- Home

- »

- Beauty & Personal Care

- »

-

Body Firming Creams Market Size And Share Report, 2030GVR Report cover

![Body Firming Creams Market Size, Share & Trends Report]()

Body Firming Creams Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Plant Extract, Non-plant Extract), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-248-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Body Firming Creams Market Size & Trends

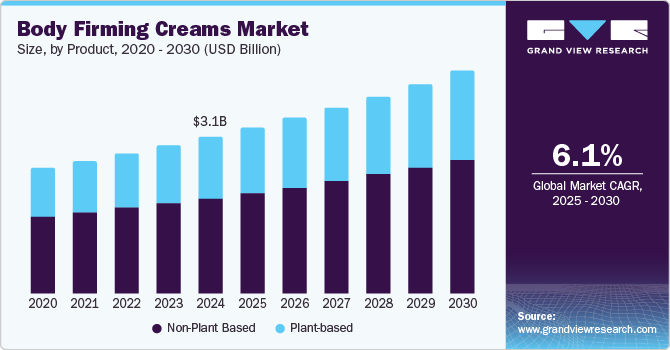

The global body firming creams market size was valued at USD 3.09 billion in 2024 and is projected to grow at a CAGR of 6.1% from 2025 to 2030. Increasing consumer awareness about the importance of maintaining skin health and appearance has increased demand for anti-aging and skin-firming products. Technological advancements in cosmetic chemistry have also played a significant role, resulting in more effective and innovative products. Additionally, the rising aging population, particularly in developed countries, contributes to market growth as older individuals seek products to maintain their skin's elasticity and firmness. The evolving consumer behaviours, such as the trend towards preventive skincare, are further augmenting the market growth

The expanding retail landscape, particularly the growth of e-commerce platforms, has made these products more accessible to a broader audience. The convenience of online shopping and targeted digital marketing strategies have significantly boosted sales.

Social media and beauty influencers are crucial in boosting product adoption and consumer interest. Platforms such as Instagram, YouTube, and TikTok have become powerful tools for marketing beauty products. Influencers' and beauty bloggers' recommendations can increase product visibility and credibility, encouraging more people to try these products.

Product Insights

Nonplant-based dominated the market with the largest revenue share of 60.9% in 2024. These creams often incorporate advanced synthetic ingredients and formulations that promise quick and visible results, appealing to a broad consumer base. These products are typically backed by extensive research and development, ensuring their efficacy and safety. Additionally, nonplant-based creams are widely available across various retail channels, including supermarkets, specialty stores, and online platforms, making them easily accessible to consumers worldwide.

The plant-based segment is expected to grow at a CAGR of 6.4% over the forecast period. This growth is driven by the increasing consumer demand for natural and organic skincare products. The rise of the clean beauty movement and the growing popularity of sustainable and ethical consumerism further propel the demand for plant-based products. Additionally, the influence of social media and beauty influencers advocating for natural skincare solutions plays a crucial role in boosting the visibility and acceptance of plant-based body-firming creams.

Distribution Channel Insights

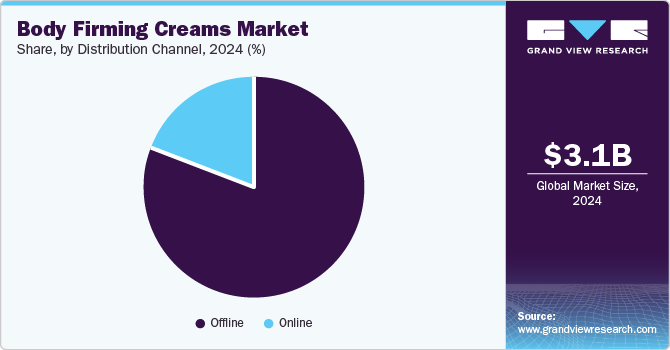

The offline segment dominated the global body-firming creams market in 2024. Traditional brick-and-mortar stores, including supermarkets, hypermarkets, specialty beauty stores, and pharmacies, offer consumers the advantage of physically examining products before purchase. This demonstrative experience is particularly important for skincare products, as consumers often prefer to test textures, scents, and immediate effects on their skin. Additionally, offline stores provide personalized customer service, which can enhance the shopping experience and build consumer trust. Many consumers also appreciate the instant gratification of purchasing and taking a product home immediately without waiting for delivery. The presence of promotional activities, in-store demonstrations, and exclusive offers further drives sales in the offline segment.

On the other hand, the online segment is projected to grow at the fastest CAGR over the forecast period. This rapid growth is fuelled by the increasing penetration of the internet and the rising popularity of e-commerce platforms. Online shopping offers unparalleled convenience, allowing consumers to browse and purchase products from the comfort of their homes anytime. The vast array of online products, often accompanied by detailed descriptions, reviews, and ratings, helps consumers make informed decisions. Additionally, the online segment benefits from targeted digital marketing strategies, personalized recommendations, and the influence of social media and beauty influencers. The ability to compare prices across different platforms and access exclusive online discounts and deals also attracts a growing number of consumers to online shopping. As technology advances and more consumers become comfortable with online transactions, the online segment is expected to see sustained growth, reshaping the distribution landscape of the body firming creams market.

Regional Insights

North America dominated the global body firming creams market in 2024. Several factors, including high consumer awareness and a strong demand for skincare products, drive this dominance. The region benefits from a well-established beauty and personal care industry, with numerous major brands and extensive research and development activities. Consumers in North America, particularly in the U.S., have a high disposable income, which allows them to invest in premium skincare products. Additionally, the growing health and wellness trend and an increasing focus on anti-aging solutions have significantly boosted the demand for body-firming creams.

U.S. Body Firming Creams Market Trends

The U.S. contributed a significant revenue share in the North American market in 2024. The U.S. market is characterized by high consumer awareness and a strong preference for advanced skincare solutions. The presence of leading beauty and personal care brands and extensive research and development efforts ensure a steady supply of innovative and effective products. The high disposable income among U.S. consumers enables them to invest in premium and luxury skincare products.

Asia Pacific Body Firming Creams Market Trends

The Asia Pacific body firming creams market is expected to grow at CAGR of 8.3% from 2025 to 2030. This growth is driven by rising disposable incomes and changing lifestyles in emerging economies such as China and India. The increasing beauty consciousness among consumers and the influence of K-beauty and J-beauty trends are significantly boosting the demand for body-firming creams.

Europe Body Firming Creams Market Trends

Europe’s body-firming creams market is expected to grow steadily over the forecast period. The region’s market is driven by the high demand for premium and luxury skincare products, particularly in countries like Germany, France, and UK. European consumers prefer high-quality, effective skincare solutions, which has led to a strong market for body-firming creams. The presence of well-established beauty brands and a robust retail network further support market growth.

Key Body Firming Creams Company Insights

Some key body firming creams market companies include Johnson & Johnson, L'Oréal S.A., Beiersdorf AG, Clarins Group, and others. Companies are focusing on innovating new formulas for skin tightening. Furthermore, several market players are adopting strategies such as new product launches, mergers and acquisitions, and collaborations with influencers.

-

L'Oréal S.A. is a global leader in the beauty and personal care industry, offering a wide range of body firming creams designed to address various skin concerns. Its products are formulated with advanced anti-aging ingredients to help reduce fine lines, wrinkles, and sagging skin while promoting skin firmness and elasticity.

-

The Estée Lauder Companies Inc. focuses on delivering high-performance skincare solutions that cater to consumers seeking effective body firming and anti-aging products. Their products are designed to boost collagen production, improve skin elasticity, and provide a more lifted and sculpted look.

Key Body Firming Creams Companies:

The following are the leading companies in the body firming creams market. These companies collectively hold the largest market share and dictate industry trends.

- L'Oréal S.A.,

- Beiersdorf AG

- Clarins Group

- Johnson & Johnson

- Sol de Janeiro

- ET Browne Drug Co. Inc.

- The Procter & Gamble Company

- Kao Corporation

- Shiseido Company, Limited

- The Estée Lauder Companies Inc.

Recent Developments

-

In August 2024, RescueMD, an innovator in skincare technology, unveiled its groundbreaking product, the RescueMD Revitalizing Body Cream. This cutting-edge body treatment, designed by plastic surgeons, promises unprecedented results in skin care, targeting a range of concerns from dryness to scars.

-

In May 2024, LG H&H launched a new body care brand called B.Clinilcx. The brand's products include skincare ingredients such as low-molecular-weight collagen, niacinamide, polyhydroxy acid (PHA), and peptides.

Body Firming Creams Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.26 billion

Revenue forecast in 2030

USD 4.38 billion

Growth rate

CAGR of 6.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, India, Japan, Australia, South Korea, Brazil, Argentina, UAE, Saudi Arabia, South Africa

Key companies profiled

L'Oréal S.A.; Beiersdorf AG; Clarins Group; Johnson & Johnson; Sol de Janeiro; ET Browne Drug Co. Inc.; The Procter & Gamble Company; Kao Corporation; Shiseido Company, Limited; The Estée Lauder Companies Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Body Firming Creams Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global body firming creams market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Plant Extract

-

Non-plant Extract

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.