- Home

- »

- Beauty & Personal Care

- »

-

Botanical Cleansing Oil Market Size, Industry Report, 2030GVR Report cover

![Botanical Cleansing Oil Market Size, Share & Trends Report]()

Botanical Cleansing Oil Market (2024 - 2030) Size, Share & Trends Analysis Report By Gender (Men, Women), By Age Group (Teenagers, Young Adults), By Distribution Channel (Hypermarkets & Supermarkets, Specialty Stores), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-340-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Botanical Cleansing Oil Market Size & Trends

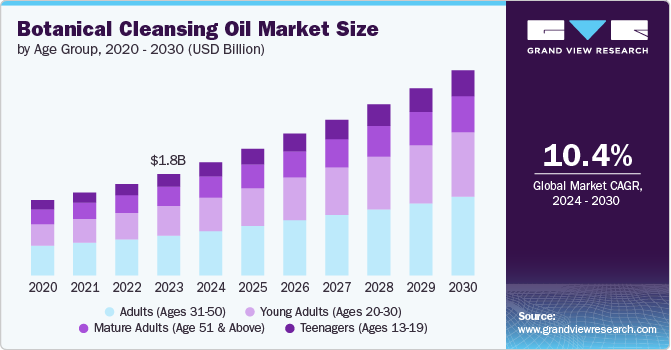

The global botanical cleansing oil market size was estimated at USD 1.83 billion in 2023 and is expected to grow at a CAGR of 10.4% from 2024 to 2030. Botanical cleansing oils are gaining prominence due to their ability to gently yet effectively remove impurities and makeup while maintaining the skin’s natural moisture barrier and pH balance. Ingredients such as fruit enzymes help exfoliate and soften the skin, while natural botanical complexes detoxify and tone. The non-stripping, clean-rinsing formulas are designed for all skin types, providing a luxurious cleansing experience with the added benefits of hydration and a refreshing natural aroma.

The modern consumer's health and wellness journey now extends beyond diet and exercise to include a heightened awareness of the potential health risks associated with artificial compounds in traditional skincare products. This shift has driven many to seek natural alternatives, favoring skincare products rich in botanical extracts and plant-based ingredients. According to a blog by Mancunian Matters published in July 2021, 34 percent of consumers preferred to buy natural and organic skincare. This trend bodes well for the botanical cleansing oil market, as health-conscious consumers increasingly prioritize safer, more natural options for their skincare routines, aligning perfectly with the benefits offered by botanical cleansing oils.

Product launches are driving the popularity of Botanical Cleansing Oil by highlighting its natural ingredients and gentle, effective cleansing properties. These launches often include promotional events, influencer endorsements, and strategic partnerships, increasing consumer awareness and trust. As a result, the product gains visibility and credibility, leading to higher adoption rates among skincare enthusiasts. In November 2023, premium brand Clé de Peau Beauté launched its Holiday Collection, which included a limited-edition Botanical Cleansing Oil. This lightweight oil, infused with moisturizing and antioxidant-rich marula, meadowfoam, argan, and grapeseed oils, dissolves impurities and waterproof makeup, leaving skin smooth and radiant.

The growing e-commerce market is significantly boosting the this market by providing a seamless integration of online and offline commerce through the O2O model. This approach, adopted by major players such as Amazon, allows businesses to attract customers online while facilitating in-store pickups, enhancing inventory planning accuracy and customer targeting. In Australia, the e-commerce channel for cosmetics has surged, driven by the increasing trend of online shopping for fragrance, personal care, and beauty products, outpacing the general retail category. According to GroupM, e-commerce accounted for 19% of the global retail market in 2022, underscoring its vital role in market expansion.

Celebrity influence, exemplified by Miranda Kerr's introduction of the Milky Mushroom Gentle Cleansing Oil in 2021 from Kora Organics, plays a pivotal role in boosting the botanical cleansing oil market. Kerr's personal endorsement and involvement in the product's development highlight its efficacy and appeal to consumers seeking gentle yet effective skincare solutions. By addressing specific needs such as makeup removal without stripping the skin, celebrities propel the popularity of botanical cleansing oils, setting trends and driving innovation in the skincare industry. This influence not only increases product visibility but also validates the efficacy and desirability of botanical ingredients among a wide audience.

Gender Insights

In the botanical cleansing oil market women users accounted for a share of about 67% in 2023. CivicScience's 2023 data reveals that women are more likely to use 3-4 skincare products compared to men, indicating a broader adoption of comprehensive skincare routines where botanical cleansing oils fit seamlessly. This demographic tendency towards using a variety of products aligns with the appeal of botanical oils, known for their natural, nourishing properties that cater to diverse skincare needs such as hydration, cleansing, and anti-aging benefits.

Demand among men is expected to rise at a CAGR of about 11.2% from 2024 to 2030. According to an article published by Tiege Honley, in January 2020, 83% of men aged 65 and above expressed interest in taking care of their skin. As men increasingly prioritize skincare, botanical cleansing oils appeal due to their effectiveness in providing gentle yet effective cleansing and hydration, which are particularly beneficial for aging skin. With rising disposable incomes and expanded availability through various distribution channels, the demand for botanical cleansing oils among men is poised to rise, meeting their specific skincare needs and preferences.

Age Group Insights

Adults aged between 31-50 accounted for a share of about 39% in the botanical cleansing oil market. A survey done by Future Plc, a publishing company, in March 2021 revealed that half of women aged 40 and over in the UK were found taking care of their skin and hair to be the best way to relax at home. In addition, 78% of these women stated that caring for their body and mind brings them happiness, and 46% mentioned they have been increasing their investment in skincare and haircare. In April 2023, Molly Sims, an actress, model, podcast host, entrepreneur, and author, launched Yse Beauty, a skincare brand tailored for women, especially those in their 40s. The brand features a Take It Off gel oil cleanser containing botanical ingredients such as meadowfoam seed oil, Camellia Seed Oil, and Passion Fruit Extract.

Demand for botanical cleansing oil among adults aged between 20-30 is set to grow at a CAGR of about 11.5% from 2024 to 2030. The trend of anti-aging products gaining popularity among young adults reflects a shift toward prevention rather than correction. Concerns about aging are increasing at younger ages, with many incorporating products that keep the skin supple and hydrated without stripping it of natural oils. For example, Kiehl's Midnight Recovery Botanical Cleansing Oil is made of pure plant oils that combine to dissolve even the most stubborn makeup and pollutants gently and effectively without over-drying the skin, leaving it feeling refreshed and clean.

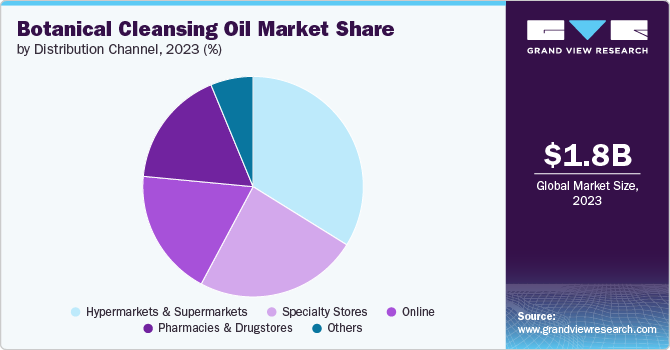

Distribution Channel Insights

The sales of botanical cleansing oil through hypermarkets & supermarkets accounted for a market share of 33% in 2023. Hypermarkets and supermarkets are increasingly becoming credible beauty retail destinations, offering a diverse range of skincare and cosmetics products. With a focus on visual merchandising and categorization, these stores create a compelling beauty shopping experience. In 2022, Sainsbury's partnered with Garnier and L'Oréal Paris to bring AI and AR-powered skincare consultations to over 100 UK stores. This technology scans customers' faces to offer personalized skincare advice, reflecting a rising focus on skin health and increasing demand for products such as botanical cleansing oil.

Online sales of botanical cleansing oil are expected to grow at a CAGR of 12.2% from 2024 to 2030. The cosmetics market's e-commerce growth is fueled by the convenience of online shopping, offering customers easy access to a wide array of beauty products from home. Sephora, for example, has enhanced its website with dedicated sections for new product launches across seven categories: Makeup, Skin Care, Bath and Body, Fragrance, Hair, and Tools and Brushes. This organized approach attracts customers seeking innovative products, including botanical cleansing oils, thereby driving their sales through online channels.

Regional Insights

The botanical cleansing oil market in North America accounted for a market share of around 23% in 2023 in the global market. The region's skincare product sales are bolstered by the growing number of consumers who are self-conscious about their looks and the increased use of cosmetics by middle-class and upper-class people. The expanding number of stores and the presence of well-known manufacturers such as Unilever and Procter & Gamble are anticipated to promote market expansion further.

U.S. Botanical Cleansing Oil Market Trends

The botanical cleansing oil market in the U.S. accounted for market share of around 85% in 2023 in the North American market. In the U.S., the demand for botanical cleansing oil is buoyed by significant consumer spending on skincare products, which are crucial to three-quarters of Americans. According to the 2023 LendingTree survey, millennials and Gen Zers lead this trend, spending substantially on skincare, where botanical cleansing oils play a pivotal role. With a focus on skin health and a preference for natural ingredients, these oils cater to the rising consumer interest in effective yet gentle skincare solutions. This demographic's spending habits underscore the high demand for botanical cleansing oils, driven by their effectiveness and appeal in skincare routines across generations.

Asia Pacific Botanical Cleansing Oil Market Trends

The botanical cleansing oil market in Asia Pacific is anticipated to rise at a CAGR of about 11.0% from 2024 to 2030. The rise of Korean beauty trends in Southeast Asia, driven by preferences for glowy and natural skin, sets the stage for increased demand for botanical cleansing oils across the Asia Pacific region. As consumers embrace the renowned Korean skincare routines, which emphasize gentle yet effective products like botanical oils, there's a growing inclination towards ingredients known for their nourishing and soothing properties.

Key Botanical Cleansing Oil Company Insights

The botanical cleansing oil market is fragmented. Many brands have recognized the presence of untapped opportunities in their product offerings and have taken steps to address these gaps in the market. This may involve the development of new products or strategic acquisitions to serve consumer needs and preferences better. For instance, in September 2022, Shiseido Europe S.A. finalized an agreement to acquire Gallinée Ltd. Gallinée, a beauty brand headquartered in London that specializes in providing comprehensive care for the skin's microbiome, from head to toe. The acquisition of Gallinée showcases Shiseido's dedication to the field of skin beauty, aligning with its mission to harmonize outer skin beauty with inner well-being.

Key Botanical Cleansing Oil Companies:

The following are the leading companies in the botanical cleansing oil market. These companies collectively hold the largest market share and dictate industry trends.

- Unilever

- FANCL Corporation

- L’Oréal Group

- Estee Lauder Companies, Inc.

- The Clorox Company

- DHC Corporation

- Kao Corporation

- Activist Skincare

- Green Envee

- Shiseido Company, Limited

Recent Developments

-

In July 2024, L'Oréal Group collaborated with Debut, a biotech beauty company, to innovate over a dozen essential bio-identical ingredients intended to replace conventional sources currently utilized in L'Oréal's global beauty and personal care products spanning hair, skin, color cosmetics, and fragrance categories. Utilizing advanced biotechnology processes such as fermentation and cell-free technology, the initiative seeks to revolutionize ingredient-sourcing methods within the beauty industry.

-

In June 2024, Estee Lauder Companies, Inc. finalized its acquisition of DECIEM Beauty Group Inc., a Canadian-based vertically integrated company with multiple brands. Following Estee Lauder Companies, Inc.'s initial investment in 2017 and majority ownership acquisition in 2021, DECIEM has utilized these resources to achieve significant growth and enhance its global presence.

-

In February 2024, Shiseido Company, Limited announced the completion of its subsidiary, Shiseido Americas Corporation's acquisition of DDG Skincare Holdings LLC, the parent company of the Dr. Dennis Gross Skincare brand. This acquisition is part of Shiseido's strategic framework focusing on skin beauty, aiming to strengthen its presence and growth in the Americas region while enhancing geographic diversification.

Botanical Cleansing Oil Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.04 billion

Revenue forecast in 2030

USD 3.70 billion

Growth rate (revenue)

CAGR of 10.4% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Gender, age group, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; & Middle East & Africa

Country scope

U.S; Canada; Mexico; UK; Germany; France; Italy; Spain; Japan; China; India; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Unilever; FANCL Corporation; L’Oréal Group; Estee Lauder Companies, Inc.; The Clorox Company; DHC Corporation; Kao Corporation; Activist Skincare; Green Envee; Shiseido Company Limited

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Botanical Cleansing Oil Market Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the botanical cleansing oil market report on the basis of product, type, packaging, distribution channel, and region.

-

Gender Outlook (Revenue, USD Billion, 2018 - 2030)

-

Men

-

Women

-

-

Age Group Outlook (Revenue, USD Billion, 2018 - 2030)

-

Teenagers (Ages 13-19)

-

Young Adults (Ages 20-30)

-

Adults (Ages 31-50)

-

Mature Adults (Age 51 & Above)

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Specialty Stores

-

Pharmacies & Drugstores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global botanical cleansing oil market was estimated at USD 1.83 billion in 2023 and is expected to reach USD 2.04 billion in 2024.

b. The global botanical cleansing oil market is expected to grow at a compound annual growth rate of 10.4% from 2024 to 2030 to reach USD 3.70 billion by 2030.

b. Asia Pacific dominated the botanical cleansing oil market with a share of around 45% in 2023. This is due to its its high demand for natural and organic skincare products, driven by a large and beauty-conscious consumer base.

b. Key players in the botanical cleansing oil market are Unilever; FANCL Corporation; L’Oréal Group; Estee Lauder Companies, Inc.; The Clorox Company; DHC Corporation; Kao Corporation; Activist Skincare; Green Envee; Shiseido Company Limited.

b. Key factors that are driving the botanical cleansing oil market growth include the increasing consumer preference for sustainable and eco-friendly products and advancements in skincare formulations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.