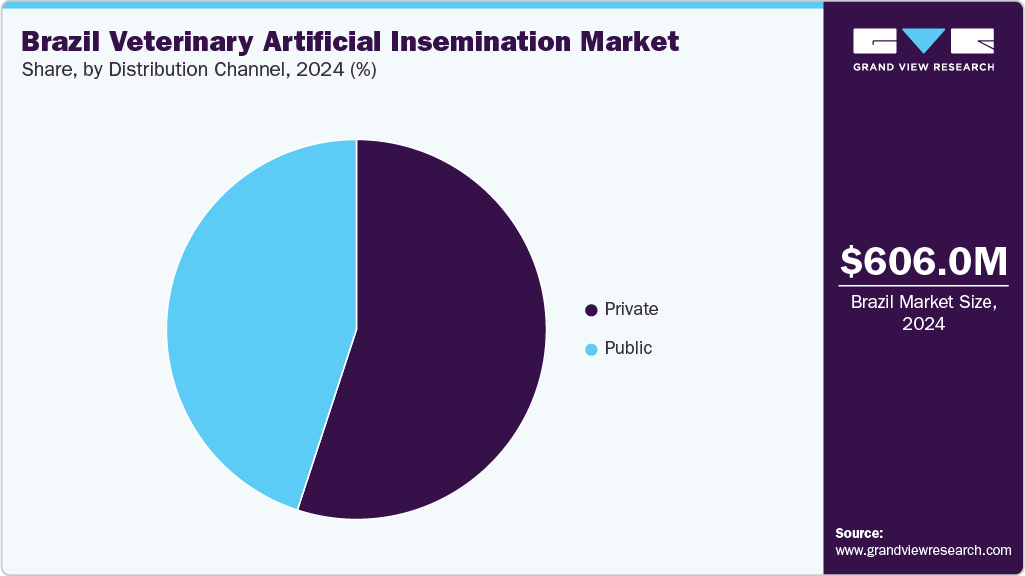

Distribution Channel Insights

The private segment dominated the Brazil veterinary artificial insemination (AI) market in terms of revenue in 2024 and is anticipate to grow at the fastest CAGR over the forecast period due to the expansion of a private sector network of enterprises and associations that provide veterinary clinics, breeders, and owners of livestock with products and services related to artificial insemination. These organizations are essential to providing end users access to genetic materials and AI technology. Additionally, private players are increasingly involved in research and developmental activities to contribute to making the current practices more efficient.

Furthermore, the private sector has invested heavily in digital platforms and cold chain logistics to strengthen its distribution channels. For instance, firms like Genex Cooperative and Reprogen offer mobile apps and online ordering systems that allow veterinarians and farmers to schedule services and receive AI products directly. Meanwhile, specialized cold storage and liquid nitrogen delivery systems ensure the safe transport of semen across Brazil’s vast geography, including rural and hard-to-reach areas. These innovations and infrastructure investments allow private firms to offer reliable, timely, and high-quality services, further reinforcing their dominance in the distribution of veterinary AI products.

Animal Insights

The bovine segment dominated the Brazil veterinary artificial insemination (AI) industry with a revenue share of 66.19% in 2024 and a CAGR of over 9.67% over the forecast period. This can be attributed to the ever-increasing use of AI in the bovine population and the country’s global dominance in beef and veal meat production. For example, as per 2024 reports from the Brazilian Association of Artificial Insemination (ASBIA), over the years, the bovine artificial inseminations in the country are on the rise, from 78.6 million in 2022 to 79.1 million in 2023. This use of AI in the bovine populace has contributed to making Brazil one of the largest producers of beef in the world.

Moreover, the 49% growth in bovine semen exports and 10% rise in production compared to the same period in 2023, as reported by the ASBIA Index, strongly drives the Brazilian veterinary artificial insemination (AI) market by signaling both increased global demand and enhanced domestic capability. The surge in exports reflects international confidence in Brazil’s bovine genetics, encouraging local producers to invest in advanced AI technologies, improve breeding practices, and expand production capacity. At the same time, the rise in production indicates a scaling up of operations within Brazil to meet both domestic and international needs. This growth cycle boosts revenue for veterinary AI companies, stimulates innovation, creates jobs in rural regions, and reinforces Brazil's global leadership in the cattle genetics industry, positioning bovine AI as a key pillar of the country's animal agriculture economy.

Sector Insights

The meat segment dominated the Brazil veterinary artificial insemination (AI) market with a share of over 61% in 2024. This can be attributed to the country’s dominance in producing different types of meat like beef, pork, and chicken. Brazil is among the top 5 meat-producing countries in the world, just behind China and the U.S. AI techniques are largely used in breeding better quality animals for meat production. For instance, according to US Department of Agriculture (USDA) data published in 2024, the top 3 beef/bovine meat-producing regions in the world are the U.S. (12.29 million MT or 20% of global production), Brazil (10.93 million MT or 18% of global production), China (7.53 million MT or 13% of global production) and the EU (6.46 million MT or 11% of global production).

The dairy segment is expected to grow with the fastest CAGR in the market over the forecast period. This is attributable to the increasing use of artificial insemination to boost dairy production in the country. For instance, according to 2024 reports by ASBIA, the adoption of AI in dairy cattle doubled from 6% in 2016 to over 12% in 2023.

Key Brazil Veterinary Artificial Insemination Company Insights

The Brazil veterinary artificial insemination market is characterized by intense competition driven by the presence of both international and domestic players offering a wide range of reproductive technologies. Key market participants such as URUS Group, TAIRANA (SEMEX group), and others dominate through robust distribution networks, extensive genetic research, and tailored breeding solutions for cattle, particularly in the dairy and beef sectors. These companies focus heavily on expanding their product portfolios with advanced semen processing technologies, sexed semen, and genomic selection tools to enhance herd productivity. Additionally, strategic collaborations with local farms, ongoing investments in biotechnology, and government support for improving livestock genetics further strengthen the competitive landscape, prompting continuous innovation and differentiation among market players.

Key Brazil Veterinary Artificial Insemination Companies:

- URUS Group

- TAIRANA (SEMEX group)

- IMV Technologies

- MINITÜB GMBH

- Genus

- CRV

- World Wide Sires, Ltd.

- Livestock Improvement Corporation Ltd (LIC)

- Flatness International

- International Protein Sires

- Semen Cardona

Recent Developments

-

In June 2024, Pon Holding announced the sale of its majority stake in Brazil’s leading veterinary AI company, Urus Group, to CVC for over Euro 600 Mn (USD 641.9 Mn)

-

In March 2024, researchers from Brazil and the U.S. successfully bred a cow through artificial insemination that produces insulin in its milk. This can prove to be very beneficial to the individuals who have diabetes, as they can directly ingest insulin-milk acquired from such cows to eliminate the need for injection administration.

-

In 2024, researchers from the Federal University of Minas Gerais (Brazil) collaborated with PIC UK to analyze over 1,500 boars using artificial intelligence to explore ways to improve their semen quality. The technology tests the anatomical structures as well as the semen of the boar and predicts the samples that have a lower AI success rate.

-

In November 2023, Semex Brazil merged its AI centre, Tairana, with Cenatte, a leading embryo facility in Brazil, to enhance its artificial insemination products & service portfolio.

-

In November 2023, the Brazilian government signed an agreement with the Cuban government for the export of dairy, beef, pork, poultry, and seafood products.

Brazil Veterinary Artificial Insemination Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 649.0 million

Revenue forecast in 2030

USD 1.0 billion

Growth rate

CAGR of 9.2% from 2025 to 2030

Actual data

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, distribution channel, animal, sector

Country scope

Brazil

Key companies profiled

URUS Group LP; TAIRANA (SEMEX group); IMV Technologies; MINITÜB GMBH; Genus; CRV; World Wide Sires, Ltd.; Livestock Improvement Corporation Ltd (LIC); Flatness International; International Protein Sires; Semen Cardona

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Brazil Veterinary Artificial Insemination Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Brazil veterinary artificial insemination market report based on solution, distribution channel, animal and sector:

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Equipment & Consumables

-

Semen

-

Normal (Conventional) Semen

-

Sexed Semen

-

-

Services

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Private

-

Public

-

-

Animal Outlook (Revenue, USD Million, 2018 - 2030)

-

Bovine

-

Swine

-

Other Animals

-

-

Sector Outlook (Revenue, USD Million, 2018 - 2030)

-

Meat

-

Dairy

-

Other Sectors

-

Frequently Asked Questions About This Report

b. The Brazil veterinary artificial insemination market size was estimated at USD 606.0 million in 2024 and is expected to reach USD 649.0 million in 2025.

b. The Brazil veterinary artificial insemination is expected to grow at a compound annual growth rate of 9.23% from 2025 to 2030 to reach USD 1.0 billion by 2030.

b. By Sector, the meat segment dominated the Brazil veterinary artificial insemination (AI) market with a share of over 61% in 2024. This can be attributed to the country’s dominance in producing different types of meat like beef, pork, and chicken. Brazil is among the top 5 meat-producing countries in the world, just behind China and the U.S. AI techniques are largely used in breeding better quality of animals for meat production.

b. Some key players operating in the Brazil veterinary artificial insemination market include URUS Group LP, TAIRANA (SEMEX group), IMV Technologies, Genus, MINITÜB GMBH,CRV, World Wide Sires, Ltd., Livestock Improvement Corporation Ltd (LIC) , Flatness International, International Protein Sires, and Semen Cardona.

b. Key factors that are driving the market growth include growing export activities, emerging innovative research activities, increasing livestock production, rising awareness & training initiatives and increasing applications of artificial intelligence.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.