Brazil Animal Health Market Size, Share & Trends Analysis Report By Animal Type (Production, Companion), By Product (Pharmaceuticals, Biologics), By Type Of Vaccines, By Disease, By Route Of Administration, By Distribution Channel, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-493-8

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Brazil Animal Health Market Size & Trends

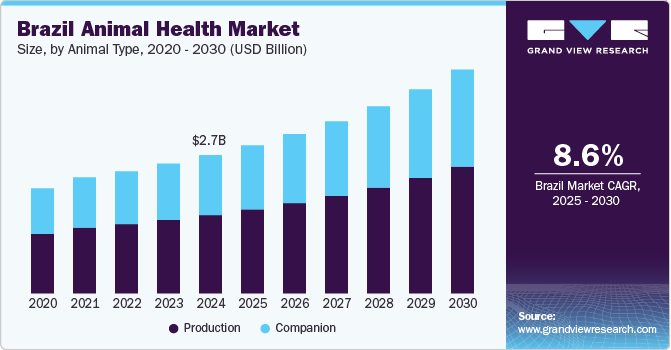

The Brazil animal health market size was estimated at USD 2.65 billion in 2024 and is expected to grow at a CAGR of 8.60% from 2025 to 2030. The increasing demand for animal protein in Brazil is a key factor driving market. As the consumption of animal products, such as meat, dairy, and eggs, rises, there is a heightened focus on maintaining the health and productivity of livestock to meet both domestic and export demands. Brazil is one of the world’s largest exporters of beef and poultry, and this status encourages farmers to adopt rigorous health management practices, including regular veterinary care, vaccination, and disease prevention measures, to ensure high-quality animal protein output. According to OECD, in 2023 Brazil's beef and veal meat consumption was projected to reach 18.1 kg per person, as compared to 17.8 kg per person in 2022. As demand for meat rises, livestock production scales up, requiring improved animal health practices to ensure meat quality and safety standards.

According to an article published by Global Ag Media, in December 2023, the director of animal health, Eduardo de Azevedo, declared at the 3rd National Forum of the Strategic Plan of the National Surveillance Program for Foot-and-Mouth Disease that Brazil's Ministry of Agriculture and Livestock (Mapa) would suspend vaccination against foot-and-mouth disease (FMD) in seven additional states starting in April 2024. By expanding the areas free of foot-and-mouth disease without vaccination and establishing and maintaining sustainable conditions to guarantee the status of a nation free of the disease, the measure promotes the Strategic Plan's advancement while safeguarding Brazil's livestock heritage and producing the greatest possible benefits for everyone involved and Brazilian society. The only Brazilian states currently recognized as foot-and-mouth disease-free zones without vaccination are Rio Grande do Sul, Paraná, Acre, Rondônia, portions of Amazonas, Santa Catarina, and Mato Grosso.

Brazil is more competitive in the global meat market, especially for beef exports, owing to the suspension of the FMD vaccine, which also lowers expenses for farmers. Advanced animal health management technology and services are essential for maintaining biosecurity across areas, but this also puts more emphasis on surveillance and monitoring to stop FMD outbreaks.

According to an article published by HealthforAnimals, Telemedicine tools are widely adopted by Brazilian pet owners. Telemedicine allows pet owners to conveniently access veterinary consultations from home, which has been especially valuable in a country with vast, diverse regions and varying levels of access to veterinary care. This digital shift is broadening access to preventive health services, timely advice for pet illnesses, and post-treatment follow-ups, helping pet owners in rural and urban areas alike. In addition, the increased use of telemedicine in Brazil’s animal health market could help improve monitoring for chronic conditions, provide regular pet wellness check-ins, and potentially reduce emergency visits.

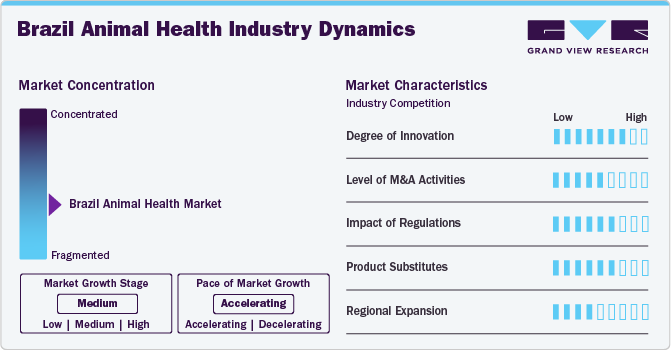

Market Concentration & Characteristics

The Brazil animal health industry exhibits a moderate concentration. The industry growth stage is medium, and the pace is accelerating. One major factor propelling the industry growth is increasing pet ownership and the growing pet population in Brazil are indeed creating significant opportunities for the animal health market in the country. According to an article published by USDA, in June 2024, In Brazil, there are four pets for every five individuals. Despite the difficult economic climate, the pet food sector which includes pet food, accessories, and medications keeps rising, positioning Brazil as the world's third largest and fastest-growing pet industry market. In addition, compared to 2022, the Brazilian pet industry's revenue, which includes pet food, accessories, and treatments, increased by 12% in 2023.

Degree of innovation is high in the industry, driven by technological advancements. Technological advancements revolutionized animal medicine by introducing innovative treatments and procedures. Novel technologies such as introduction of novel vaccines in veterinary medicine. In addition to livestock, companion animal health is also benefiting from novel vaccine technologies. Vaccines for emerging diseases in pets, are now more widely available. These innovations are crucial as Brazil sees rising pet ownership and an increasing focus on pet health.

Level of merger and acquisition activities in the industry is moderate, with companies strategically acquiring or merging with others to expand their product portfolios, enhance their market presence, and gain competitive advantages. For instance, in September 2022, Mitsui & Co. acquired a 29.44% stake in Brazil's fourth-largest animal health company, Ouro Fino Saúde Animal, which serves both livestock and companion animal markets in Brazil and Latin America. This investment aligns with Mitsui's focus on animal health amid Brazil’s rapidly growing market, driven by high demand in livestock and a rising number of companion animals.

Since strict laws control the creation, production, marketing, and distribution of veterinary products, regulations have a significant impact on the industry. The Brazilian regulatory authority in charge of regulating medicines, biologicals, and medical feed additives for animal usage is the Ministry of Agriculture, Livestock Production, and Food Supply (MAPA). The Secretary of Agricultural Defense's Livestock Products Inspection Department is in charge of MAPA's regulatory operations. Additionally, local regulatory actions are carried out by Federal Agriculture Superintendence.

Level of product substitute in the industry is moderate to high. in Brazil animal health market, generic medicines represent a low to moderate threat of substitutes. While generics offer cost-effective alternatives, branded medicines continue to dominate due to established efficacy, higher perceived quality, and strong brand trust among veterinarians and pet owners. Regulatory standards in Brazil also play a role, as they ensure high-quality controls for branded products, which can make generics appear less reliable. However, as cost pressures grow, especially in livestock and large-scale animal healthcare sectors, generics may become more attractive, gradually increasing their presence as viable alternatives.

Regional expansion in the industry is moderate as companies seek opportunities to broaden their geographical footprint through strategic partnerships, collaborations, or establishing subsidiaries abroad. For instance, in October 2024, DSM-Firmenich opened a new factory in Sete Lagoas, Brazil, to produce 100,000 tons of cattle supplements annually, targeting improved livestock health and productivity. This facility strengthens DSM-Firmenich’s position in Brazil’s animal health market and supports Minas Gerais' agribusiness sector with advanced digital tools for precision livestock farming.

Animal Type Insights

Production animals dominated the market in 2024 and is expected to grow at a CAGR of 8.59% over the forecast period. This can be attributed to the increasing focus by government healthcare organizations on food safety and sustainability. Policymakers in Brazil are actively promoting food security and large-scale food production to meet the growing demand for animal-based protein, especially as the country plays a crucial role in global food exports. For instance, according to the Food and Agriculture Organization (FAO), Brazil is one of the top beef and poultry producers, with approximately 40% of its meat exports directed to global markets. As the demand for animal products rises, improving livestock productivity becomes essential, and the government’s policies emphasize enhancing the production of animal healthcare to ensure long-term sustainability.

The companion animal segment is anticipated to grow lucratively from 2025 to 2030 due to increased companion animal ownership, awareness, and demand for efficient animal care. The rise in companion animal ownership is largely driven by the associated health benefits, with pets playing a vital role in enhancing their owners' mental and emotional well-being. In addition, a significant rise in companion animal ownership in Brazil's developed and developing regions can be attributed to increasing urbanization and growing disposable income.

Product Insights

The pharmaceutical segment accounted for the largest revenue share in 2024. This can be attributed to the increasing prevalence of food-borne diseases, brucellosis, and zoonotic diseases that are potentially hazardous to animals, thus leading to clinical urgency for the use of potent pharmaceuticals and targeted medicines. Growing expenditure on animals is expected to boost the market. The pharmaceuticals segment is further classified into parasiticides, anti-infective, anti-inflammatory, analgesics, and other pharmaceuticals. In addition, a significant rise in the incidence of animal bites results in an increased risk of disease and microbe transmission, which further propels the demand for pharmaceuticals.

The biologics segment is anticipated to grow at a CAGR of 10.02% during the forecast period. This growth can be attributed to the significant increase in the country's companion animal population, which requires long-term healthcare solutions. As more pets are adopted, particularly in urban areas, the vaccine demand for disease prevention has risen, further expanding the potential for this segment. In addition, epidemics in recent years, including outbreaks of zoonotic diseases, have caused substantial losses in the animal breeding industry in Brazil, driving the demand for vaccines as a protective measure. The Brazilian government has proactively addressed these issues with initiatives such as the National Program for the Control and Eradication of Animal Diseases, which has helped boost vaccine adoption. In addition, the relatively short duration of clinical trials and vaccine approval cycles, typically around three years in Brazil, has led to the rapid introduction of new vaccines in the market. This accelerated pace of vaccine development and approval is expected to continue supporting the biologics segment's growth in Brazil's animal health market.

Type of Vaccine Insights

The cattle vaccine segment dominated the market in 2024 and is experiencing significant growth, primarily due to the large-scale cattle population and the need to protect against infectious diseases such as foot-and-mouth disease (FMD), brucellosis, and bovine respiratory disease (BRD). Brazil, with a cattle population exceeding 230 million, is a leading global beef producer, and its cattle vaccine programs are essential to safeguard both animal health and productivity. The country's national vaccination efforts have immunized over 200 million cattle annually, leading to FMD-free status in many regions. This is vital for maintaining robust beef export markets, particularly to countries such as Japan and the European Union that demand FMD-free meat.

Advancement in the development of recombinant vaccines for cattle is expected to drive the market's growth. For instance, a study published in March 2020 in Vaccine Journal stated the high protective efficiency of the recombinant vaccines in castles. The study also highlighted that the proposed vaccine production method for botulism in cattle is efficient, safe, cost-effective, and industry friendly. This advancement in botulism vaccine technology could benefit industrial workers and cattle breeders, offering potential economic advantages.

Disease Type Insights

The cattle diseases segment in Brazil's animal health market is expanding significantly, driven by the country's status as one of the largest beef producers and exporters globally. The prevalence of diseases such as Foot-and-Mouth Disease (FMD), Bovine Respiratory Disease Complex, and Bovine Viral Diarrhea has necessitated substantial investments in vaccines and biosecurity measures. For instance, Brazil's successful efforts in controlling FMD through nationwide vaccination campaigns have played a critical role in maintaining access to key export markets, such as China and the United States. In addition, the rising incidence of parasitic infections such as bovine anaplasmosis and babesiosis, especially in tropical regions, has driven the adoption of antiparasitic treatments and integrated pest management solutions among cattle ranchers. The increasing prevalence of infectious diseases in cattle is expected to grow the segment.

The other disease segment is growing as the country’s diverse animal population, including pets, horses, and wildlife, faces various health challenges. The demand for treatments targeting diseases such as Canine Parvovirus, Leptospirosis, and heartworm disease has increased significantly. The rise in pet ownership, particularly in urban areas, has fueled a 10% annual growth in pet health products. In addition, zoonotic diseases such as Rabies and Leishmaniasis remain concerns, with over 3,000 reported cases of Leishmaniasis in dogs in 2023, leading to greater investments in vaccines and prevention programs.

Route of Administration Insights

The oral segment in the route of administration continues to dominate Brazil's animal health market in 2024, particularly in managing large-scale livestock operations. This method is preferred for its simplicity and efficiency in treating and preventing diseases in cattle, poultry, and swine, with oral medications such as dewormers, antibiotics, and vaccines widely used across these sectors. For instance, in Brazil's poultry industry, which ranks among the largest in the world, oral vaccines and medications are administered to millions of birds to ensure their health and productivity. In cattle farming, oral treatments are used for parasite control and disease prevention. Approximately 60% of veterinary pharmaceutical products in Brazil are administered orally, underscoring the popularity of this method in the livestock industry.

The injectable segment in Brazil's animal health market is witnessing significant growth. This expansion is largely driven by the increasing adoption of injectable vaccines, antibiotics, and hormone treatments across Brazil's large livestock and pet sectors. Brazil, the world's second-largest beef producer, and the largest chicken exporter, relies heavily on injectable vaccines to manage diseases such as Foot-and-Mouth Disease (FMD) and Bovine Respiratory Disease in cattle and poultry. In 2023, nearly 200 million doses of FMD vaccines were administered, reflecting a growing focus on disease prevention in the livestock industry.

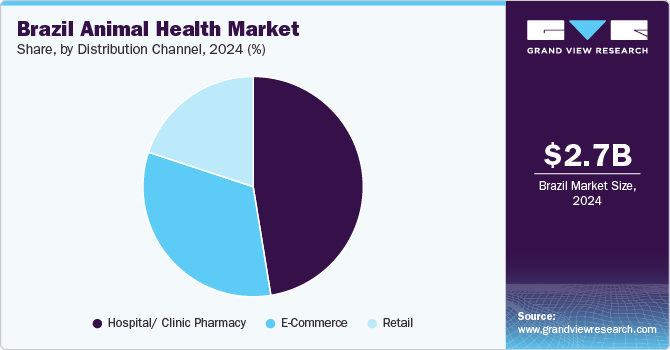

Distribution Channel Insights

The hospital/clinic pharmacy segment held the largest revenue share in 2024, driven by accessibility, affordability, and the availability of advanced veterinary treatments. This segment is expected to grow consistently as chronic diseases, including diabetes, arthritis, and heart disease, continue to rise in companion animals. As of 2022, Brazil's pet population reached approximately 140 million, with nearly 50% of households owning pets, contributing to the increased demand for veterinary care in hospitals and clinics. The growing adoption of companion pets and the subsequent rise in hospital visits, especially for treatment or readmission, have resulted in higher demand for veterinary pharmaceuticals.

E-commerce segment is expected to experience significant growth from 2025 to 2030 due to increasing convenience and accessibility for consumers. Rising pet adoption, technological advancements, and increased internet penetration drive the shift toward online purchasing. With over 160 million internet users in Brazil as of 2023 and the majority accessing the web via smartphones, the demand for e-commerce platforms that offer veterinary medicines is expected to rise. These platforms allow for the preordering of medications, ensuring consistent supply without the need to visit traditional pharmacies.

Key Brazil Animal Health Company Insights

The industry is characterized by highly competitive rivalry among existing players. Large global companies such as Zoetis, Merck Animal Health, and Boehringer Ingelheim dominate the market with a wide range of vaccines, pharmaceuticals, and diagnostics products. Their ability to introduce innovative products and leverage their global presence gives them a competitive edge. Brazilian companies like Ourofino Saúde Animal, Vetoquinol Brazil, and HIPRA Brazil also hold a significant market share. These market players undertake several strategic initiatives to boost their market presence and share, including partnerships & collaborations, mergers & acquisitions, R&D, geographic expansion, and service launches.

For instance, in June 2024, Future Cow, Brazil's first precision fermentation startup, is developing animal-free milk through fermentation technology that replicates milk proteins without cows. By using a digital blueprint of cow DNA, the company produces milk free from hormones, lactose, and antibiotics, with a significantly reduced environmental impact.

Key Brazil Animal Health Companies:

- Zoetis Inc.

- Ceva Santé Animale

- Merck & Co., Inc.

- Vetoquinol S.A.

- Boehringer Ingelheim Gmbh

- Elanco Animal Health Incorporated

- Virbac

- Phibro Animal Health Corporation

- Dechra Pharmaceuticals Plc

- Bimeda, Inc.

- Biogénesis Bagó

- Ourofino Saúde Animal

- FARMABASE

- Vetnil

- Alivira Saúde Animal

Recent Developments

-

In June 2024, Elanco Animal Health secured initial approval in Brazil for Zenrelia, an innovative pet health product, with plans to launch in Q4 2024. This approval, granted by Brazil's Ministry of Agriculture, Livestock and Food Supply, aligns with Elanco's strategy to expand in the Brazilian animal health market, where Zenrelia's effectiveness and convenience are expected to meet significant demand.

-

In October 2024, Amlan International entered into partnership with VetPro to distribute its mineral-based feed additives, Calibrin-Z and Varium, in Northern Brazil. This alliance aims to strengthen Amlan's market presence in Brazil's expanding animal nutrition sector by leveraging VetPro's regional expertise to promote innovative feed solutions that enhance livestock health and productivity.

-

In July 2024, Biogénesis Bagó opened a new vaccine production plant in Campo Largo, Brazil, with a $30 million investment, making it the largest veterinary vaccine producer in Latin America. The facility will produce over 10 million doses annually for pets and livestock, strengthening Biogénesis Bagó's presence in Brazil’s animal health market and expanding its reach across Latin America.

Brazil Animal Health Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 2.84 billion |

|

Revenue forecast in 2030 |

USD 4.29 billion |

|

Growth rate |

CAGR of 8.60% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Animal type, product, type of vaccine, disease type, route of administration, distribution channel |

|

Key companies profiled |

Zoetis Inc.; Ceva Santé Animale; Merck & Co., Inc.; Vetoquinol S.A.; Boehringer Ingelheim Gmbh; Elanco Animal Health Incorporated; Virbac; Phibro Animal Health Corporation; Dechra Pharmaceuticals Plc; Bimeda, Inc.; Biogénesis Bagó; Ourofino Saúde Animal; FARMABASE; Alivira Saúde Animal |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Brazil Animal Health Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the Brazil animal health market report based on the animal type, product, type of vaccine, disease, route of administration, and distribution channel.

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Production Animals

-

Poultry

-

Swine

-

Cattle

-

Sheep & Goats

-

Fish

-

-

Companion Animals

-

Dogs

-

Cats

-

Horses

-

Others

-

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Biologics

-

Vaccines

-

Attenuated Live Vaccines

-

Inactivated Vaccines

-

Subunit Vaccines

-

DNA Vaccines

-

Recombinant Vaccines

-

Autogenous Vaccines

-

-

Other Biologics

-

-

Pharmaceuticals

-

Parasiticides

-

Anti-infectives

-

Anti-inflammatory

-

Analgesics

-

Others

-

-

Medicinal Feed Additives

-

-

Type of Vaccine Outlook (Revenue, USD Million, 2018 - 2030)

-

Cattle Vaccine

-

Porcine Vaccine

-

Poultry Vaccine

-

Aquaculture Vaccine

-

Other Vaccines

-

-

Disease Outlook (Revenue, USD Million, 2018 - 2030)

-

Porcine Diseases

-

Poultry Diseases

-

Cattle Diseases

-

Aquaculture Diseases

-

Other Diseases

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Injectable

-

Subcutaneous

-

Intramuscular

-

-

Intravenous

-

Topical

-

Other Routes (Intranasal, Otic)

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail

-

E-Commerce

-

Hospital/ Clinic Pharmacy

-

Frequently Asked Questions About This Report

b. The Brazil animal health market size was estimated at USD 2.65 billion in 2024 and is expected to reach USD 2.84 billion in 2025.

b. The Brazil animal health market is expected to grow at a compound annual growth rate of 8.60% from 2025 to 2030 to reach USD 4.29 billion by 2030

b. Pharmaceuticals dominated the Brazil animal health market with a share of 50.26% in 2024. This is attributed to the increasing prevalence of food-borne diseases, brucellosis, and zoonotic diseases that are potentially hazardous to animals, thus leading to clinical urgency for the use of potent pharmaceuticals and targeted medicines

b. Some key players operating in the Brazil animal health market include Zoetis Inc., Ceva Santé Animale, Merck & Co., Inc., Vetoquinol S.A., Boehringer Ingelheim Gmbh, Elanco Animal Health Incorporated, Virbac, Phibro Animal Health Corporation, Dechra Pharmaceuticals Plc, Bimeda, Inc., Biogénesis Bagó, Ourofino Saúde Animal, FARMABASE, FARMABASE, Alivira Saúde Animal

b. Key factors that are driving the market growth include increasing demand for animal protein, growing uptake of pet insurance, and supportive initiatives by Governments

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."