BOPP Films Market Size, Share & Trends Analysis Report By Type (Bags & Pouches, Labels), By Thickness, By Production Process (Tenter, Tubular), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-369-9

- Number of Report Pages: 184

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

BOPP Films Market Size & Trends

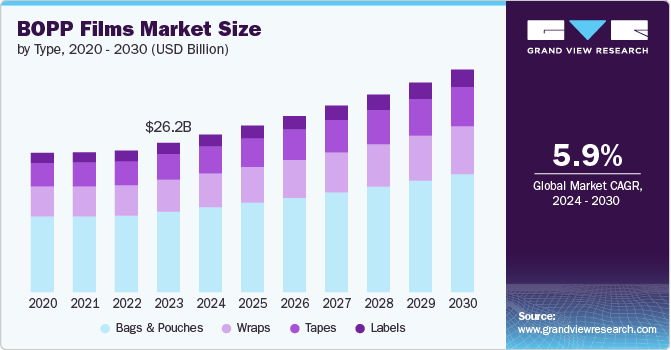

The global BOPP films market size was estimated at USD 26.14 billion in 2023 and expected to grow at a CAGR of 5.92% from 2024 to 2030. The market is experiencing significant growth, driven by their extensive application across various industries such as packaging, labeling, and lamination. Biaxially oriented polypropylene (BOPP) films are preferred for their superior clarity, excellent barrier properties, and high tensile strength, making them ideal for packaging food products, consumer goods, and industrial applications.

The market is benefiting from advancements in manufacturing technologies, leading to enhanced product quality and performance. Additionally, increasing consumer demand for sustainable and recyclable packaging solutions is propelling the adoption of BOPP films, as they are environmentally friendly and can be recycled multiple times without losing their essential properties.

Drivers, Opportunities & Restraints

The primary drivers of the BOPP films market include the increasing demand for flexible packaging solutions and the rising awareness of sustainable packaging materials. BOPP films offer several advantages over traditional packaging materials, such as reduced packaging weight, improved shelf life of products, and cost-effectiveness. The growing e-commerce industry is also fueling the demand for robust and durable packaging solutions, further boosting the market. Moreover, advancements in technology have enabled the production of high-performance BOPP films with enhanced properties like moisture resistance, clarity, and printability, making them highly suitable for various packaging applications. The trend towards convenience and ready-to-eat food products is another significant driver, as BOPP films provide excellent protection and extended shelf life for these products.

With increasing environmental concerns and stringent regulations regarding plastic waste, there is a growing demand for sustainable packaging solutions. Companies that invest in the research and development of eco-friendly BOPP films can capitalize on this trend and gain a competitive edge. Additionally, the expanding applications of BOPP films in emerging sectors such as electronics, pharmaceuticals, and personal care products offer significant growth potential. Innovations in coating and metallization technologies can further enhance the functionality of BOPP films, opening up new avenues for market expansion.

Despite its promising growth, the market faces several challenges that could hinder its progress. One of the primary restraints is the volatility in raw material prices, particularly polypropylene resin, which can impact the overall production cost and profitability of BOPP films. Additionally, the market is highly competitive, with numerous players vying for market share, leading to price wars and reduced profit margins. The stringent regulations and standards imposed by various governments on plastic packaging materials also pose a challenge, requiring manufacturers to continuously invest in compliance and sustainability measures.

Type Insights

The bags & pouches held the market with the largest revenue share of 54.02% in 2023. Bags & pouches represent a significant portion of the market due to their extensive use in food and consumer goods packaging. They offer excellent barrier properties, durability, and printability, which are essential for maintaining product freshness and extending shelf life. The demand for flexible packaging solutions is driving the growth of this segment, as consumers seek convenient and reliable packaging options.

Wraps, another key segment, benefit from the clarity and strength of BOPP films. These properties make wraps ideal for packaging a variety of products, from food items to industrial goods, ensuring product protection and shelf appeal. The increasing preference for ready-to-eat and convenience foods further boosts the demand for wraps. Tapes and labels also play a crucial role in the BOPP films market. Tapes made from BOPP films are favored for their adhesive strength and durability, while labels are in high demand due to their superior printability and aesthetic qualities, essential for branding and promotional activities.

Thickness Insights

The 15-30 microns held the market with the largest revenue share of 36.24% in 2023. This segment represents a substantial share of the market, offering a balance between flexibility and strength. These films are used in a variety of applications, from food and beverage packaging to personal care products, due to their excellent barrier properties and durability. The 30-45 microns segment is particularly suited for more demanding applications, where enhanced protection and mechanical properties are required, such as in industrial packaging and heavy-duty wraps.

Films with a thickness of more than 45 microns are used in specialized applications that require maximum durability and protection. These thicker films are ideal for applications involving heavy or bulky items, providing robust packaging solutions. Films below 15 microns are typically used for packaging lightweight items, providing sufficient protection without adding significant weight. This segment is popular in the food packaging industry, where minimal material usage without compromising on quality is crucial.

Production Process Insights

The tenter process held the market with the largest revenue share of 58.02% in 2023. The tenter process is the most widely used method, known for producing films with superior mechanical properties and excellent clarity. This process involves stretching the film in both the machine and transverse directions, resulting in films with enhanced strength and uniform thickness. The versatility of the tenter process allows for the production of BOPP films in various thicknesses and widths, making it suitable for a wide range of applications.

The tubular process, while less common than the tenter method, offers distinct advantages, particularly in terms of cost-effectiveness and production efficiency. This process involves extruding the film through a tubular die and then expanding it, producing films with good optical properties and uniform thickness. The tubular process is often used for producing BOPP films for specific applications where these characteristics are prioritized.

Application Insights

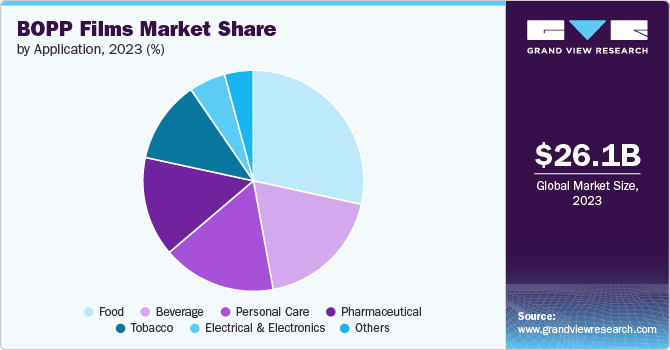

The food application held the market with the largest revenue share of 28.42% in 2023. The food industry is the largest consumer of BOPP films, utilizing them for packaging snacks, bakery products, confectioneries, and other food items. The excellent barrier properties of BOPP films protect food products from moisture, oxygen, and other contaminants, preserving their freshness and extending shelf life. The demand for ready-to-eat and convenience foods is further driving the growth of this segment.

In the beverage industry, BOPP films are used for labeling and packaging various types of drinks, including bottled water, soft drinks, and alcoholic beverages. The clarity and printability of BOPP films make them ideal for attractive and informative labels that enhance brand visibility and appeal. The tobacco industry also relies on BOPP films for packaging cigarettes and other tobacco products, where the films provide the necessary protection against moisture and maintain product quality.

Regional Insights

The BOPP films market in North America is driven by the high demand for flexible and sustainable packaging solutions, particularly in the food and beverage sector. The United States plays a significant role, with a strong emphasis on innovative packaging technologies and a well-established food processing industry. The demand for convenience foods and ready-to-eat meals is propelling the use of BOPP films, which offer excellent barrier properties and extend the shelf life of packaged goods.

U.S. BOPP Films Market Trends

The U.S. BOPP films is the largest market in North America, characterized by a robust consumer base and advanced packaging industry. The country's focus on sustainability and recyclability in packaging materials is encouraging the adoption of BOPP films, which are environmentally friendly and can be recycled multiple times. The growing e-commerce sector also fuels the demand for durable and high-performance packaging solutions, enhancing the market's expansion. Innovations in film manufacturing and the development of bio-based BOPP films are expected to further drive market growth in the United States.

Asia Pacific BOPP Films Market Trends

Asia Pacific BOPP films market dominated the global market and accounted for the largest revenue share of over 45.58% in 2023. China and India are major contributors due to their rapidly growing economies, rising disposable incomes, and expanding packaging industries. North America and Europe are also significant markets, driven by the high demand for flexible packaging and stringent regulations regarding food safety and packaging standards.

Europe BOPP Films Market Trends

The BOPP films market in Europe is considered significant, driven by strong demand in the food, beverage, and pharmaceutical industries. Countries like Germany, France, and the United Kingdom are key contributors, with well-established packaging industries and a high focus on sustainability. The European Union's stringent regulations on packaging waste and recyclability are pushing manufacturers to adopt eco-friendly materials, boosting the demand for BOPP films.

Asia Pacific BOPP Films Market Trends

The Asia-Pacific BOPP films market is the largest and fastest-growing market with China and India being major contributors. Rapid urbanization, rising disposable incomes, and the expanding middle class are driving the demand for packaged food and consumer goods, thereby increasing the need for BOPP films. The region's booming e-commerce industry also contributes significantly to the market growth, requiring durable and efficient packaging solutions. Moreover, the development of advanced manufacturing facilities and the availability of low-cost labor are making APAC a hub for BOPP film production, attracting investments from global players.

Key BOPP Films Company Insights

The market is highly competitive, with numerous key players striving to enhance their market share through strategic initiatives such as mergers and acquisitions, product innovations, and expansions.

Prominent companies like Jindal Poly Films Ltd., Taghleef Industries, Cosmo Films Ltd., and Innovia Films have established strong market positions by continuously investing in research and development to introduce advanced and sustainable BOPP film solutions. These companies are focusing on improving the performance characteristics of their films, such as barrier properties, clarity, and printability, to meet the evolving demands of various end-use industries.

Key BOPP Films Companies:

The following are the leading companies in the BOPP films market. These companies collectively hold the largest market share and dictate industry trends.

- Cosmo Films Limited

- Taghleef Industries

- CCL Industries

- Jindal Poly Films

- Sibur Holdings

- Zhejiang Kinlead Innovative Materials

- Inteplast Group

- Poligal S.A.

- Uflex Ltd.

- Polinas

- Polibak

- Toray Industries

Recent Developments

-

In March 2024, Jindal Films Europe Virton S.p.r.l, a prominent manufacturer of specialty BOPP and BOPE films, announced the release of two new sustainable film products - Bicor 25 and 30 MBH568. These films are designed to help the flexible packaging and labeling industries meet upcoming European mechanical recycling guidelines.

-

In March 2024, Toppan Inc. launched GL-SP, an innovative barrier film for sustainable packaging. These films are made with BOPP, and GL-SP enables the creation of recyclable monomaterial packaging for dry products. This new film offers excellent barrier properties, comparable to traditional polyethylene terephthalate films, while maintaining high transparency, allowing consumers to see the product inside and enhancing packaging design and appeal.

-

In March 2022, Innovia Films, a major producer of specialty BOPP film, expanded its production capacity in Germany. The company is adding a new 8.8-meter-wide multilayer co-extrusion line at its facility near Leipzig, which will have an annual capacity of 36,000 tons. This new line will manufacture thin-gauge label films, meeting the growing demand for more sustainable materials with lower resin content in Europe.

BOPP films Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 27.61 billion |

|

Revenue forecast in 2030 |

USD 38.98 billion |

|

Growth rate |

CAGR of 5.92% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors and trends |

|

Segments covered |

Type, thickness, production process, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa |

|

Key companies profiled |

Cosmo Films Limited; Taghleef Industries; CCL Industries; Jindal Poly Films; Sibur Holdings; Zhejiang Kinlead Innovative Materials; Inteplast Group; Poligal S.A.; Uflex Ltd.; Polinas, Polibak; Toray Industries. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global BOPP Films Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the BOPP films market report based on the type, thickness, production process, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Bags & Pouches

-

Wraps

-

Tapes

-

Labels

-

-

Thickness Outlook (Revenue, USD Million, 2018 - 2030)

-

Below 15 Microns

-

15-30 Microns

-

30-45 Microns

-

More Than 45 Microns

-

-

Production Process Outlook (Revenue, USD Million, 2018 - 2030)

-

Tenter

-

Tubular

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food

-

Beverage

-

Tobacco

-

Personal Care

-

Pharmaceutical

-

Electrical & Electronics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global BOPP films market size was estimated at USD 26.14 billion in 2023 and is expected to reach USD 27.61 billion in 2024.

b. The global BOPP films market is expected to grow at a compound annual rate of 5.92% from 2024 to 2030, reaching USD 38.98 billion by 2030.

b. Bags & pouches led the type segment, accounting for 54.02% of the global revenue in 2023.

b. Some of the major companies in the global BOPP films market include Cosmo Films Limited, Taghleef Industries, CCL Industries, Jindal Poly Films, Sibur Holdings, Zhejiang Kinlead Innovative Materials, Inteplast Group, Poligal S.A., Uflex Ltd., Polinas, Polibak, and Toray Industries.

b. Biaxially Oriented Polypropylene (BOPP) films market is experiencing significant growth, driven by their extensive application across various industries such as packaging, labeling, and lamination. BOPP films are preferred for their superior clarity, excellent barrier properties, and high tensile strength, making them ideal for packaging food products, consumer goods, and industrial applications.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."