Brain Imaging Devices Market Size, Share & Trends Analysis Report By Product (Devices (EEG, MRI), By Application (Epilepsy, Brain Tumor), By Modality (Fixed, Portable), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-307-3

- Number of Report Pages: 220

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Brain Imaging Devices Market Size & Trends

The global brain imaging devices market size was estimated at USD 5.26 billion in 2023 and is expected to grow at a CAGR of 8.14% from 2024 to 2030. Major factors contributing to the market growth include technological advancements, an increase in R&D activities, the rising awareness of neurodegenerative diseases, and a growing incidence of brain or neurological disorders. A major study published by The Lancet Neurology reveals that over three billion individuals globally were affected by a neurological disorder in 2021. These disorders have become the primary reason for poor health and disability worldwide. Since 1990, the total burden of disability, sickness, and early mortality, measured in disability-adjusted life years (DALYs), attributed to neurological conditions has risen by 18%.

The market growth is anticipated to be driven by the availability of various brain imaging technologies, including magnetic resonance imaging (MRI), computed tomography (CT), Magnetoencephalography (MEG), Electroencephalography (EEG), and PET scanners, which offer applications for both functional and structural imaging. Additionally, technological advancements, such as the incorporation of AI, the development of wearable brain imaging devices, and other innovations, are expected to further contribute to this growth. For instance, Hyperfine, Inc. announced the FDA approval of the world's first portable magnetic resonance brain imaging system -the Swoop system in January 2024 . They introduced the eighth generation of its AI-enhanced Swoop system software. This latest update significantly boosts the image quality produced by the Swoop system and offers major enhancements in ease of use, including a real-time assistance feature for improved accuracy in patient positioning and a streamlined process for image uploads.

“Our latest AI-powered software, the eighth generation of our proprietary software platform, embodies our commitment to supporting clinicians in critical decision-making.

Our focus on image quality with this latest software has been on the DWI sequence, which is key in stroke imaging. Since its first FDA clearance in 2020, we’ve been dedicated to continually enhancing image quality and workflow efficiencies to define best-in-class, user-centric, ultra-low field MR brain imaging.”

-Tom Teisseyre PhD, Chief Operating Officer of Hyperfine, Inc.

Several initiatives undertaken by the government for the awareness and treatment of neurological disorders are expected to contribute to market growth. For instance, in 2022, during the World Health Assembly, member countries agreed to follow a new plan called the Intersectoral global action plan on epilepsy and other neurological disorders for the years 2022-2031 (IGAP). This plan aims to focus on neurological disorders, which have not received enough attention before. The plan provides a detailed guide for countries to better prevent, identify early, treat, and help people recover from neurological disorders. IGAP outlines specific goals and steps to make treatment and support more accessible for people with these conditions, promote brain health, improve research and data collection, and use a public health approach to tackle epilepsy and other neurological disorders.

“The Intersectoral Global Action Plan 2022-2031 sets out a roadmap for countries to improve prevention, early identification, treatment and rehabilitation of neurological disorders. To achieve equity and access to quality care, we also need to invest in more research on risks to brain health, improved support for the healthcare workforce, and adequate services,”

-Dévora Kestel, Director, WHO Department of Mental Health and Substance Use.

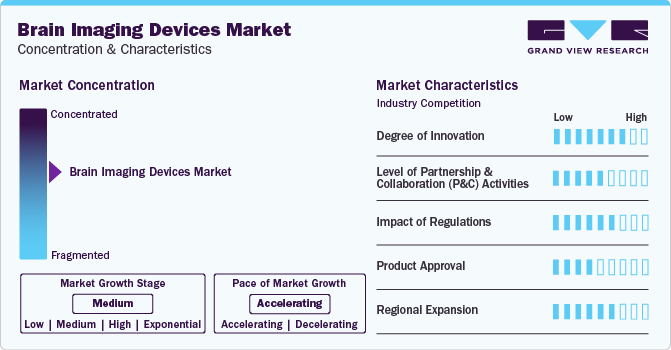

Market Concentration & Characteristics

The market is accelerating at a high pace and has seen significant innovation driven by technological advancements that have significantly enhanced the accuracy and efficiency of imaging outcomes. Moreover, the rising incidence of brain disorders is further expected to fuel the demand and development in this industry. This surge in brain-related health issues has emphasized the necessity for more advanced brain imaging devices.

Major players in the industry are continuously working to improve their product offerings to expand their customer base and gain a larger industry share. This involves upgrading their products, exploring acquisitions, obtaining government approvals, and engaging in important cooperation activities. For instance, in February 2024 , Neuro42, Inc., a company specializing in MRI and robotic solutions for diagnosing and treating brain conditions, received FDA clearance for its compact diagnostic MRI scanner. This breakthrough by Neuro42 makes it unnecessary to move patients to a specialized imaging suite, allowing for immediate diagnosis and enhancing the treatment results for individuals with serious neurological issues.

- Brain imaging technology has experienced considerable innovation due to technological advancements, positioning it at the forefront of medical diagnostics. For instance, in February 2024, the company InMed AI from India launched a new tool that uses AI to help check for serious brain injuries. This tool, called Neuroshield CT TBI, helps healthcare professionals by detecting and quantifying intracranial hemorrhage, fracture, and midline shift. It works by using by employing AI, which swiftly analyzes brain CT images and notifies doctors about any critical findings.

"Using this solution, patients can be automatically triaged for review by a neurosurgeon, and patients with normal scans can be discharged without [the] intervention of radiologists or neurosurgeons."

-Dr Deepak Agrawal, professor of Neurosurgery at All India Institute Of Medical Science Trauma Centre in New Delhi

- Companies that manufacture brain imaging devices are undertaking partnership and collaboration activities. This strategic approach seeks to improve technological capabilities, expand industry reach, and maintain competitiveness. For instance, in January 2023, NeuroLogica Corp., part of Samsung Electronics Co. Ltd., entered a collaboration with The University of Dundee in Scotland, UK, to conduct research utilizing the OmniTom Elite with Photon Counting Detector (PCD) computed tomography (CT) imaging technology.

“This collaboration with The University of Dundee, a leading university research center, opens the pathway to great synergy for accelerating the pace of innovation. It will move the clinical research of PCD CT imaging to the next level.”

-Jason Koshnitsky, Sr. Director, Global Sales and Marketing, NeuroLogica

-

Regulatory agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) are key players in guiding the development and use of medical brain imaging technologies. Their regulations are designed to ensure the safety and effectiveness of these medical devices for patients.

-

Seeking government approvals for products to stay competitive in the industry and the growing demand and adoption of medical imaging devices for neurology application is an important factor driving industry growth. For instance, in June 2023 , Ezra received FDA approval for its innovative AI technology, Ezra Flash, aimed at enhancing brain imaging processes. This technology is specifically developed to boost the quality of magnetic resonance imaging (MRI) scans.

“Our mission at Ezra is to detect cancer early for everyone in the world and I’m really excited about this new AI enabling us to make our scan more affordable. By boosting quality while reducing scan time, we’re decreasing our cost for a full body MRI by 30% and we’re passing these cost savings to our customers.”

-Emi Gal founder and CEO Ezra

- The brain imaging devices industry’s geographical reach has been expanding at a moderate to high level owing to population growth, growing healthcare expenditure, and regulatory environments. For instance, in March 2024, The Indian division of Wipro GE Healthcare, a leading entity in medical technology, is set to launch 40 new products in the near future. This initiative underscores the company's commitment to developing and producing products within India, targeting both domestic and international markets.

Product Insights

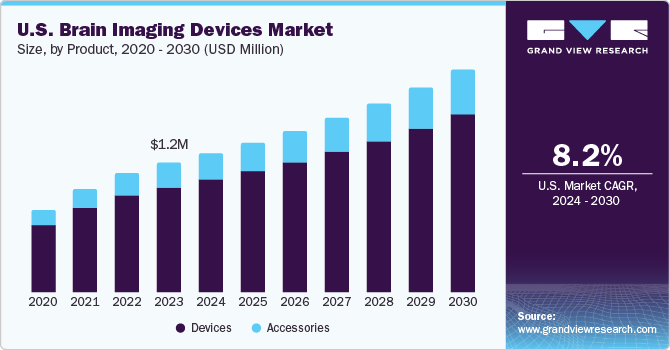

The devices segment dominated the market in 2023 and is expected to lead at the fastest CAGR from 2024 to 2030. This segment encompasses devices utilized for brain imaging and functional scanning, including CT, MRI, MEG, EEG, PET, and other equipment such as sleep monitoring devices, and electromyography devices. Among the devices segment, MRI held a significant market share in 2023 due to its characteristics, particularly in functional magnetic resonance imaging (fMRI), which detects alterations in blood flow and oxygen levels resulting from brain activity. This technique leverages the magnetic field of the scanner to manipulate the magnetic nuclei of hydrogen atoms, allowing for their measurement and conversion into images.

Furthermore, the electroencephalography devices market is expected to exhibit the fastest CAGR of 10.22% among the devices segment from 2024 to 2030. Electroencephalography devices record electrical activity in the brain and aid in diagnosing conditions such as epilepsy and sleep disorders. They also enhance neurofeedback therapies and brain-computer interfaces. Technological advancements in EEG devices are fueling the segment's growth. Modern EEG equipment is becoming more sophisticated, offering higher resolution, better portability, and user-friendly interfaces. The integration of artificial intelligence (AI) and machine learning (ML) with EEG analysis is transforming the landscape of neurological research and clinical diagnostics.

AI algorithms can process and interpret complex EEG data more quickly and accurately than traditional methods. This capability enhances the diagnostic process for conditions like epilepsy, enabling faster and more precise detection of seizures. Furthermore, AI-driven EEG analysis opens new avenues for personalized medicine, where treatments can be tailored to the individual's unique brain activity patterns. For instance, in April 2024, a team from the Creativity Research Lab at Drexel University devised an artificial intelligence method capable of accurately determining a person's brain age using electroencephalogram (EEG) scans. This innovation has the potential to facilitate early and frequent screenings for neurodegenerative conditions. The findings have been documented in the journal Frontiers in Neuroergonomics.

"Brain MRIs are expensive, and until now, brain-age estimation has been done only in neuroscience research laboratories, But my colleagues and I have developed a machine-learning technology to estimate a person's brain age using a low-cost EEG system. It can be used as a relatively inexpensive way to screen large numbers of people for vulnerability to age-related. And because of its low cost, a person can be screened at regular intervals to check for changes over time. This can help to test the effectiveness of medications and other interventions. And healthy people could use this technique to test the effects of lifestyle changes as part of an overall strategy for optimizing brain performance."

-John Kounios, Ph.D., professor in Drexel's College of Arts and Sciences and Creativity Research Lab director

The accessories segment is expected to grow at the fastest CAGR of 9.05% from 2024 to 2030. This is owing to the advancements in imaging modalities, growing demand for precise brain scans, and increased awareness of neurological disorders necessitating comprehensive diagnosis and monitoring. Essential components within this segment, such as electrodes, sensors, MRI machine coils, cables, batteries, contrast agents among other such accessories are enhancing image clarity, which is expected to serve to complement primary imaging devices. Their constant advancements and development are significant factors in boosting the overall effectiveness and efficiency of brain imaging techniques, thereby driving the growth of this segment.

Application Insights

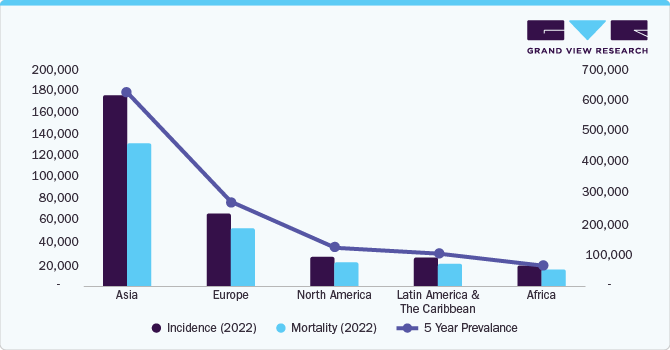

The brain tumor segment dominated the market by capturing a share of 23.38% in 2023. This is primarily attributed to the increasing prevalence of this condition. As cases of brain tumors become more common, there's an increasing demand for advanced imaging techniques to accurately detect and monitor these tumors. Consequently, the market for brain imaging technologies, particularly those specialized in detecting brain tumors, is expected to experience significant growth. For instance, according to the International Agency for research on cancer in 2022, there were about 321,731 cases of brain and central nervous system cancer globally, it was stated that this type of cancer ranked 19th among all other cancer types.

|

Continent |

Incidence (2022) |

Mortality (2022) |

5 Year Prevalence |

|

Asia |

177,139 |

132,799 |

628,694 |

|

Europe |

67,559 |

54,001 |

277,002 |

|

North America |

28,126 |

22,530 |

122,560 |

|

Latin America and the Caribbean |

26,992 |

21,314 |

99,486 |

|

Africa |

19,289 |

15,877 |

60,134 |

|

Oceania |

2,626 |

1,979 |

11,437 |

The epilepsy segment is expected to grow at the fastest CAGR of 9.29% from 2024 to 2030. Advances in imaging technologies have enhanced the ability to identify and diagnose epilepsy-related anomalies in the brain, leading to growing demand for specialized imaging equipment for this purpose. Furthermore, increasing awareness about epilepsy and its neurological implications has a greater focus on early detection and intervention, thereby leading to market expansion. Additionally, ongoing research and development efforts aimed at advancing imaging modalities for epilepsy diagnosis and monitoring are driving innovation within the market, thereby creating a broader scope and opportunities for market participants. For instance, in September 2022, Researchers at the Indian Institute of Science (IISc), in collaboration with AIIMS Rishikesh, announced an algorithm capable of identifying brain scans to detect the occurrence and type of epilepsy.

Modality Insights

Fixed brain imaging devices segment held the largest market share of 47.15% in 2023. Fixed imaging devices provide high-resolution images of the brain, facilitating precise diagnosis and treatment planning for several brain disorders. These are available in imaging centers, hospitals, and diagnostic facilities, these devices offer accessibility to both healthcare professionals and patients seeking accurate neurological assessments. Moreover, they often integrate advanced features such as multi-modal imaging and specialized software, which enhance their diagnostic accuracy and adaptability. Additionally, the rising incidence of neurological conditions has fueled the need for effective brain imaging devices, thus contributing to the expansion of the fixed imaging devices segment.

The portable imaging devices segment is expected to grow at the fastest growth rate of 8.90% over the forecast period 2024 to 2030. These devices offer an advantage over traditional fixed devices due to their mobility and flexibility, enabling healthcare professionals to conduct brain imaging procedures conveniently in various settings, including clinics, ambulances, and even remote locations. This portability enhances accessibility to imaging services, particularly in regions with limited healthcare infrastructure or during emergency situations where rapid diagnosis is crucial. The growth drivers behind these devices include the increasing prevalence of neurological disorders, the need for early and accessible diagnosis, advancements in wearable technology, and the growing interest in brain-computer interfaces (BCIs). The desire for real-time monitoring of brain health in everyday settings also significantly fuels the expansion of this market. Emerging players are continuously involved in the R&D of the new and innovative brain imaging devices to stay competitive in the market. For instance, in September 2023, EM Vision has been recognized as the top innovator in the health category of the 2023 AFR BOSS Most Innovative Companies list, a testament to their groundbreaking work in the healthcare innovation sector. EM Vision's standout innovation is its revolutionary portable brain-scanning device. This product is designed to leverage advanced imaging technologies to facilitate the rapid, non-invasive assessment of brain health and function. The device operates on the principle of electromagnetic imaging, utilizing a combination of techniques to generate detailed images of the brain's structure and activity .

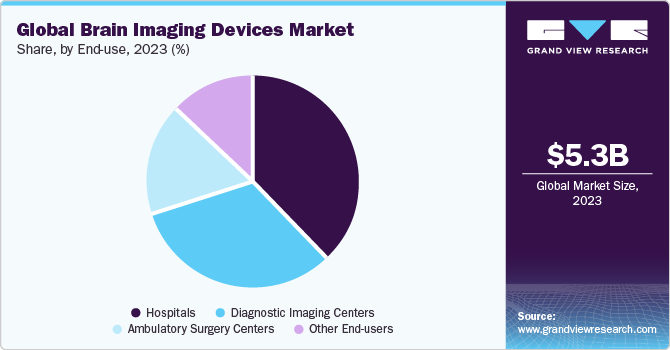

End-use Insights

The hospital segment dominated the market with a share of over 37.73% in 2023. Hospitals play a crucial role in diagnosing and treating neurological disorders, which often requires the use of advanced brain imaging technologies. These facilities have the necessary financial resources to invest in advanced equipment, enabling them to deliver comprehensive diagnostic services to patients. Additionally, hospitals employ diverse teams of specialists, such as neurologists, neurosurgeons, and radiologists, who work together to ensure accurate diagnoses and develop effective treatment strategies. The growing global prevalence of neurological conditions is further expected to fuel the demand for brain imaging devices in hospitals, emphasizing the importance of precise and timely diagnostics in managing these disorders.

Diagnostic imaging centers are expected to grow at the fastest growth rate over the forecast period. With the rising awareness of the significance of early diagnosis and treatment for brain-related disorders, there's an increasing dependence on diagnostic imaging centers for their specialized equipment and expertise. Moreover, these centers adopt the latest advancements in imaging technology, aiming to maintain advanced and high diagnostic capabilities. For instance, in March 2024, Fujifilm India announced the installation of its innovative Open MRI machine, APERTO Lucent, at the Vijaya Diagnostic Centre in Hyderabad. Also, the convenience and accessibility provided by diagnostic imaging centers are leading to the growing adoption of these facilities by patients.

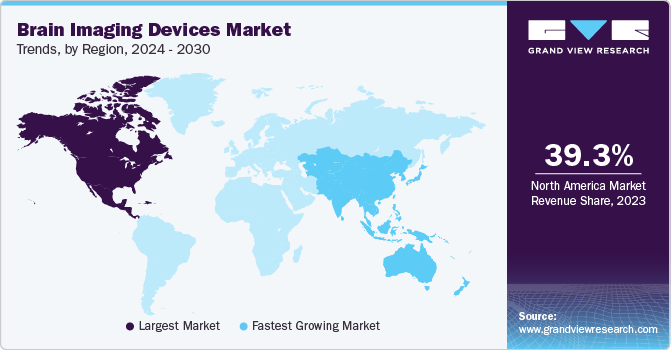

Regional Insights

North America brain imaging devices market held the largest share of 39.29% in 2023. Factors such as the presence of advanced healthcare infrastructure and substantial investments in medical research and technology are fueling the market growth. This infrastructure facilitates the uptake of advanced brain imaging technologies. Additionally, North America has the presence of many medical device manufacturers and neuroscience research institutions. These facilities provide innovation and advancement in brain imaging devices, resulting in the expansion of the market in this region.

U.S. Brain Imaging Devices Market Trends

The brain imaging devices market in the U.S. held the largest revenue share in 2023 in the North America region. The growth can be attributed to the presence of major market players in this country such as GE healthcare, Siemens Healthineers AG, and Koninklijke Philips N.V. Furthermore, various initiatives adopted by key players in the market are expected to contribute to market growth. For instance, in January 2024 , Siemens Healthineers announced the FDA approval of the MAGNETOM Cima.X 3 Tesla (3T) magnetic resonance imaging scanner.

Europe Brain Imaging Devices Market Trends

The Europe brain imaging devices marketheld a significant revenue share in 2023. The increasing prevalence of brain disorders in Europe, coupled with growing awareness about the importance of early diagnosis and intervention, is contributing to the growing demand for brain imaging devices. This demand is further accelerated by favorable reimbursement policies and government initiatives to improve access to advanced medical technologies. For instance, the Human Brain Project (HBP) was a collaborative effort spanning multiple European nations, aimed at advancing the fields of neuroscience and medicine, while also striving to develop brain-inspired information technology.

The brain imaging devices market in the UK is expected to grow owing to advancements in technology that have led to the development of more precise and efficient imaging devices, which are increasingly being adopted by healthcare facilities and the growing R&D activities in the country are further expected to boost market growth. For instance, in February 2024[ , Cerca Magnetics, a spin-out company from the University of Nottingham, received USD 2.15 million in funding. This funding is part of a larger investment of USD 48.37 million by the government in the UK's quantum sector. This investment aims to support research in wearable brain imaging technology, with a specific focus on the early detection of dementia.

The France brain imaging devices market is expected to grow from 2024 to 2030 due to the growing cases of brain diseases such as brain cancer in the country necessitating the use of brain imaging devices. For instance, according to the International Agency for cancer research, stated that in 2022, brain, and central nervous system cancer accounted for 41 cases which is estimated to rise by 2027 to 164 cases.

The brain imaging devices market in Germany is expected to grow from 2024 to 2030. This can be attributed to the rapid aging of the population, which increases the prevalence of brain disorders such as Alzheimer's disease. In addition, the country’s developed healthcare system, coupled with a highly skilled workforce and substantial healthcare spending, also contributes to this growth.

Asia Pacific Brain Imaging Devices Market Trends

The Asia Pacific brain imaging devices market is estimated to witness the fastest CAGR of 9.30% from 2024 to 2030. The increasing prevalence of brain related disorders and brain-related ailments in countries across Asia Pacific is driving the demand for advanced diagnostic technologies. Conditions such as Alzheimer's disease, Parkinson's disease, and stroke are becoming more prevalent due to factors such as aging populations, lifestyle changes, and improved disease awareness. Thus, there is a growing need for accurate and timely diagnosis, which brain imaging devices can provide.

The brain imaging devices market in China is expected to grow at a notable growth rate from 2024 to 2030, due to the presence of several market players within the country. Each of these players is employing diverse strategies aimed at sustaining competitiveness and driving market expansion.

The Japan brain imaging devices market is expected to grow from 2024 to 2030. This growth is mainly attributed to the country's focus on technological advancement and the widespread uptake of advanced solutions. For instance, in November 202 , RapidAI, a healthcare technology firm specializing in imaging analysis software, announced its achievement of Class III Shonin clearance in Japan. Alongside this regulatory milestone, RapidAI introduced a hybrid technology platform named Rapid Edge Cloud and a non-contrast CT solution for stroke identification within the Japanese market.

Latin America Brain Imaging Devices Market Trends

The brain imaging devices in the Latin America market are anticipated to undergo moderate growth throughout the forecast period. This is owing to the growing awareness and recognition of the importance of early detection and diagnosis of brain-related conditions among healthcare professionals and the general population. This increased awareness is driving the demand for advanced diagnostic technologies, including brain imaging and monitoring devices, to help in the timely identification and treatment of such conditions.

MEA Brain Imaging Devices Market Trends

The brain imaging devices market in MEA is anticipated to witness growth owing to several key factors. There is a rising prevalence of brain disorders across various countries in the MEA region. Factors such as aging populations, changing lifestyles, and increased awareness of mental health issues contribute to the increasing incidence of these conditions. As a result, there is a growing demand for early detection and treatment of brain disorders. Thus, boosting the brain imaging devices market growth.

Key Brain Imaging Devices Company Insights

The major players in the brain imaging devices market are actively enhancing their product portfolios through various strategies aimed at staying competitive and expanding their market share. This includes continuous product upgrades to incorporate the latest technological advancements, strategic collaborations, and exploring opportunities for acquisitions. Additionally, obtaining government approvals for their products is crucial to ensure compliance with regulatory standards.

GE Healthcare, Philips Healthcare, Siemens Healthineers, MEGIN, and Canon Medical Systems Corporation are among the major market players driving innovation and growth in the brain imaging devices sector. These companies are committed to developing advanced solutions that cater to the evolving needs of healthcare providers and patients.

Key Brain Imaging Devices Companies:

The following are the leading companies in the brain imaging devices market. These companies collectively hold the largest market share and dictate industry trends.

- GE Healthcare

- Philips Healthcare

- Siemens Healthineers

- Medtronic

- Compumedics Limited

- MEGIN

- CTF MEG NEURO INNOVATIONS, INC

- FieldLine Inc

- Cerca Magnetics Limited

- Advanced Brain Monitoring, Inc.

- CANON MEDICAL SYSTEMS CORPORATION

- Natus

- Magstim EGI

- Cadwell

- Nihon Kohden Corporation

- NeuroLogica Corp.

Brain Imaging Devices Market: Emerging Players/Startups

In the rapidly evolving landscape of MedTech, a new wave of startups is revolutionizing the field of brain imaging with groundbreaking devices and innovative approaches. These pioneering companies globally are leveraging cutting-edge technologies such as artificial intelligence (AI), machine learning (ML), and advanced neuroimaging techniques to transform the understanding and treatment of neurological conditions.

By improving treatments for mental health and exploring new areas in brain research, these startups are doing more than just pushing science forward; they're changing how we think about it. They're making it easier and more effective for doctors, researchers, and everyone interested to learn about and understanding the brain.

Some of the emerging players/startups in the brain imaging devices market include:

-

Openwater: A startup established in San Francisco in 2016, aims to make brain imaging more accessible and portable using novel, body-wearable devices.

-

Kernel: Kernel focuses on developing advanced brain imaging and neuroprosthetic devices. Their technology aims to facilitate better understanding of the human brain.

-

Neurable: Neurable specializes in interpreting human brain activity, and develops brain-computer interfaces that have applications in various fields, including virtual reality.

-

EMOTIV: Emotive produces EEG technology-based non-invasive brain monitoring tools suitable for use in academic research, educational purposes, and consumer technology.

-

MindMaze: It develops integrated solutions that merge virtual reality, neuroscience, and artificial intelligence to facilitate recovery from brain injuries and enhance the understanding of neural functions.

-

Cognixion: Cognixion specializes in assistive communication devices for people with disabilities, utilizing brain-computer interface technology.

-

BrainQ: BrainQ aims to identify therapeutic targets within the brain to aid in the recovery of stroke victims and those with spinal cord injuries utilizing AI algorithms.

Recent Developments

-

In March 2024, Neurophet, a company specializing in AI solutions for brain disorders, participated in the AD/PD 2024, an international event focusing on Alzheimer's, Parkinson's, and related neurological diseases. At this event, Neurophet unveils technologies aimed at treating Alzheimer's disease, including tools for analyzing side effects and predicting amyloid positivity, which are nearing commercialization.

"Neurophet's technology is expected to play a key role in clinical trials, prescription, side effect monitoring, and prognosis observation of Alzheimer's disease treatment. Neurophet will focus on advancing technology and commercializing solution for the treatment."

- Jake Junkil Been, CEO of Neurophet.

-

In March 2024, FUJIFILM India launched the Echelon Synergy MRI Machine during its CT & MRI User Conclave. Representing a significant advancement in healthcare technology, the Echelon Synergy offers unmatched performance, rapid examination times, energy efficiency, and affordability.

-

In February 2024, Philips, in collaboration with Synthetic MR, launched Smart Quant Neuro 3D for diagnosing and evaluating therapy effectiveness for brain disorders such as multiple sclerosis (MS), traumatic brain injury (TBI), and dementia. The Smart Quant Neuro 3D technology offers automated measurement of different brain tissues, decision-making support for brain diseases, tracking progression, and evaluating therapy outcomes.

“Smart Quant allows for shorter exams and exploration of quantitative metrics, which show great potential to better stratify patients with similar imaging characteristics on conventional MR sequences. It’s a fast quantitative MR technique that’s integrated into our clinical workflow, allowing us to generate multiple synthetic weighted images from a single sequence,”

-Dr. Julien Savatovsky, Neuroradiologist and Head of the Radiology Department at the Hospital Foundation Adolphe De Rothschild (Paris, France).

-

In October 2023, Positrigo initiated its expansion into the U.S. market by establishing a local subsidiary, setting the stage for the launch of NeuroLF, its specialized brain PET system. This strategic move came at a time when the demand for brain Positron Emission Tomography (PET) was surging in the United States.

-

In November 2022, Neurosteer received FDA approval for its single-channel electroencephalogram (EEG) brain monitoring platform. The company has enhanced the traditional EEG system by integrating an adhesive-backed electrode strip that connects to a compact sensor, providing a more streamlined and user-friendly solution.

Brain Imaging Devices Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 5.65 billion |

|

Revenue forecast in 2030 |

USD 9.04 billion |

|

Growth rate |

CAGR of 8.14% from 2024 to 2030 |

|

Actual period |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, modality, end-use |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

GE HealthCare; Siemens Healthineers AG; Koninklijke Philips N.V.; Medtronic; Compumedics Limited ; MEGIN; CTF MEG NEURO INNOVATIONS, INC; FieldLine Inc; Cerca Magnetics Limited; Advanced Brain Monitoring, Inc.; Canon Medical Systems Corporation; Natus; Magstim EGI; Cadwell; Nihon Kohden Corporation; NeuroLogica Corp. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Brain Imaging Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the this study, Grand View Research has segmented the global brain imaging devices market report based on product, application, modality, end-use and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Devices

-

EEG

-

MEG

-

MRI

-

CT

-

PET

-

Other Devices

-

-

Accessories

-

Electrodes

-

Sensors

-

Other Accessories

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Stroke

-

Brain Tumor

-

Traumatic brain injury (TBI)

-

Epilepsy

-

Sleep Apnea

-

Headache

-

Structural anomalies

-

Other Applications

-

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

Fixed

-

Portable

-

Wearable

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Imaging Centers

-

Ambulatory Surgery Centers

-

Other End-users

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global brain imaging devices market size was estimated at USD 5.26 billion in 2023 and is expected to reach USD 5.65 billion in 2024.

b. The global brain imaging devices market is expected to grow at a compound annual growth rate of 8.14% from 2024 to 2030 to reach USD 9.04 billion by 2030.

b. The brain tumor segment dominated the brain imaging devices market with a share of 23.38% in 2023. This is attributable to the increasing prevalence of this condition.

b. Some key players operating in the brain imaging devices market include GE HealthCare; Siemens Healthineers AG; Koninklijke Philips N.V.; Medtronic; Compumedics Limited ; MEGIN; CTF MEG NEURO INNOVATIONS, INC; FieldLine Inc; Cerca Magnetics Limited; Advanced Brain Monitoring, Inc.; Canon Medical Systems Corporation; Natus; Magstim EGI; Cadwell; Nihon Kohden Corporation; NeuroLogica Corp.

b. Key factors that are driving the brain imaging devices market growth include technological advancements, increase in R&D activities, the rising awareness of neurodegenerative diseases, and growing incidence of brain or neurological disorders.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."