- Home

- »

- Homecare & Decor

- »

-

Boutique Hotel Market Size, Share & Trends Report, 2030GVR Report cover

![Boutique Hotel Market Size, Share & Trends Report]()

Boutique Hotel Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Luxury, Mid-Scale, Budget) By Traveler Type (Leisure Travelers, Business Travelers), By Booking Mode (Direct Booking, Travel Agents), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-433-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Boutique Hotel Market Summary

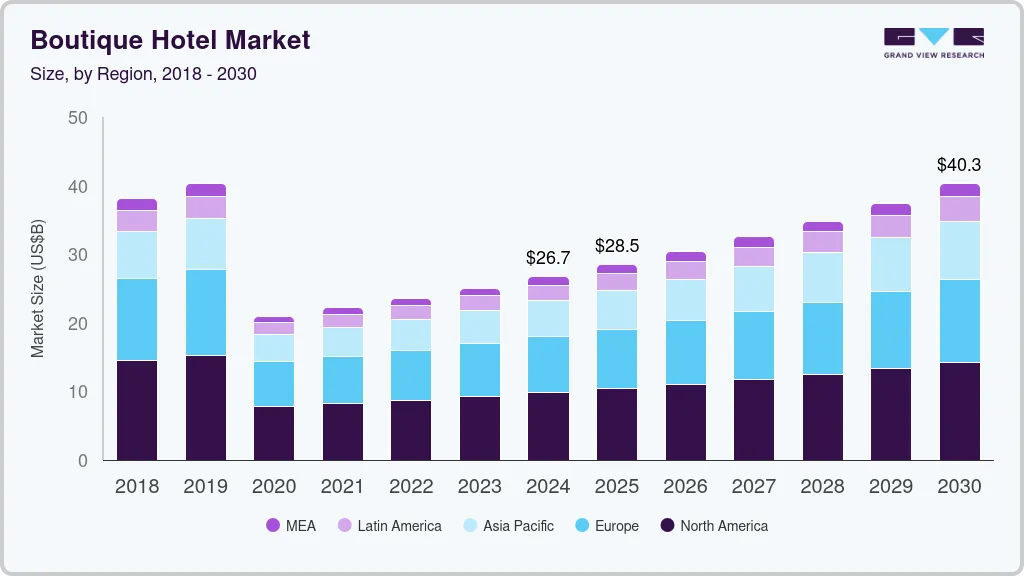

The global boutique hotel market size was valued at USD 26.68 billion in 2024 and is projected to reach USD 40.26 billion by 2030, growing at a CAGR of 7.2% from 2025 to 2030. This growth is driven by increasing consumer preference for unique and personalized travel experiences, rising disposable incomes, and the expansion of boutique hotel chains globally.

Key Market Trends & Insights

- The North America veterinary diagnostics industry led the global industry in 2024, capturing the largest revenue share of 38.25%.

- The U.S. veterinary infectious disease diagnostics industry is anticipated to grow significantly over the forecast period.

- By traveler type, the Leisure travelers contributed to more than 70% of the market revenue in 2023.

- By type, the luxury boutique hotels accounted for a revenue share of 53.10% in 2023.

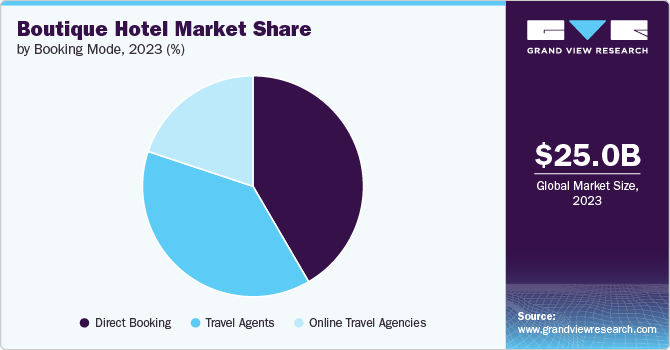

- By booking mode, direct booking saw an uptick in the market, contributing to over 41% of the global market revenue in 2023.

Market Size & Forecast

- 2024 Market Size: USD 26.68 Billion

- 2030 Projected Market Size: USD 40.26 Billion

- CAGR (2025-2030): 7.2%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Additionally, the market benefits from the growing trend of experiential travel and the demand for distinctive accommodations. The market growth is fueled by a rising consumer demand for unique and personalized travel experiences that stand out from traditional hotel offerings. For instance, properties like The Hoxton in London and The Ace Hotel in New York showcase the appeal of boutique hotels, offering distinctive design, curated local experiences, and personalized service that cater to travelers seeking more than just standard accommodations.Key trends in the market include a focus on unique design aesthetics, immersive local experiences, and sustainability. Many boutique hotels are embracing eco-friendly practices and incorporating sustainable materials into their design. For example, The Kimpton Hotel brand is known for its commitment to sustainability, including energy-efficient practices and locally sourced materials. Additionally, the rise of experiential travel has led to increased demand for boutique hotels that offer immersive experiences, such as cultural tours or culinary adventures.

Key destinations for boutique hotels are often vibrant urban centers and culturally rich locales. Cities like Paris, Tokyo, and New York continue to be popular, with boutique properties such as Hotel des Grands Boulevards in Paris and The Shinjuku Granbell Hotel in Tokyo attracting discerning travelers. Additionally, emerging destinations like Medellín, Colombia, are gaining traction for their boutique offerings, such as The Charlee Hotel, which provides a mix of modern amenities and local flair.

Type Insights

Luxury boutique hotels accounted for a revenue share of 53.10% in 2023. This substantial market share is attributed to their ability to offer high-end, personalized experiences that cater to affluent travelers seeking exclusivity and exceptional service. The appeal of luxury boutique hotels lies in their unique design, top-notch amenities, and attention to detail, which set them apart from mainstream accommodations. Additionally, their focus on providing bespoke services and local cultural immersion resonates strongly with high-net-worth individuals, driving substantial revenue in this category.

Revenue from mid-scale boutique hotels is expected to grow at a CAGR of 7.0% from 2024 to 2030, attributed to the increasing demand for affordable yet distinctive lodging options that offer a unique experience without the high price tag of luxury properties. Mid-scale boutique hotels such as Hotel Indigo in various locations and Mama Shelter in cities like Paris and Los Angeles cater to a broad range of travelers seeking personalized service and stylish accommodations at a more accessible price point. The expanding middle class, combined with a rising interest in unique travel experiences and local cultural immersion, drives robust growth in this category.

Traveler Type Insights

Leisure travelers contributed to more than 70% of the market revenue in 2023.Leisure travel is increasing due to a combination of rising expenditure levels and growing interest in outdoor activities. In August 2023, the Regional Office of Sustainable Tourism released the results of its 2023 annual leisure travel study. According to the study, the average daily spending by leisure travelers reached USD 491, marking the highest level in 20 years, with total trip expenditures slightly up to USD 1,768 from USD 1,697 in 2022. This trend reflects travelers' willingness to invest more in their vacations.

Revenue from business travelers in the market is projected to grow at a CAGR of 6.9%, owing to the increasing demand for personalized and distinctive lodging experiences that cater to the specific needs of corporate clients. Boutique hotels offer intimate atmospheres, advanced technological amenities like contactless services and virtual concierges, and unique local experiences that appeal to business travelers seeking comfort and efficiency beyond traditional accommodations.

Booking Mode Insights

Direct booking saw an uptick in the market, contributing to over 41% of the global market revenue in 2023. Direct bookings often offer better rates and exclusive benefits, appealing to cost-conscious travelers who prefer bypassing third-party booking platforms. Additionally, boutique hotels are leveraging their websites and direct booking channels to enhance guest relationships, offer personalized services, and provide a more seamless and direct booking experience. This shift also allows hotels to retain higher revenue margins by avoiding commission fees associated with third-party platforms.

Bookings through online travel agencies are expected to grow at a CAGR of 7.9% from 2024 to 2030, driven by the increasing reliance on digital platforms for travel planning and booking. For example, Expedia and Booking.com offer extensive comparison tools and user reviews that simplify the decision-making process for travelers. The convenience of these platforms is further enhanced by advancements like AI-driven recommendations and personalized offers, such as those seen on platforms like TripAdvisor. Additionally, the rise of mobile bookings through apps like Airbnb and the expansion of OTA services into emerging markets, including Southeast Asia and Latin America, further fuel this growth.

Regional Insights

North America boutique hotel market is accounted for a share of 36.90% of the global market revenue in 2023.Travelers in North America are increasingly seeking personalized and unique experiences, which boutique hotels provide through distinctive design and tailored services.Major North American cities continue to attract tourists, increasing demand for boutique hotels. Cities like New York, Los Angeles, and Miami see high volumes of travelers seeking unique and high-end lodging options.

U.S. Boutique Hotel Market Trends

The U.S. boutique hotel market is expected to grow at a CAGR of 7.0% from 2024 to 2030. As of June 2023, U.S. boutique hotels have seen notable performance growth, with RevPAR (Revenue Per Available Room) returning to 2019 levels, up 7.4% year-over-year, according to a midyear report by The Highland Group. Occupancy rose by 4.2% and ADR (Average Daily Rate) increased by 0.4%, from USD 261.67 to USD 262.93 between June 2022 to June 2023. The report projects a significant rise in branded boutique hotel rooms under construction, from 19,001 rooms now to nearly triple by 2028, reflecting increased demand in the U.S.

Europe Boutique Hotel Market Trends

Boutique hotel market in Europe accounted for a share of over 30% of the global market revenue in 2023. This strong performance is driven by the region's rich cultural heritage and diverse travel experiences, which attract both leisure and business travelers seeking unique accommodations. Major European cities like Paris, London, and Barcelona have seen notable growth in boutique hotel offerings, catering to high demand for personalized and luxury stays.

Asia Pacific Boutique Hotel Market Trends

Asia Pacific boutique hotel market is expected to grow at a CAGR of 8.4% from 2024 to 2030. Key markets such as China, India, and Southeast Asia are leading this expansion, with cities like Tokyo, Bangkok, and Jakarta seeing a surge in boutique hotel developments. For example, in Tokyo, properties like The Peninsula offer luxurious and culturally immersive stays, while Bangkok's 137 Pillars Suites & Residences caters to high-end travelers seeking distinctive experiences.

Key Boutique Hotel Company Insights

Key companies in the market include major players like Marriott International, Hyatt Hotels Corporation, AccorHotels, and Hilton Worldwide, all of which have expanded their portfolios to include upscale and boutique properties. In its recent expansion in 2024, Hilton added nearly 400 boutique hotels from the Small Luxury Hotels of the World (SLH) collection, enhancing its luxury portfolio with unique properties. In addition, boutique hotel brands like Graduate Hotels, Thompson, Ace Hotel, and The Hoxton are rapidly expanding globally. The Hoxton, now part of Accor, has expanded to 13 destinations, including Amsterdam, Chicago, and Barcelona, offering high-design lobbies and affordable rates.

Key Boutique Hotel Companies:

The following are the leading companies in the boutique hotel market. These companies collectively hold the largest market share and dictate industry trends.

- Marriott International, Inc.

- Accor

- Rosewood Hotel Group

- Kimpton Hotels & Restaurants

- The Hoxton

- Soho Boutique Hoteles

- Ace Hotel

- The Standard Hotels

- Hotel Indigo

- Joie de Vivre (Hyatt)

Recent Developments

-

In 2024, some of the new boutique hotels opening in the Americas include Hotel Casa Lucia, Banyan Tree Veya, Moxy Banff, Hotel Saint Augustine, and Trailborn Highlands, and some of the boutique hotels opening in Africa include Mokete Camp, Tawana Okavango Delta, and Voaara Sainte-Marie.

-

In July 2024, Hilton announced that the group is significantly expanding its luxury offerings by adding nearly 400 boutique hotels from Small Luxury Hotels of the World (SLH) to its portfolio. These properties, which include unique city, beach, and resort hotels, are now available for booking through Hilton’s channels. Hilton Honors members can earn and redeem points at these SLH hotels and enjoy exclusive benefits. The partnership aims to provide diverse and intimate luxury experiences, enhancing Hilton’s global luxury presence.

-

In June 2023, Kirkwood Collection expanded their presence in boutique hotels market owing to the heightened demand for the luxury lifestyle space. The company acquired three luxury boutique hotel properties in Palm Springs, California.

Boutique Hotel Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 28.46 billion

Revenue forecast in 2030

USD 40.26 billion

Growth rate

CAGR of 7.2% from 2025 to 2030

Actuals

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, traveler type, booking mode, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia; Brazil; South Africa; UAE

Key companies profiled

Marriott International; Inc.; Accor; Rosewood Hotel Group; Kimpton Hotels & Restaurants; The Hoxton; Soho Boutique Hoteles; Ace Hotel; The Standard Hotels; Hotel Indigo; Joie de Vivre (Hyatt)

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Boutique Hotel Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global boutique hotel market based on type, traveler type, booking mode, and region.

-

Type Outlook (Revenue, USD Billion; 2018 - 2030)

-

Luxury

-

Mid-Scale

-

Budget

-

-

Traveler Type Outlook (Revenue, USD Billion; 2018 - 2030)

-

Leisure Travelers

-

Business Travelers

-

Others

-

-

Booking Mode Outlook (Revenue, USD Billion; 2018 - 2030)

-

Direct Booking

-

Travel Agents

-

Online Travel Agencies

-

-

Regional Outlook (Revenue, USD Billion; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global boutique hotel market size was estimated at USD 25.04 billion in 2023 and is expected to reach USD 26.68 billion in 2024.

b. The global boutique hotel market is expected to grow at a compound annual growth rate of 7.1% from 2024 to 2030 to reach USD 40.26 billion by 2030.

b. The boutique hotel market in North America accounted for a share of 36.90% of the global market revenue in 2023 owing to presence of major tourist attractions in the region, cities like New York, Los Angeles, and Miami see high volumes of travelers seeking unique and high-end lodging options.

b. Key companies in the boutique hotel market include major players like Marriott International, Hyatt Hotels Corporation, AccorHotels, and Hilton Worldwide.

b. Key factors that are driving the boutique hotel market growth include increasing consumer preference for unique and personalized travel experiences, rising disposable incomes, and the expansion of boutique hotel chains globally.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.