- Home

- »

- Plastics, Polymers & Resins

- »

-

BOPP Dielectric Films Market Size & Share Report, 2030GVR Report cover

![BOPP Dielectric Films Market Size, Share & Trends Report]()

BOPP Dielectric Films Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Silica-based, Aluminum-based, Polymer-based), By Application (Electric Vehicles, Electrical & Electronics, Power Grids, Power Generation, Aerospace), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-404-5

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

BOPP Dielectric Films Market Summary

The global BOPP dielectric films market size was estimated at USD 1.51 billion in 2023 and is projected to reach USD 10.27 billion by 2030, growing at a CAGR of 31.5% from 2024 to 2030. The rising demand for capacitors in various industrial applications such as electric vehicles (EVs), electrical & electronics, and power generation is driving the market growth.

Key Market Trends & Insights

- The Asia-Pacific dominated the BOPP dielectric films market with a revenue share of 31.85% in 2023.

- Based on material, the aluminum-based segment led the market with the largest revenue share of 41.32% in 2023.

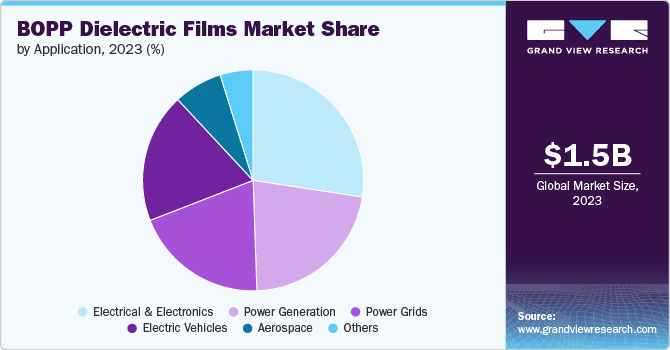

- Based on application, the electrical & electronics segment led the market with the largest revenue share of 28.15% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.51 Billion

- 2030 Projected Market USD 10.27 Billion

- CAGR (2024-2030): 31.5%

- Asia-Pacific: Largest market in 2023

- Middle East & Africa: Fastest growing market

One prominent trend in the market is the emerging popularity and increasing adoption of EVs owing to the rising awareness among governments and individuals regarding global warming and climate change. Biaxially oriented polypropylene (BOPP) dielectric films are used as an insulating material in the battery cells of EVs. They provide a barrier between the different layers of the battery, preventing short circuits and enhancing the overall safety and efficiency of the battery.

The power grid application segment is experiencing significant growth, driven by the rising demand for electricity. The advent of advanced technologies such as artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT), along with the proliferation of various electronic devices for residential, commercial, and industrial use, is promoting the demand for BOPP dielectric films in this segment. Capacitors with BOPP dielectric films are essential for voltage stabilization, power factor correction, and energy storage in power grids. The excellent dielectric properties of BOPP dielectric films, combined with their high thermal stability and resistance to environmental stress, make them ideal for these applications.

The market is expected to witness various opportunities over the forecast period. Emerging markets present substantial growth opportunities for the Biaxially oriented polypropylene (BOPP) dielectric films industry. Rapid industrialization, urbanization, and increasing disposable incomes in countries such as India, China, Brazil, and Southeast Asian nations are driving demand for packaging materials across various sectors. The expansion of the retail, consumer goods, and electronics industries in these regions creates a significant market for BOPP dielectric films. In addition, infrastructure development and rising energy needs are leading to increased demand for BOPP dielectric films in applications related to renewable energy and electrical insulation. Targeting these emerging markets with tailored products and localized strategies can drive significant growth for BOPP film manufacturers.

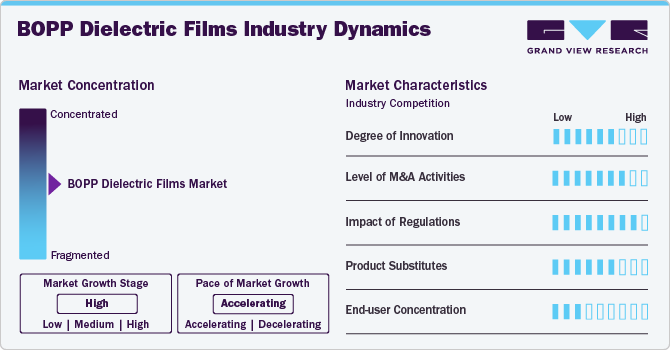

Industry Dynamics

The market is moderately consolidated in nature with the presence of key industry players such as Cosmo Films Ltd., TAGHLEEF INDUSTRIES, Sichuan EM Technology Co., Ltd., Xpro India Limited, and JPFL Films PVT. Ltd., AEC GROUP, UFlex Limited, Toray Plastics (America), Inc. (Toray Industries Inc.), and SRF Limited, which dominate a significant market share. These companies often engage in aggressive marketing strategies, research and development initiatives, and mergers and acquisitions to strengthen their market position and expand their product offerings.

Regulations significantly impact the market by setting standards for safety, environmental protection, and operational practices. Governmental bodies such as the EU RoHS (Restriction of Hazardous Substances), US EPA (Environmental Protection Agency) regulations, and the Waste Electrical and Electronic Equipment (WEEE) directive play a crucial role in regulating the market growth by setting standards for safety and environmental impact. Compliance with these regulations often requires BOPP dielectric films manufacturers to invest in higher-quality materials and manufacturing processes, which can increase production costs. Moreover, regulatory requirements drive innovation towards more sustainable technologies and practices, such as improved waste management and emissions control systems.

While BOPP dielectric films are widely used due to their excellent properties, several alternative materials are gaining traction in the market. These alternatives offer unique benefits and address some of the environmental and functional limitations associated with BOPP dielectric films. Some of these alternatives include PET Films (polyethylene terephthalate), PE Films (Polyethylene), PLA Films (Polylactic Acid), Cellophane Films, and others.

Material Insights

Based on material, the aluminum-based segment led the market with the largest revenue share of 41.32% in 2023. Aluminum-based BOPP dielectric films have become an important solution for enhancing the performance of electrical insulation materials. BOPP film is in the electrical insulation materials industry due to its excellent high tensile strength, low moisture absorption, and dielectric strength. These properties make Biaxially oriented polypropylene (BOPP) dielectric films suitable for capacitor, transformer, and motor insulation applications. The use of BOPP dielectric films helps develop more reliable and efficient electrical equipment.

Silica-based BOPP dielectric films are highly appreciated in electrical applications due to their exceptional dielectric properties. Owing to their excellent thermal stability, high breakdown strength, and moisture resistance, these films are utilized as a dielectric layer in capacitors and as insulation material in various electrical and electronic devices. This makes silica-based BOPP dielectric films an excellent choice for enhancing the performance and reliability of electrical components.

Application Insights

Based on application, the electrical & electronics segment led the market with the largest revenue share of 28.15% in 2023. The growing disposable income of individuals globally and the emergence of the e-commerce industry are driving the demand for various electrical & electronic goods. The convenience of the shopping experience offered by online shopping platforms attracts a large number of consumers. Moreover, the high penetration of smart devices such as smartphones, personal computers, laptops, and tablets globally also fuels the growth of this segment.

The power generation segment is expected to grow at a rapid CAGR over the forecast period. Many countries are increasingly focusing on energy security, owing to the wide range of energy applications. Diversifying energy sources and investing in local power generation projects help reduce reliance on imported fuels and enhance national energy security. This strategic focus drives investments in various power generation technologies to ensure a reliable and resilient energy supply, resulting in a risen need for Biaxially oriented polypropylene (BOPP) dielectric films in the power generation segment.

Regional Insights

The BOPP dielectric films market in North America is expected to grow at a significant CAGR over the forecast period. This can be attributed to its well-established automotive, aerospace, and energy sectors. The region is experiencing a shift towards renewable energy sources, thus promoting EVs and electricity-related industries, leading to an increased demand for BOPP. This can be attributed to the region’s increasing focus on sustainability.

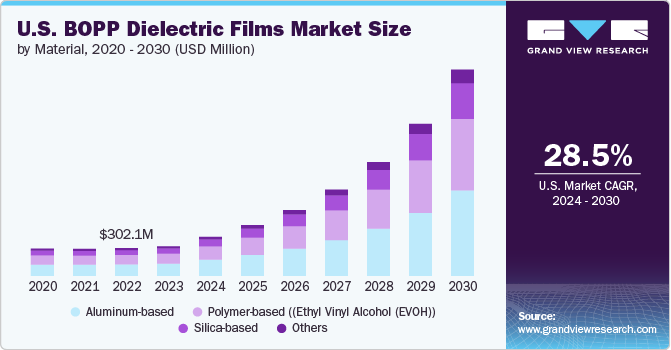

U.S. BOPP Dielectric Films Market Trends

The BOPP dielectric films market in U.S.held the largest revenue share of 76.46% in North America in 2023. The country is a hub of technological innovations in the automotive, healthcare, and electronics industries. The well-established technological infrastructure drives research & development (R&D) activities in the U.S., thereby further promoting the usage of BOPP dielectric films in different innovations. The country is also witnessing an increase in demand for EVs.

The Canada BOPP dielectric films market is expected to grow at a significant CAGR over the forecast period. The automotive industry, especially EVs, in Canada is expected to witness a significant demand for Biaxially oriented polypropylene (BOPP) dielectric films in the coming years, owing to their usage in interior and exterior components, battery packaging, and thermal management applications. Automotive manufacturing is one of the largest industrial sectors in the country. As of 2022, it accounted for 12% of the country’s gross domestic product (GDP).

Europe BOPP Dielectric Films Market Trends

The BOPP dielectric films market in Europe is projected to grow at a significant CAGR during the forecast period, owing to the presence of large automotive companies, such as Volkswagen AG, Mercedes-Benz Group AG, Stellantis N.V., JAGUAR LAND ROVER LIMITED, ASTON MARTIN, Volvo Car Corporation, Bayerische Motoren Werke AG, h.c. F. Porsche AG, Ferrari S.p.A., Automobili Lamborghini S.p.A., and McLaren Automotive Limited, are increasingly launching EVs in the region.

The UK BOPP dielectric films market is projected to grow at a substantial CAGR from 2024 to 2030, owing to the increasing investments in the healthcare industry by the government’s of the country. In addition, favorable government policies aimed at reducing greenhouse emissions such as manufacturing zero-emission vehicles by 2040 are also driving the market.

The BOPP dielectric films market in Germany is expected to grow at a rapid CAGR through the forecast period. Germany was one of the major consumers of BOPP dielectric films in Europe in 2023, owing to the presence of large R&D and production facilities of automotive. The country is well known for its engineering capabilities and is one of the largest exporters of automobiles and industrial equipment in the world, owing to a high global demand for engineered goods manufactured in the country.

Asia Pacific BOPP Dielectric Films Market Trends

Asia-Pacific dominated the BOPP dielectric films market with a revenue share of 31.85% in 2023. The region is home to many leading electronics manufacturers, producing everything from smartphones to high-performance computing devices. As these products become more compact and powerful, the need for safe and efficient capacitors increases driving the demand for BOPP dielectric films in the region.

The BOPP dielectric films market in China is anticipated to grow at the fastest CAGR during the forecast period. It is the largest producer of automobiles and a prominent player in the electrical & electronic components market owing to the presence of leading manufacturers such as Dongfeng Motor Company, Great Wall Motors, Xiaomi Corporation, Hisense Co., Ltd., and Sumitomo Electric Industries, Ltd. Increasing investments by the major automotive manufacturers in the country has led to a growth in the production of all types of vehicles, including EVs, and hybrid vehicles, which is expected to have a positive impact on the demand for BOPP dielectric films in the coming years.

The India BOPP dielectric films market is expected to witness at a significant CAGR during the forecast period. The country is increasingly adopting EVs owing to favorable government policies and initiatives such as Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles in India (FAME India) and the Electric Mobility Promotion Scheme (EMPS) 2024.

Central & South America BOPP Dielectric Films Market Trends

The BOPP dielectric films market in Central & South America is anticipated to grow at the fastest CAGR during the forecast period, owing to the ongoing development in electronics and automotive (EVs) industries. Positive economic trends in the region have significantly increased the purchasing power of customers, which has favorably impacted the market growth. The growing sectors of electrical & electronics, energy, and automotive in the region are expected to contribute to the regional product demand over the next few years.

Middle East & Africa BOPP Dielectric Films Market Trends

The BOPP dielectric films market in Middle East & Africais anticipated to grow at the fastest CAGR during the forecast period. Rapid industrialization, coupled with improving infrastructure in the Middle East, is expected to positively impact product demand. The growth of the construction sector, mainly in the UAE and Qatar, owing to the economic recovery, advanced real estate regulatory framework, and increasing number of infrastructure projects, is expected to drive the demand for BOPP dielectric films in various applications.

Key BOPP Dielectric Films Company Insights

Key companies are adopting several organic and inorganic expansion strategies, such as mergers & acquisitions, new product launches, capacity expansion, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

Key BOPP Dielectric Films Companies:

The following are the leading companies in the BOPP dielectric films market. These companies collectively hold the largest market share and dictate industry trends.

- Cosmo Films Ltd.

- TAGHLEEF INDUSTRIES

- Sichuan EM Technology Co., Ltd.

- Xpro India Limited

- JPFL Films PVT. Ltd.

- AEC GROUP

- UFlex Limited

- Toray Plastics (America), Inc. (Toray Industries Inc.)

- SRF Limited

- NAN YA PLASTICS CORPORATION

- HMC Polymers Company Limited

- Tatrafan, s.r.o

- Oji Holdings Corporation

- PAN Electronics (India) Ltd.

- Steiner GmbH & CO. KG

Recent Developments

-

In March 2024, Toray Plastics (America), Inc. announced that it will use ExxonMobil’s Exxtend technology for recycling. This technology will be used to produce polypropylene films from certified circular resins. Through this move, the company aims to achieve plastic circularity. ExxonMobil’s certified circular resin helps redirect plastic waste from incineration or landfill and does not require recertification for use with Toray’s film, as it is a virgin-quality resin

-

In December 2023, Cosmo Films Ltd. launched metalized capacitor-grade BOPP dielectric films. These new films are used in the manufacturing of various types of DC and AC capacitors. These capacitors have diverse applications ranging from industrial applications to electronic appliances, automobiles, power electronics, renewable power systems, electric vehicles, etc. The company currently has a production capacity of 750 MT per annum for these metalized films, and we will scale up this product category in the future. These films are manufactured under clean room conditions with micro-splitting capability, and the thickness ranges from 2.5 microns to 12 microns

BOPP Dielectric Films Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.98 billion

Revenue forecast in 2030

USD 10.27 billion

Growth rate

CAGR of 31.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE, Oman

Key companies profiled

Cosmo Films Ltd.; TAGHLEEF INDUSTRIES; Sichuan EM Technology Co., Ltd.; Xpro India Limited; JPFL Films PVT. Ltd.; AEC GROUP; UFlex Limited; Toray Plastics (America), Inc. (Toray Industries Inc.); SRF Limited; NAN YA PLASTICS CORPORATION; HMC Polymers Company Limited; Tatrafan, s.r.o; Oji Holdings Corporation; PAN Electronics (India) Ltd.; Steiner GmbH & CO. KG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global BOPP Dielectric Films Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global BOPP dielectric films market report based on material, application, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Silica-based

-

Aluminum-based

-

Polymer-based (Ethyl Vinyl Alcohol (EVOH))

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Electric Vehicles

-

Power Grids

-

Power Generation

-

Solar & Wind Energy Systems

-

Nuclear

-

-

Aerospace

-

Electrical & Electronics

-

Others

-

-

Region Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East

-

Saudi Arabia

-

UAE

-

Oman

-

-

Frequently Asked Questions About This Report

b. The global BOPP dielectric films market size was valued at USD 1.51 billion in 2023 and is expected to reach USD 1.98 billion in 2024.

b. The global BOPP dielectric films market is expected to grow at a CAGR of 31.5% from 2024 to 2030 to reach USD 10.27 billion by 2030.

b. Electrical & electronics segment dominated the market with a revenue share of over 28.2% in 2023. The growing disposable income of individuals globally and the emergence of the e-commerce industry are driving the demand for various electrical & electronic goods.

b. Key players operating in the BOPP dielectric films market include Cosmo Films Ltd.; TAGHLEEF INDUSTRIES; Sichuan EM Technology Co., Ltd.; Xpro India Limited; JPFL Films PVT. Ltd.; AEC GROUP; UFlex Limited; Toray Plastics (America), Inc. (Toray Industries Inc.); SRF Limited; NAN YA PLASTICS CORPORATION; HMC Polymers Company Limited; Tatrafan, s.r.o, among others

b. The rising demand for capacitors in various industrial applications such as electric vehicles (EVs), electrical & electronics, and power generation is driving the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.