Bot Security Market Size, Share, & Trends Analysis Report By Component (Solution, Services), By Security Type, By Deployment, By Enterprise Size, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-337-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Bot Security Market Size & Trends

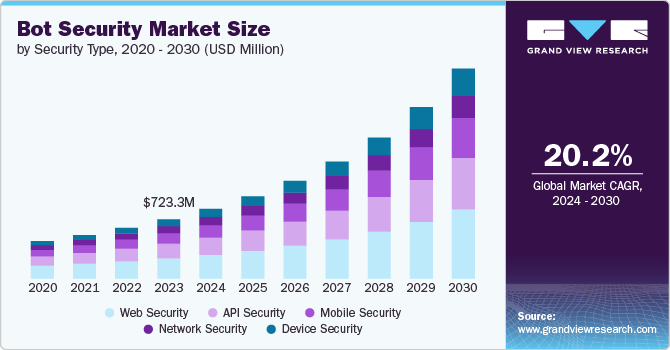

The global bot security market size was estimated at USD 732.3 million in 2023 and is expected to grow at a CAGR of 20.2% from 2024 to 2030. The increase in automated cyberattacks drives the market's growth. Malicious bots are used extensively to execute various cyberattacks, such as credential stuffing, data scraping, denial-of-service attacks, and click fraud. These automated threats can compromise the security and integrity of websites, applications, and networks, leading to substantial financial and reputational damage. As a result, organizations across various industries recognize the need for advanced bot security solutions to detect and mitigate these threats in real time.

The increasing adoption of digital channels and e-commerce platforms contributes to the growth of the bot security market. As businesses expand their online presence and offer more services through digital channels, they become prime targets for malicious bots that seek to exploit vulnerabilities in web applications and APIs. For instance, e-commerce websites are frequently targeted by bots attempting to scrape pricing information, conduct inventory hoarding, or execute fraudulent transactions. Bot security solutions help protect these digital assets by identifying and blocking malicious bot traffic, ensuring legitimate users have a secure and seamless online experience.

The advancement of bot technologies and the emergence of sophisticated bots, such as advanced persistent bots and human-like bots, are also driving the demand for robust bot security measures. These bots can mimic human behavior, bypass traditional security mechanisms, and evade detection by conventional bot management tools. To combat these advanced threats, organizations require sophisticated bot security solutions that leverage machine learning, behavioral analysis, and artificial intelligence (AI) to distinguish between legitimate users and malicious bots accurately. The continuous innovation in bot technology necessitates a parallel advancement in bot security capabilities, fueling market growth.

Moreover, increasing awareness and focusing on customer experience also contribute to the growth of the bot security market. Malicious bots can disrupt the user experience by slowing down websites, causing application outages, and compromising transaction security. Organizations prioritizing customer satisfaction and brand reputation invest in bot security solutions to safeguard their digital platforms and provide users with a smooth, secure, and reliable experience. Businesses can enhance customer trust and loyalty by mitigating bot-related disruptions and ensuring optimal performance.

Component Insights

The solution segment accounted for the largest revenue share of 72.1% in 2023. The growing awareness about the risks associated with bot attacks drives the segment's growth. As organizations become more informed about the potential damage caused by bots, they are more likely to invest in specialized security solutions. Industry reports, cybersecurity conferences, and educational initiatives highlight bot security's importance, leading to increased adoption of advanced solutions.

The service segment is expected to grow at a CAGR of 22.5% during the forecast period. The shortage of skilled cybersecurity professionals drives the segment's growth. Many organizations lack the in-house expertise required to effectively manage and respond to bot threats. Security services bridge this gap by providing access to skilled professionals who can offer specialized knowledge and support. This includes services such as security assessments, incident response, and managed security services, which ensure that organizations have the necessary expertise to address their security challenges.

Security Type Insights

The web security segment accounted for the largest revenue share of over 34% in 2023. The rising incidence of data breaches and cyberattacks targeting web applications underscores the need for effective security measures. High-profile incidents involving the theft of sensitive data, such as personal information and financial details, have highlighted the vulnerabilities of web applications. Web security solutions are essential for preventing these breaches, protecting user data, and maintaining the integrity of online services.

The device security segment is expected to grow at the fastest CAGR from 2024 to 2030. Organizations are increasingly adopting end-to-end security solutions that encompass all aspects of their IT infrastructure, including devices. This approach to security ensures that devices are not left as weak links in the security chain. Device security solutions are integral to end-to-end security strategies, providing comprehensive protection against bot attacks. This focus on comprehensive security drives the integration of device security measures into broader security frameworks, enhancing overall organizational resilience against bot threats.

Deployment Insights

The cloud segment accounted for the largest revenue share of 61.3% in 2023. The need for scalable and flexible security solutions drives the growth of the cloud segment in the bot security market. Traditional on-premises security solutions often lack the scalability required to handle the dynamic nature of cloud environments. On the other hand, cloud-based security solutions offer the scalability and flexibility to adapt to changing workloads and threat landscapes. Organizations can easily scale their security measures up or down based on demand, ensuring continuous protection without compromising performance. This scalability is particularly crucial for businesses experiencing rapid growth or seasonal fluctuations in traffic.

The on-premise segment is expected to grow at a CAGR of 15.8% during the forecast period. Data privacy and security concerns drive the adoption of on-premise bot security solutions. Organizations handling sensitive or confidential information, such as financial institutions, healthcare providers, and government agencies, often prefer to keep their data on-site to minimize the risk of data breaches and unauthorized access. On-premise solutions ensure that data remains within the organization’s physical and digital boundaries, providing security and peace of mind.

Enterprise Size Insights

The large enterprises segment accounted for the largest revenue share of 57.5% in 2023. Large enterprises typically manage various digital assets, including websites, mobile applications, APIs, and cloud services. This extensive digital footprint presents numerous entry points for bot attacks, making comprehensive security coverage essential. Bot security solutions help large enterprises protect their diverse digital assets by providing real-time monitoring, threat detection, and response capabilities. These solutions ensure that all entry points are secured, reducing the risk of successful bot attacks and safeguarding the enterprise's digital ecosystem.

The SME segment is expected to grow significantly from 2024 to 2030. The increasing reliance on digital platforms and online services among SMEs drives the market's growth. As more SMEs embrace e-commerce, digital marketing, and online customer engagement, they become more exposed to bot-related threats. Malicious bots can disrupt online operations, compromise customer data, and damage the business's reputation. Implementing bot security solutions helps SMEs protect their digital platforms, ensuring smooth and secure online operations that are critical for business success.

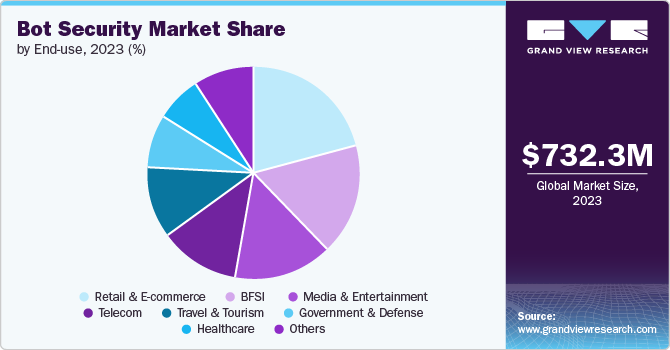

End-use Insights

The retail & e-commerce segment held a revenue share of over 20% in 2023 and is expected to dominate the market by 2030. The exponential growth of online shopping, particularly accelerated by the COVID-19 pandemic, has led to an increased focus on securing digital storefronts. As more consumers turn to online platforms for shopping, the volume of transactions and the amount of sensitive customer data being processed have surged. It makes e-commerce websites prime targets for cybercriminals who deploy bots to exploit vulnerabilities. Implementing robust bot security measures is crucial to protect customer data, ensure transaction security, and maintain consumer trust in online shopping platforms.

The healthcare segment is expected to grow at the fastest CAGR from 2024 to 2030. The need to protect patients' sensitive data drives the market's growth in the healthcare industry. Healthcare organizations store vast amounts of confidential information, including medical records, insurance details, and personal identifiers. This data is highly sought after by cybercriminals for identity theft, fraud, and other malicious activities. Bots can exploit vulnerabilities in healthcare systems to gain unauthorized access to patient data, leading to breaches that compromise patient privacy and trust. Implementing effective bot security measures helps healthcare providers safeguard sensitive information, ensuring compliance with patient confidentiality laws such as the Health Insurance Portability and Accountability Act (HIPAA).

Regional Insights

North America bot security market held the largest revenue share of 37.8% in 2023.The leading technological advancements and digital transformation in various sectors, including finance, healthcare, retail, and government driving the growth in this region. These advancements have expanded the attack surface for cyber threats, including bots, which exploit vulnerabilities in interconnected networks, cloud infrastructure, and Internet of Things (IoT) devices.

The bot security market in the U.S. is growing significantly at a CAGR of 17.9% over the forecast period. Stringent regulations, such as the HIPPA and various state-specific data breach laws, mandate organizations implement robust security measures to safeguard sensitive information from unauthorized access and breaches. Bot security solutions play a crucial role in helping organizations meet regulatory compliance requirements by detecting and mitigating bot-related threats that could compromise data privacy and integrity.

Asia Pacific Bot Security Market Trends

The bot security market in Asia Pacific is growing significantly at a CAGR of 22.8% from 2024 to 2030. Economic growth and increasing digital connectivity in Asia have accelerated the adoption of digital technologies and online services, creating new opportunities and challenges for cybersecurity. As businesses expand their online presence and adopt digital payment systems, they become prime targets for bot-driven attacks aimed at financial fraud, identity theft, and account takeover, thus creating opportunities for various cybersecurity solutions, including bot security.

Europe Bot Security Market Trends

The bot security market in Europe is growing significantly at a CAGR of 19.7% from 2024 to 2030. In Europe, there is a strong emphasis on protecting individual privacy rights and fostering consumer trust in digital services. Organizations must demonstrate their commitment to data privacy and security to maintain trust with customers, partners, and stakeholders. Effective bot security solutions play a crucial role in safeguarding personal data, preventing unauthorized access, and mitigating the impact of cyber incidents on consumer trust.

Key Bot Security Company Insights

Key players operating in market are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key Bot Security Companies:

The following are the leading companies in the bot security market. These companies collectively hold the largest market share and dictate industry trends.

- Akamai Technologies

- Cequence Security, Inc.

- Cloudflare, Inc.

- DataDome

- F5, Inc.

- Fortinet, Inc.

- Imperva

- Radware

- Reblaze Technologies Ltd.

- Sophos Ltd.

Recent Developments

-

In July 2024, Cloudflare, a cloud service provider, launched a new tool designed to combat AI bots, crawlers, and scrapers that harvest data from websites without permission. The solution addresses the growing concern among website owners about AI companies training models on their content without consent or compensation.

-

In April 2024, Fastly, an edge cloud platform provider introduced a Bot Management solution to enhance cybersecurity at the network edge. This advanced tool is designed to combat automated bot attacks, significantly reducing fraud risks, DDoS attacks, account takeovers, and other online attacks. Fastly Bot Management operates by classifying malicious and non-malicious bots at the Network Edge, offering multiple server-side and client-side mitigation techniques.

Bot Security Market Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 860.4 million |

|

Revenue forecast in 2030 |

USD 2.59 billion |

|

Growth rate |

CAGR of 20.2% from 2024 to 2030 |

|

Actual data |

2018- 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, security type, deployment, enterprise size, end- use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; Saudi Arabia; UAE; South Africa |

|

Key companies profiled |

Akamai Technologies; Cequence Security, Inc.; Cloudflare, Inc.; DataDome; F5, Inc.; Fortinet, Inc.; Imperva; Radware; Reblaze Technologies Ltd.; Sophos Ltd |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Bot Security Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the global bot security market report based on component, security type, enterprise size, deployment, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Services

-

-

Security Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Web Security

-

API Security

-

Mobile Security

-

Device Security

-

Network Security

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-Premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small & Medium Enterprises (SMEs)

-

Large Enterprises

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail and eCommerce

-

Media and Entertainment

-

Travel and Tourism

-

BFSI

-

Telecom

-

Government and Defense

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global bot security market size was estimated at USD 732.3 million in 2023 and is expected to reach USD 860.4 million in 2024.

b. The global bot security market is expected to grow at a compound annual growth rate of 20.2% from 2024 to 2030 to reach USD 2.59 billion by 2030.

b. Solution segment dominated the market in 2023 with a market share of over 72%. The growing awareness about the risks associated with bot attacks drives the segment's growth.

b. Some key players operating in the bot security market include Akamai Technologies; Cequence Security, Inc.; Cloudflare, Inc.; DataDome; F5, Inc.; Fortinet, Inc.; Imperva; Radware; Reblaze Technologies Ltd.; Sophos Ltd

b. The increasing adoption of digital channels and e-commerce platforms contributes to the growth of the bot security market. As businesses expand their online presence and offer more services through digital channels, they become prime targets for malicious bots that seek to exploit vulnerabilities in web applications and APIs.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."