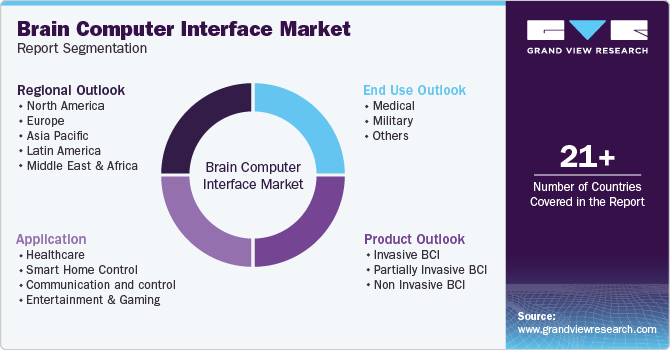

Brain Computer Interface Market Size, Share & Trends Analysis Report By Product (Invasive, Non-invasive), By Application (Healthcare, Communication & Control, Entertainment & Gaming), By End-use (Medical, Education & Research), And Segment Forecasts, 2025 - 2030

- Report ID: 978-1-68038-459-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Brain Computer Interface Market Size & Trends

The global invasive brain computer interface total addressable market was estimated at USD 160.44 billion in 2024 and is expected to grow at a CAGR of 1.49% from 2025 to 2030. Several research studies reported that invasive brain computer interface (BCI) have higher assurance of restoring motor function and communication in patients with conditions such as Amyotrophic Lateral Sclerosis (ALS), spinal cord injuries, and stroke.

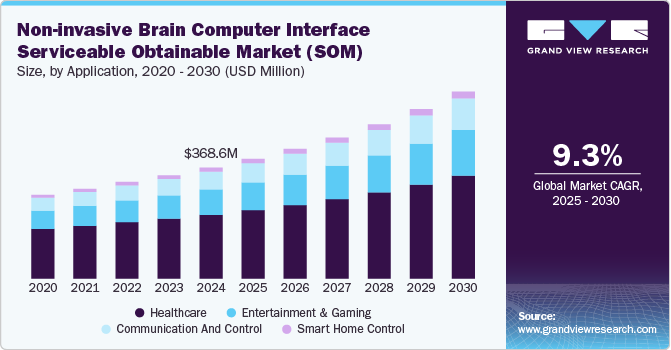

The global non-invasive brain computer interface serviceable obtainable market was estimated at USD 368.60 million in 2024 and is expected to grow at a CAGR of 9.35% from 2025 to 2030. Key market drivers include the increasing prevalence of conditions requiring neuroprosthetics devices, the rising global geriatric population base, and technological developments facilitating communication and movement in paralytic patients. Furthermore, the use of this technology in home control systems, virtual gaming, and military communication enhances the market's applicability, fueling its growth.

The COVID-19 pandemic has significantly influenced the growth of the BCI market. The pandemic accelerated the adoption of telemedicine and remote monitoring technologies, increasing interest in BCIs for healthcare applications, particularly in aiding patients with neurological conditions. In addition, the focus on advancing medical technology for better patient outcomes during the pandemic has spurred investment in innovative BCI solutions.

However, supply chain disruptions and economic uncertainties have posed challenges, potentially delaying development and deployment. Overall, COVID-19 has highlighted the importance of BCI technologies in modern healthcare, fostering both opportunities and challenges for market growth.

The increasing prevalence of neurodegenerative disorders is a significant driver of growth in the BCI market. Neurodegenerative disorders, such as Alzheimer's disease, Parkinson's disease, Amyotrophic Lateral Sclerosis (ALS), and Multiple Sclerosis (MS), are characterized by the progressive degeneration of neurons, leading to a gradual loss of function in the affected areas of the brain and nervous system.

According to the WHO report, around 82 million people will be affected by dementia by 2030 and this number will reach 152 million by 2050. This shows the potential demand for BCI in the coming years. These conditions can severely impact an individual's motor functions, communication abilities, and overall quality of life. As the global population ages, the incidence of these disorders is expected to rise, creating a pressing need for innovative solutions that can help manage symptoms, restore lost functions, and improve the lives of affected individuals.

Case Study:

-

The study involved implanting a Brain-Computer Interface (BCI), named CortiCom, on brain areas associated with speech and upper limb function in a patient with ALS, a progressive neurodegenerative disease affecting muscle and speech functions.

-

A patient, aged 62, diagnosed with ALS in 2014, faced severe swallowing and speech difficulties, making communication challenging.

-

In 2023, using the BCI and a specialized computer algorithm, the patient could translate brain signals into commands, enabling him to operate a communication board with six basic commands (left, right, up, down, enter, and back) to control smart devices such as room lights and streaming TV applications.

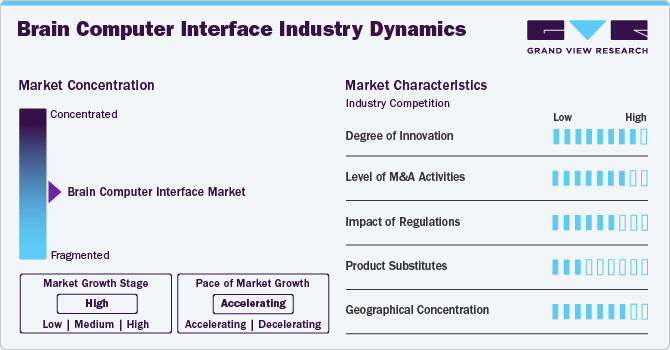

Industry Dynamics

The degree of innovation in the brain computer interface industry is high. Technological innovation is driven by use of various sensors, integration with AI and machine learning advancements to enhance the performance and accuracy. For instance, in July 2024, Synchron, a company specializing in brain-computer interfaces (BCIs) to restore functionality in individuals with motor impairments, announced the integration of OpenAI-powered generative AI into its BCI platform. This integration introduced a new chat feature designed to enhance the technology's functionality.

The M&A activities, such as mergers, acquisitions, and partnerships, enable companies to expand geographically, financially, and technologically. For instance, in May 2022, Blackrock Neurotech acquired MindX, a spatial computing software firm, to enhance the development of its advanced brain-computer interface products.

“By fusing our hardware DNA with their software DNA, we enhance our neural data analysis and enable flexibility and customization for a variety of BCI applications. Furthermore, the opportunity to broaden applications through spatial software and [augmented reality] exponentially advances our commercialization aims.”

-Blackrock co-founder and CEO

The BCI industry is regulated by various regulatory bodies, such as the FDA. For instance, in May 2021, the FDA issued a guidance document offering recommendations for Investigational Device Exemptions (IDEs) and Q-Submissions related to implanted BCI devices for patients with amputation or paralysis. The document outlines recommendations for non-clinical testing and clinical study design for these devices. As a "leapfrog" guidance, it provides early insights into emerging technologies that are anticipated to be important for public health, with the understanding that recommendations may evolve as further information emerges.

Geographical expansion enables companies to tap into new, underserved regions with varying healthcare needs and regulatory environments. This expansion allows for the adoption of BCI solutions in emerging markets. Moreover, entering new regions often involves collaborating with local healthcare providers and governments, fostering innovation and customization of ERP solutions to meet specific regional requirements. This not only increases market share but also enhances the global footprint and competitiveness of BCI providers.

Application Insights (For Invasive BCI)

Depression application segment held the largest share in the total addressable market in 2024. This growth is attributed to the growth of the depression segment due to increased initiatives by government bodies. For instance, in June 2023, the EU Commission allocated approximately USD 1.32 billion for mental health initiatives spanning the 27-member European Union, establishing mental health as a fundamental component of health policy. The brain-computer interface (BCI) sends targeted pulses that help treat depression. Moreover, the device detects brain signals and utilizes an AI-driven "mood graph" to implement precise minor adjustments in the brain, helping to lift a patient from severe depressive episodes.

Application Insights (For Non-invasive BCI)

Healthcare segment held the highest market share of 57.5% in 2024. The growth is owing to the high applicability of this technology in the treatment of sleep disorders, neurological diseases, paralytic patients, and in studying neuroscience. Moreover, technological advancement & increasing initiatives by the key industry players are further fueling the market growth. For instance, in May 2024, CorTec received FDA approval for an investigational device exemption (IDE) application for its closed-loop brain-computer interface. This IDE permits the University of Washington School of Medicine to assess CorTec’s Brain Interchange implant system in a clinical study, focusing on a novel stroke rehabilitation treatment that utilizes cortical stimulation to promote brain plasticity.

Entertainment & gaming segment is projected to witness lucrative growth over the forecast period. This growth is attributed to the increasing investment and rising awareness about the technology. Companies such as Valve and Neuralink are investing in brain-computer interface technology to develop next-generation gaming devices.

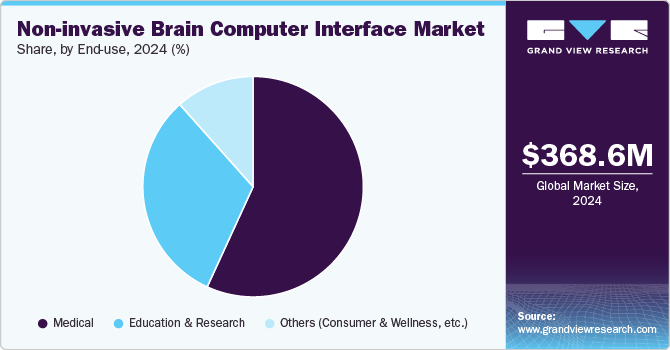

End-use Insights (For Non-invasive BCI)

Medical segment dominated the market, with the largest share in 2024. The growth is owing to its application in assisting disabled patients. BCI assists patients suffering from diseases such as paralysis, epilepsy, parkinsonism, and Alzheimer’s in moving to carry out activities independently, using an operating wheelchair, prosthetics, and various other instruments. Hence, market players and universities are developing BCIs to cater to these demands.

For instance, in August 2023, researchers from UC Berkeley and UC San Francisco announced the development of a BCI that enables a woman with severe paralysis caused by a brainstem stroke to communicate via a digital avatar. This development marks the first instance of synthesizing speech or facial expressions directly from brain signals. In addition, the system can decode these signals into text at nearly 80 words per minute, representing a significant advancement over existing commercial technologies.

Education & research segment is expected to grow at the fastest CAGR over the forecast period. Several universities and research institutions are at the forefront of BCI research, developing technologies to restore communication and mobility for individuals with neurological conditions. For instance, the University of Michigan Direct Brain Interface (UM-DBI) project transforms non-invasive BCIs into effective clinical tools for those with physical disabilities.

Regional Insights

North America brain computer interface market accounted for the largest revenue share of 48.43% in 2024, primarily due to high R&D investments and a large number of clinical trials being conducted on brain devices in this region. In addition, the rising incidence of neurodegenerative conditions such as Parkinson's, Alzheimer's, and Huntington's disease in this region is expected to propel market growth. In addition, the rising demand for immersive gaming is expected to lead to the development of technologies such as augmented brain-computer interfaces that further boost the adoption of BCI technology in this region.

U.S. Non-invasive Brain Computer Interface Market Trends

Brain computer market of the U.S. accounted for the largest regional share in 2024. One of the key factors driving the market growth is initiatives undertaken by market players and medical schools to advance BCIs and its applications. For instance, in March 2024, a team of neurosurgeons and neuroscientists from Mount Sinai's Icahn School of Medicine became the first in New York to investigate a new BCI designed to map extensive areas of the brain's surface in real-time, with a resolution hundreds of times greater than conventional arrays used in neurosurgical procedures.

Europe Non-invasive Brain Computer Interface Market Trends

The brain computer interface market in Europe is expected to grow significantly during the forecast period. The growth is attributed to the increasing strategic initiatives to create awareness and increase adoption through various events. For instance, in June 2024, ONWARD Medical N.V. will be featured in a keynote presentation at HLTH Europe, a prominent event for digital health leaders. The company's CEO, along with a trial participant, would discuss the investigational ARC-BCI Therapy, which uses artificial intelligence to enable thought-driven movement after paralysis. They would also explore the future of therapies for spinal cord injuries (SCI) and share the experience of Gert-Jan, the first human implanted with a brain-computer interface to restore walking.

Brain computer interface market in the UK had a substantial share in 2024. The growth is attributed to the increasing participation by market players in various competitions that promote designing and developing BCI solutions. For instance, in December 2021, Imperial startup from London won the global BEETL AI Challenge for EEG Transfer Learning competition, sponsored by Facebook Reality Labs, for its brain-computer interface technology.

France brain computer interface market is positively influenced by the increasing efforts to develop and adopt AI-based healthcare solutions. For instance, in May 2024, Allianz Trade and Inclusive Brains, a French startup specializing in generative AI-powered neural interfaces, partnered to develop Prometheus. This brain-machine interface converts neurophysiological data, including heart activity, brainwaves, eye movements, and facial expressions, into mental commands.

Asia Pacific Non-invasive Brain Computer Interface Market Trends

Brain computer interface market in the Asia Pacific region is expected to exhibit the highest growth over the forecast period. Significant untapped opportunities, increasing healthcare expenditure, and growing awareness amongst patients are expected to drive the demand for brain-computer interfaces in this region.

Japan brain computer interface market held a significant market share in the region in 2024. The increasing development and adoption of AI-based healthcare solutions is one of the key factors contributing to market growth. For instance, in March 2024, researchers at Kobe University developed a method to identify relevant input data, providing insights into AI algorithms and potentially advancing brain-machine interface technology. They demonstrated that an AI image recognition algorithm could predict a mouse's movement status based on brain functional imaging data.

Brain computer interface market in India is driven by the increasing initiatives by the government. For instance, the "Advancing MEG-based Brain-Computer Interface Supported Upper Limb Post-Stroke Rehabilitation" project was funded by the Department of Science and Technology (DST) of the Government of India and the UK India Education and Research Initiative (UKIERI) phase-II under the DST-UKIERI Thematic Partnership program till 2020. This international collaboration focuses on three key components: exoskeleton, brain-computer interface (BCI), and rehabilitation.

Key Brain Computer Interface Company Insights

Some major players catering to the brain computer interface market are Natus Medical Incorporated, Brain Products GmbH, Compumedics Neuroscan, EMOTIV, and Neurosky, among others. There are various small and large manufacturers offering products, resulting in intense competition among the manufacturers.

The industry players are increasing their focus on strategic partnerships such as mergers and acquisitions, new product launches & partnerships & collaborations to get maximum revenue share in this sector. In March 2024, Neurable Inc. announced a collaboration with Healthspan Digital Inc. to commercialize Neurable's brain health tools. The partnership focuses on equipping precision health and longevity clinics with advanced brain span technology to support efforts in enhancing cognitive performance and well-being. This collaboration marks a step forward in developing precision health solutions, leveraging BCI technology to address brain health optimization.

Key Brain Computer Interface Companies:

The following are the leading companies in the BCI market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- G.Tec medical engineering GmbH

- Natus Medical Incorporated

- Compumedics Neuroscan

- Brain Products GmbH

- Integra LifeSciences Corporation

- Advanced Brain Monitoring, Inc.

- EMOTIV

- NeuroSky

- ANT Neuro

- NIRx Medical Technologies, LLC

- Ripple Neuro.

- Neuroelectrics

- OpenBCI

- COGNIONICS, INC. (CGX)

- Blackrock Neurotech

- Synchron

- Neurable

Recent Developments

-

In September 2024, Synchron reported favorable outcomes from the COMMAND study, which assessed the safety and efficacy of its BCI device in six participants over a 12-month.

-

In September 2024, Synchron reported the first integration of Amazon's Alexa by a patient implanted with its brain-computer interface (BCI). The patient utilized thought-based commands to operate smart home features via the "Tap to Alexa" functionality on an Amazon Fire tablet. This technology enabled the individual to access Kindle books, control lights, manage smart devices, initiate video calls, play media, and make online purchases without using hands or voice.

-

ANT Neuro organized the 9th Graz Brain-Computer Interface Conference 2024 in September 2024 in Austria.

-

In April 2023, Blackrock Neurotech and the American Association for the Advancement of Science (AAAS) announced the first BCI art exhibit, to be showcased at AAAS headquarters in Washington, D.C. This exhibit will display works created by patients with paralysis using Blackrock's thought-to-cursor implantable BCI technology.

-

In July 2023, Lenovo collaborated with OpenBCI to develop NeuroFly using OpenBCI's Galea device and expertise.

-

In January 2023, Synchron announced that JAMA Neurology published long-term, peer-reviewed safety results from a clinical study involving 4 patients with extreme paralysis who were implanted with Synchron's first-generation Stentrode neuroprosthesis device. Developed in collaboration with Ripple LLC, this system utilized Ripple's neural sensing technology for signal acquisition, data telemetry, and signal processing.

Brain Computer Interface Market Report Scope

|

Report Attribute |

Details |

|

Invasive BCI Total Addressable Market (TAM) value in 2025 |

USD 168,265.3 million |

|

Invasive BCI Total Addressable Market (TAM) value forecast in 2030 |

USD 228,169.1 million |

|

Non-invasive BCI Market size value in 2025 |

USD 397.59 million |

|

Non-invasive BCI Revenue forecast in 2030 |

USD 621.57 million |

|

Invasive BCI Growth Rate |

CAGR of 1.49% from 2025 to 2030 |

|

Non-invasive BCI Growth Rate |

CAGR of 9.35% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; U.K.; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Medtronic; g.tec medical engineering GmbH; Natus Medical Incorporated; Compumedics Neuroscan; Brain Products GmbH; Integra LifeSciences Corporation; Advanced Brain Monitoring, Inc.; EMOTIV; NeuroSky; ANT Neuro; NIRx Medical Technologies, LLC; Ripple Neuro.; Neuroelectrics; OpenBCI; COGNIONICS, INC. (CGX); Blackrock Neurotech; Synchron; Neurable |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Brain Computer Interface Market Report Segmentation

This report forecasts revenue growth and provides at global, regional, and country levels an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global brain computer interface market report based on product, application, end use, and region:

-

Invasive Brain-Computer Interface (BCI) Total Addressable Market (TAM) Application Outlook (Revenue in USD Million; 2018 - 2030)

-

MND/ALS

-

Stroke

-

Spinal Cord Injury

-

Multiple Sclerosis Patients

-

Cerebral Palsy

-

Amputation

-

Epilepsy

-

Depression

-

Parkinson's Disease

-

-

Non Invasive BCI Serviceable Obtainable Market (SOM) Application Outlook (Revenue in USD Million; 2018 - 2030)

-

Healthcare

-

Disabilities Restoration

-

Brain Function Repair

-

-

Smart Home Control

-

Communication and control

-

Entertainment & Gaming

-

-

Non Invasive BCI Serviceable Obtainable Market (SOM) End-use Outlook (Revenue in USD Million, 2018 - 2030)

-

Medical

-

Education & Research

-

Others (Consumer & Wellness, etc.)

-

-

Non Invasive BCI Serviceable Obtainable Market (SOM) Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."