- Home

- »

- Medical Devices

- »

-

Brazil Endoscopy Devices Market Size, Industry Report,2030GVR Report cover

![Brazil Endoscopy Devices Market Size, Share & Trends Report]()

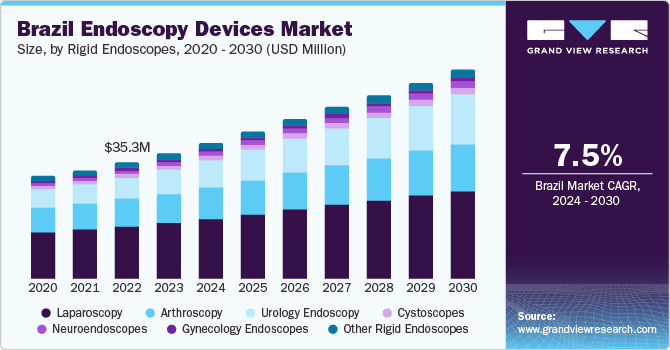

Brazil Endoscopy Devices Market Size, Share & Trends Analysis Report By Product (Endoscopes, Visualization Systems, Visualization Components, Operative Devices), By Application, By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-209-0

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Brazil Endoscopy Devices Market Trends

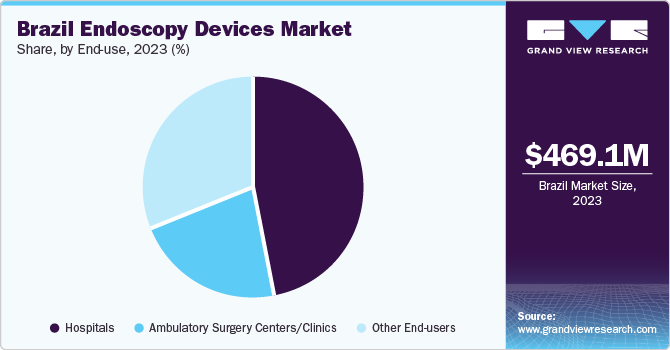

The Brazil endoscopy devices market size was valued at USD 469.1 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 7.80% from 2024 to 2030. Increasing prevalence of various gastrointestinal, cardiovascular, and other target diseases are expected to boost the market growth. Technological advancements such as digital and magnetic endoscopy devices will further propel the market growth. During COVID-19 pandemic the government had to restrict the elective procedures, furthermore, large number of endoscopy centers in Brazil accommodated COVID-19 patients during the pandemic, which impacted the market growth negatively. However, post pandemic the market witnessed significant growth as elective procedures were resumed.

The less invasive properties and affordable post and pre-procedure cost of endoscopy devices are the major factors anticipated to boost the market growth over the forecast period. Furthermore, a shift in trend to use disposable endoscopic components to minimize the procedure cost and the chance of cross-contamination is also expected to accelerate market growth over the years. Minimally invasive surgeries are economically viable alternatives to open surgeries and result in reduced risk of postoperative complications, shorter hospital stay and recovery time, and decreased blood loss during surgeries.

Technological advancements in minimally invasive surgeries are expected to drive the demand for endoscopy procedures further. Development of capsule endoscopes and robot-assisted endoscopy has increased the demand for minimally invasive endoscopic surgeries. Technological advancements in minimally invasive surgeries and introduction of new products, majorly endoscopic visualization systems in the market, are expected to propel market growth. Furthermore, the growing number of healthcare centers, such as hospitals, oncology specialty clinics, and cancer centers, is increasing in the need for endoscopy devices.

Increasing prevalence of cancer and cancer-related mortality is expected to drive the market demand for endoscopic procedures with enhanced visualization. According to the National Institute of Cancer, Brazil, the country is estimated to register 704,000 cancer cases from 2023 to 2025. In addition, the emergence of endoscopic bariatric surgeries, namely, endoscopic sleeve gastroplasty is expected to heighten market growth. This procedure uses sutures for restructuring the stomach and aids in reducing the stomach size by 70%. Although weight loss due to endoscopic bariatric surgery is not as effective as surgical bariatric procedure, endoscopic bariatric surgery results in better health outcomes. Thus, a rise in demand for these endoscopic bariatric procedures is expected to propel the demand for endoscopes and endoscopy devices.

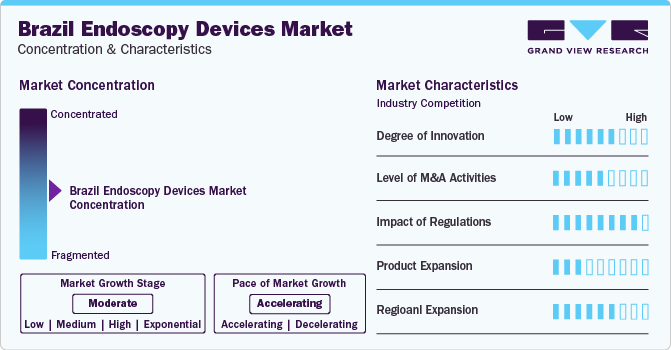

Market Concentration & Characteristics

The Brazil endoscopy devices market growth is moderate, and the pace of market growth is accelerating. The market is moderately competitive, and key players contribute to this competitive landscape with strategic initiatives, product development, research and development, and regional expansion to propel market growth.

The Brazil endoscopy devices market is characterized by a high degree of innovation owing to the increasing research and development by market participants and regulatory bodies and academic institutions. The “see-and-treat" TRUCLEAR hysteroscope by Smith & Nephew exemplifies a vital technological advancement in this market.

Market players in the Brazil endoscopy devices market are undertaking merger and acquisition activities to increase their product portfolio and aid product capabilities. For instance, in December 2023, Medtronic plc announced a partnership with Cosmo Intelligent Medical Devices to leverage their AI-integrated healthcare solutions in endoscopic care.

The medical devices regulatory framework has witnessed drastic changes since the COVID-19 pandemic. To aid the procurement of medical devices, the National Health Surveillance Agency (ANVISA) in Brazil had reduced the regulations essential for their certification and approval. With a new Medical Devices Regulation coming into force in March 2023, product safety and quality have been more emphasized, and manufacturers can expect strengthened support in incorporating emerging technologies.

Market participants strive for new features to drive product expansions, investing in heavy research and development. For instance, the innovative capsule endoscopy technology acts as a substitute to the conventional endoscope.

The Brazil endoscopy devices market has witnessed internal regional expansion and North American players’ expansion in the country. Some companies are devising business growth strategies through mergers and acquisitions to expand their business geographies. Key manufacturers in the region are collaborating with local distributors and expanding their geographical reach. For instance, in July 2022, Olympus’ venture capital fund, Olympus Innovation Ventures, made its first investment, a Series A financing of Virgo Surgical Video Solutions to utilize their minimally invasive technology and techniques in respiratory care, urology, gastroenterology, and other applications.

Product Insights

Brazil endoscopy visualization components market dominated the endoscopy devices market in 2023, accounting for a 36.50% revenue share. This is attributable to the adoption of ultra-high-definition visualization systems, which aid in the diagnosis and treatment of complex diseases such as cancer, lung disorders, urological disorders, and more. The Brazilian market may face challenges such as a lack of skilled professionals, prohibitive prices, and a lack of patient and provider awareness. In an attempt to aid the process of endoscopic visualization, Medtronic plc launched an AI-driven endoscopy module to treat colorectal cancer in August 2022.

The Brazil endoscopes market segment is anticipated to grow at the fastest CAGR over the forecast period. The segment growth is driven by the increasing adoption of minimally invasive surgical procedures and growing awareness of endoscopes for various diagnostic and therapeutic procedures. Their varied usage in cardiology, orthopedic treatment, pulmonology, and other care areas makes endoscopes a highly demanded commodity.

Application Insights

The Brazil gastrointestinal (GI) endoscopy segment dominated the market with a staggering 55.52% market share. The introduction of technologically advanced procedures by key market players is boosting the uptake of GI endoscopy. The introduction of capsule endoscopy to diagnose various GI disorders is driving the market further. New product developments by market leaders, such as Olympus Corporation and a few others, are expected to drive the market.

The urology endoscopy (cystoscopy) market segment is expected to grow at the fastest rate over the forecast period. A growing number of urology surgeries and the increasing prevalence of urologic cancers are among the factors expected to drive the demand for urology endoscopies. According to the World Cancer Research Fund, bladder cancer is the tenth most common cancer across the globe; there were approximately 550,000 new bladder cancer cases detected in 2018 globally, among which, 22.8% were females and 77.2% were males. Subsequent increase in the treatment rate is expected to boost the adoption of endoscopic devices in urologic surgeries. The growing adoption of flexible endoscopes and use of endoscopic devices to diagnose and treat urologic disorders are boosting the market growth.

End-use Insights

Hospitals led the market share with 46.73%, owing to the rapidly growing number of surgeries performed in hospitals. The segment is expected to grow significantly as hospitals are the most common setting for endoscopy procedures and they require specialized equipment and skilled healthcare professionals, Furthermore, the increasing number of hospitals and clinics and the country’s improving infrastructure, are also contributing to the hospitals segment’s dominance.

Ambulatory Surgery Centers (ASCs)/clinics are anticipated to grow fastest over the forecast period. Increase in preference for minimally invasive surgeries and shorter hospital stays are key drivers expected to boost the demand for endoscopic surgeries in ASCs. The growing trend of same-day surgery has resulted in significant cost-savings and optimum care delivery in developed economies.

Key Brazil Endoscopy Devices Company Insights

The market is fragmented, with prominent players accounting for a large percentage. Key Brazilian endoscopy devices companies include Boston Scientific Corporation; Johnson and Johnson; Medtronic plc; KARL STORZ; and Olympus Corporation. Key market players undertake varied strategic initiatives for sustained growth, such as mergers, collaborations, product development, and expansion across the country. Major players such as Olympus Innovation and Ventures are investing in startups and local players to utilize innovative technologies that reduce clinical expenditure and aid healthcare quality.

Key Brazil Endoscopy Devices Companies:

- Boston Scientific Corporation

- Johnson and Johnson

- Medtronic plc

- KARL STORZ

- Olympus Corporation

- Conmed Corporation

- Smith and Nephew PLC

- Fujifilm Holdings Corporation

- Richard Wolf GmbH

- Stryker Corporation

Recent Developments

-

In October 2022, Allurion, the world’s first gastric balloon, received approval to launch in Brazil. Through recent launches in Australia, Canada, Mexico, India, and Brazil, the company has nearly doubled its global presence with the aim of bringing cutting-edge technology for efficient GI care.

-

In April 2021, Smith & Nephew announced launch of enabling technology for INTELLO Connected Tower Solution with introduction of 4KO Arthroscopes and Laparoscopes DOUBLEFLO Inflow/Outflow Pump, which will help surgeons meet the diverse needs of the patient.

-

In November 2020, Stryker completed acquisition of Wright Medical giving it opportunities to explore in trauma and extremities care and biologics with a complementary product portfolio and customer base.

Brazil Endoscopy Devices Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 793.79 million

Growth rate

CAGR of 7.80% from 2024 to 2030

Actual data

2016 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, end-use

Country scope

Brazil

Key companies profiled

Boston Scientific Corporation; Johnson and Johnson; Medtronic plc; KARL STORZ; Olympus Corporation; Conmed Corporation; Smith and Nephew PLC; Fujifilm Holdings Corporation; Richard Wolf GmbH; Stryker Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Brazil Endoscopy Devices Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2030. For this study, Grand View Research has segmented the Brazil endoscopy devices market report based on product, application and end-use.

-

Product Outlook (Revenue, USD Million, 2016 - 2030)

-

Endoscopes

-

Rigid Endoscopes

-

Laparoscopes

-

Arthroscopes

-

Urology Endoscopes

-

Cystoscopes

-

Gynecology Endoscopes

-

Neuroendoscopes

-

Other Rigid Endoscopes

-

-

Flexible Endoscopes

-

Upper Gastrointestinal Endoscopes

-

Colonoscopes

-

Bronchoscopes

-

Sigmoidoscopes

-

Laryngoscopes

-

Pharyngoscopes

-

Duodenoscopes

-

Nasopharyngoscopes

-

Rhinoscopes

-

Other Flexible Endoscopes

-

-

Disposable Endoscopes

-

Laparoscopes

-

Arthroscopes

-

Ureteroscopes

-

Cystoscopes

-

Gynecology Endoscopes

-

Neuroendoscopes

-

Bronchoscopes

-

Hysteroscopes

-

Laryngoscopes

-

Sinuscopes

-

Otoscopes

-

Sigmoidoscopes

-

Pharyngoscopes

-

Duodenoscopes

-

Nasopharyngoscopes

-

Rhinoscopes

-

Colonoscopes

-

-

Capsule Endoscopes

-

Robot Assisted Endoscopes

-

-

Endoscopy Visualization Systems

-

Standard Definition (SD) Visualization Systems

-

2D systems

-

3D systems

-

-

High Definition (HD) Visualization Systems

-

2D systems

-

3D systems

-

-

-

Endoscopy Visualization Component

-

Camera Heads

-

Insufflators

-

Light Sources

-

High Definition Monitors

-

Suction Pumps

-

Video Processors

-

-

Operative Devices

-

Energy Systems

-

Access Devices

-

Suction & Irrigation Systems

-

Hand Instruments

-

Wound Retractors

-

Snares

-

-

-

Application Outlook (Revenue, USD Million, 2016 - 2030)

-

Gastrointestinal (GI) Endoscopy

-

Laparoscopy

-

Obstetrics/Gynecology Endoscopy

-

Arthroscopy

-

Urology Endoscopy (Cystoscopy)

-

Bronchoscopy

-

Mediastinoscopy

-

Otoscopy

-

Laryngoscopy

-

Other Applications

-

-

End-use Outlook (Revenue, USD Million, 2016 - 2030)

-

Hospitals

-

Ambulatory Surgery Centers/Clinics

-

Other End-users

-

Frequently Asked Questions About This Report

b. The Brazil endoscopy devices market size was estimated at USD 469.1 million in 2023 and is expected to reach USD 505.7 million in 2024.

b. The Brazil endoscopy devices market is expected to grow at a compound annual growth rate of 7.8% from 2024 to 2030 to reach USD 793.79 million by 2030.

b. Endoscopy visualization systems dominated the Brazil endoscopy devices market with a share of 36.5% in 2023. This is attributable to the increasing preference for HD visualization systems by medical professionals in the diagnosis & treatment of complex diseases.

b. Some key players operating in the Brazil endoscopy devices market include Boston Scientific Corporation; Johnson and Johnson; Medtronic plc; KARL STORZ; Olympus Corporation; Conmed Corporation; Smith and Nephew PLC; Fujifilm Holdings Corporation; Richard Wolf GmbH; Stryker Corporation

b. Key factors that are driving the Brazil endoscopy devices market growth include a significant increase in the prevalence of age-related diseases, a rise in demand for endoscopy devices in diagnostic & therapeutic procedures, and increasing adoption of minimally invasive surgeries.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."