- Home

- »

- Alcohol & Tobacco

- »

-

Bottled RTD Cocktails Market Size And Share Report, 2030GVR Report cover

![Bottled RTD Cocktails Market Size, Share & Trends Report]()

Bottled RTD Cocktails Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Malt-based, Spirit-based, Wine-based), By Distribution Channel (Hypermarkets/Supermarkets, Liquor Stores), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-458-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bottled RTD Cocktails Market Size & Trends

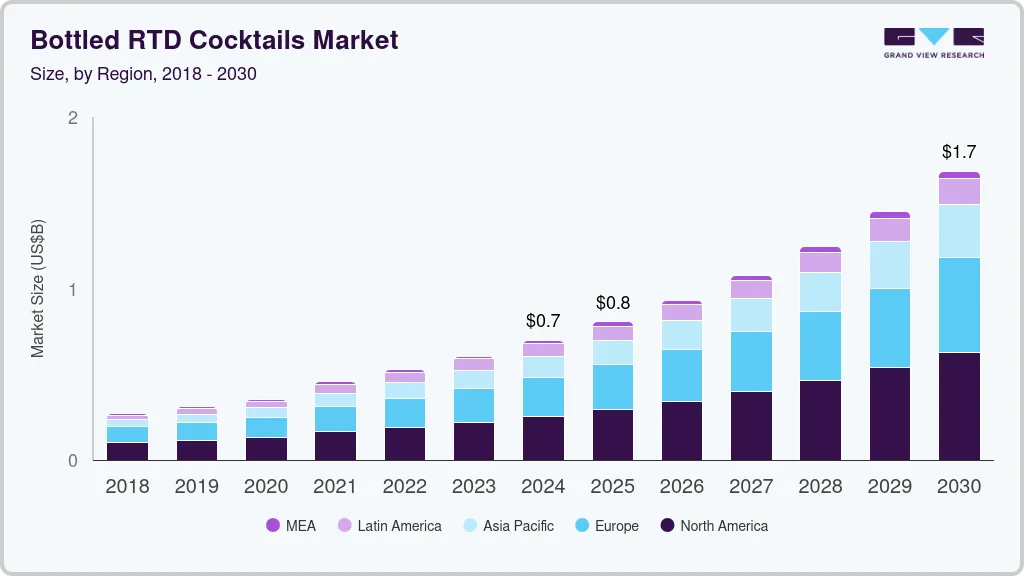

The global bottled RTD cocktails market size was valued at USD 698.4 million in 2024 and is expected to grow at a CAGR of 15.9% from 2025 to 2030. Modern consumers lead increasingly busy lives and are seeking products that offer ease of use without compromising on quality. Bottled RTD cocktails provide a perfect solution by offering the flavors and sophistication of handcrafted cocktails without the need for complex preparation. This is particularly attractive for those who want to enjoy a high-quality cocktail at home or on the go. Moreover, the portability and ease of bottled RTD cocktails also make them an ideal choice for outdoor activities like picnics, barbecues, and festivals, further expanding their appeal to a broad consumer base.

The COVID-19 pandemic had a profound impact on consumer behavior, particularly when it comes to at-home drinking. With the closure of bars, restaurants, and clubs during lockdowns, consumers began seeking alternatives to enjoy their favorite cocktails at home. This shift in behavior created a significant demand for bottled RTD cocktails, as they provided a convenient way to replicate the bar experience in the comfort of one’s own home. Even after the reopening of bars and restaurants, many consumers have continued to enjoy cocktails at home, contributing to the sustained growth of the RTD market. According to IWSR Drinks Market Analysis, the RTD cocktails category is expected to grow 12% in volume globally by 2027, with much of this growth driven by increased at-home consumption.

Manufacturers are continuously innovating to meet the evolving tastes and preferences of consumers, resulting in a wide variety of new product launches in the bottled RTD cocktails market. One of the major trends in the industry is the premiumization of RTD cocktails. Brands are increasingly focusing on creating high-quality, premium RTD cocktails using craft spirits, fresh ingredients, and sophisticated packaging. For example, premium brands like Crafthouse Cocktails are gaining popularity by offering cocktails made with artisanal spirits and high-end ingredients. These premium RTD cocktails are often marketed as “bar-quality” drinks, appealing to consumers who want an elevated drinking experience without having to leave their homes.

Many consumers are looking for beverages that offer both indulgence and health benefits, leading to the rise of low-calorie and low-sugar RTD cocktails. Manufacturers have responded by launching RTD cocktails that are marketed as “better-for-you” options, often containing fewer than 100 calories per serving and made with natural ingredients, such as organic fruits, botanicals, and no artificial sweeteners. Hard seltzers, a subcategory of RTD beverages, have been particularly successful in this space, attracting health-conscious consumers with their light, refreshing taste, and low-calorie content. Brands like High Noon and Truly have gained a strong foothold in the market by promoting their health-friendly attributes.

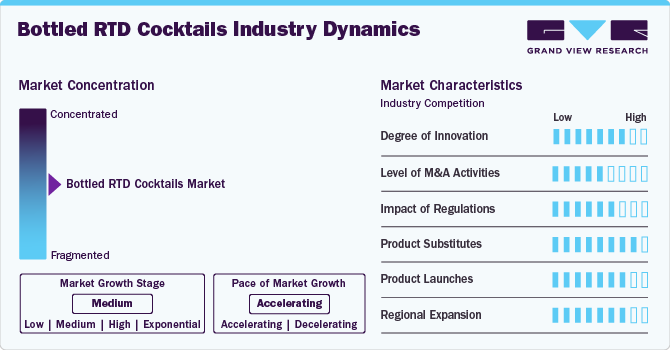

Market Concentration & Characteristics

The bottled RTD cocktails market is characterized by significant innovation in flavors, packaging, and health-conscious formulations. Brands are experimenting with craft spirits, unique flavor infusions, and organic ingredients to cater to evolving consumer tastes. Eco-friendly packaging and low-calorie, low-alcohol variants are also gaining popularity, reflecting a growing focus on sustainability and health-consciousness.

Mergers and acquisitions (M&A) have surged in the RTD cocktails market, driven by established beverage companies acquiring smaller, innovative brands to expand their portfolios. Companies like Diageo and Pernod Ricard have made strategic acquisitions to enter the rapidly growing market. These deals allow larger firms to tap into emerging trends and diversify their offerings in a highly competitive landscape.

Regulations around alcohol sales, labeling, and packaging play a significant role in the RTD cocktail market. Varying alcohol tax policies and distribution laws across regions can impact pricing and availability. Stricter labeling requirements related to ingredients and health warnings, particularly in the U.S. and Europe, push manufacturers to prioritize transparency and safety, influencing product formulation and packaging.

The RTD cocktail market faces competition from other alcoholic beverages like craft beers, seltzers, and wine coolers. Non-alcoholic alternatives, such as alcohol-free cocktails and mocktails, are also emerging as popular substitutes due to increasing demand for sober-curious options. These substitutes challenge RTD cocktails to innovate continuously and differentiate themselves through quality, flavor, and convenience.

The market has seen a flurry of new product launches, particularly around health-focused and premium cocktails. Many brands are introducing low-alcohol or alcohol-free variants to cater to wellness-conscious consumers, emphasizing natural ingredients and bold, refreshing flavors.

There is significant expansion into regions like Asia Pacific and Latin America. Rising disposable incomes, urbanization, and growing interest in Western drinking trends are driving demand in these regions. International brands are entering these markets through partnerships, distribution deals, and local product adaptations to meet regional tastes and preferences.

Type Insights

Spirit-based bottled RTD cocktails held a revenue share of 64.8% in 2023. This is largely driven by consumer preference for higher-quality, premium cocktails that mirror the experience of traditional bar drinks. Spirit-based bottled RTD cocktails often feature popular base spirits like vodka, rum, tequila, and gin, which are widely recognized and associated with classic cocktails such as margaritas, mojitos, and martinis. Moreover, spirit-based RTD cocktails are the premiumization trend within the beverage industry. Consumers are willing to pay a higher price for a quality product, and spirit-based RTD cocktails often cater to this demand by using high-quality, craft spirits. Brands like Crafthouse Cocktails, and On The Rocks have capitalized on this trend by offering premium, craft spirit-based options that replicate the bar experience.

Wine-based bottled RTD cocktails are expected to grow at a CAGR of 16.9% from 2024 to 2030. One of the primary factors behind the rapid growth of wine-based RTD cocktails is the increasing health consciousness among consumers. Wine is often perceived as a healthier and more sophisticated alternative to spirits, particularly among consumers who prefer lower-alcohol options. Wine-based bottled RTD cocktails are also benefitting from the rising popularity of spritzes and other lighter, fruit-forward beverages. Products like wine spritzers and sangria in bottled RTD formats are gaining popularity due to their refreshing taste profiles and lower alcohol content. These products appeal to a wide demographic, particularly among millennials and Gen Z consumers, who are gravitating toward lighter, more sessionable drinks.

Distribution Channel Insights

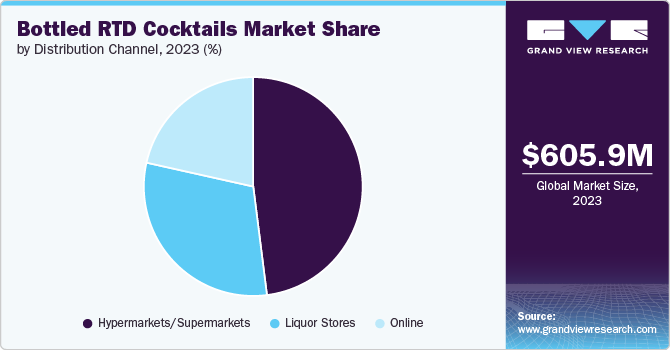

The sales of bottled RTD cocktails through hypermarkets/supermarkets accounted for a revenue share of 48.0% in 2023. These retail outlets have become the go-to destination for consumers purchasing RTD cocktails due to their wide range of product offerings, convenience, and competitive pricing. The ability to stock a diverse array of brands and product types makes hypermarkets and supermarkets a preferred shopping location for consumers looking to explore new RTD cocktail options. Moreover, hypermarkets and supermarkets are easily accessible and are often located in urban and suburban areas, making them highly convenient for consumers. Additionally, supermarkets offer a one-stop shopping experience, where consumers can purchase a variety of products, including groceries and alcohol, all in one place.

The sales of bottled RTD cocktails through online channels are expected to grow at a CAGR of 17.7% from 2024 to 2030. This growth is being driven by the increasing consumer preference for e-commerce platforms, particularly in the wake of the COVID-19 pandemic. As consumers shifted toward online shopping during lockdowns, the convenience of purchasing alcohol, including bottled RTD cocktails, from the comfort of home became more appealing. The rise of alcohol delivery apps such as Saucey, and Minibar Delivery has also contributed to the rapid growth of the online distribution channel. These platforms offer a wide variety of RTD cocktails and deliver them directly to consumers' doors, providing a seamless shopping experience. Many online retailers also offer personalized recommendations and subscription services, which encourage repeat purchases and customer loyalty.

Regional Insights

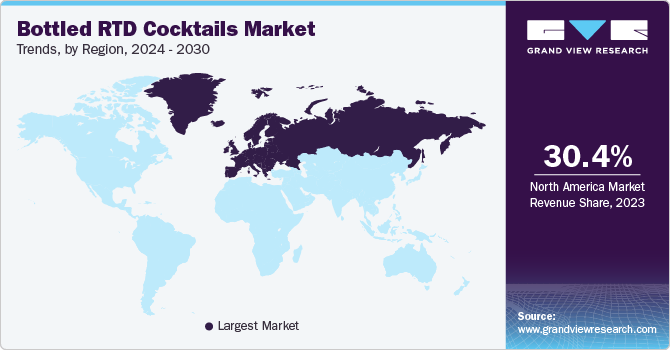

North America bottled RTD cocktails market is driven by shifting consumer preferences and lifestyle changes. Increasingly busy schedules and a growing emphasis on convenience have led consumers to seek out products that offer the experience of traditional cocktails without the need for extensive preparation. Moreover, the rise of social media and mixology influencer culture has further accelerated this trend, with consumers eager to explore imaginative flavors and premium ingredients that bottled RTD cocktails often feature. Besides, the impact of the COVID-19 pandemic, which saw a rise in at-home consumption, has solidified the position of RTD cocktails as a go-to option for social gatherings and casual occasions.

Europe Bottled RTD Cocktails Market Trends

The bottled RTD cocktails market in Europe accounted for a revenue share of 30.4% in 2023. One of the key reasons for Europe’s dominance is the well-established drinking culture in the region, where consumers are familiar with cocktails and are willing to try new and innovative RTD options. Countries like the U.K., Germany, and Italy have seen strong growth in RTD cocktail sales, particularly among younger consumers who are looking for convenient, on-the-go beverage options. The rise of premiumization and the demand for craft cocktails have also fueled the growth of the RTD market in Europe. European consumers are increasingly seeking high-quality, authentic RTD cocktails made with natural ingredients and artisanal spirits. This trend is particularly evident in countries like France and Spain, where consumers have a long-standing appreciation for premium beverages.

Asia Pacific Bottled RTD Cocktails Market Trends

The bottled RTD cocktails market in Asia Pacific is expected to grow with a CAGR of 16.7% from 2024 to 2030 A key driving factor is the rising disposable income and changing lifestyle patterns of consumers in countries like China, Japan, South Korea, and Australia. As more consumers in these countries adopt Western drinking habits, the demand for convenient, ready-to-drink beverages like RTD cocktails is increasing. Another factor contributing to the growth of RTD cocktails in Asia Pacific is the expanding urban population. As more people move to urban areas, they tend to lead busy, fast-paced lives, making RTD cocktails an attractive option for those seeking convenience and portability. Moreover, the rise of modern retail formats such as hypermarkets, convenience stores, and online platforms has also made RTD cocktails more accessible to consumers in the region.

Key Bottled RTD Cocktails Company Insights

Key players operating in the bottled RTD cocktails market are Diageo, Brown‑Forman, Suntory Global Spirits Inc., Campri, Euphoric Beverages, The Family Jones, Wigle Whiskey, High West Whiskey, Don Ciccio & Figli, and Infinity Beverages LLC. The market participants are constantly working toward new product launches, partnerships, M&A activities, and other strategic alliances to gain new market avenues. The following are some instances of such initiatives.

Key Bottled RTD Cocktails Companies:

The following are the leading companies in the bottled RTD cocktails market. These companies collectively hold the largest market share and dictate industry trends.

- Diageo

- Brown‑Forman

- Suntory Global Spirits Inc.

- Campri

- Euphoric Beverages

- The Family Jones

- Wigle Whiskey

- High West Whiskey

- Don Ciccio & Figli

- Infinity Beverages LLC

Recent Developments

-

In February 2024, Diageo launched a new range of premium RTD bottled cocktails in the UK, featuring a Tanqueray Negroni (17.5% ABV), Johnnie Walker Old Fashioned (20.5% ABV), and Cîroc Cosmopolitan (17.5% ABV).

-

In April 2023, Jennifer Lopez, also known as J Lo, launched her own premium RTD cocktail brand, Delola, through The House of Delola. The first release, Delola Spritz, features three flavors: Bella Berry Spritz, Paloma Rosa Spritz, and L’Orange Spritz, made with natural botanicals and spirits like tequila, vodka, and amaro. Lopez developed Delola to offer better ingredients, fewer calories, and an easy-to-serve cocktail option. Beam Suntory is a minority investor and global distribution partner for the brand, which will be available in the U.S. in 375ml and 750ml bottles.

Bottled RTD Cocktails Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 805.7 million

Revenue forecast in 2030

USD 1.68 billion

Market size volume in 2025

USD 88,873 thousand liters

Volume forecast in 2030

USD 181,831 thousand liters

Growth Rate (Revenue)

CAGR of 15.9% from 2025 to 2030

Growth Rate (Volume)

CAGR of 15.4% from 2025 to 2030

Actuals

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in thousand liters; revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue and volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S, Canada, Mexico, U.K., Germany, France, Italy, Spain, China, Japan, India, Australia & New Zealand, South Korea, Brazil, South Africa

Key companies profiled

Diageo, Brown‑Forman, Suntory Global Spirits Inc., Campri, Euphoric Beverages, The Family Jones, Wigle Whiskey, High West Whiskey, Don Ciccio & Figli, Infinity Beverages LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bottled RTD Cocktails Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bottled RTD cocktails market report on the basis of type, distribution channel, and region.

-

Type Outlook (Volume, Thousand Liters; Revenue, USD Million, 2018 - 2030)

-

Malt-based

-

Spirit-based

-

Wine-based

-

-

Distribution Channel Outlook (Volume, Thousand Liters; Revenue, USD Million, 2018 - 2030)

-

Hypermarkets/Supermarkets

-

Online

-

Liquor Stores

-

-

Regional Outlook (Volume, Thousand Liters; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The bottled RTD cocktails market size was estimated at USD 605.9 million in 2023 and is expected to reach USD 698.1 million in 2024.

b. The bottled RTD cocktails market is expected to grow at a compounded growth rate of 15.8% from 2024 to 2030 to reach USD 1.68 billion by 2030.

b. Spirit-based bottled RTD cocktails dominated the bottled RTD cocktails market with a share of 64.8% in 2023. This is largely driven by consumer preference for higher-quality, premium cocktails that mirror the experience of traditional bar drinks. Spirit-based RTD cocktails often feature popular base spirits like vodka, rum, tequila, and gin, which are widely recognized and associated with classic cocktails such as margaritas, mojitos, and martinis.

b. Some key players operating in the bottled RTD cocktails market include Diageo, Brown‑Forman, Suntory Global Spirits Inc., Campri, Euphoric Beverages, The Family Jones, Wigle Whiskey, High West Whiskey, Don Ciccio & Figli, Infinity Beverages LLC.

b. One of the most significant factors driving the bottled RTD cocktails market is the growing consumer preference for convenience. Modern consumers lead increasingly busy lives and are seeking products that offer ease of use without compromising on quality.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.