Border Security Market Size, Share & Trends Analysis Report By Domain (Land, Maritime, Airborne), By Systems, By Installation (New Installations, Upgradation), By Vertical, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-438-1

- Number of Report Pages: 122

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Border Security Market Size & Trends

The global border security market size was estimated at USD 26.76 billion in 2023 and is expected to grow at a CAGR of 6.8% from 2024 to 2030. The market growth is driven by the increasing geopolitical tensions, cross-border crimes, and the need for advanced surveillance systems. Governments worldwide are investing heavily in modernizing their border security infrastructure to enhance national security. The market encompasses a wide range of technologies, including unmanned aerial vehicles (UAVs), biometrics, radar systems, and advanced detection and tracking systems. The adoption of artificial intelligence (AI) and machine learning (ML) in border security is also gaining traction, enabling real-time threat detection and response. The growth is further propelled by collaborations between defense contractors and governments, leading to the development of innovative solutions tailored to specific border security needs.

Security products are widely utilized across various industries for applications, including aerial photography and videography, mapping and surveying, rescue operations, asset inspection, research, and emergency response. The increasing adoption of unmanned aircraft, as well as unmanned ground and underwater vehicles in the defense sector, is anticipated to boost the demand for advanced long-range obstacle detection and collision avoidance systems. Moreover, the growing need for security is being driven by the deployment of autonomous systems for tasks such as site exploration, rescue and recovery missions, location surveillance, and crowd monitoring by defense forces and regulatory authorities.

Emerging countries are increasingly pressured to maintain the highest levels of security due to the growing number of threats. In response, governments have implemented advanced border protection technologies to ensure effective and reliable security measures. These strategies are designed to identify and neutralize potentially harmful risks that could threaten national security. Additionally, security technologies come in various forms, each offering unique advantages. Innovations such as security scanners, electronic gates, perimeter intrusion detection systems, surveillance cameras, land vehicles, radar systems, maritime and riverine vessels, airplanes and helicopters, and unmanned aerial vehicles (UAVs, UGVs) are enhancing protection against a wide range of threats from different platforms.

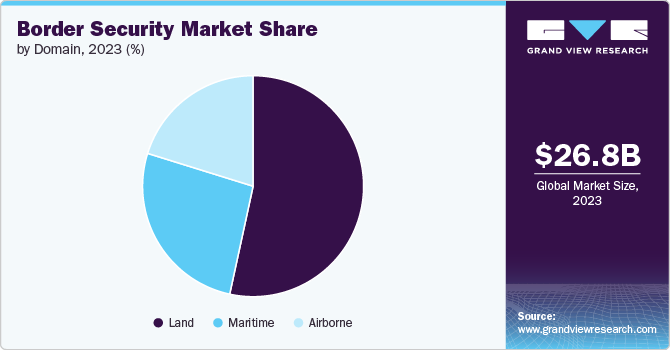

Domain Insights

The land segment led the market in 2023, accounting for over 52.0% share of the global revenue, primarily due to the increasing need for robust security measures across land borders, which are often the most vulnerable to illegal crossings, smuggling, and other threats. Governments worldwide have been investing heavily in advanced land-based security technologies, such as surveillance cameras, perimeter intrusion detection systems, radar systems, and UGVs. These technologies are critical for monitoring and securing extensive land borders, particularly in regions with high levels of cross-border activities. Additionally, geopolitical tensions and the rising concerns over terrorism, illegal immigration, and human trafficking have further intensified the focus on securing land borders.

The maritime segment is predicted to foresee significant growth in the coming years, driven by the increasing focus on securing vast and porous coastlines that are susceptible to illegal activities such as smuggling, piracy, and unauthorized fishing. With global trade heavily reliant on maritime routes, the need for enhanced maritime security has become more critical than ever. Additionally, the rise in geopolitical tensions and territorial disputes in critical regions like the South China Sea and the Gulf of Aden has further fueled the demand for maritime security solutions. The growing importance of safeguarding maritime borders, coupled with advancements in technology, is expected to propel the maritime segment’s rapid growth in the coming years.

Systems Insights

The surveillance systems segment accounted for the largest revenue share in 2023. These systems are critical for monitoring vast and often challenging terrains, including remote land borders and expansive maritime zones. The rise in cross-border terrorism, smuggling, and illegal immigration has further intensified the demand for robust surveillance solutions. Additionally, the integration of AI and ML in surveillance systems has enhanced their capability to analyze vast amounts of data, enabling quicker and more accurate threat detection. The effectiveness of these systems in providing continuous, real-time intelligence has made them a cornerstone of modern border security strategies.

The unmanned systems segment is predicted to foresee significant growth in the coming years. These systems offer significant advantages, such as enhanced surveillance capabilities, reduced risk to human personnel, and the ability to operate in challenging or inaccessible terrains. The rising demand for 24/7 border monitoring and the need for rapid response to potential threats has led to greater reliance on unmanned systems, which can cover large areas efficiently and provide real-time intelligence. Furthermore, advancements in autonomy, sensor technology, and AI-driven analytics are making these systems more sophisticated and effective in detecting, tracking, and responding to illegal activities.

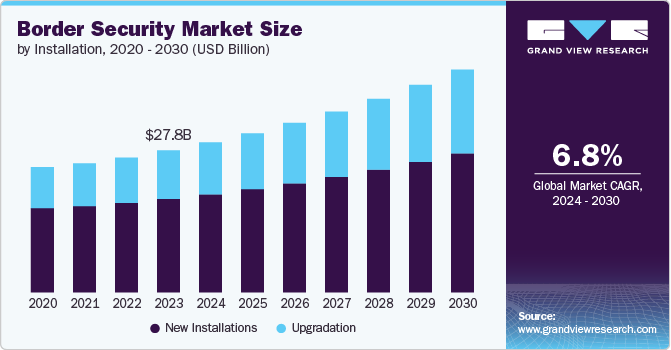

Installation Insights

The new installations segment accounted for the largest revenue share in 2023. Many countries, particularly those facing heightened security challenges, have prioritized the deployment of advanced border security systems to address evolving threats such as terrorism, illegal immigration, and smuggling. This has led to substantial investments in new installations of surveillance systems, perimeter intrusion detection systems, and unmanned technologies. The focus on securing land, maritime, and air borders has resulted in the construction of new facilities equipped with cutting-edge technologies to enhance border protection. Additionally, the adoption of new installations is often driven by the need to replace outdated or ineffective systems, ensuring that border security remains robust and up to date.

The upgradation segment is anticipated to witness significant growth in the coming years. As threats become more advanced, there is a growing demand to upgrade outdated systems with the latest technologies, including AI-driven analytics, advanced sensors, and enhanced surveillance systems. Governments and security agencies are focusing on retrofitting their current installations to improve efficiency, reliability, and response times. This includes upgrading perimeter intrusion detection systems, enhancing cybersecurity measures, and integrating unmanned systems for better operational capabilities. The upgradation of existing systems is often more cost-effective and quicker to implement than building new installations, making it an attractive option for many countries facing budget constraints.

Vertical Insights

The military segment accounted for the largest market revenue share in 2023.Militaries worldwide are increasingly focusing on comprehensive border security solutions to address a range of threats, including terrorism, illegal smuggling, and cross-border conflicts. This focus has led to substantial expenditures on sophisticated surveillance systems, unmanned vehicles, radar systems, and advanced communication technologies. The military's need for high-performance, reliable, and integrated systems to ensure national security has driven the demand for cutting-edge border security solutions.

The homeland security segment is anticipated to exhibit the highest CAGR over the forecast period. Governments are investing heavily in enhancing homeland security measures to address challenges such as terrorism, cyberattacks, natural disasters, and border control issues. This includes deploying advanced technologies for surveillance, detection, and response, and improving coordination among various agencies. The integration of innovative solutions like AI-driven analytics, biometric systems, and sophisticated communication networks is crucial for enhancing situational awareness and operational effectiveness. Additionally, the growing focus on comprehensive security strategies and emergency preparedness has spurred investments in both new installations and upgrades of existing systems.

Regional Insights

North America dominated with a revenue share of over 31.0% in 2023. The U.S. government, in particular, has dedicated significant resources to enhancing its border security infrastructure to address threats such as illegal immigration, drug trafficking, and terrorism. This includes deploying sophisticated surveillance systems, UAVs, and advanced perimeter intrusion detection systems. The region's focus on national security, coupled with high defense budgets and technological innovation, has driven the development and implementation of cutting-edge border security solutions. Additionally, the strategic importance of North America's borders, both with neighboring countries and in maritime areas, has reinforced the need for robust security measures.

U.S. Border Security Market Trends

The U.S. border security market is expected to grow significantly from 2024 to 2030. The U.S. has implemented robust border enforcement measures and innovative technologies like biometric systems and automated border control systems. The country's large defense budget and commitment to national security have enabled it to lead in the development and deployment of cutting-edge border security solutions.

Europe Border Security Market Trends

The border security market in the European region is expected to witness significant growth over the forecast period. European countries have faced increasing challenges related to illegal immigration, terrorism, and cross-border crimes, prompting substantial government spending on state-of-the-art security solutions. Additionally, the European Union's focus on enhancing border control and cooperation among member states has driven the adoption of integrated security technologies and infrastructure upgrades.

Asia Pacific Border Security Market Trends

The border security market in the Asia Pacific region is anticipated to register rapid growth over the forecast period. Countries like China, India, and Japan have prioritized strengthening their border security infrastructure to address these issues effectively. Additionally, the region's diverse geographic landscape and extensive borders necessitate sophisticated and adaptable security solutions.

Key Border Security Company Insights

Key border security companies include Northrop Grumman Systems Corporation, Airbus SAS, Lockheed Martin Corporation, and General Dynamics Corporation. Companies active in the border security market are focusing aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/ Installation development. For instance, in March 2024, drone manufacturer Garuda Aerospace introduced Trishul, a new surveillance drone designed for border patrol operations. This drone is capable of monitoring human movement, natural disasters, and traffic conditions, among other applications. Equipped with an array of sensors, including high-definition cameras, infrared, and radar, Trishul offers detailed data on speed and potential safety threats.

Key Border Security Companies:

The following are the leading companies in the border security market. These companies collectively hold the largest market share and dictate industry trends.

- Northrop Grumman Systems Corporation

- Airbus SAS

- Lockheed Martin Corporation

- General Dynamics Corporation

- BAE Systems

- Thales

- RTX Corporation

- Elbit Systems Ltd.

- RAFAEL Advanced Defense Systems Ltd.

- Teledyne FLIR LLC

Recent Developments

-

In August 2024, Canadian border authorities introduced a new app designed to assist in tracking individuals who have been ordered to leave the country. The Canada Border Services Agency (CBSA) will use facial biometrics to verify identities and employ the app to monitor their locations. The app, called ReportIn, is intended to enable foreign nationals and permanent residents who are subject to immigration enforcement conditions to report their status without needing to visit a CBSA office in person.

-

In April 2024, ideaForge Technology Ltd., a prominent player in drone technology and manufacturing, unveiled new cutting-edge solutions aimed at strengthening its position in the U.S. market. These advanced solutions for Border Protection and Public Safety highlight the company's dedication to tackling key challenges faced by border patrol agencies and law enforcement through technological innovation.

-

In June 2023, SITA introduced its most advanced intelligence and targeting solution to date. This offering serves as the core for dynamic and integrated border management, aiding governments in identifying and managing risks well before they approach their land, sea, and air borders. SITA Intelligence and Targeting employs sophisticated risk assessment techniques and artificial intelligence to greatly reduce the time required for strategic risk analysis and operational situational awareness across various data streams. This allows for actionable intelligence to be gathered, enabling proactive measures against high-risk individuals before they enter the country.

Border Security Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 28.29 billion |

|

Revenue forecast in 2030 |

USD 42.02 billion |

|

Growth rate |

CAGR of 6.8% from 2024 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Domain, systems, installation, vertical, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA |

|

Key companies profiled |

Northrop Grumman Systems Corporation; Airbus SAS; Lockheed Martin Corporation; General Dynamics Corporation; BAE Systems; Thales; RTX Corporation; Elbit Systems Ltd.; RAFAEL Advanced Defense Systems Ltd.; Teledyne FLIR LLC |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Border Security Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global border security market report based on domain, system, installation, vertical, and region:

-

Domain Outlook (Revenue, USD Million, 2017 - 2030)

-

Land

-

Maritime

-

Airborne

-

-

System Outlook (Revenue, USD Million, 2017 - 2030)

-

Surveillance Systems

-

Detection Systems

-

Communication Systems

-

Border Security Systems

-

Laser Systems

-

Unmanned Systems

-

Perimeter Intrusion Detection Systems

-

Cybersecurity Systems

-

-

Installation Outlook (Revenue, USD Million, 2017 - 2030)

-

New Installations

-

Upgradation

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

Military

-

Homeland Security

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global border security market size was estimated at USD 26.76 billion in 2023 and is expected to reach USD 28.29 billion in 2024.

b. The global border security market is expected to grow at a compound annual growth rate of 6.8% from 2024 to 2030 to reach USD 42.02 billion by 2030.

b. North America dominated the border security market with a share of 32.3% in 2023. The U.S. government, in particular, has dedicated significant resources to enhancing its border security infrastructure to address threats such as illegal immigration, drug trafficking, and terrorism.

b. Some key players operating in the border security market include Northrop Grumman Systems Corporation, Airbus SAS, Lockheed Martin Corporation, General Dynamics Corporation, BAE Systems, Thales, RTX Corporation, Elbit Systems Ltd., RAFAEL Advanced Defense Systems Ltd., and Teledyne FLIR LLC.

b. Key factors that are driving the border security market growth include innovations in surveillance, detection, and communication technologies, and significant investments by governments in modernizing border security infrastructure and expanding capabilities to address evolving threats.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."