- Home

- »

- Alcohol & Tobacco

- »

-

Brandy Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Brandy Market Size, Share & Trends Report]()

Brandy Market Size, Share & Trends Analysis Report By Product (Flavored, Regular), By Price (Economy, Premium, Luxury), By Quality, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-258-9

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Brandy Market Size & Trends

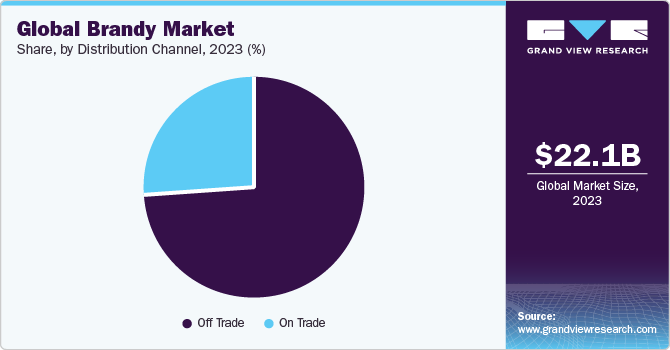

The global brandy market size was estimated at USD 22.12 billion in 2023 and is projected to grow at a CAGR of 6.8% from 2024 to 2030. The advancements in distillation techniques and the introduction of innovative ingredients have resulted in improvements in the resilience and excellence of crafted spirits, thus broadening their availability to a broader clientele. Moreover, the capability to tailor and individualize stands as a pivotal benefit of these advancements, empowering the crafting of beverages tailored to suit the preferences of individual consumers, thereby enhancing both taste and overall drinking experience.

The market is experiencing a surge in consumer demand for premium and aged spirits, reflecting a broader trend where consumers prioritize superior-quality beverages for their enriching experiences. This shift is prompting distilleries to respond with limited-edition releases, single-barrel selections, and aged variants, catering to discerning consumers who value exclusivity and sophistication. The aging process in oak barrels enhances brandy with complex flavors and a smooth finish, appealing particularly to connoisseurs.

In addition, the expansion of e-commerce facilitates access to a diverse range of brandy products globally. At the same time, a focus on sustainable practices in production and packaging resonates with environmentally conscious consumers. Diversification of flavor profiles, including infusions and flavored brandies, attracts a new wave of experimental consumers, while perceived health benefits contribute to product demand. In addition, the rise of mixology culture and cocktail bars makes brandy more accessible to younger audiences, further driving market growth.

In February 2022, Bacardi India launched Good Man, marking its inaugural venture into the domestic spirits market. This premium blended brandy represents Bacardi India's debut in both the brandy sector and the Indian-made foreign liquor (IMFL) category. Crafted from a fusion of French and Indian grape brandies, Good Man undergoes a minimum two-year aging process in oak casks, embodying a blend of tradition and innovation.

Manufacturers are continually innovating in the realm of brandy flavors, leveraging various techniques and ingredients to create unique and enticing options for consumers. From traditional fruit infusions to more adventurous combinations such as spices, herbs, and botanicals, the landscape of brandy flavors is constantly evolving.

Moreover, the younger demographics are known for their adventurous palates and willingness to experiment with new flavors and experiences. They are attracted to brandy cocktails not only for their sophisticated and complex taste but also for the sense of exploration and creativity they offer. Social media platforms further amplify this trend, with influencers and enthusiasts sharing innovative cocktail recipes and experiences, driving curiosity and engagement among peers. As a result, brandy manufacturers are strategically positioning their products to appeal to these demographics by offering versatile and flavorful options that cater to their evolving tastes and preferences, thereby fueling the growth of the cocktail culture.

For instance, in September 2022, Stella Rosa, renowned as America's top imported wine, alongside its parent company Riboli Family Wines, ventures into the spirits sector with the introduction of their premium imported flavored brandy collection such as Stella Rosa Smooth Black, Tropical Passion, and Honey Peach Brandy.

Market Concentration & Characteristics

Some product substitutes for brandy include whiskey, rum, cognac, and various liqueurs. Whiskey, whether Scotch, bourbon, or rye, offers a similar depth of flavor and complexity but with distinct characteristics based on the grains used and the production process. Rum provides a sweeter alternative, often with tropical fruit and spice notes. Cognac, while technically a type of brandy, offers a different flavor profile due to its specific grape varietals and aging process, with a smoother and more refined taste. Liqueurs such as Grand Marnier or Amaretto offer sweetness and flavor complexity, which can be used as a substitute in cocktails or enjoyed on their own. Each of these substitutes offers its own unique taste experience, catering to different preferences and occasions.

The level of mergers and acquisitions (M&A) activities in the brandy industry is currently moderate. As the technology matures and market demand grows, companies are increasingly exploring strategic partnerships, acquisitions, and collaborations to enhance their capabilities, expand their product offerings, and gain a competitive edge.

Product Insights

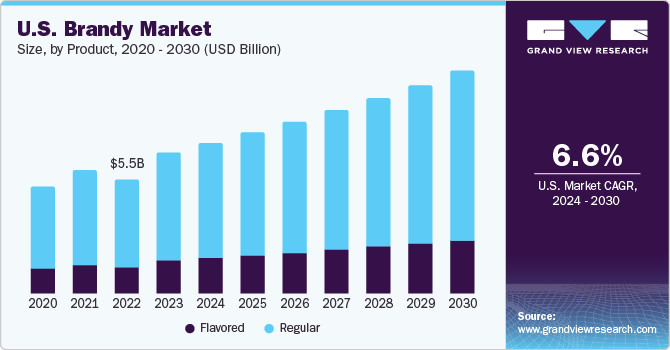

The regular/unflavored segment held the market with the largest revenue share of 76.6% in 2023. Regular flavored brandy can be enjoyed neat, on the rocks, or as a key ingredient in various cocktails. Its versatility makes it appealing to a wide range of consumers with different preferences.

The flavored segment is anticipated to grow at the fastest CAGR of 7.6% from 2024 to 2030. Flavored brandy can often be more approachable for individuals who may find the taste of traditional brandy too strong or intense. The added flavors can make the spirit more palatable to a broader audience.

Price Insights

Based on price, the economy price segment led the market with the largest revenue share of 41.7% in 2023. Economy-priced brandy offers consumers a budget-friendly option without compromising too much on taste. This affordability makes it accessible to a broader audience, including students, young professionals, and budget-conscious individuals. Despite being priced lower than premium or luxury brandies, economy-priced brandy often delivers a reasonable level of quality and flavor. Consumers perceive it as offering good value for money, making it an attractive choice for everyday enjoyment.

The premium price segment is anticipated to grow at the fastest CAGR of 7.2% from 2024 to 2030. Many premium brandies are aged for extended periods in oak barrels, allowing them to develop complex flavours, depth, and character over time. The aging process imparts nuances such as vanilla, caramel, and spice, enhancing the overall drinking experience. Premium-priced brandies are often associated with luxury, sophistication, and prestige. Consumers may be willing to pay higher prices to indulge in a premium product that reflects their discerning taste and social status.

Distribution Channel Insights

Based on distribution channel, the off-trade segment led the market with the largest revenue share of 73.9% in 2023. Off-trade channels often feature a diverse range of brandy products, including both domestic and international brands, as well as different grades and flavors. This variety allows consumers to explore different options and find brandies that suit their tastes and preferences.Off-trade outlets may provide educational materials, such as tasting notes and product descriptions, to inform consumers about different brandy varieties, production methods, and serving suggestions. This information empowers consumers to make informed purchasing decisions and explore new brandy experiences.

The on-trade segment is anticipated to grow at the fastest CAGR of 6.6% from 2024 to 2030. Brandy is a key ingredient in many classic and contemporary cocktails served in bars and restaurants. Cocktails such as the Sidecar, Brandy Alexander, and Sazerac showcase the versatility and depth of flavour that brandy brings to mixed drinks, appealing to cocktail enthusiasts and casual drinkers alike. On-trade establishments often feature a selection of premium brandies, including VSOP and XO varieties, to cater to patrons seeking a more sophisticated and indulgent drinking experience. These premium offerings may be served neat or on the rocks, allowing customers to savour the nuances of aged brandy.

Quality Insights

Based on quality, the very special (VS) segment led the market with the largest revenue share of 42.9% in 2023. VS brandy is often more affordable compared to higher-grade options like VSOP or XO. This makes it accessible to a broader range of consumers who may be looking for a quality spirit without a premium price tag. VS brandy is versatile and can be enjoyed in various ways. It can be sipped neat, on the rocks, or used as a base for cocktails and mixed drinks. Its versatility appeals to both casual drinkers and cocktail enthusiasts.

The very superior old pale (VSOP) segment is projected to grow at the fastest CAGR of 7.1% from 2024 to 2030. VSOP brandy undergoes a longer aging process than VS brandy, resulting in enhanced depth, complexity, and smoothness. The extended time spent in oak barrels allows the brandy to develop richer flavours and aromas, making it more appealing to discerning drinkers. The designation of "Very Superior Old Pale" signifies a higher level of quality and craftsmanship. VSOP brandy is often crafted using premium ingredients and traditional production methods, resulting in a superior tasting experience.

Regional Insights

North America dominated the brandy market with a revenue share of 38.1% in 2023. North America is home to some of the world's leading technology companies and research institutions. The region has seen significant advancements in 3D printing technology, including improvements in printing speed, accuracy, and material capabilities. These advancements have made it easier and more cost-effective to produce high-quality brandy, driving adoption among manufacturers and consumers alike.

U.S. Brandy Market Trends

The brandy market in the U.S. is expected to grow at the fastest CAGR of 6.6% from 2024 to 2030. The U.S. market is witnessing growth, propelled by a complex interplay of consumer preferences, market innovations, and cultural dynamics. This shift is complemented by an adventurous palate among consumers, eager to explore brandy's diverse flavor profiles. The market is further revitalized by innovations, with distillers introducing novel flavors, aging techniques, and limited editions, alongside the resurgence of cocktail culture that embraces brandy as a key ingredient in craft cocktails. Economic growth, resulting in increased disposable income, along with a demographic shift towards younger consumers seeking authenticity and quality, further fuel the market's expansion.

Asia Pacific Brandy Market Trends

The brandy market in Asia Pacific is expected to grow at the fastest CAGR of 7.3% from 2024 to 2030. Many countries in the Asia-Pacific region, such as China, Japan, and South Korea, are major manufacturing hubs with well-established supply chains and production capabilities. This infrastructure makes it conducive for the adoption of 3D printing technology in footwear manufacturing. Companies can leverage existing manufacturing infrastructure to integrate 3D printing into their production processes, reducing costs and lead times.

Key Brandy Company Insights

The market is highly competitive, with a range of companies offering various prices. Many big players are increasing their focus on new price launches, partnerships, and expansion into new markets to compete effectively.

Key Brandy Companies:

The following are the leading companies in the brandy market. These companies collectively hold the largest market share and dictate industry trends.

- Hennessy

- Rémy Martin

- Courvoisier

- Martell

- Torres

- E&J Gallo

- Christian Brothers

- St-Rémy

- Germain-Robin

- Vecchia Romagna

Recent Developments

-

In November 2023, Tilaknagar Industries Limited (TI), a prominent Indian-Made Foreign Liquor Manufacturer (IMFL), revealed its premiumization strategy with the introduction of Mansion House Chambers Brandy, an upscale iteration of its renowned brand, Mansion House. Tilaknagar Industries, recognized as one of India's leading producers of premium brandy, aims to capitalize on this launch to expand its presence and appeal to discerning consumers seeking elevated spirits experiences

-

In October 2023, Burnt Faith, a brandy distillery, revealed its new consumer-facing cocktail bar at the brandy house located in Walthamstow, East London, adding a vibrant dimension to the Blackhorse Road Beer Mile. The cocktail menu showcases classic cocktails with a local twist, such as the Aged Negroni featuring Burnt Faith British Brandy, VRSD London Vermouth, and Select Aperitivo, along with a Sazerac made with Burnt Faith British Brandy, Rittenhouse Rye, Devils Botany Absinthe, and Peychaud’s Bitters

-

In June 2022, Milestone Brands LLC, a distinguished premium spirits company, announced its acquisition of Victoria Distillers Inc ("VDI"), a venerable artisan distillery in Canada known for crafting Empress 1908 Gin, and Azzurre Spirits Corporation, the U.S. importer of Empress 1908 Gin. This strategic move underscores Milestone Brands' commitment to expanding its portfolio and strengthening its position in the global spirits market by integrating esteemed brands with rich heritage and exceptional quality

Brandy Market Report Scope

Report Attribute

Details

Market price value in 2024

USD 23.63 billion

Revenue forecast in 2030

USD 35.16 billion

Growth rate

CAGR of 6.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, price, quality, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; UK; Spain; Italy; France; China; India; Japan; South Korea; Australia & New Zealand; Brazil; South Africa; UAE

Key companies profiled

Hennessy; Rémy Martin; Courvoisier; Martell; Torres; E&J; Gallo; Christian Brothers; St-Rémy; Germain-Robin; Vecchia Romagna

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Brandy Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global brandy market report based on product, price, quality, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Flavored

-

Regular

-

-

Price Outlook (Revenue, USD Million, 2018 - 2030)

-

Economy

-

Premium

-

Luxury

-

-

Quality Outlook (Revenue, USD Million, 2018 - 2030)

-

Very Special

-

Very Superior Ole Pale

-

Extra Old

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

On Trade

-

Bars & Restaurants

-

Pubs

-

-

Off Trade

-

Supermarkets/Hypermarkets

-

Liquor Stores

-

Online

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global brandy market size was estimated at USD 22.12 billion in 2023 and is expected to reach USD 23.63 billion in 2024.

b. The global brandy market is expected to grow at a compounded growth rate of 6.8% from 2024 to 2030 to reach USD 35.16 billion by 2030.

b. The regular/unflavored segment accounted for a share of over 76.6% of the global revenues in 2023. Regular flavored brandy can be enjoyed neat, on the rocks, or as a key ingredient in various cocktails. Its versatility makes it appealing to a wide range of consumers with different preferences.

b. Some key players operating in the market include Hennessy, Rémy Martin, Courvoisier, Martell, Torres, E&J, Gallo, Christian Brothers, St-Rémy, Germain-Robin, Vecchia Romagna

b. Key factors that are driving the market growth includes advancements in distillation techniques and the introduction of innovative ingredients have resulted in improvements in the resilience and excellence of crafted spirits, thus broadening their availability to a broader clientele.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."