- Home

- »

- Beauty & Personal Care

- »

-

Body Mist Market Size, Share & Trends Analysis Report 2030GVR Report cover

![Body Mist Market Size, Share & Trends Report]()

Body Mist Market (2025 - 2030) Size, Share & Trends Analysis Report By End Use (Women, Men, Unisex), By Distribution Channel (Supermarkets & Hypermarkets, Drugstores & Pharmacies), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-403-2

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Body Mist Market Summary

The global body mist market size was estimated at USD 7.15 billion in 2024 and is projected to reach USD 9.37 billion by 2030, growing at a CAGR of 4.6% from 2025 to 2030. The rise in wellness and self-care trends, coupled with a growing emphasis on personal expression through scent, has further accelerated this demand.

Key Market Trends & Insights

- The body mist market in North America accounted for a market share of 31.18% in 2023.

- The body mist market in the U.S. accounted for a market share of around 81.25% in 2023.

- By end-use, women’s body mists accounted for a share of 72.74% in 2023.

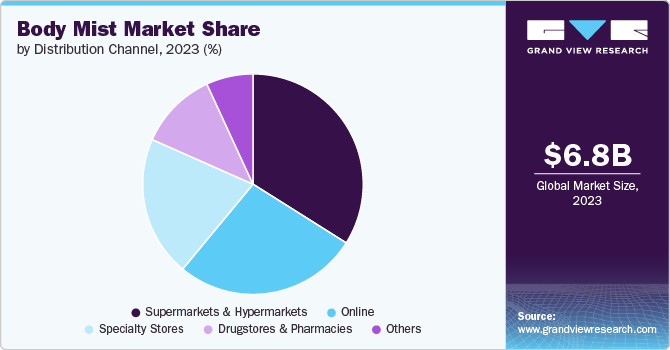

- By distribution channel, sales of body mist through hypermarkets and supermarkets accounted for a market share of about 33.95% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 7.15 Billion

- 2030 Projected Market Size: USD 9.37 Billion

- CAGR (2025-2030): 4.6%

- Europe: Largest market in 2023

This makes them less intense and ideal for those who prefer a more subtle scent. The rise in wellness and self-care trends, coupled with a growing emphasis on personal expression through scent, has further accelerated this demand. Body mists often feature diverse formulations and packaging innovations, making them appealing to a wide range of consumers seeking both variety and value in their fragrance choices.Body mists are often used as a refreshing spray throughout the day. They are commonly applied after showering or during the day for a light burst of fragrance. The application is usually straightforward: the mist is sprayed directly onto the skin or clothing. These products are popular for their affordability compared to perfumes, and they come in a variety of scents. Body mists can be a suitable option for individuals seeking an easy and economical way to maintain a pleasant fragrance without the strong presence of more concentrated perfumes.

Body mists have experienced a notable resurgence, driven by a blend of nostalgia and contemporary appeal. This revival is partly attributed to the growing trend of the Y2K style, which has seen a marked increase in interest from both millennials and younger consumers. This renewed interest is reflected on social media platforms, with the #bodymist hashtag amassing over 1.4 billion views on TikTok (as of January 2024), underscoring the significant engagement and enthusiasm for these products.

Brands such as Sol de Janeiro have played a crucial role in this revival. Their perfume mists, particularly the Cheirosa ’62 scent inspired by the popular Brazilian Bum Bum Cream, have gained substantial traction. Sol de Janeiro's success is evidenced by their average sale of one perfume mist every seven seconds, and their products have been featured prominently on TikTok. This trend highlights a shift towards more complex and elevated fragrances within the body mist category, appealing to both nostalgic customers and a new generation seeking accessible, playful, and versatile scent options.

Body mists are available in various formulations, some of which include moisturizing ingredients or skin-beneficial additives. Innovations in body mists today focus on enhancing both fragrance and skincare benefits. Brands like Chanel have introduced mists that not only offer alluring scents but also incorporate functional ingredients such as camellia water and red camellia extract, traditionally used in skincare. This trend towards integrating skincare elements reflects a broader movement towards multifunctional products. In addition, some body mists are being developed to address personal care needs, such as those blending deodorizing agents with refreshing scents, exemplified by products like OffCourt Performance Body Spray. These advancements highlight the evolving versatility and sophistication of body mists.

End Use Insights

Women’s body mists accounted for a share of 72.74% in 2023. Body mists are popular among women due to their light, long-lasting fragrance that keeps them feeling fresh throughout the day. They also offer hydrating benefits, nourishing and moisturizing the skin. Their compact, travel-friendly packaging makes them convenient for on-the-go use. In addition, the right fragrance can enhance mood and boost confidence, making body mists a valuable part of many women's daily routines. Brands such as Bath & Body Works are popular among women as these offer body mists in different varieties.

Demand for men’s body mists is set to grow at a CAGR of 4.9% from 2024 to 2030. This is due to growing awareness and preference for personal grooming and fragrance among men. With increasing emphasis on self-care and an expanding range of options tailored specifically for men, body mists offer a convenient and refreshing alternative to traditional colognes. In addition, the affordability and diverse scent profiles of body mists cater to a broad audience, further driving their popularity.

Distribution Channel Insights

Sales of body mist through hypermarkets and supermarkets accounted for a market share of about 33.95% in 2023. This is due to the growing demand for affordable, accessible personal care products that align with consumers' values on sustainability and clean ingredients. Retailers like Walmart are increasingly stocking these items to cater to eco-conscious shoppers, including millennials and Gen Z, who prioritize natural and organic options. By featuring body mists from emerging, sustainable brands, hypermarkets can attract a broader customer base seeking both value and environmental responsibility.

Online sales of body mist are expected to grow at a CAGR of 5.8% from 2024 to 2030. This is due to the growing trend of consumers shifting their shopping from physical stores to online platforms. The convenience of online shopping, combined with the ability to compare prices and access a wider range of products easily, drives this shift. In addition, the rise of e-commerce has been fueled by increased digital engagement and a preference for the convenience of home delivery, especially during peak shopping seasons like the holidays.

Regional Insights

The body mist market in North America accounted for a market share of 31.18% in 2023. Demand for body mist here is huge due to increasing consumer preference for affordable luxury and everyday indulgence. The rise of personal care and wellness trends, coupled with a growing emphasis on self-expression through scents, has boosted demand. In addition, the market benefits from innovations in fragrances and packaging, enhancing product appeal. The expansion of retail channels, including online platforms, has further contributed to its growth.

U.S. Body Mist Market Trends

The body mist market in the U.S. accounted for a market share of around 81.25% in 2023. In 2023, the market for prestige body mists skyrocketed.This resurgence is fueled by a nostalgic longing for the body sprays popular in the '90s and early 2000s, combined with contemporary updates from luxury and niche brands. Modern body mists offer a sophisticated yet accessible fragrance experience, aligning with current trends for light, joyful, and versatile scent options. They cater to a broad audience seeking an easy, everyday indulgence in personal care, free from the intensity of traditional perfumes.

Asia Pacific Body Mist Market Trends

The body mist market in Asia Pacific is anticipated to grow at a CAGR of 5.8% from 2024 to 2030. This is due to the growing preference for affordable luxury and the region's increasing focus on personal care and self-expression. Modern body mists offer a light, versatile fragrance experience that appeals to consumers seeking both everyday indulgence and convenience. In addition, the revival of nostalgic beauty trends, combined with innovative formulations and packaging, is driving interest across diverse demographics. Enhanced accessibility through expanding retail channels further boosts their market appeal.

Key Body Mist Company Insights

The body mist industry is fragmented. Many brands have recognized the presence of untapped opportunities in their product offerings and have been adopting strategies such as marketing campaigns, mergers & acquisitions, and product launches to gain market share.

Key Body Mist Companies:

The following are the leading companies in the body mist market. These companies collectively hold the largest market share and dictate industry trends.

- Bath & Body Works

- Victoria's Secret

- LVMH

- Chanel

- The Estée Lauder Companies

- NEST New York

- Ariana Perfumes

- Bodycology

- Aeropostale

- Comp10

- Paris Hilton Fragrances

Recent Developments

-

In May 2024, Secret Temptation launched a new collection of body mists for women, featuring four distinct fragrances: Dew, Bold, Magic, and Bloom. Each scent is formulated with natural ingredients, ensuring safety for the skin and providing a refreshing experience. Developed through thorough research on consumer preferences, these mists are dermatologically tested to deliver long-lasting freshness and enhance daily routines.

-

In March 2024, Bath & Body Works collaborated with Netflix for a year-long partnership, starting with a special collection inspired by “Bridgerton” Season Three. The collaboration introduces the “Diamond of the Season” line, featuring body mist, hand soap, hand sanitizer, lotion, and a candle, all designed to evoke the show's distinctive scenes and characters.

-

In February 2024, Skylar Brands expanded its popular Boardwalk Delight fragrance into a versatile Hair & Body Mist format. Originally launched as an Eau de parfum in 2023, Boardwalk Delight quickly became a bestseller, and the new mist format allows for easy, on-the-go applications. Priced at USD 30, this eco-friendly, hypoallergenic mist features a blend of raspberry sorbet, creamy coconut milk, cotton candy, and vanilla. It is crafted to be gentle on sensitive skin while offering a refreshing, travel-friendly option for daily use.

Body Mist Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.49 billion

Revenue forecast in 2030

USD 9.37 billion

Growth Rate (Revenue)

CAGR of 4.6% from 2025 to 2030

Actuals

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End use, distribution channel, and region

Regional scope

North America, Europe, Asia Pacific, Central & South America, & Middle East & Africa

Country scope

U.S, Canada, Mexico, UK, Germany, France, Italy, Spain, Japan, China, India, Brazil, Argentina, South Africa, and Saudi Arabia

Key companies profiled

Bath & Body Works; Victoria's Secret; LVMH; Chanel; The Estée Lauder Companies; NEST New York; Ariana Perfumes; Bodycology; Aeropostale; and Paris Hilton Fragrances

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Body Mist Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global body mist market report based on end use, distribution channel, and region.

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Women

-

Men

-

Unisex

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Specialty Stores

-

Pharmacies & Drugstores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The body mist market was estimated at USD 6.84 billion in 2023 and is expected to reach USD 7.16 billion in 2024.

b. The body mist market is expected to grow at a compound annual growth rate of 4.6% from 2023 to 2030 to reach USD 9.37 billion by 2030.

b. Europe dominated the body mist market with a share of around 32% in 2023. This is due to its frequent use as part of daily fragrance rituals, driven by the region's high-value share and preference for premium and personalized scents.

b. Key players in the body mist market are Bath & Body Works; Victoria's Secret; LVMH; Chanel; The Estée Lauder Companies; NEST New York; Ariana Perfumes; Bodycology; Aeropostale; Paris Hilton Fragrances.

b. Key factors that are driving the body mist market growth include its affordability, versatility, and appeal as lighter, everyday fragrance options compared to traditional perfumes.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.