- Home

- »

- Automotive & Transportation

- »

-

Boom Truck Market Size, Share And Trends Report, 2030GVR Report cover

![Boom Truck Market Size, Share & Trends Report]()

Boom Truck Market (2024 - 2030) Size, Share & Trends Analysis Report By Mount, By Lifting Capacity, By Boom Length, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-458-0

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Boom Truck Market Size & Trends

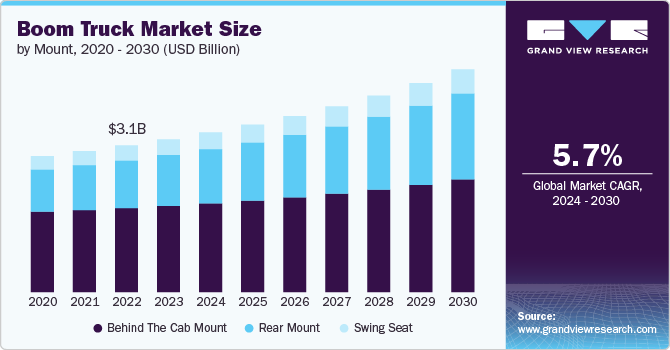

The global boom truck market size was estimated at USD 3.25 billion in 2023 and is expected to grow at a CAGR of 5.7% from 2024 to 2030. A boom truck is a type of crane mounted on a truck chassis designed to lift and move heavy loads. It combines the mobility of a truck with the lifting capability of a crane, making it versatile for various applications, especially in construction, maintenance, and industrial settings. The rapid surge in investments in infrastructure development around the globe, growing urbanization, and high demand for mobile construction equipment can be attributed to the growth of the market.

As governments and private entities invest heavily in upgrading and building infrastructure such as bridges, roads, and skyscrapers, the demand for boom trucks increases. These vehicles play a crucial role in lifting and placing materials and equipment at various heights and angles, which is essential for complex construction projects. With numerous large-scale infrastructure projects underway globally, the need for versatile and powerful boom trucks is expected to rise, fueling market expansion. Thus, rising infrastructure development across the globe, particularly in developing countries, is driving the growth of the market.

The ongoing trend of urbanization and the construction of high-rise buildings are further boosting the growth of the boom truck market. As cities expand and vertical construction becomes more common, the need for specialized equipment that can handle the demands of high-rise projects grows. Boom trucks are essential for reaching elevated construction sites and performing tasks such as placing large materials and equipment. The increasing number of high-rise residential and commercial buildings is driving demand for boom trucks with extended reach and lifting capacity, contributing to market growth.

Furthermore, the market is experiencing significant growth due to rapid technological advancements. Modern boom trucks are increasingly integrated with cutting-edge technologies such as telematics, real-time data monitoring, and advanced load control systems. These innovations enhance safety, efficiency, and operational capabilities, making boom trucks more attractive to construction and industrial companies. For instance, telematics allows operators to track equipment performance and maintenance needs remotely, reducing downtime and extending the lifespan of the cranes. As technology continues to evolve, the market is expected to witness a surge in demand for boom trucks equipped with the latest features, driving overall growth in the sector.

High initial costs and ongoing maintenance expenses could hamper the growth of the market. In addition, the complex regulatory environment, including stringent safety and environmental standards, can increase compliance costs and operational challenges. Furthermore, the availability of alternative lifting solutions, such as aerial work platforms or traditional cranes, may limit market growth as companies evaluate the most cost-effective options for their needs. However, growing technological advancements and the rising development of boom trucks with a focus on emission control are expected to improve the market’s growth.

Mount Insights

The behind the cab mount segment dominated the market in 2023 and accounted for 56.43% share of global revenue. The segment is witnessing significant growth due to its unique advantages in maneuverability and space efficiency. This mounting configuration positions the boom behind the truck's cab, which helps in optimizing the truck's balance and stability. The behind-the-cab mount allows for a more compact truck design, enhancing its ability to navigate compact job sites and urban environments. This feature is particularly beneficial for applications in congested areas where space is limited. Thus, as urbanization increases and construction projects become more complex, the demand for behind-the-cab mount boom trucks is expected to rise, thereby driving the segment's growth.

The rear mount segment is projected to witness significant growth from 2024 to 2030. In this configuration, the boom is mounted at the rear of the truck, which provides a clear line of sight for the operator and allows for greater lifting capacities and boom reach. Rear-mounted boom trucks are particularly advantageous for applications that require frequent repositioning or for tasks where maximum lifting height and reach are crucial. This setup also facilitates better loading and unloading of materials, as it allows the truck to stay in a stationary position while the boom extends. The rear mount design is favored in heavy-duty and large-scale construction projects, where the ability to handle substantial loads and achieve extended reach is essential. As the demand for high-capacity and versatile lifting solutions increases, the rear mount segment is poised for substantial growth.

Lifting Capacity Insights

The 10 - 20 metric tons segment dominated the market in 2023. Increasing demand for boom trucks with lifting capacity between 10 and 20 metric tons in medium-sized construction projects and industrial applications where moderate lifting power is required can be attributed to the segment growth. Boom trucks in this capacity range are ideal for tasks such as lifting building materials, performing maintenance work, and handling equipment in urban and suburban settings. Their ability to maneuver in confined spaces while providing sufficient lifting power makes them a preferred choice for a wide range of applications. In addition, the vast availability of boom trucks within this capacity range in the market is further expected to improve the market’s growth. For instance, QMC Building Cranes provides boom truck models within the 10 - 20 metric ton range. Some of these models include 4033R, 4037R, 4055R, and 4070R.

The more than 50 metric tons segment is projected to witness significant growth from 2024 to 2030. These high-capacity boom trucks are essential for handling heavy and oversized materials, such as large, prefabricated components, industrial machinery, and complex construction elements. Their superior lifting capabilities enable them to perform critical tasks in demanding environments, such as high-rise construction sites, large infrastructure projects, and major industrial operations. Several market players provide boom trucks within this capacity range. For instance, Load King provides, Load King 60-150 Boom Truck. This boom truck has a 60-ton lifting capacity and a maximum tip height of 118 ft. With the addition of a 47 ft jib, the maximum tip height increases to 170 ft.

Boom Length Insights

The less than 20m segment dominated the market in 2023. Increasing demand for boom trucks with boom lengths less than 20m in confined or low-height environments can be attributed to segment growth. These boom trucks are particularly used in tasks that require precise and reliable lifting at moderate heights, such as maintenance work on building facades, small-scale construction projects, and utility repairs. Their compact size and ability to operate efficiently in compact spaces make them ideal for urban areas where height restrictions and space constraints are common. In addition, boom trucks in this category often come at a lower cost, making them accessible for small to medium-sized businesses and projects, thereby increasing the segment’s growth.

The more than 40m segment is projected to witness significant growth from 2024 to 2030. The segment is witnessing rapid growth owing to the increasing complexity of construction and industrial projects that require extended reach and high-lifting capabilities. The growing adoption of these boom trucks in high-rise construction, large-scale infrastructure projects, and industrial applications is further driving the segment’s growth. As the demand for taller buildings and expansive industrial facilities rises, the need for boom trucks with boom lengths of more than 40 m is expected to increase from 2024 to 2030.

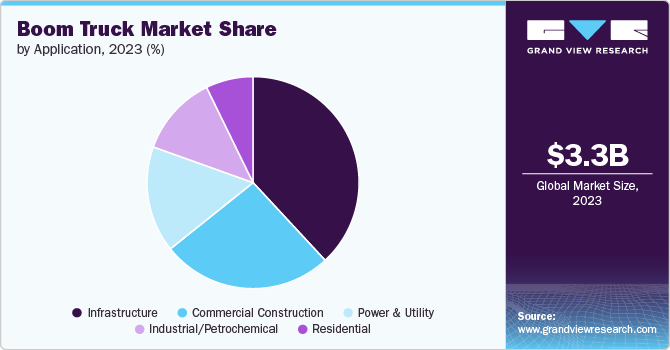

Application Insights

The infrastructure segment dominated the market in 2023. Boom trucks are essential in road, tunnels, and bridge construction, where they are utilized to lift and position heavy precast concrete elements, such as bridge beams and girders. Their mobility and compact design enable them to maneuver through compact spaces and congested work sites, facilitating efficient material transport and placement. The rise in public and private sector funding for infrastructure development, coupled with urbanization and the need for infrastructure modernization, drives the demand for boom trucks capable of supporting complex and extensive projects.

The power & utility segment is projected to witness considerable growth from 2024 to 2030. Utility companies depend on boom trucks to maintain power lines and other infrastructure. The maneuverability and compact size of boom trucks make them well-suited for navigating densely populated areas, such as urban environments, where power lines are common. Furthermore, these trucks are crucial for transporting and positioning the equipment required for utility maintenance and repair tasks. The market for boom trucks in this segment is growing due to the increasing demand for reliable and efficient utility services, along with the need for ongoing maintenance and upgrades of aging infrastructure.

Regional Insights

The North America boom truck market dominated the global market in 2023 and accounted for 35.12% of the overall share. The region's significant infrastructure development and industrial activities is a major factor behind the market's growth. The U.S. and Canada are investing heavily in infrastructure projects such as bridges, roads, and high-rise buildings, which require versatile and high-capacity boom trucks. Furthermore, North America is a hub for technological advancements in boom truck design, contributing to increased efficiency and safety features. The region's growing construction and industrial sectors, along with a strong focus on maintaining and upgrading existing infrastructure, further boost demand for boom trucks.

U.S. Boom Truck Market Trends

The U.S. boom truck market is expected to grow at a significant CAGR from 2024 to 2030. Increasing residential, commercial, and infrastructure development activities across the country can be attributed to the market's growth. The growing focus on infrastructure repair and modernization, along with the increasing complexity of construction projects, drives the demand for high-capacity and versatile boom trucks, thereby driving the market's growth.

Europe Boom Truck Market Trends

The Europe boom truck market is expected to grow at a considerable CAGR from 2024 to 2030. The market is expanding due to factors such as infrastructure development, urbanization, and stringent environmental regulations. European countries are investing in modernizing their infrastructure, including transportation networks and energy facilities, which drives the need for advanced boom trucks capable of handling complex lifting tasks.

Asia Pacific Boom Truck Market Trends

The Asia Pacific boom truck market is expected to grow at the highest CAGR from 2024 to 2030. Increasing investments in infrastructure development and urbanization are major factors behind the market's growth. Countries such as China, India, and Japan are leading major construction projects, including high-rise buildings, large-scale industrial facilities, and transportation networks, which create a strong demand for boom trucks. The region's rapid economic development and expanding urban populations drive the need for efficient and versatile lifting equipment. Furthermore, the rise of smart cities and advancements in construction technology contribute to the increasing adoption of boom trucks.

Key Boom Truck Company Insights

Key players operating in the boom truck market include The Manitowoc Company, Inc.; Fassi Gru S.p.A.; Elliott Equipment Company; Altec Industries; Manitex International, Inc.; Terex Corporation; Palfinger AG; Tadano Ltd.; Load King; and QMC Building Cranes. The vendors are focusing on numerous strategic initiatives, including agreements, new product development, and partnerships & collaborations to gain a competitive advantage over their rivals. The following are some instances of such initiatives:

-

In August 2023, Link-Belt launched a 120 TTLB telescopic boom truck crane. The Link-Belt 120 TTLB truck terrain crane is equipped with a 197 ft. (60 m) seven-section pin and latch boom, along with all-wheel steering and a tight turning radius. Its all-wheel steering capability makes the 120 TTLB highly maneuverable in confined jobsite spaces. Equipped with a steerable rear axle and super single tires, the 120 TTLB offers four steering modes: independent rear, independent front, combination, and crab.

-

In March 2023, Manitex International, Inc. introduced the TC850 Series truck-mounted crane. The TC85159 model offers an 85-ton base rating at a 10-foot radius and is equipped with a 159-foot, 5-section full power boom that extends proportionally. It provides a tip height of 168 feet, or up to 228 feet when fitted with the optional 2-piece, 30’-60’ bi-fold offset lattice jib.

Key Boom Truck Companies:

The following are the leading companies in the boom truck market. These companies collectively hold the largest market share and dictate industry trends.

- The Manitowoc Company, Inc.

- Fassi Gru S.p.A.

- Elliott Equipment Company

- Altec Industries

- Manitex International, Inc.

- Terex

Boom Truck Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.40 billion

Revenue forecast in 2030

USD 4.73 billion

Growth rate

CAGR of 5.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Mount, lifting capacity, boom length, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

The Manitowoc Company, Inc.; Fassi Gru S.p.A.; Elliott Equipment Company; Altec Industries; Manitex International, Inc.; Terex Corporation; Palfinger AG; Tadano Ltd.; Load King; QMC Building Cranes

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Boom Truck Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the boom truck market report based on mount, lifting capacity, boom length, application, and region:

-

Mount Outlook (Revenue, USD Million, 2018 - 2030)

-

Behind the Cab Mount

-

Rear Mount

-

Swing Seat

-

-

Lifting Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Less than 10 Metric Tons

-

10 - 20 Metric Tons

-

21 - 30 Metric Tons

-

31 - 40 Metric Tons

-

41 - 50 Metric Tons

-

More than 50 Metric Tons

-

-

Boom Length Outlook (Revenue, USD Million, 2018 - 2030)

-

Less than 20m

-

20 - 30m

-

31 - 40m

-

More than 40m

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Infrastructure

-

Commercial Construction

-

Power & Utility

-

Industrial/Petrochemical

-

Residential

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global boom truck market size was estimated at USD 3.25 billion in 2023 and is expected to reach USD 3.40 billion in 2024.

b. The global boom truck market is expected to grow at a compound annual growth rate of 5.7% from 2024 to 2030 to reach USD 4.73 billion by 2030.

b. North America dominated the boom truck market with a share of 35.12% in 2023. The region's significant infrastructure development and industrial activities is a major factors behind the regional market's growth.

b. Some key players operating in the boom truck market include The Manitowoc Company, Inc., Fassi Gru S.p.A., Elliott Equipment Company, Altec Industries, Manitex International, Inc., Terex Corporation, Palfinger AG, Tadano Ltd., Load King, and QMC Building Cranes.

b. Key factors that are driving the market growth include the rapid surge in investments in infrastructure development around the globe, growing urbanization, and high demand for mobile construction equipment.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.